RoboStreet – December 8, 2022

Unemployment Report Supports Market Rebound Following Services Data

This week, markets started off lower following a higher-than-expected U.S. services report which intensified inflation and Fed action fears. Markets then turned positive on Thursday as the latest unemployment data eased some market concerns. As a flurry of economically-impactful releases arrived this week, all eyes will now be on the Federal Open Market Committee meeting which will take place next week.

On Monday, the U.S. stock market had its biggest dip in nearly a month as a result of higher-than-normal readings from the services sector in America. The recent spike in activity might require the Federal Reserve to be more assertive with their policy changes than expected, as they attempt to combat inflation. The most recent ISM survey conducted in the service sector of the U.S. economy reveals strong growth, with a noteworthy increase to 56.5% in November! This impressive surge proves that despite any uncertainty, our nation’s economic prosperity is still on an upward trajectory and continues to develop steadily over time.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Likewise, investors have been closely monitoring the U.S. labor market for indications of development and growth lately. Last week, data displaying a higher-than-expected increase in wages as well as an increasingly strong job sector resulted in stocks plummeting once it became clear that the Federal Reserve’s endeavors to keep inflation from running rampant had not been successful.

Stocks demonstrated mixed performance last Friday, while the week as a whole was incredibly impressive in wake of November’s stellar jobs report. Unfortunately, this success caused apprehension that beating inflation might be more complex than initially expected. In Friday’s release, the November jobs data revealed that average hourly wages had surged over five percent during the last year. Although this is great news for employees, certain market experts grew concerned about inflation continuing to escalate.

On Thursday, the weekly U.S. jobs data ignited investor confidence as the number of continuing jobless-benefit claims rose to their highest level since February – an indication that could soothe the Federal Reserve’s need to raise interest rates any further.

Early December saw a slight yet meaningful increase in unemployment benefits applications, hitting 230,000 for the week–meeting expectations. Furthermore, ongoing claims also rose to 1.67 million individuals, the highest number since February of this year, climbing by 62 thousand and signifying a gradual rise in layoffs due to an economic downturn.

Additional releases this week included several Q3 reports as well as the October Trade Deficit data and the producer price index. These key economic indicators gave insight into our current financial landscape and have shaped the up-and-down nature of the market this week.

Thursday saw long-term yields rise, with the 10-year Treasury note yield growing 8.5 basis points to stand at 3.492%. Despite this increase in yield from Thursday onwards, it remains lower than where we started the month overall. With treasury yields remaining a focal point for many investors, following developments here is essential as we move into 2023.

With a weak U.S. dollar and declining interest rates, the 10-year yield fell beneath its long-term support level of 3.5%. I anticipate the 10-year yield will continue to decrease and reach a low of 2.5% by the end of 2023. Contrary to earlier predictions, this year has seen an increase in yields caused by inflation fears while concurrently experiencing reduced market volatility. Despite this trend, recent weeks have brought recession panic leading to lower yields and equity markets. Historically speaking, capital has in the past shifted from equity to bonds exclusively.

The U.S. dollar has been oversold and should pick up during the month of January/February. It’s highly likely that our current Christmas rally will remain in effect for a while longer, but expect the bear market to keep dragging on into next year as well. The Q4 earnings season will soon start influencing stock prices again, so stay mindful of any changes in your investments before it is too late! With this in mind, let’s review the latest levels in the market.

