RoboStreet – September 1, 2022

Markets Continue Slump Following Jackson Hole Comments

Following last week’s Jackson Hole meeting, where Fed Chair Jerome Powell reinforced the Fed’s intention to continue fighting inflation until the job is done, markets plummeted to their lowest level in months. To start September, U.S. indices were on track to finish for a fifth straight losing session. Before the closing bell on Thursday, the Dow Jones turned positive while the Nasdaq and S&P continued to sell off.

This week, all eyes will be on the August unemployment report due Friday, alongside hourly earnings and nonfarm payrolls. On Thursday, weekly unemployment data released showed a dip to its lowest level in months. Next week, we will see a shortened trade week, with Monday off in observance of the Labor Day holiday, which is set to feature the latest Beige Book from the Federal Reserve. Apart from the Beige Book, the next key reading of inflation will be released on September 13th with CPI data.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

As the shares sold off all week, it is clear market pullback has started. While there could be some relief rallies in place, I am seeing several indicators that point to the end of the latest rally. The dollar’s latest rebound is one key indicator as well as weakness in the tech sector with QQQ and SPY showing some signs of weakness.

Stocks in the United States fell to their lowest levels in at least a month Thursday as bond yields rose, adding to worries about economic growth. COVID lockdowns are resuming in certain parts of China which have piled onto the latest pressures on the global economy.

The U.S. has instituted new license requirements for data-center sales in China and Russia in order to restrict access to its information and, ultimately, effecting sales and shares. After the U.S. government restricted sales of certain products to China, Nvidia and Advanced Micro Devices fell heavily, along with most semiconductor stocks.

As I take in the latest news from the U.S. and overseas I am seeing a certain trend in the market that will likely influence my trades moving forward. I am still firmly under the impression the market’s previous uptick was simply a rally and that the bear market, just as we’ve seen this week, is due to resume.

The market has, by all means, started the next leg down and can make marginal lows in the September-October time frame. Looking at the current market condition, I expect this bearish sentiment to continue through October when a short Christmas rally could follow.

Mega-cap tech stocks are a key indicator of market direction and we’re continuing to see signs of weakness, in marquee names such as AAPL and QQQ. Oil and commodities have started their pullbacks and FXI, the leading Chinese large-cap ETF, has the potential to resume outperforming U.S. markets.

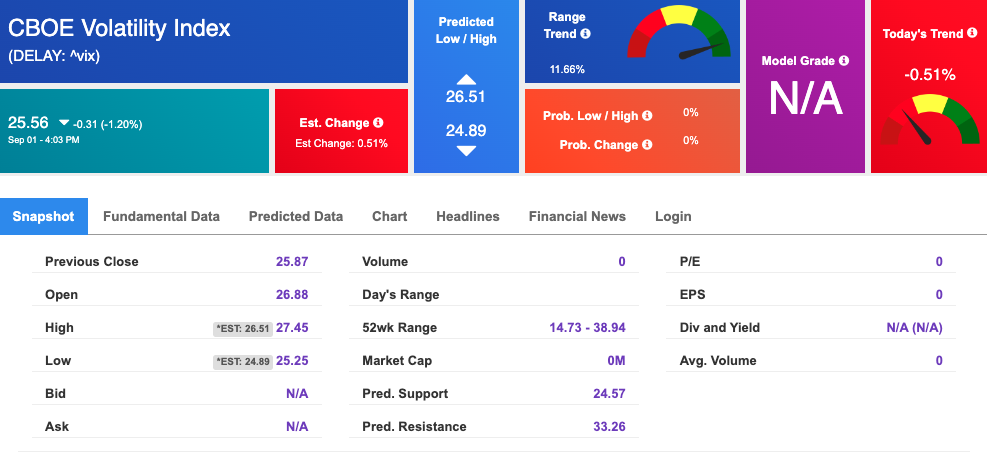

I will be keeping an eye on the volatility index, $VIX, which has recently seen extended movement – trading as high as the $28 level.

