RoboStreet – September 15, 2022

Mixed Week Turns Lower Following Retail and Inflation Data

In the final hour of trading on Thursday, U.S. stocks could not hold on to gains made earlier that day and sold off significantly as bond yields continued to climb higher. As always, inflation was in focus this week with key CPI and PPI data that impacted markets upon release. Also on Thursday, markets were spooked by the potential of supply chain disruptions due to the railway union negotiations. While a deal was announced late Thursday, markets continued their see-saw week by closing significantly lower.

Released on Tuesday, U.S. Consumer Price Index increased 0.1% in August and slowed to 8.3% year over year, versus expectations for a monthly decrease of 0.1% and an annual rise of 8%. The core inflation rate additionally rose more than what was anticipated. This shocked major U.S. indices to their worst daily losses since June 2020. Markets recovered somewhat on Wednesday with the release of the Producer Price Index which revealed that prices for wholesale goods and services declined again for the second month in a row.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The August producer price inflation rate, more commonly known as the Producer Price Index (PPI), saw a 0.1% decline last month due in large part to fuel costs. Core PPI, which is an index of wholesale prices that excludes volatile food and energy items, went up by 0.2% in August. The two reports offered a mixed reading of inflation which, unfortunately, could prolong inflation; wages, rent, and food in the latest reports were noted to be also increasing but were bailed out by gas prices which dropped significantly after spiking in the summer.

Finally, according to the latest retail report released on Thursday, economic growth was steady but unimpressive over the summer, with a 0.3% rise in August as Americans spent more on new cars and going out to eat. Despite an improved job market, consumer spending in the United States remains robust. Americans continue to spend money but largely due to the greater prices they are paying as a result of accelerating inflation. For the past year, retail spending has remained virtually unchanged when adjusted for inflation.

With the market having started its next leg down, marginal lows can be hit as soon as the end of this month or early October. As it stands, I would be a seller in any future rallies, and I advise subscribers not to chase the market at these levels. Overhead resistance levels in the SPY are presently at $404 and then $416. The $SPY support is at $390, and then $380 and I anticipate the market to continue its retreat for the next two to eight weeks.

Short-term the market is oversold and still has the potential to retrace some of its previous losses. Headline news and reports from the Fed will continue to dictate markets. Next week, the latest Federal Open Market Committee meeting is scheduled and the majority of market watchers have factored in a 75 basis point increase. The Fed has vowed to combat inflation at all costs and some are even considering a 75-point hike in the November FOMC as well. With the high risk of over-tightening, a recession could follow as soon as next year.

Keeping this in mind, I am going to be looking at a specific sector of stocks and ETFs which are primed for volatile times such as these. As I outlined above, I expect bearish conditions to continue, with the possibility of an annual rally around the holidays. Still, there is a lot to come before any substantial relief rally could manifest, and with multiple FOMCs, midterm elections, and the ongoing situation in Ukraine, I am not only expecting volatility- I am preparing for it.

This week’s featured sector is that of inverse ETFs aligned with major tech specifically. Mega-cap tech shares are the leading indicator of what the rest of the market will do. We’ve already seen several tech stocks like Apple show weakness and impact SPY/QQQ performance.