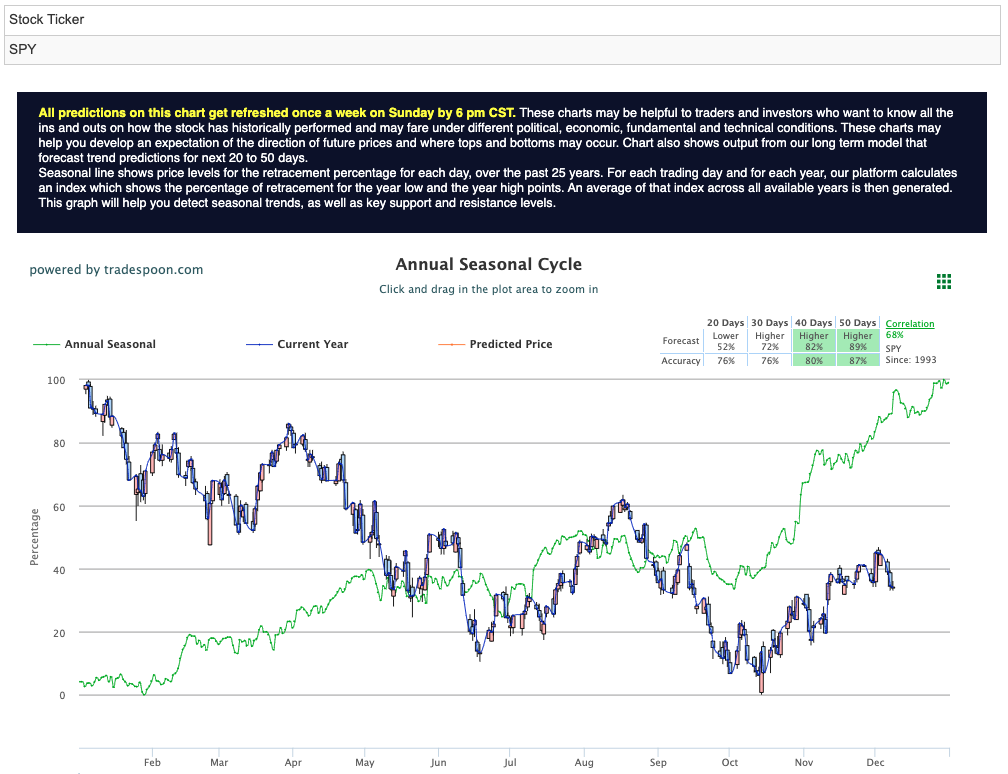

With the $VIX trading near the $22 level, I am watching the overhead resistance levels in the SPY, which are presently at $400 and then $410. The $SPY support is at $390 and then $385. I expect the market to continue the current rally for the next 2-4 weeks. The short-term market is moving within a clearly outlined range. I would be market neutral at this time and encourage subscribers not to chase the market to the downside or upside.

Having said that, it appears there is a path higher for one specific type of trade after this holiday rally wraps up. As rates rise on expectations that the Fed will be more hawkish longer, one sector could see added pressure and weakness which makes this trade a go-to move for me.

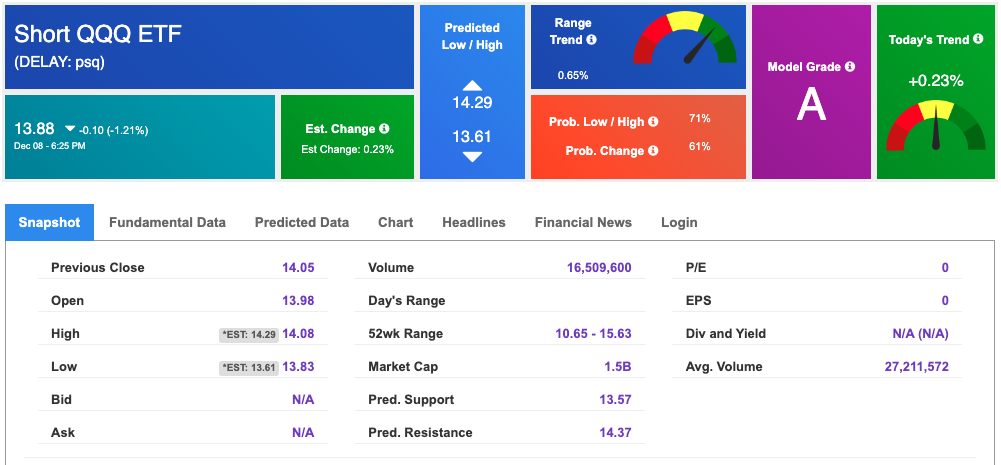

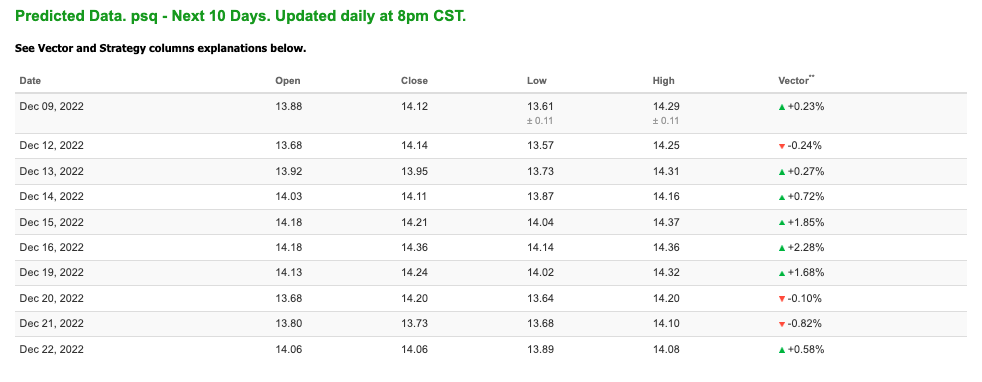

Short QQQ ETF (PSQ) is one of my favorite short ETFs that I have successfully traded in the past. The symbol is trading just under $14 and on the lower after pressing up against the higher end of its 52-week range of $10.65-$15.63. Having recently dipped below its resistance, PSQ offers a unique opportunity if the market continues as projected above. Similarly, the symbol sports a model grade of “A” indicating it is in the top 10% of accuracy for the Tradespoon data universe.

