The stock market had another volatile week, influenced by significant earnings reports and key inflation data. This week saw prominent companies such as Disney (DIS), Western Digital (WDC), and PayPal (PYPL) release their earnings, along with crucial Consumer Price Index (CPI) and Producer Price Index (PPI) data, which all had an impact on the market’s next move.

On Monday, the market had a mixed trading session as concerns about the debt ceiling and anticipation of this week’s economic reports loomed. Stocks drifted lower on Tuesday as debt ceiling negotiations and Wednesday’s inflation report remained a cause for concern. President Joe Biden met with House and Senate leaders from both parties to discuss raising the debt ceiling, but no deal was made. The unresolved dispute surrounding the debt ceiling continues to be a cause for concern, as a potential U.S. default on its debt would pose a funding risk for the government and increase the overall riskiness of other financial assets such as corporate bonds and stocks.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Despite PayPal reporting strong first-quarter earnings, revenue, and total payment volume that exceeded expectations, the company’s shares experienced a significant decline on Tuesday. The market’s disappointment stemmed from Wall Street’s underwhelmed response to PayPal’s raised outlook for 2023. Although PayPal’s earnings saw a notable 33% increase from the previous year, reaching $1.17 per share, and its revenue rose by 9% to $7.04 billion, surpassing estimates by approximately 1%, investors remained unconvinced.

Similarly, Airbnb faced a similar fate as its shares fell during extended trading on Tuesday following the release of its first-quarter earnings. Although the company’s earnings outperformed analyst estimates, the provided guidance for the current quarter was slightly weaker than expected, leading to a cautious outlook among investors. Additionally, after the market closed on Tuesday, Rivian, Airbnb, and Electronic Arts unveiled their respective earnings reports.

On Wednesday, stocks were mostly in the green as the latest inflation report showed signs of easing inflation, with tech stocks leading the rally. The consumer price index’s 4.9% year-over-year gain for April was less than economists had expected and lower than March’s result. The market is confident that the Federal Reserve’s interest rate hikes are working to cool inflation, which means the Fed could pause its rate hikes this June. This expectation of lower rates and controlled inflation has brought the 10-year Treasury yield down to just under 3.44% from just over 3.5% before the inflation data hit the wires on Wednesday morning. Excluding food and energy, the CPI increased 5.5% over the previous 12 months, down slightly from March’s level.

Then on Thursday, April’s PPI data showed that wholesale inflation advanced at the slowest pace in more than two years, rising 0.2% month over month, slower than the 0.3% expected. On an annual basis, prices moved up 2.3%. The PPI data suggest that the Fed is making progress in its battle to tame inflation. Moreover, producer prices for April declined at a slower pace than in March, which is consistent with a declining increase in consumer prices, and markets hope to see the Federal Reserve pause interest rate increases, which are meant to reduce inflation by denting economic demand.

On the earnings front, Disney reported a top-line beat in its fiscal second quarter, but it also disclosed a 2% decline in memberships and projected another massive operating loss in its streaming business for the current quarter, which sent its shares lower. PacWest shares also plunged 22.7% after the regional lender said deposit outflows slumped 9.5% last week.

Overall, the market was driven by the key inflation and earnings reports released this week, with investors closely monitoring the Federal Reserve’s actions to manage inflation.

