RoboStreet – March 2, 2022

Oil Experiences Massive Breakout

It was only a couple of years ago that America was energy independent, with the production fields of the U.S. oil fields and offshore drilling platforms having the U.S. in a net exporting nation with its energy needs more than satisfied where gas prices were under $2.00 per gallon and super high-paying jobs aplenty in the energy sector. Today, with the ushering of the new administration, and its war on fossil fuels, the situation is entirely changed to the detriment on several fronts.

With the events at hand in Ukraine, sanctions on Russia, potential major global distribution of oil, and heightened geopolitical risk, America’s business and consumer need for gasoline, diesel, jet fuel, lubricants, and all manner of products made with petroleum inputs are under a pricing siege that has little in the way of being worked out anytime soon. It is a surreal set of circumstances that has further upside risk in the weeks ahead.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

While there are certainly a lot of breakout sectors in the commodity space, the prices of metals, corn, wheat, sugar, cocoa, cement fertilizer, orange juice, and other soft commodities will be adversely affected by a number of factors, whereas the price of oil is a longer-term supply-demand issue. The world is simply using a lot more oil than it is forecast to produce in the next five years and the green lobby and its influence have put a firm bid under crude prices as a result of curtailing production.

The short-sighted view of the renewable camp is now being felt at the pump and everywhere else. I don’t know of anyone that doesn’t want affordable solar, wind, hydro, biomass, or geothermal power to replace carbon fuels. That’s easy. What I take issue with is the “all or nothing” approach the green lobby has taken. Smart planning would have had efficient and affordable renewable capacity replacing fossil fuels on a gradual basis without jacking up prices to justify the cost of renewables or rationalizing the costly proposition of clean energy.

Did anyone think to ask the question of which country produces the cleanest fossil fuels in the world? It’s the U.S., by a wide margin. But I digress and simply have to buy into the investment proposition that the oil and gas companies are going to be printing money for the next several years. According to the International Energy Agency, renewable energy makes up only about 28% of the global electricity demand in 2021 and electric car sales more than doubled to 6.6 million, representing close to 9% of the global car market and more than tripling their market share from two years earlier.

Well, that means that 91% of the cars and trucks driving around the globe are doing so on internal combustion engines. Regardless of all the anti-oil narrative that dominates the media, the best case for higher fuel prices in a world that is reopening from Covid-19 is, in my view, incredibly bullish. Oil production plus geopolitical strife will very likely keep crude prices elevated above $80/bbl unless the global economy falls into recession.

I’ll touch on this further in my commentary after giving a technical market update.

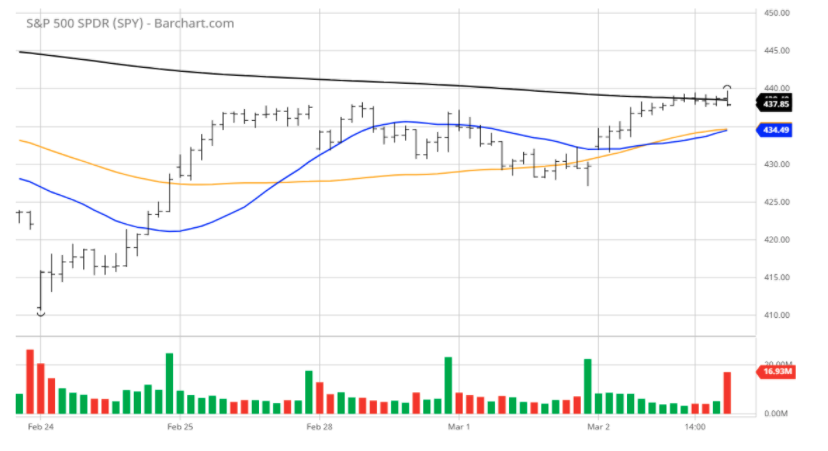

The $SPY rallied on Wednesday, and closed at $437, at the top of the recent range. The $SPY was up 1.8%. The value/reflationary ($VTV) closed up 2.0%, below the 50 DMA. The technology sector ($QQQ) traded higher 1.7%, at $347, and closed at the top of the recent range. The very short-term trend is working higher.

