RoboStreet – February 3, 2022

Bulls Proving Resilient Against Fed Headwinds

The abrupt change in Fed policy that triggered the market correction got to a point where valuations in the best-of-breed blue-chip stock got to levels that brought buyers off the sidelines. Many leading stocks of the past two years traded down to their respective 200 DMA lines, and either briefly breached them or held these key technical support levels. It’s been a true test of establishing future market leadership.

There have been some very high-profile earnings-related blowups that have also tested the mettle of the market’s resolve. Netflix Inc. (NFLX), PayPal Inc. (PYPL), Intel Corp. (INTC), and Meta Platforms Inc. (FB) caused a lot of tension but were offset by impressive earnings from Apple Inc. (AAPL), Microsoft Corp. (MSFT), Alphabet Inc. (GOOG), MasterCard Inc. (MA), Texas Instruments Inc. (TXN), American Express Co. (AXP) and others.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

The Fed laid out their fiscal policy roadmap that didn’t surprise markets from the narrative delivered back in December, stating QE would end in March, followed by the likelihood of three quarter-point rate hikes and no mention of reducing the balance sheet. It came off as a more-measured approach, but that could change with the upcoming CPI and PPI readings due out Feb. 10 and Feb. 15 where inflationary pressures probably were more elevated in January.

Ukraine remains an outside threat to market sentiment, and with the market now extended over the very short-term, some cautionary back-and-filling into the inflation data would not be unexpected and actually be constructive for market technicals. Other than the Russell 2000, the major indexes recovered their 200 DMA lines that will likely be tested once more. Any relief from the Ukraine standoff and further positive data on the Omicron variant stand to provide follow-on buying in stocks, but not without a healthy dose of volatility to keep investors guessing.

CURRENT TRADING LANDSCAPE

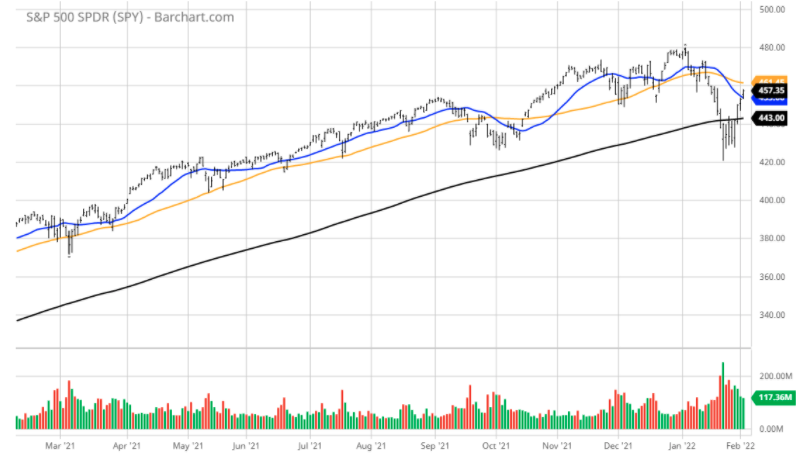

The $SPY continued to trade higher and broke out of the recent range. The $SPY traded higher, up 1.0%, and closed at $457, above the December low. The value/reflationary closed higher, up 0.9%, above the 50 DMA. The technology sector ($QQQ) closed higher 0.8% at $368, above the 200 DMA.

The $DXY continued to reverse its recent gains, closed down another 0.6%, and closed below the 50 DMA. The $DXY should continue the pullback in the next 1-2 weeks, which would benefit reflationary stocks. The $TLT traded sideways, up 0.3%, and closed below the 200 DMA. The $VIX traded lower at the 21 level. The $SPY short-term support level is at $445 (key long-term support) followed by $435. The SPY overhead resistance is at $460.

The $QQQ’s started its rally which should continue for the next 4-8 weeks. I do expect volatility to persist, but the pattern of higher lows and higher highs should continue short term. I would be a seller of the high beta stocks into the rallies and continue rotating the portfolio into the value stocks ($XLE, $XLI, $XME and $XLF).

I would consider rebalancing portfolio at this time and have an overall market BULLISH portfolio. I do expect the $SPY’s rebound to continue for the next 1-2 months. I do not expect the $SPY to post a new all-time high in the first half of this year. The December unemployment data and ECB decision this week can set the direction for the market.

Short–term the market is overbought, and after the dismal report from $FB, $QQQ can potentially retest the recent lows.

If you are trading options consider selling premium with April and May expiration dates.

Based on our models, the market (SPY) will trade in the range between $430 and $470 for the next 2-4 weeks.

Of the many fluid situations impacting stocks both positively and negatively, the weakening dollar is coming into view as providing a future boost to the emerging markets. A weaker dollar increases buying power for countries that have to spend heavily on imports of finished goods, commodities, and food.

In the past week, the dollar has taken a sharp turn lower following a recent spike, accompanied by heavy selling volume, implying a change of trend is underway.

This is a probable green light to initiate positions in emerging markets via ETFs and/or stocks. In light of the fact that due diligence on foreign stocks can be harder to process, it is our view that trading the ETFs is the best avenue to manage risk/reward. There are some mega-cap stocks in China that can be traded separately that Wall Street has good research coverage in, but not so in greater Asia, South America, Central America and Eastern Europe where most of the compelling emerging market stocks trade.