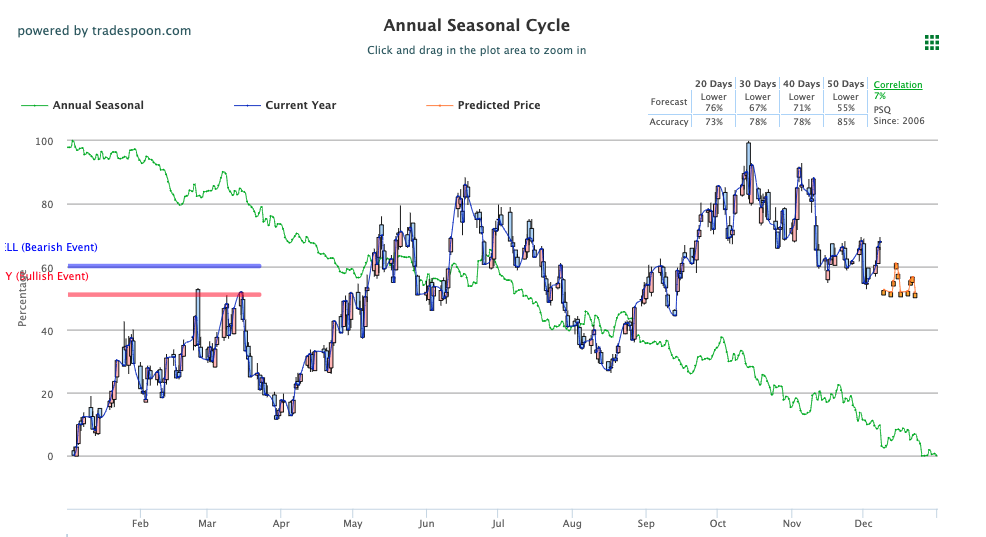

Looking into the Seasonal Chart of $PSQ, we see several additional positive indicators. The gap between the annual season price marked in green, and the current year price, marked in blue appear to be coming together after gaping widely between September and November which offers room for the symbol to tick up as QQQ ticks down. The forecast is similar to the one we saw in the Stock Forecast Toolbox, which adds to my confidence in the symbol. See $PSQ Seasonal Chart below:

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

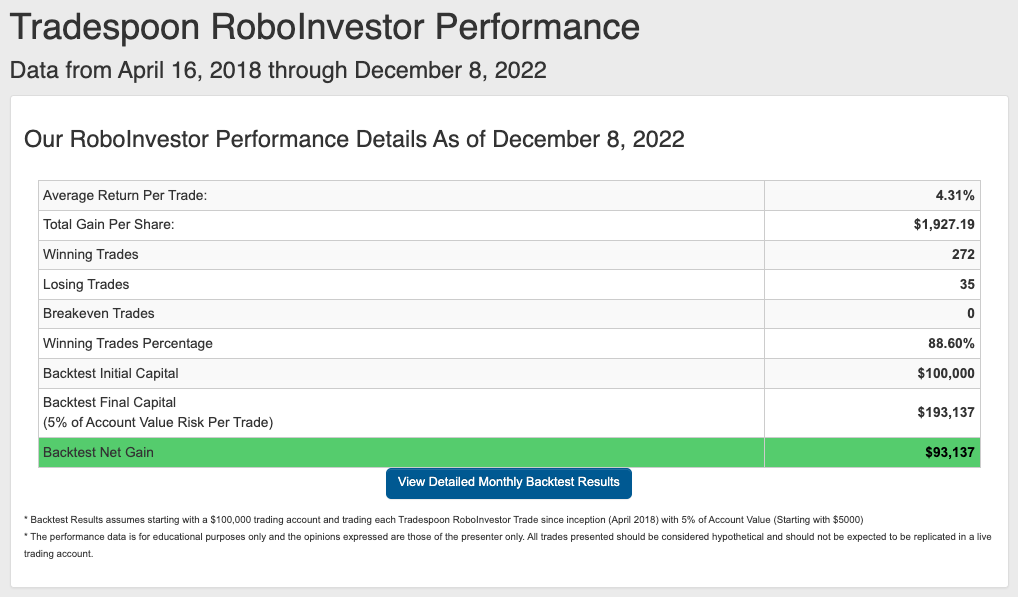

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 89.11% going back to April 2018.

The market continues to shape up to be as unpredictable as I’ve seen since the pandemic broke out in early 2020 – and we just started Q4! Inflation, Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!