The $DXY closed higher, near the $97.5, at the June 2020 high. The $TLT closed significantly lower 3.4% and closed near the recent lows. The ten-year yield closed lower near 1.85%. The $VIX traded lower near the 30 level.

The $SPY short-term support level is at $420 (key long-term support) followed by $400. The SPY overhead resistance is at $445 and then $460.

Due to the escalation of Geopolitical risks in Ukraine, one has to assume that the $SPY January lows will be re-tested again shortly and most likely continue the downward momentum in the next couple of weeks.

I would be a seller of the high beta stocks into the rallies and have a market NEUTRAL portfolio at this time.

I would consider rebalancing portfolio at this time and have an overall market NEUTRAL portfolio. I do not expect the $SPY to post a new all-time high in the first half of this year. There is a high probability that the $SPY main long-term support at $420 level will not hold. All eyes are on the geopolitical risk in Ukraine.

If you are trading options consider selling premium with April and May expiration dates.

Based on our models, the market (SPY) will trade in the range between $400 and $470 for the next 2-4 weeks.

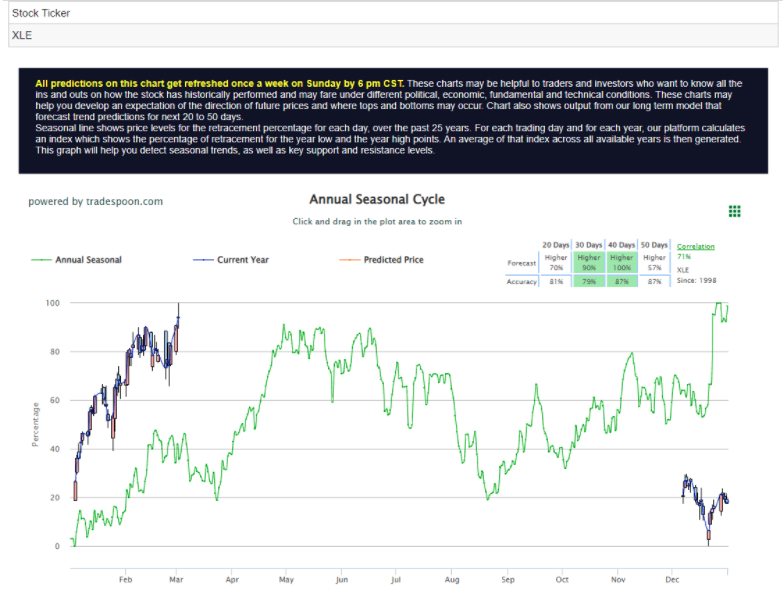

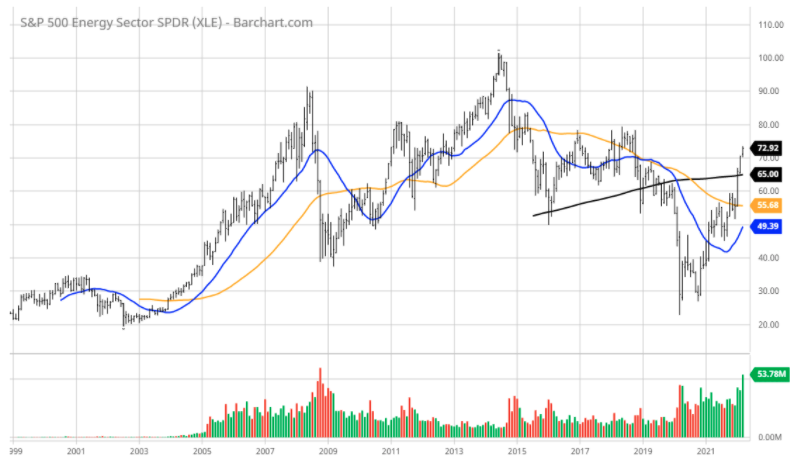

So, looking at the most opportune of the energy investment assets, I and my AI platform favor the Energy Select Sector SPDR ETF (XLE) as the most risk-averse, cleanest way to pay the bull trend in the energy space.