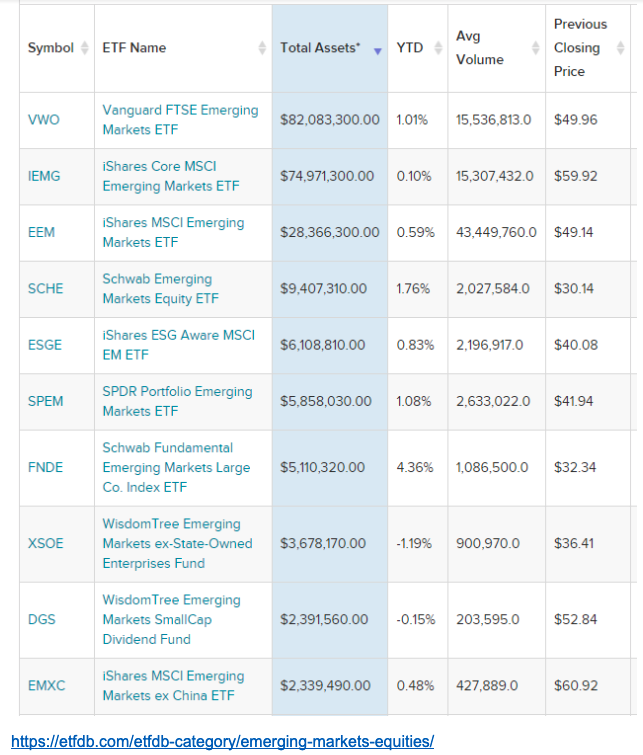

A look at the most widely-traded ETFs shows a nice array of choices for investors to work with. The biggest ETFs by AUM will have top holdings that resemble each other, but underneath, their compositions will vary greatly, giving each ETF its own unique profile.

I find it intriguing that the largest hedge fund in the world, Bridgewater Capital, had the three largest emerging market ETFs as the fund’s top three holdings at the end of the third quarter of 2021. Overseen by Ray Dalio, the history isn’t quick to trade out of major positions inside three months, so I’m thinking when the 13-F reports are released for the fourth quarter this month, his fund will still be hugely long these ETFs.

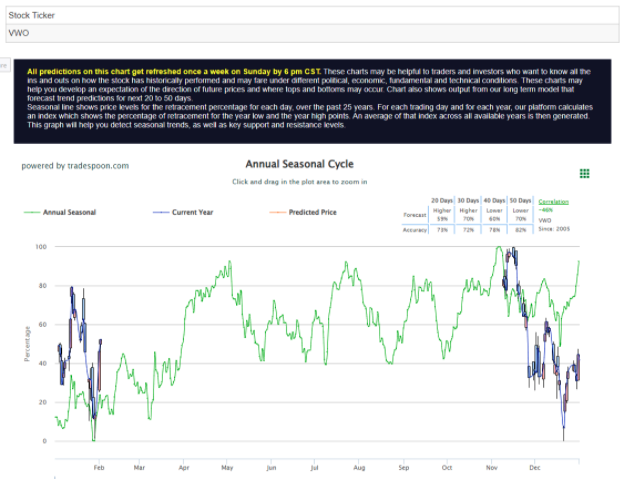

A quick snapshot of the 10-year chart of VWO, the largest emerging market ETF, has retraced a decade-long upside breakout to key support that sets up very nicely for 2022.

At issue with this investment is getting the timing right and executing a premier entry point for this ETF as well as the others listed. This is where my years of developing a cutting-edge AI platform become so valuable. The proprietary algorithms that are built into my models provide exacting data for which to buy into as well as exit positions.

One of our AI tools, the Seasonal Chart, is registering a “Higher” reading for the next 20 and 30-day periods for shares of VWO. How we position this trade will be intertwined with the broader market landscape, but the short-term data is bullish, which typically can lead to longer-term bullish data as the trade matures.

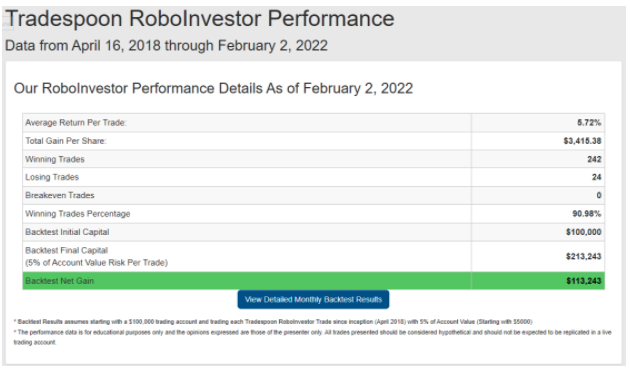

We deploy this platform in our RoboInvestor investment advisory service that has a winning trades percentage of better than 90%. That’s the power of AI.

By joining RoboInvestor, members are provided an online newsletter delivered every other weekend with two new recommendations to act on when the market opens on Monday. Depending on what our AI platform unveils during the week leading up to the distribution of the newsletter, we may recommend blue-chip stocks or ETFs in major indexes, market sectors, sub-sectors, commodities, precious metals, currencies, interest rates, volatility, and shorting opportunities via inverse ETFs.

RoboInvestor is an unrestricted advisory service seeking trades with the highest probability ratios for generating profits. My conviction level is to the point where my personal investment capital is involved in every trade I recommend. My journey to wealth creation is a shared experience with every member of RoboInvestor, and I wouldn’t have it any other way.

My advice is don’t try to trade this market alone in 2022. The Fed has shifted its policy and the tailwinds of QE have been removed. Now the hard work of producing market-beating gains is the task ahead and having a time-tested AI-based platform to identify the highest-quality trades in a volatile market is, in my view, paramount. Make your smartest trade of the year this week – join our RoboInvestor community – and let’s pursue a richly profitable year ahead together.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!