Market turmoil continues as stocks retreat and losses extend for a second consecutive day. The eyes of the financial world remain fixed on the Federal Reserve and key economic indicators, as macroeconomic uncertainty dominates the headlines. On Thursday, we saw the Dow Jones Industrial Average plummet nearly 250 points, as well as all three major U.S. indices falling, further exacerbating the downward trend. In other news, tensions in Russia have many experts speculating about the potential shift in global energy supplies, with ramifications that could reverberate throughout the financial world.

The uncertain outlook of interest rates continues to rock the stock market, as Wednesday saw a dip in all three major U.S. indices. Investors were on edge after a string of comments from Federal Reserve officials sparked concerns about the future direction of interest rates. The technology sector was hit particularly hard, with Alphabet experiencing a major drop of over 7%, significantly impacting the Nasdaq. Microsoft, on the other hand, saw a more modest decrease of less than 1%, as the company prepares to launch its own ChatGPT-powered search product. In other sectors, Meta stock declined while oil prices rose and the dollar weakened.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

These losses follow a hopeful Tuesday, where the S&P 500 and Nasdaq both rose by over 1%. Federal Reserve Chairman Jerome Powell reinforced the need for further interest rate hikes, a sentiment that was already well-known by the market. However, Powell’s mention of inflation likely declining throughout the year came as a surprise and suggests that the Fed may be nearing the end of its interest rate-hike cycle. As the week comes to a close, investors will be closely watching key earnings reports from companies like PayPal, AbbVie, Lyft, PepsiCo, and Philip Morris.

In a closely-watched speech, Federal Reserve Chairman Jerome Powell reinforced his stance on disinflation and the need for higher interest rates over the long term. The market viewed this as a sign of potentially no end in sight, given the current unemployment rate which is at a historical low. Meanwhile, the dollar remains resilient and interest rates continue to climb, suggesting that the best of the current rally may be behind us.

We are deeply saddened by the news of a catastrophic earthquake that recently hit Turkey, which could have far-reaching repercussions for our global economy. In other parts of the world, the U.S. East Coast where temperatures keep dropping to record lows, exacerbating existing problems and putting extra strain on local communities. Finally, Bitcoin’s previous high has hit an unfortunate roadblock causing overall market fluxes to increase even further.

Looking ahead, the market is expected to remain within a range of 430 at the top and 380 at the bottom for the next few months, with a neutral outlook. In Europe, the financial markets have fully recovered from the losses of last year and are now just 10% away from regaining the ground lost in 2022.

As earnings season winds down, there are a few notable reports worth mentioning, including those from DIS, Uber, and CVS. Investors will also be keeping a close eye on the upcoming CPI data release next Tuesday, as it may serve as the next catalyst for market activity. See $SPY Seasonal Chart:

With the $VIX, volatility index, trading near the $20 level, I am watching the overhead resistance levels in the SPY, which are presently at $420 and then $430. The $SPY support is at $410 and then $402. I expect the market to trade sideways for the next 2-8 weeks while I would also remain MARKET NEUTRAL ON THE MARKET at this time and encourages subscribers to hedge their positions.

Taking these developments into consideration there is one symbol I will be looking to add to my portfolio in the coming days.

Walt Disney Co. (DIS) is a diversified multinational mass media and entertainment conglomerate that operates in several industries including media networks, parks and resorts, studio entertainment, consumer products, and interactive media. The company’s stock has been a staple of the stock market for many years and has a long history of providing strong returns to investors.