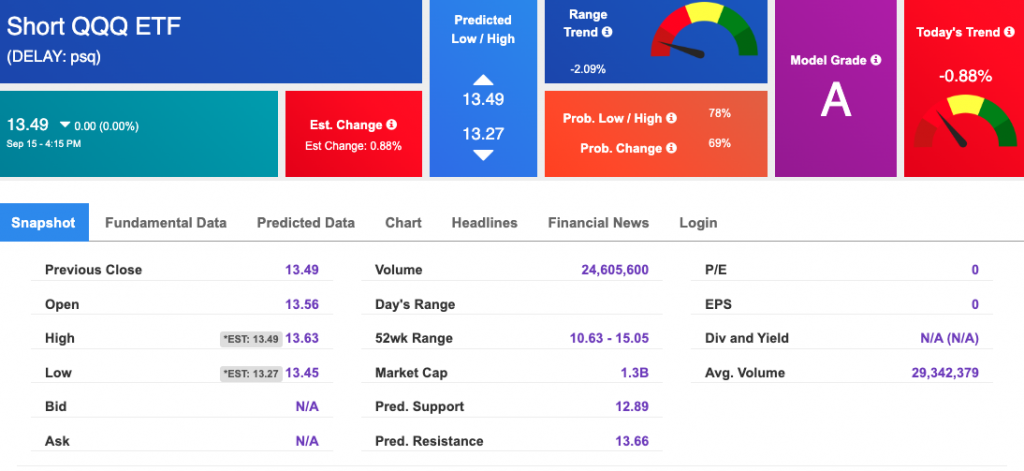

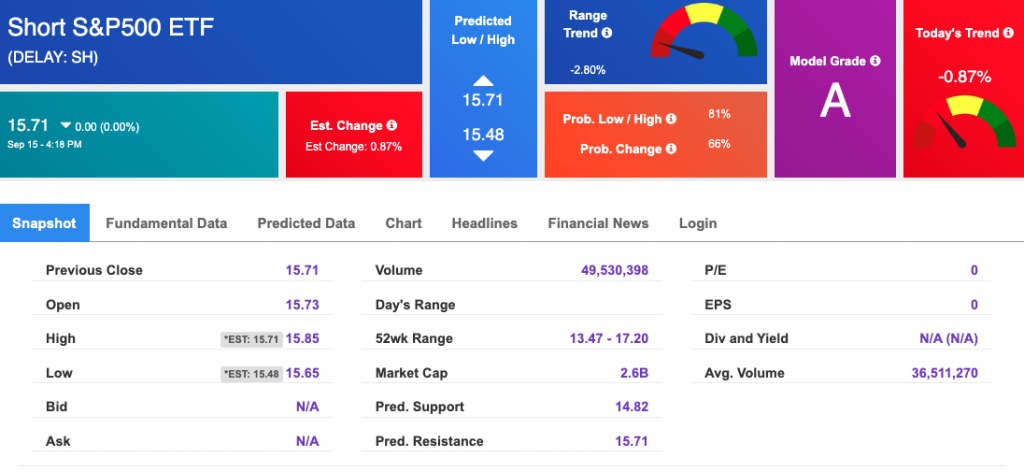

To hedge for upcoming volatility I am buying inverse ETFs $PSQ and $SH. These symbols are meant to short the day-to-day performance of these major indices, which are directly tied to tech performance.

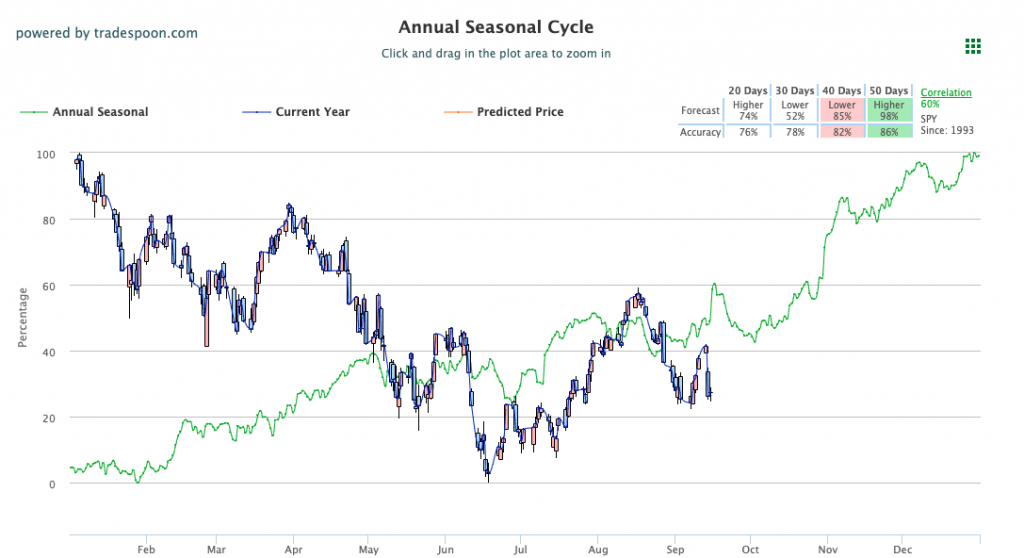

ProShares Short QQQ ETF (PSQ) has already seen positive action following the latest volatility with shares rising on Thursday by over 1.3%. The inverse ETF is trading below its 52-week high of $15 and has broken through a key level based on my A.I. toolset. See PSQ Season Chart below:

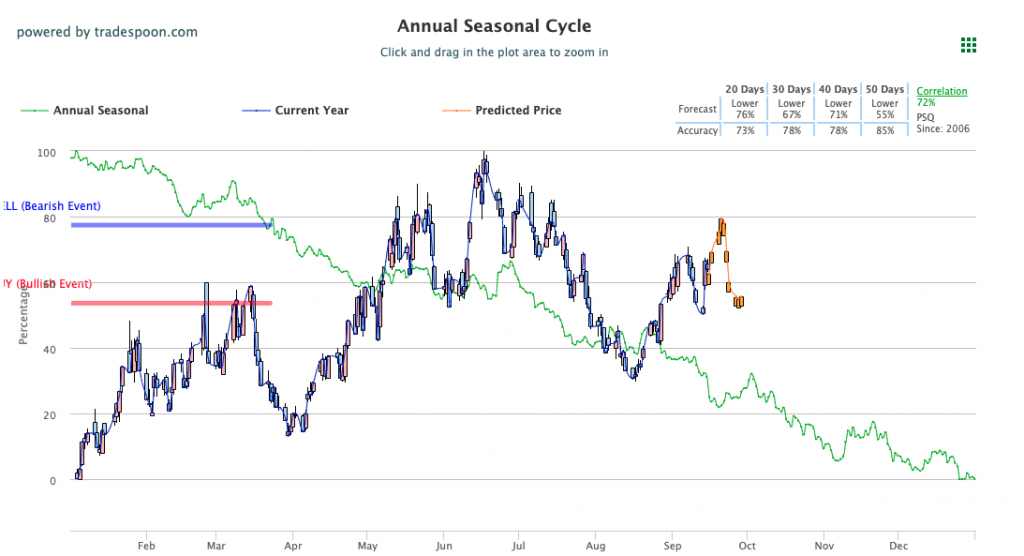

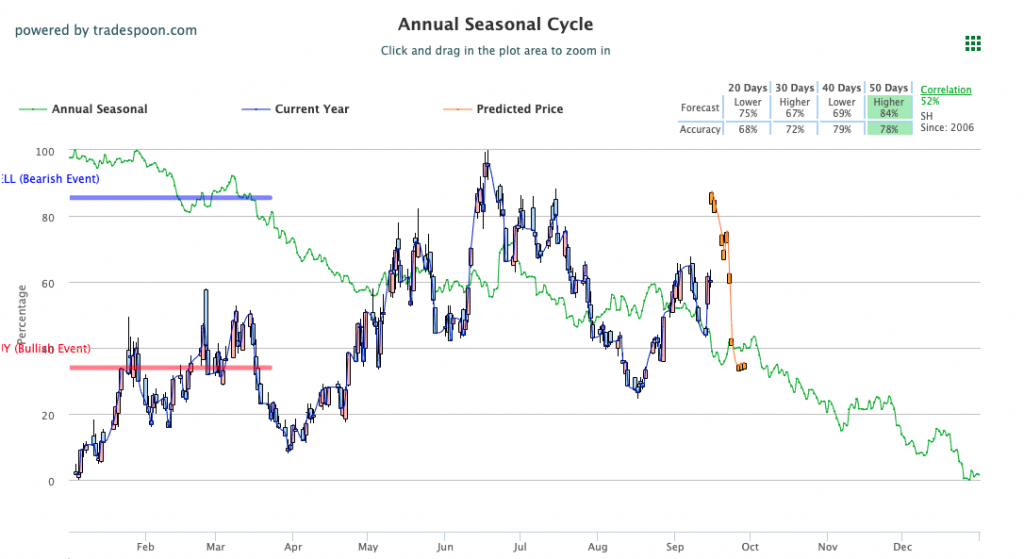

ProShares Short S&P 500 ETF (SH) is also seeing positive movement following the latest CPI and PPI reports, up 1.15% on Thursday. This inverse ETF shorts the S&P 500 and is currently trading near the $16 level, below its 52-week high. See SH Season Chart below:

These two symbols are primed for a significant uptick if volatility ensues, and as I laid out above I am expecting just that. The market has become oversold and with the FOMC meeting and midterm elections ahead, the VIX could spike – and do so for an extended period. If that is the case, there is no better sector to hedge with than that of the tech-attached inverse ETFs.

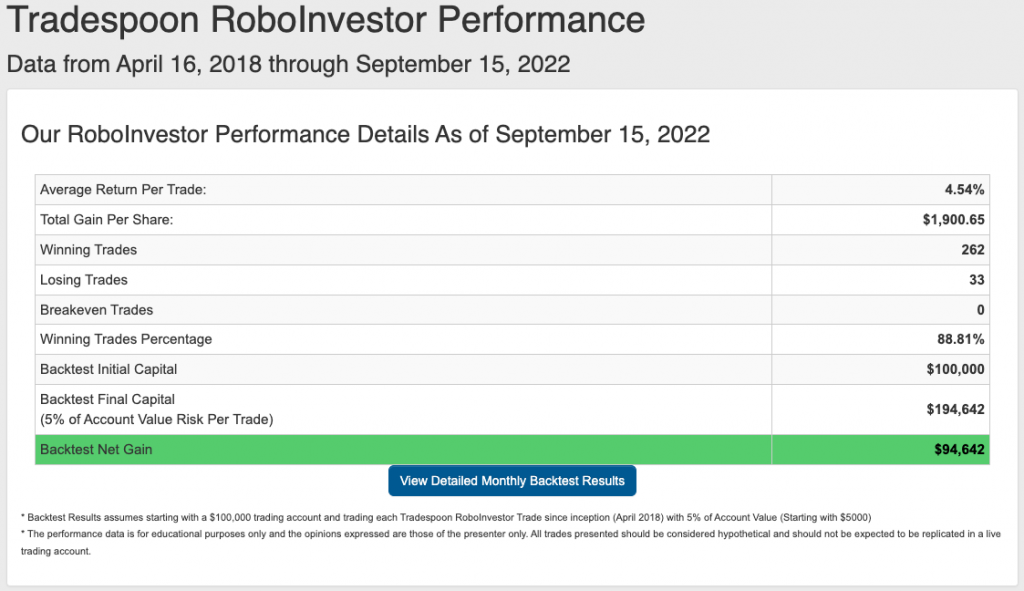

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior. We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.81% going back to April 2018.

The market is still very unpredictable, and we still have an entire quarter left in 2022. Inflation, Fed decisions, geopolitical tension, and the Ukraine war are all influencing how money is being gained and lost. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!