RoboStreet – April 14, 2022

Market Sets Up For Volatile Earnings Season

The few earnings reports marking the beginning of the first-quarter reporting season are indicating that investors need to be wary of how the market is going to treat good, neutral, and bad news. Companies that make their numbers, but don’t raise guidance, raise dividends and announce stock buybacks face selling pressure on the news.

This is a very fickle and unforgiving market for those companies that don’t live up to revenue and profit forecasts. The hot inflation data released this week set a tone of caution for the path ahead in that while some economists are stating March will reflect peak inflation conditions, the bond market isn’t really buying into that narrative.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

In fact, following a two-day respite from a bout of heavy selling, bond yields are once again ticking higher, with the 10-yr yield up to 2.78% as of yesterday. WTI crude also looked to have topped out, pulling back to $96/bbl, followed by a sudden pivot higher, and trading right back up to $104/bbl in just two sessions.

On the earnings front, UnitedHealth Group Inc. (UNH) is getting bid higher after posting solid results, but financials remain a source of funds, being sold off even as most banks and brokers are meeting or beating estimates. Shares of BlackRock Inc. (BLK) declined reflecting current market conditions while Goldman Sachs Group Inc. (GS) and JPMorgan Chase & Co. (JPM) beat estimates, but the market is not rewarding these Dow components, sensing slow deal flow in the months ahead.