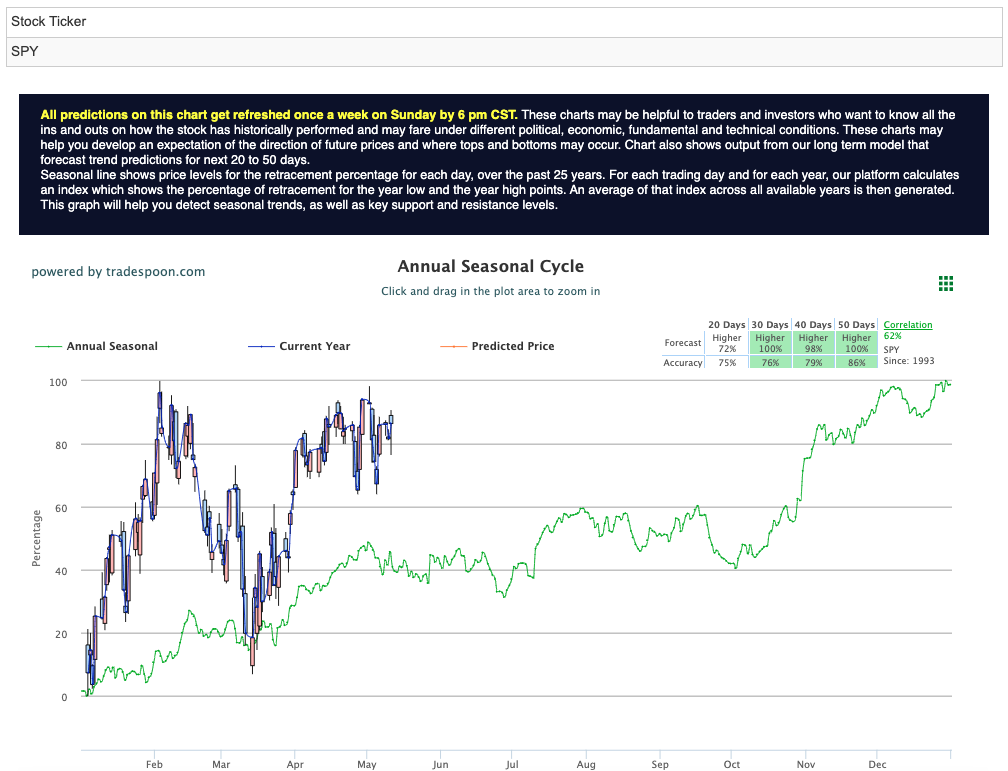

As we closely monitor the market’s performance, we are paying attention to the overhead resistance levels in the SPY, currently at $418 and then $430. Conversely, the $SPY support stands at $410 and then $406. See $SPY Seasonal Chart:

Based on our analysis, we anticipate the market to trade sideways for the next 2-8 weeks, leading us to adopt a market bearish stance. In light of this, we encourage our subscribers to hedge their positions. With this objective in mind, we have identified our next robust portfolio addition:

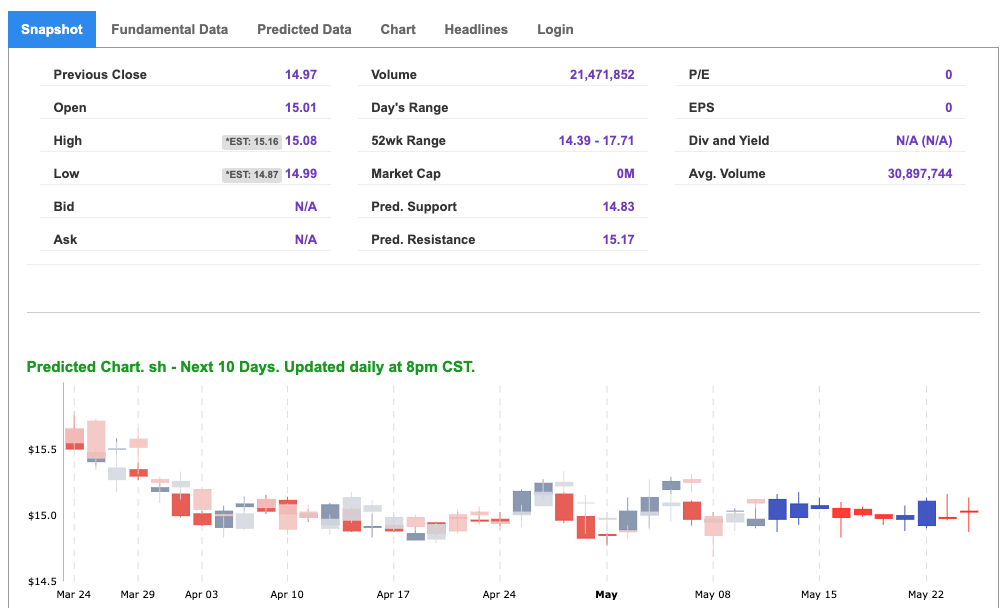

The ProShares Short S&P 500 ETF (SH) is an exchange-traded fund designed to provide investors with an opportunity to profit from a decline in the S&P 500 index. By holding a portfolio of derivative instruments like futures, options, and swaps, $SH aims to move in the opposite direction of the S&P 500, thereby allowing investors to mitigate potential losses during market downturns.

While $SH is primarily intended as a short-term hedge, offering protection against downside risk, it is not suitable for long-term investment strategies. The fund is most effective when utilized during periods of market stress and volatility. It serves as a tactical investment tool for those looking to hedge their long positions in the S&P 500 or for those who anticipate a market correction.

Currently priced in the vicinity of $15, $SH is trading in the lower half of its 52-week range, suggesting significant potential for upside movement. Furthermore, there are various market catalysts that could drive its price higher. If you are seeking a means to safeguard your portfolio against downside risk during market downturns, $SH can serve as an effective hedge. Our A.I. toolset aligns with this assessment, making it a compelling addition to consider for risk management purposes.

