The stock market experienced a volatile week, beginning with a strong rally driven by renewed optimism, particularly in the consumer discretionary sector. Major indices surged on Monday, with the S&P 500 and Dow Jones Industrial Average both gaining over 1%, while the Nasdaq Composite rose nearly 2%. This rally came after a turbulent prior week marked by significant uncertainty surrounding Federal Reserve policy, economic data, and geopolitical concerns, which had weighed on investor sentiment.

Tesla played a central role in the strong performance of the consumer discretionary sector, which was on track for a 3.2% weekly gain. Tesla’s stock surged by 10.1% on Monday alone, despite facing ongoing challenges, including tariff threats, economic uncertainty, and weakening consumer sentiment. Additionally, Tesla’s brand image has been impacted by consumer protests linked to CEO Elon Musk’s political affiliations. While the company enjoyed a powerful start to the week, it remains down 32% year-to-date, reflecting broader struggles within the consumer discretionary sector, which has lost 11.1% in 2025.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

As the week progressed, market sentiment was once again tested by trade-related concerns. The Trump administration’s tariff policies took center stage midweek, contributing to renewed uncertainty. Reports of reciprocal tariffs on March 19–20 led to selling pressure, pushing major indices lower amid fears that higher import costs would weaken consumer demand. However, by March 24–25, a more optimistic tone emerged as Trump hinted at a more targeted tariff approach, fueling a relief rally. The S&P 500 climbed 1.7%, and the Dow Jones Industrial Average surged over 600 points on March 24, reflecting hopes that trade tensions might ease, though caution lingered as the week neared its close.

On Wednesday, market sentiment shifted again as large-cap technology stocks, which had been driving the market higher, dragged the S&P 500 lower. The decline snapped a three-day winning streak for major indices, as investors appeared cautious amid concerns over regulatory challenges and continued economic uncertainty.

GameStop was one of the bright spots in a mixed market, surging by 12% after announcing that its board had approved a plan to purchase Bitcoin. This news followed widespread speculation about the videogame retailer’s interest in new growth strategies. GameStop reported fiscal fourth-quarter earnings of $0.29 per share on $1.28 billion in revenue, compared to $0.21 per share on $1.79 billion a year ago, signaling a shift towards more modernized business initiatives.

Nvidia suffered a 5.7% drop, as reports emerged that Chinese regulators were discouraging major domestic tech firms from purchasing the company’s H20 chips due to energy-efficiency concerns. This development signals growing tensions around U.S. semiconductor exports, further complicating the already strained trade relationship between the U.S. and China.

Boeing also faced headwinds, falling 2.2% after a federal judge ordered the company to face trial in June regarding a criminal case tied to the 737 MAX crashes in 2018 and 2019. Boeing had sought to withdraw its earlier guilty plea agreement, which had blamed the company for misleading regulators.

In contrast, Chewy saw its stock climb after reporting fiscal fourth-quarter earnings that exceeded expectations. CEO Sumit Singh highlighted “strong active customer growth” as a key driver behind the positive performance, suggesting resilience in the pet-products sector amidst broader market challenges.

As Thursday approached, Lululemon’s fourth-quarter earnings report became a point of interest. Analysts were optimistic about a strong holiday quarter, though questions about future guidance lingered. The stock has fallen 12% year-to-date, compared to the broader S&P 500’s 2.8% decline. Trading at 21.6 times next year’s earnings—well below its five-year average of 36.7—investors are eyeing any positive guidance as a potential upside catalyst.

Overseas, European markets mirrored U.S. concerns, as trade tensions with the U.S. escalated. President Trump confirmed a 25% tariff on automotive imports, prompting fears of a broader escalation in protectionist policies. These concerns are not only impacting the automotive industry but also reverberating through various sectors.

Amid the tariff debates, the Federal Reserve’s policy actions remained a focal point. The central bank’s decision to maintain interest rates was widely anticipated, but its updated economic projections painted a more cautious outlook. The Fed reduced its U.S. GDP growth forecast for 2025 to 1.7% from the prior estimate of 2.1%, citing a range of economic challenges. Policymakers acknowledged that tariffs could push inflation higher but emphasized that they would only react if inflation pressures became persistent.