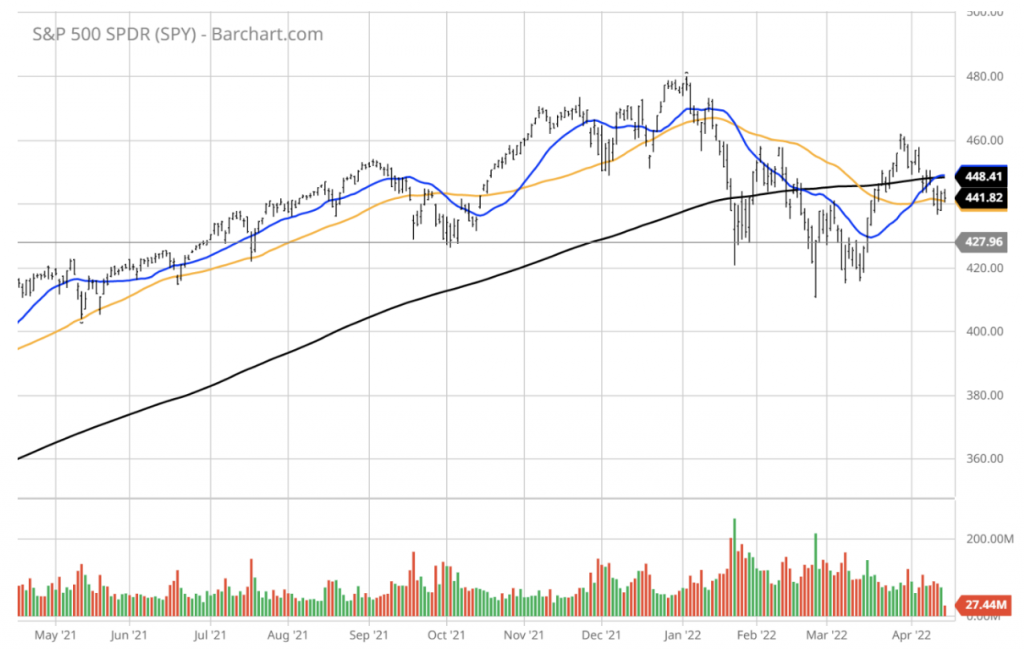

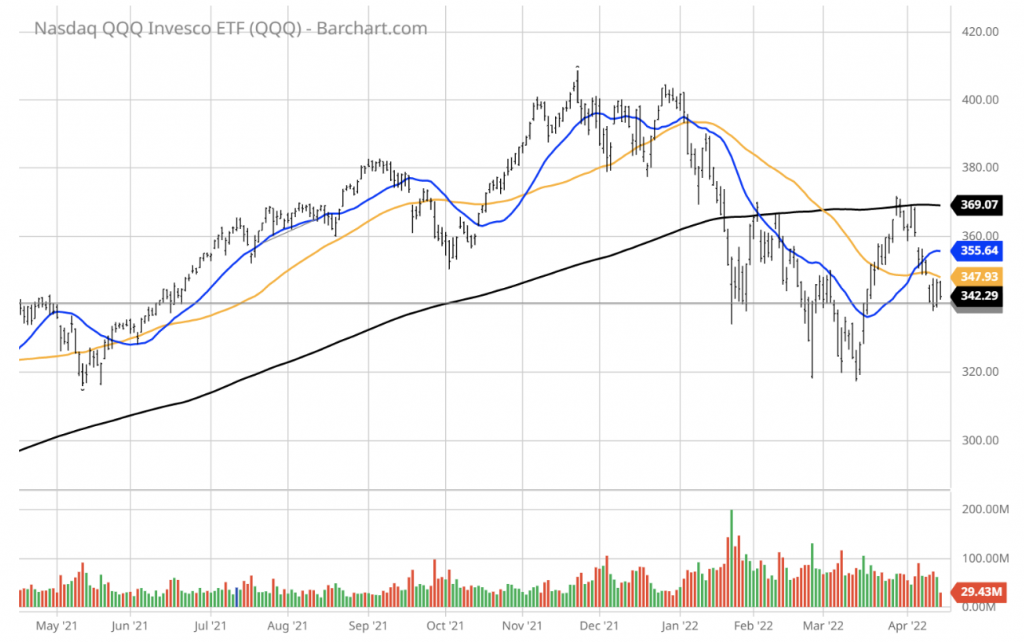

The $SPY closed higher 1.1%, at $443, above the 50% retracement between the recent highs and lows. The value/reflationary ($VTV) closed higher 0.5%, at $148, near the all-time highs. The technology sector ($QQQ) closed higher 2.1%, at $346, between the 50 DMA and the 200 DMA.

The $DXY closed lower, near the $100 level, at the June 2020 high. The $TLT closed higher 0.2%, at $123, and at the July 20219 lows. The ten-year yield closed lower at 2.69%. The $VIX closed higher near the 21 level, above the historical average.

The $SPY short-term support level is at $438 followed by $420. The SPY overhead resistance is at $445 and then $451.

Assuming the geopolitical risks in Ukraine have reached the status quo, it is reasonable to assume that the $SPY February low is set and the pattern of higher highs and higher lows will continue in the next two to six weeks. The market has reached extreme oversold levels and is due for a rebound in the next few sessions.

I would be a buyer of the low beta stocks into the pullbacks and have a market BULLISH portfolio at this time.

I do not expect the $SPY to post new all-time highs in the first half of this year. There is a high probability that the $SPY main long-term support at $415 is now set but might be retested in the next few months.

If you are trading options consider selling premium with June and July expiration dates.

Based on our models, the market (SPY) will trade in the range between $415 and $470 for the next 2-4 weeks.

It is clear what forces that the market cares about most – inflation and higher interest rates – that usurp worries over Ukraine, China, supply chain constraints, and anything else that comes to mind. My work suggests that inflation has peaked in March and that the outgoing tide for the market will begin to reverse itself in the near term.

The inflation data for April, which isn’t released until early May, will very likely show some ebbing of prices on several inputs. Lumber and beef prices have already come down by 30% and 20% respectively. Shipping and trucking rates are also being negotiated at lower premiums and mortgage rates topping 5% are putting a crimp on the sizzling pace of the housing market.

