As we delve into the intricacies of recent economic data and market movements, a comprehensive analysis emerges, shedding light on both domestic and global financial landscapes.

This week, the focus remained on Friday’s crucial PCE data. We also received inflation data from Europe, particularly Germany, which has taken an unexpected downturn, revealing a downside surprise. Simultaneously, the Bank of Japan (iBOJ) has opted to maintain its yield control policy.

On Thursday witnessed a substantial rally in stocks, spearheaded by small-cap performance. The exodus of Angola from OPEC triggered a decline in oil prices, while the 10-year Treasury yield displayed an upward trend. Recovering from significant losses in the prior session, all three major U.S. indexes – Dow Jones Industrial, S&P 500, and Nasdaq Composite – rebounded on Thursday, showcasing gains.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Consumer confidence in the U.S. has notably surged, as indicated by The Conference Board’s consumer confidence index rising to 110.7 in December from the revised 101 reading in November, surpassing economist expectations.

Examining market dynamics, short-term overbought conditions prevail, likely leading to a shallow pullback in the coming weeks. Noteworthy is the breakout of SMH, XLI, and QQQ to new all-time highs. Anticipation builds for key economic reports, including durable goods orders, personal income, and personal spending, scheduled for Friday. Additionally, the Fed’s preferred inflation gauge, the PCE index, is expected to show a gain of 3.3%.

A consensus among market participants suggests that the Fed will refrain from raising rates in the current and next year. There is a high probability of interest rate cuts in the first half of 2024. Political uncertainties, including rising Trump ratings, add an element of unpredictability. DXY and longer-dated treasuries have dipped below key moving averages, signaling potential continued weakness in the dollar and a rally toward the end of the year.

FedEx reported weaker-than-expected quarterly earnings, attributing it to effective cost control. Despite the challenges, full-year financial guidance was maintained. The broader sentiment reflects encouragement about the economy’s growth mode.

Mortgage rates have reached their lowest levels since June, driven by shifting market expectations and lower Treasury yields. Concurrently, crude oil prices experienced volatility following Angola’s departure from OPEC.

Expressing a shift to a market-neutral stance, the analysis indicates a low probability of recession based on current economic data. While short-term pullbacks are expected, patterns of higher highs and higher lows are likely to persist into the next year.

As we stand on the cusp of 2024, adopting a market-neutral stance emerges as a sagacious choice, guided by the prospect of imminent short-term pullbacks. This cautious approach finds support in economic indicators that presently suggest a low probability of recession, providing a foundation for strategic decision-making.

Forecasts for the S&P 500 underscore a potential rally within the $450-470 range, with pivotal short-term support anticipated between 400-430 in the ensuing months. Amidst this backdrop, maintaining a nuanced strategy becomes imperative, recognizing the likelihood that the zenith of the ongoing rally may have already transpired. The market awaits a catalyst to propel it to greater heights, underscoring the necessity for a methodical and adaptable approach to navigate potential fluctuations as we transition into the new year. For reference, the SPY Seasonal Chart is shown below:

In essence, adopting a market-neutral stance aligns with the prudent evaluation of current economic conditions, offering investors a thoughtful and resilient approach to the evolving market landscape. With this in mind, I have identified my next move in the market.

In the current market environment marked by lower highs and lower lows in interest rates, certain sectors are poised for strategic opportunities. Notably, the materials sector, along with industrials and early cyclicals, stands out. The lower interest rates have implications for these sectors, as they tend to benefit from an environment where borrowing costs are reduced, encouraging investment and expansion.

$VMC – Vulcan Materials Company: A Compelling Buy in the Current Market Conditions:

As we navigate the nuanced market landscape, one company that stands out amidst the favorable conditions for materials is Vulcan Materials Company ($VMC). Vulcan Materials operates in the materials sector, specializing in the production of construction aggregates, asphalt, and concrete. The sector’s strength aligns with the current market conditions, showcasing the potential for sustained growth.

Lower interest rates contribute to a thriving infrastructure and construction environment, benefiting companies involved in the production of essential building materials. Vulcan Materials is well-positioned to capitalize on the anticipated boom in infrastructure projects.

The lower cost of financing encourages increased demand for raw materials. Vulcan Materials, as a leading supplier of construction aggregates, is poised to meet this growing demand, solidifying its position in the market. Vulcan Materials has demonstrated resilience in its earnings, even in the face of economic uncertainties. This stability makes it an attractive option for investors seeking a reliable investment amid market fluctuations.

Similarly, the industrial sector, including companies involved in manufacturing and infrastructure, is poised to gain from the prevailing interest rate trend. With lower financing costs, these companies can invest in capital projects and enhance production capacity. Early cyclicals, which are sensitive to economic cycles, are expected to benefit as well, capitalizing on increased consumer spending and business investment fueled by lower interest rates.

As we navigate through the intricacies of economic indicators and market dynamics, the landscape appears multifaceted, requiring astute observation and a keen understanding of the interplay between global events and financial markets.

In conclusion, Vulcan Materials Company ($VMC) emerges as a robust investment choice, aligning with the favorable market conditions for materials, industrials, and early cyclicals. Investors looking for a strategic addition to their portfolios in the current economic landscape may find $VMC to be a compelling buy.

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

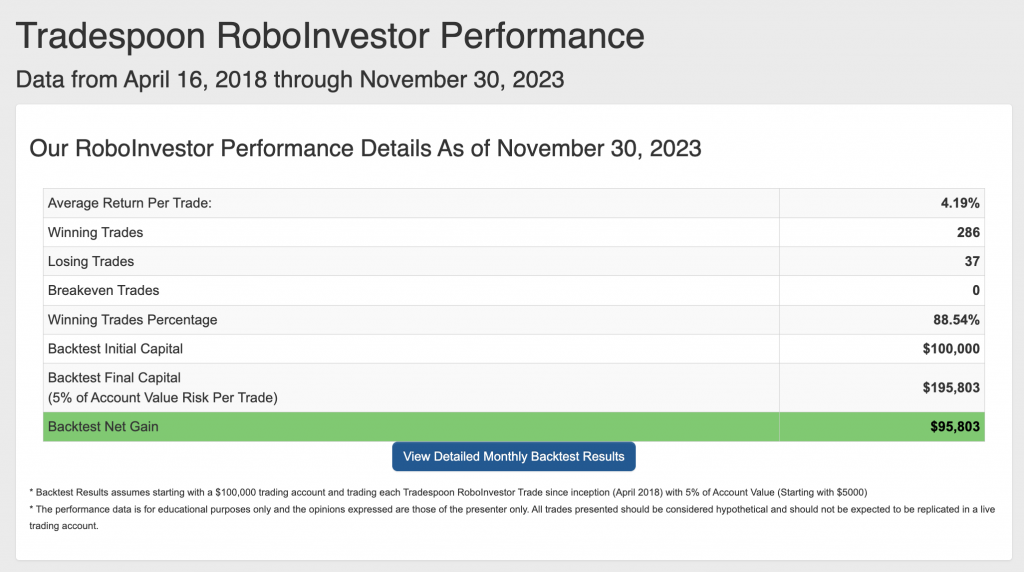

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.40% going back to April 2018.

As we enter Q4 comes to a close, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!