There is always headline risk in commodity-based companies because, in general, the businesses are high risk, high reward oriented. Hence, the ETF proposition makes good business sense, especially after an initial upward move that has floated the best and also second-hand stocks.

Oil prices are caught up in a powerful uptrend, putting a huge bid under the oil-producing stocks. Shares of XLE are in the midst of a multi-year upside breakout and could easily test the all-time highs indicated from the chart below.

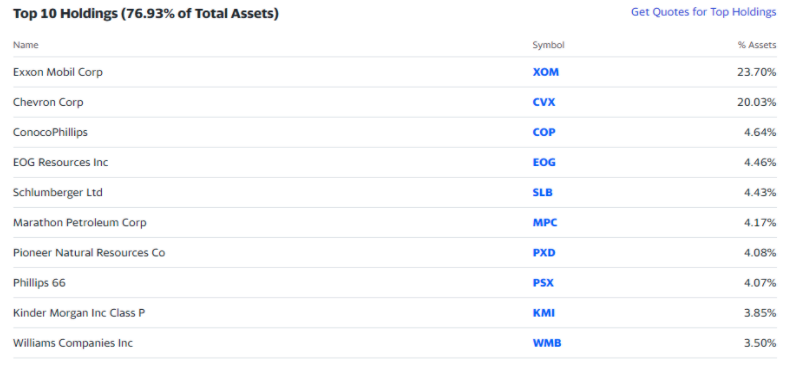

XLE is made up of the premier energy companies in the world, dollar-denominated, paying huge dividends and under serious institutional accumulation that is providing for the very best inflationary or geopolitically hedge available to fund managers today.

Based on my short-term indicators, I’ll be looking to add XLE to our RoboInvestor portfolio in the coming days on any dips. RoboInvestor is a stock and ETF advisory service that recommends blue-chip stocks and ETFs in major indexes, market sectors, sub-sectors, commodities, interest rates, currencies, precious metals, volatility, and shorting opportunities via inverse ETFs.

RoboInvestor is a platform built around artificial intelligence that are proprietary algorithms developed by me over the past decade. These AI models are always thinking, learning, and crunching data 24/7 every day. The platform never sleeps and continues to be refined over time.

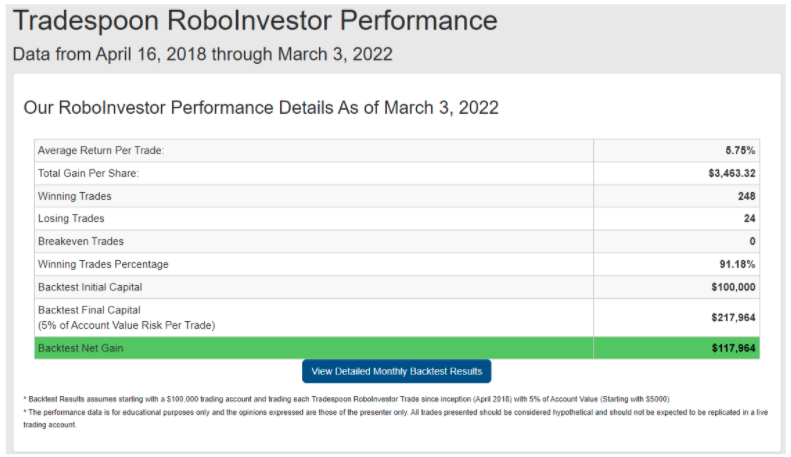

The performance over the time that we have put RoboInvestor to work for our subscribers is a testament to the power of custom AI as our Winning Trades Percentagestands at 91.18% of all trades going back to April 2018. To my knowledge, I don’t believe there is another service with this kind of three-year performance.

As a sample of how our AI tools work for us, our timing on exiting six trades in early February secured some nice profits to where we can revisit these stocks at lower and more favorable levels. Sometimes we score big gains and sometimes we score smaller gains, but the most important aspect is that we score gains in better than 9 out of every 10 trades we put our capital to use.

Against a highly fluid and uncertain investing landscape that is coping with inflation, Fed policy, and geopolitical issues, having an agnostic AI platform to guide us going forward is crucial to generating successful returns. Take a bullish step to increase the performance of your portfolio and make RoboInvestor your best trade of 2022!

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!