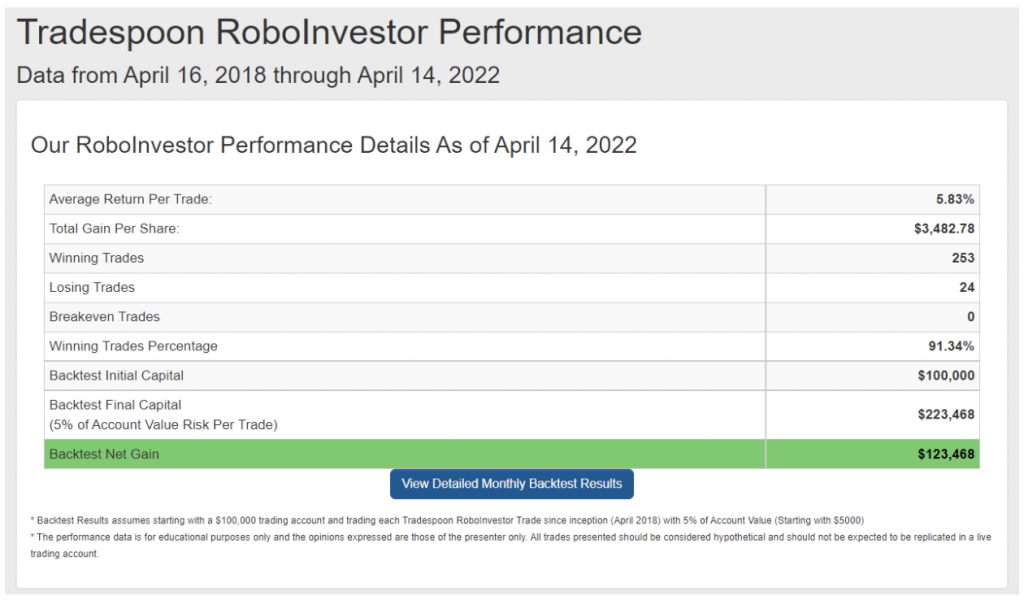

Our RoboInvestor stock and ETF advisory service are built on an artificial intelligence platform using custom-tailored algorithms that screen for high-quality, high-probability trades. This set of AI tools is crucial to our being able to determine when it’s time to take the unpopular position of buying into stressed-out sectors at attractive prices.

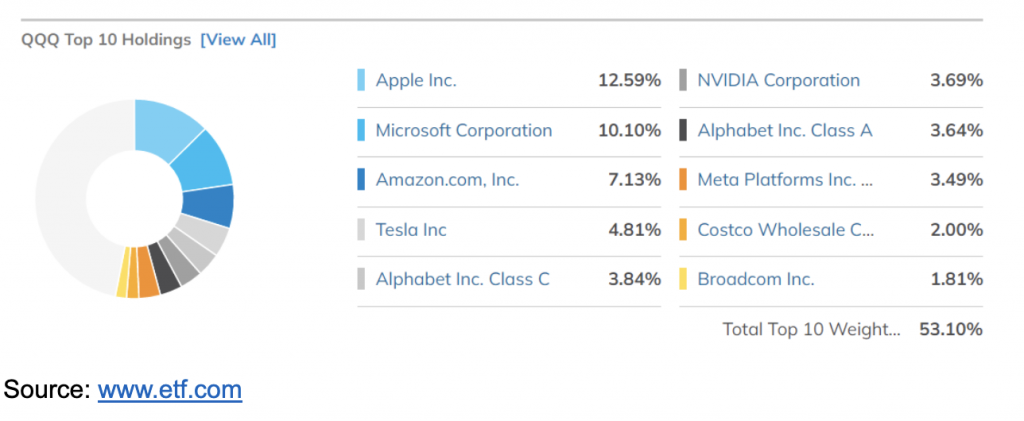

Case in point is that of the big-cap technology stocks, which have borne the brunt of the selling pressure among the 11 major market sectors. The Invesco QQQ Trust Series ETF (QQQ). As the most widely-traded big-cap tech ETF, QQQ is top-heavy with the best-of-breed, dominant companies in their respective sub-sectors. The top 10 holdings within QQQ make up 53.10% of total assets. which stands at $185 billion.

It’s my view, and that of my AI system, that these leading companies will report pretty robust Q1 results and offer better-than-expected forward guidance. Assuming my analysis is correct, QQQ should pivot higher. Following a torrid rally from $320 to $370 in March, shares of QQQ have retraced better than 50% of the gain, and are testing technical support at $340, where my AI indicators are flashing oversold signals.

Our AI-driven Seasonal Chart confirms this potential reversal pattern setup, showing “Higher” probability readings for the next 20, 30, 40, and 50-day periods. That’s about as bullish a read-out as my system generates, and one that can produce big profits.

For investors seeking a time-tested, market-tested trading platform powered by AI, then RoboInvestor is a service to highly consider putting to work for one’s portfolio. Our track record over the past four years speaks for itself. The Winning Trades Percentage is a very impressive 91.34% going back to April 2018.

As a RoboInvestor subscribers, members receive an online newsletter every other week, delivered over the weekend. The portfolio will range in size from 15-25 holdings, consisting of blue-chip stocks and ETFs that include major indexes, sectors, sub-sectors, commodities, precious metals, interest rates, currencies, and shorting opportunities using inverse ETFs.

Within each newsletter, I lay out my views on the market and the investing landscape, review our current portfolio holdings and provide two new recommendations to take action on when the market opens Monday morning. At any time, when my AI indicators trigger sell signals, I’ll send out an email to exit positions. We do all the work and members simply follow our instructions.

2022 has certainly proven to be a very challenging year for investors and not having a bona fide investment system in place will result in serious underperformance. Take me up on my offer to come alongside your portfolio and put in place a set of AI tools that has the potential to generate a steady stream of wealth-building trades. Let joining RoboInvestor be your best trade of 2022 and let’s get busy making money.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!