The bond market also reflected economic uncertainty, with the 10-year Treasury yield continuing to trade in a volatile range between 3.6% and 4.8%. However, lower-than-expected inflation data helped ease concerns about further rate hikes, supporting a more neutral market stance.

A late-week rally helped the S&P 500 and Nasdaq end a multi-week losing streak by March 24, but gains were tempered by ongoing uncertainty. The broader tech sector continued to face pressures, but Tesla’s notable rebound—surging 12% on March 24 alone—provided a much-needed lift. Tesla’s move toward launching a robotaxi service in 2025, coupled with regulatory progress in China, sparked optimism for the electric vehicle maker, even as the broader tech sentiment remained fragile.

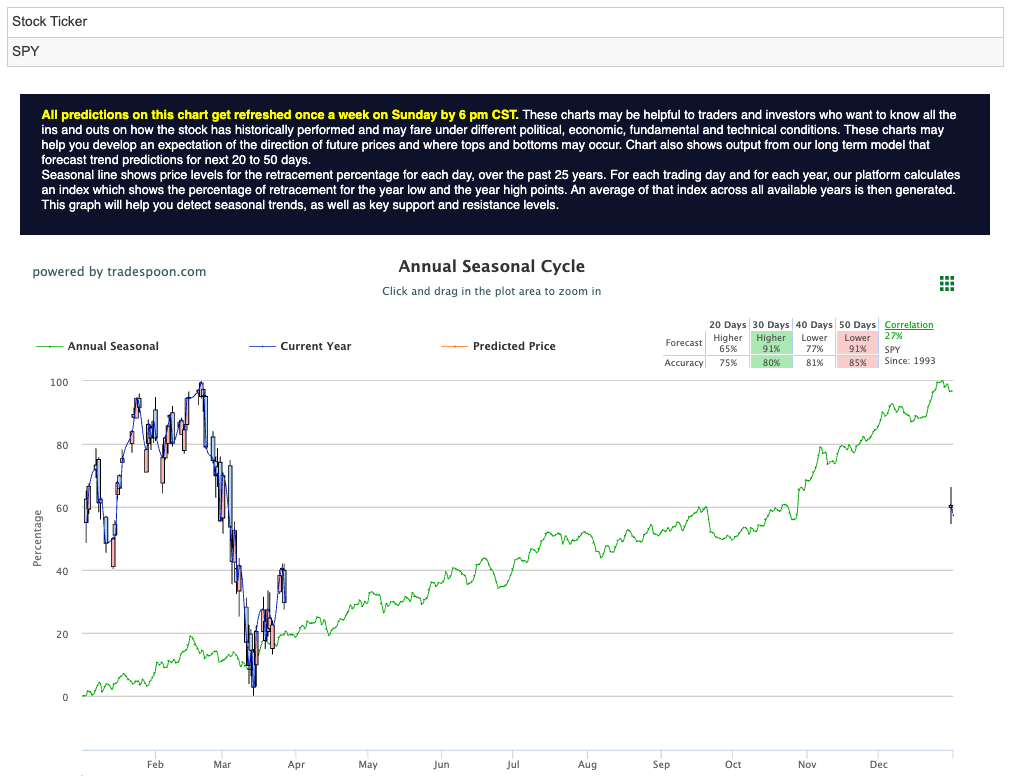

The S&P 500 remains in a sideways trading pattern as inflation data aligns with expectations and corporate earnings season exceeds forecasts. The primary risk to the market remains the prospect of interest rates staying higher for longer, alongside rising unemployment trends. In the short term, the SPY rally could extend toward the $580–$600 range, with key support levels at $530–$550. While near-term movements suggest consolidation, the long-term trend remains under pressure, keeping investors cautious as they navigate an uncertain landscape. For reference, the SPY Seasonal Chart is shown below:

Looking ahead, the March jobs report, due for release on April 4, will be a crucial data point for the market. Investors are also awaiting updates on new home sales, weekly jobless claims, and revised fourth-quarter GDP data, all of which could provide additional clarity on the health of the economy.