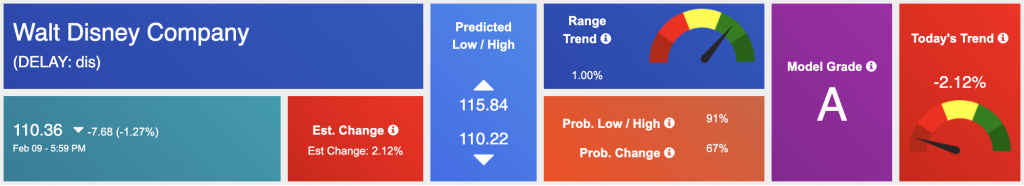

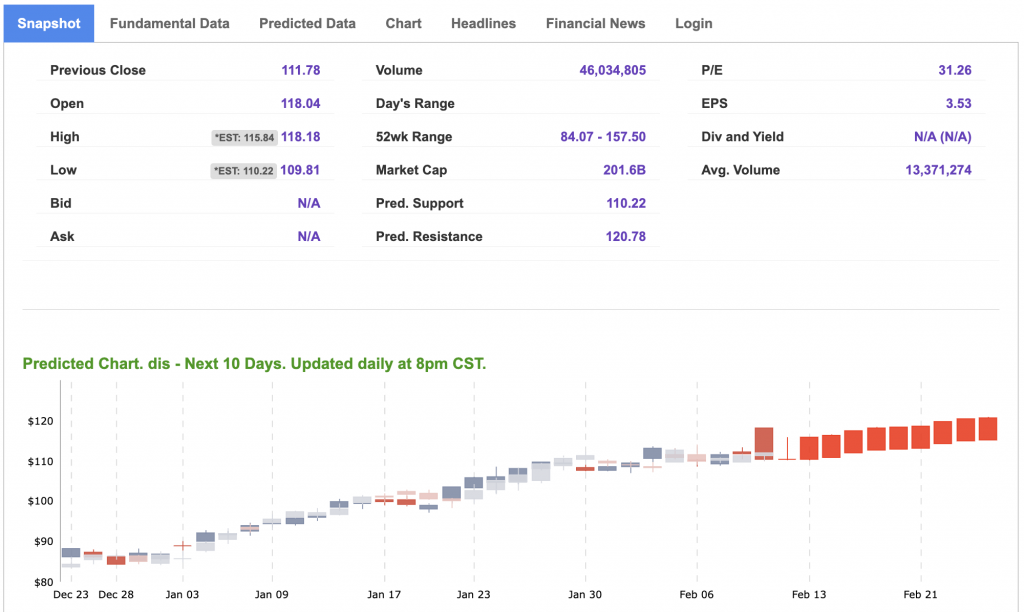

Currently, Disney’s stock traded lower on Thursday but has seen an impressive month – up over 15%. Still, the symbol trades below its 52-week high and has plenty of room for the upside.

The company has made substantial investments in its streaming services by launching Disney+ in 2019 and acquiring multiple major franchises, including Marvel and Star Wars. Anticipating a rise in demand for streamed content, these actions are expected to be successful over time as they capitalize on this growing market.

Overall, Disney’s current outlook is relatively positive, with the company’s diverse revenue streams, strong brand recognition, and strategic investments in new technologies and content positioning it well for future growth.

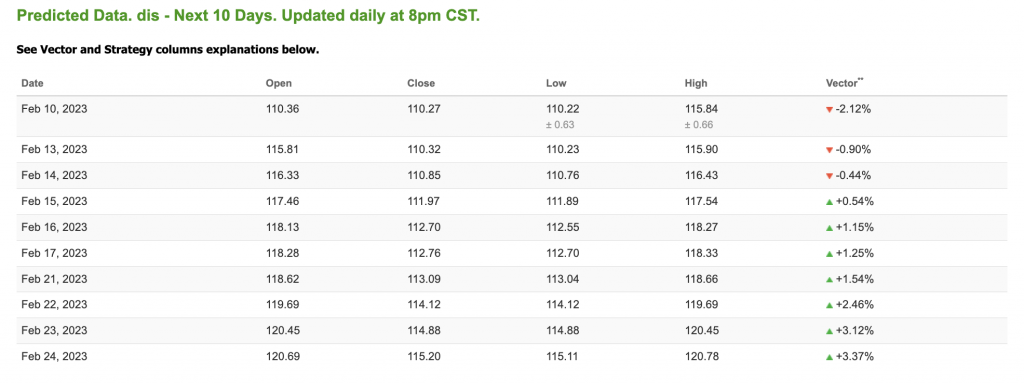

The 10-Day Stock Forecast Toolbox outlook for DIS is exceptionally optimistic, highlighting an unrelenting and solid upward trend. This gives me trust in my projections and potential decisions surrounding DIS.

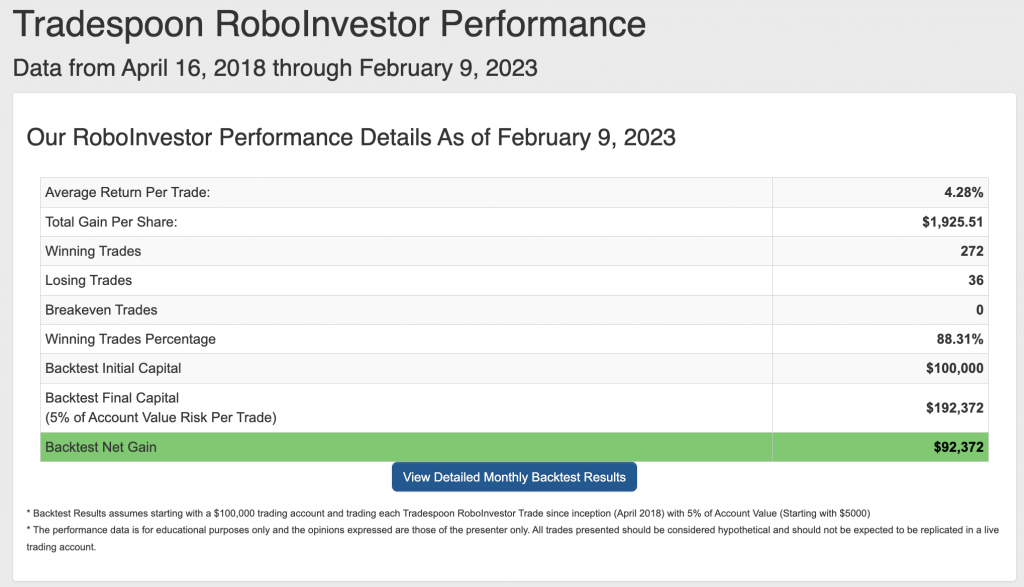

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.31% going back to April 2018.

Inflation, Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. 2023 is set up to be an eventful market year. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!