I am also watching the overhead resistance levels in the SPY, which are presently at $406 and then $417. The $SPY support is at $390 and then $380. I am expecting the market to continue the current pullback for the next 2-8 weeks. See $SPY Seasonal Chart below:

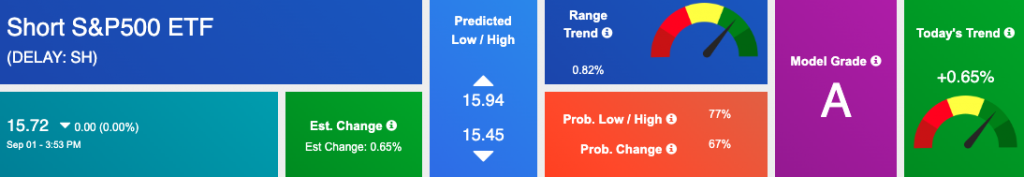

Similar to last week, I am going to be looking at one particular ETF to profit from during this time, which I believe is due for continued success.

ProShares Short S&P 500 (SH) is an ETF intended for shorting the S&P 500, which consists of large-cap U.S. stocks. Currently managing over $2.5 billion in assets, this ETF has been trading in the $15 range, below its 52-week high of $17.20.

While we may encounter some relief rallies, I am squarely under the belief the bear market has resumed. HP Inc., (HPQ) had weak earnings which warned of a slowdown in computer sales. $SNAP declared its intention of cutting its workforce by 20%. Weakness in the secotr is building and quickly.

The best part of the rally is firmly behind us at this point. This gives the short ETF a one-of-a-kind opportunity ahead of the next FOMC meeting when the Fed is likely to raise interest rates.

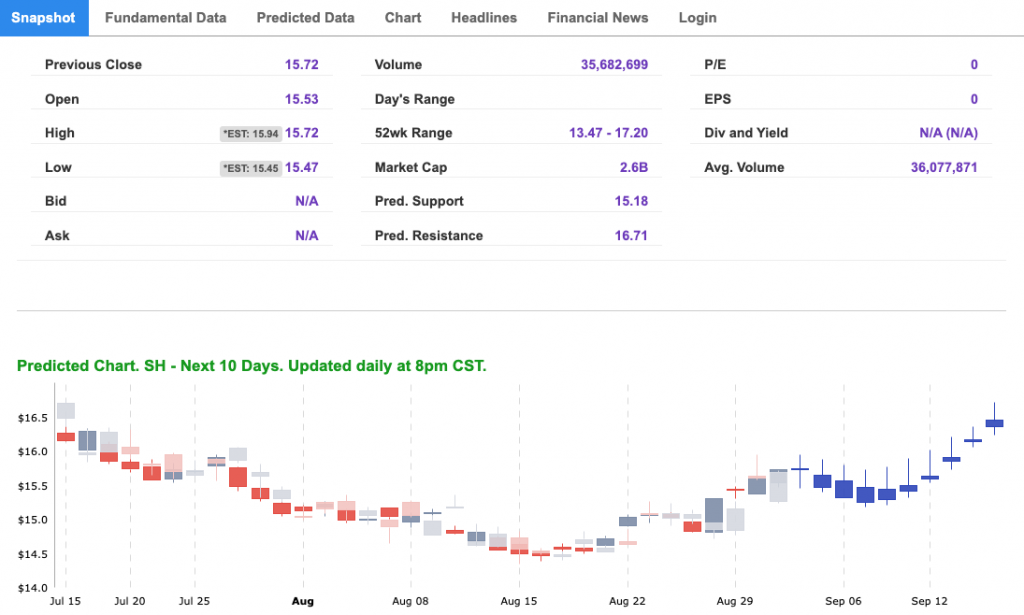

Reviewing the $SH Seasonal Chart, seen above, we see that the annual season price, marked in green, has dipped below the current year price, marked in blue. The symbol is showing potential to go higher in the next 30, 40, and 50-day ranges with a growing accuracy percentage.