As the market continues to navigate the challenges posed by tariff fears, shifting Federal Reserve signals, and mixed economic data, volatility remains high. The Cboe Volatility Index (VIX) rose to just under 19, indicating elevated investor caution. Despite this, market participants continue to focus on earnings reports and economic data as key indicators of the broader market’s trajectory. For now, the S&P 500 remains in a sideways trading pattern, though market sentiment remains fragile, with uncertainty surrounding interest rates and rising unemployment trends posing risks in the longer term.

As economic conditions continue to evolve, investors must stay vigilant, monitoring key factors like corporate earnings, inflation reports, and central bank policies. With the Fed taking a cautious approach, market volatility is expected to persist as new economic data shapes expectations for future rate cuts.

Stay Agile, Stay Ahead

In this complex environment, a well-balanced and diversified strategy is essential. Agility is your advantage—capitalize on emerging opportunities while protecting against potential risks. Staying informed during earnings season and as macroeconomic conditions unfold will help you make timely, well-informed decisions.

Growth Amidst Challenges

While market challenges persist, ample opportunities for growth and strategic positioning remain. By focusing on key indicators and maintaining discipline, you can confidently navigate the market and position yourself for success.

Unlock Smarter Investment Decisions with RoboInvestor

Step into the future of investing with RoboInvestor—your AI-powered advisory service designed to pinpoint high-profit opportunities in today’s dynamic market. Our advanced technology cuts through the noise, providing clear, data-driven insights and strategies. Say goodbye to emotional bias and hello to precision in every trade.

Exclusive Market Insights Delivered Biweekly

Every other weekend, you’ll receive our exclusive newsletter featuring my latest market analysis, technical outlooks, updates on existing positions, and fresh trade recommendations to act on when the market opens Monday.

Flexibility and Precision with RoboInvestor

Whether it’s blue-chip stocks, ETFs, commodities, or even inverse ETFs, RoboInvestor offers a flexible approach tailored to current market conditions. With a model portfolio holding 12 to 25 positions, we’ve recently adopted a more selective strategy, focusing on the best opportunities for growth while remaining cautious.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

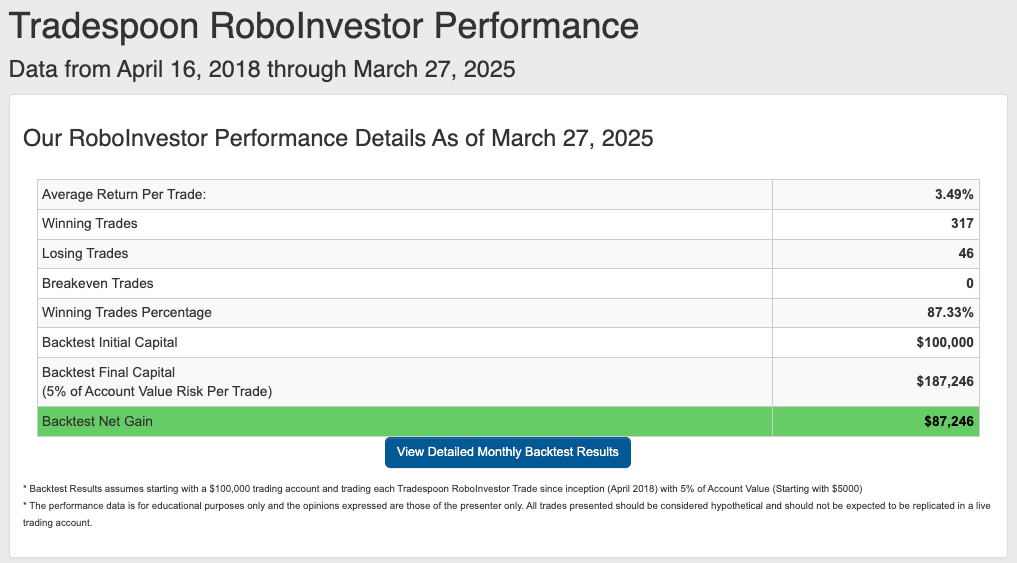

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.33% going back to April 2018.

As we enter Q2 of 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!