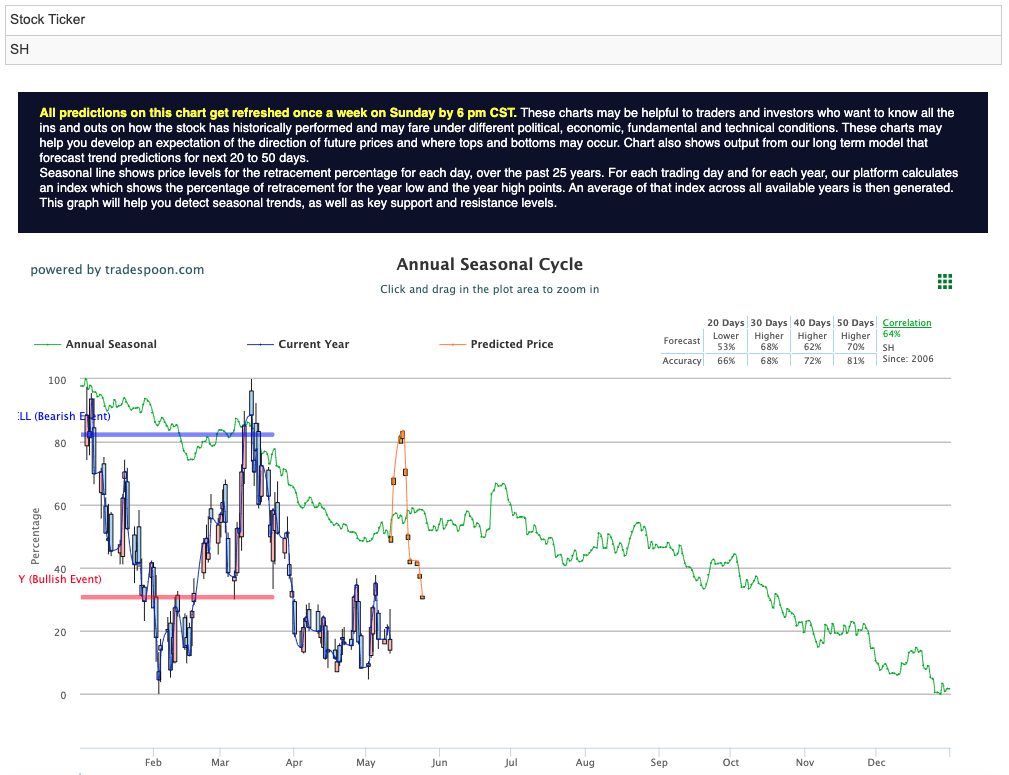

Looking at our Seasonal Chart forecast for SH we see that three of the four time frames are flashing higher which is ideal! The Seasonal Chart tool is primed for long-term forecasts, which when coupled with our short-term overview of SH, show that the symbol is in a great spot to move higher. See SH Seasonal Chart:

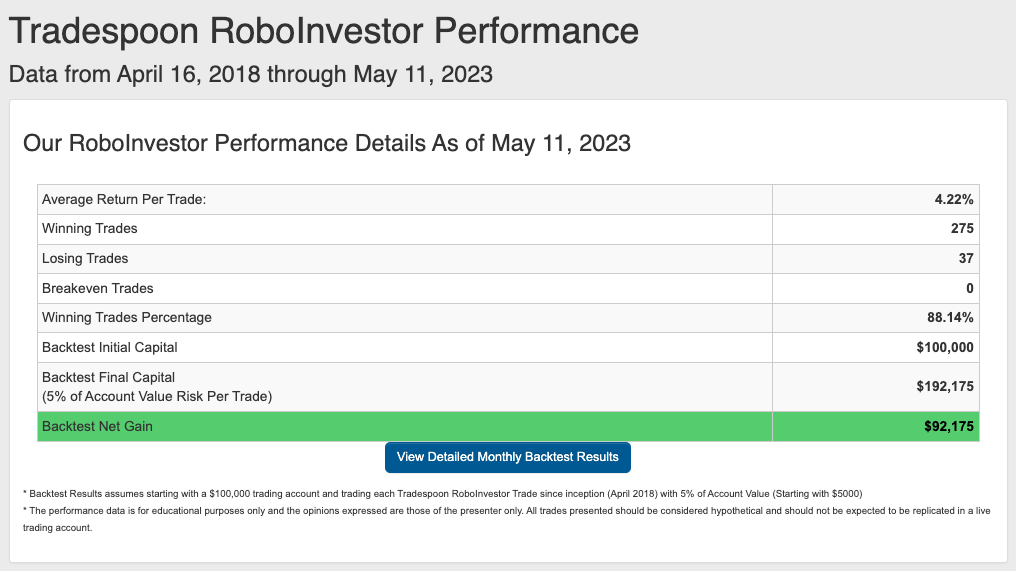

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.14% going back to April 2018.

In 2023, investors are facing a dynamic market affected by a combination of factors such as inflation, Federal policies, and geopolitical tensions, including the ongoing conflict in Ukraine. To successfully navigate this complex landscape, it is crucial to partner with a trustworthy and knowledgeable investment platform. RoboInvestor provides the necessary expertise and tools to help investors manage their portfolios with confidence and capitalize on opportunities in the fast-paced market.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!