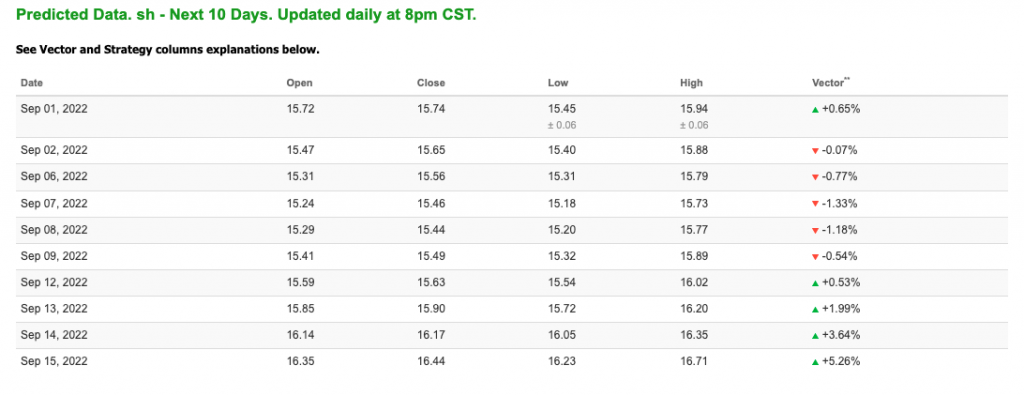

Using the Stock Forecast Toolbox, SH is signaling a continuous trend upward in its 10-day forecast. The symbol is trading below its 52-week and monthly highs and has potential for the upside. SH was trading around $17 just this July. The overbought nature of the market makes this symbol path of least resistance up and our A.I. tools are showing just the same!

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior. We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

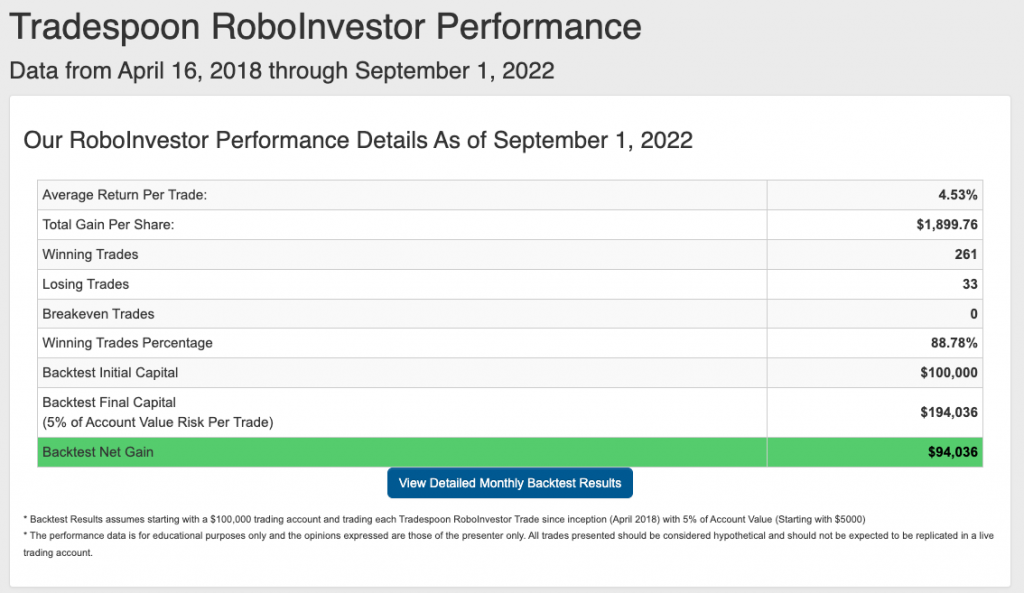

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.78% going back to April 2018.

The market continues to shape up to be as unpredictable as I’ve seen since the pandemic broke out in early 2020 – and we still have more than 3 months to go! Inflation, Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!