The U.S. stock market entered the new week on an optimistic note as major indexes posted gains, building momentum after breaking a five-day losing streak last Friday. Despite persistent uncertainties surrounding inflation, interest rates, and geopolitical factors, investors found reasons to cheer, with the S&P 500 and Nasdaq showing resilience. Meanwhile, chip stocks led a strong rally, boosting broader market sentiment.

Stocks opened sharply higher on Monday, continuing an upward trajectory from Friday’s gains. The S&P 500 rose 0.8%, while the Dow Jones Industrial Average added 0.6%, and the Nasdaq surged 1.2%, driven by strength in semiconductor and technology stocks. Investor optimism was bolstered by a renewed focus on potential economic stabilization and positive developments in AI-related sectors. Consumer staples remained flat, and utilities and real estate sectors experienced minor losses of 0.5% and 0.2%, respectively. However, most S&P 500 sectors moved higher, reflecting broad-based participation in the rally.

One notable driver of market activity was President-elect Donald Trump’s denial of reports suggesting a potential rollback of tariffs. The tariff debate stirred volatility earlier in the session, but Trump’s comments on social media offered some clarity, strengthening the U.S. dollar and easing market jitters. The Washington Post’s report that tariffs might be limited to critical imports added a layer of complexity to the ongoing policy debate.

Semiconductor stocks were standout performers, continuing their recent rally. Nvidia surged 4.7%, extending Friday’s gains of 4.5%, buoyed by strong demand for its AI chips. ASML, Advanced Micro Devices, and Micron Technology also saw significant gains, rising 8.7%, 4%, and 12%, respectively. These moves followed Foxconn’s announcement of record revenue in the fourth quarter, highlighting robust demand across the tech supply chain. Super Micro Computer jumped 11% after Microsoft revealed plans to invest $80 billion in AI data centers over the current fiscal year. Microsoft’s stock climbed 1.9%, adding to Friday’s 1.1% gain, driven by optimism around its AI initiatives.

Last Friday brought a mix of optimism and caution. The ISM Manufacturing PMI for December climbed to 49.3, its highest level in nine months, signaling stabilization in the manufacturing sector. However, rising Treasury yields — with the 10-year yield hitting 4.574% — highlighted ongoing economic concerns. The major indexes ended the day with modest gains as the S&P 500 added 1%, the Nasdaq rose 1.4%, and the Dow increased by 0.6%. Investor sentiment was buoyed by stabilization in bond markets and a renewed focus on potential economic recovery. Energy and communication services outperformed, while real estate lagged. Despite lingering fears about inflation and the Fed’s cautious monetary policy, market participants appeared cautiously optimistic.

The stock market’s trajectory in the coming weeks will be shaped by several critical factors. Investors are closely watching upcoming economic reports, including Wednesday’s ADP private-sector employment data, which will provide insights into labor market conditions and broader economic health. Earnings reports are also expected this week from companies such as Delta Air Lines, Cal-Maine Foods, Jefferies Financial, Albertsons, Infosys, Constellation Brands, Walgreens Boots Alliance, KB Home, and Tilray Brands. These results could significantly influence market sentiment. Rising bond yields remain a concern, particularly as they impact sectors like real estate and utilities. However, continued stabilization in bond markets could support broader market gains.

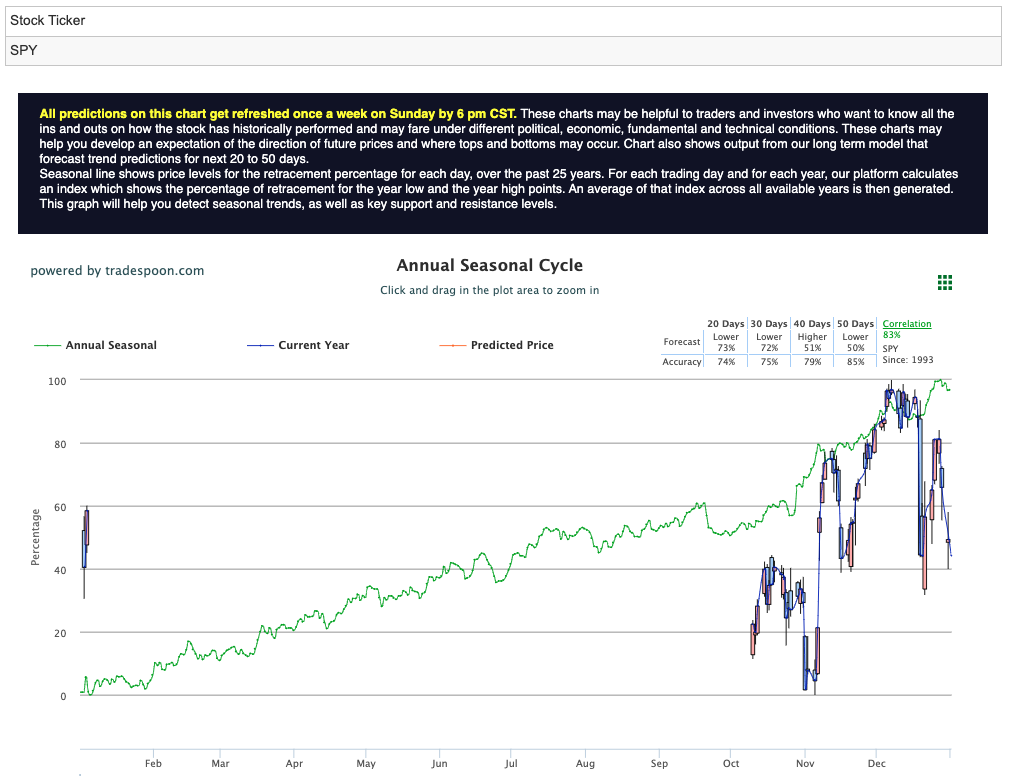

The tech sector, led by AI developments, continues to be a bright spot. Microsoft’s aggressive investments in AI infrastructure and Nvidia’s dominance in the chip market are likely to sustain investor interest. Despite persistent headwinds from inflation, rising unemployment, and the Fed’s conservative policy stance, the stock market has shown remarkable resilience. The S&P 500’s recent momentum suggests the potential for further upside, with the SPY ETF eyeing higher levels in the $620-$640 range, supported by strong technical levels between $560-$580. For reference, the SPY Seasonal Chart is shown below:

As volatility remains a key theme, investors should remain cautious while capitalizing on opportunities in high-growth sectors like AI and semiconductors. With earnings season and economic data on the horizon, the market’s direction will depend on how well it navigates these uncertainties. For now, the U.S. stock market is holding its ground, offering a cautiously optimistic outlook for the near term.

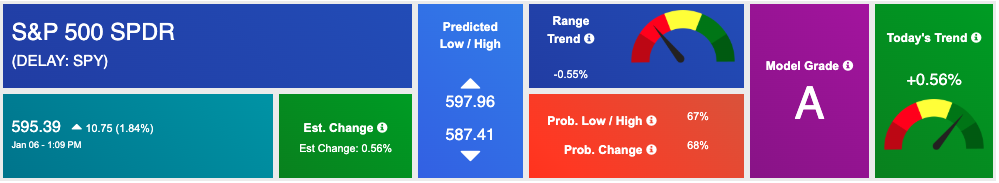

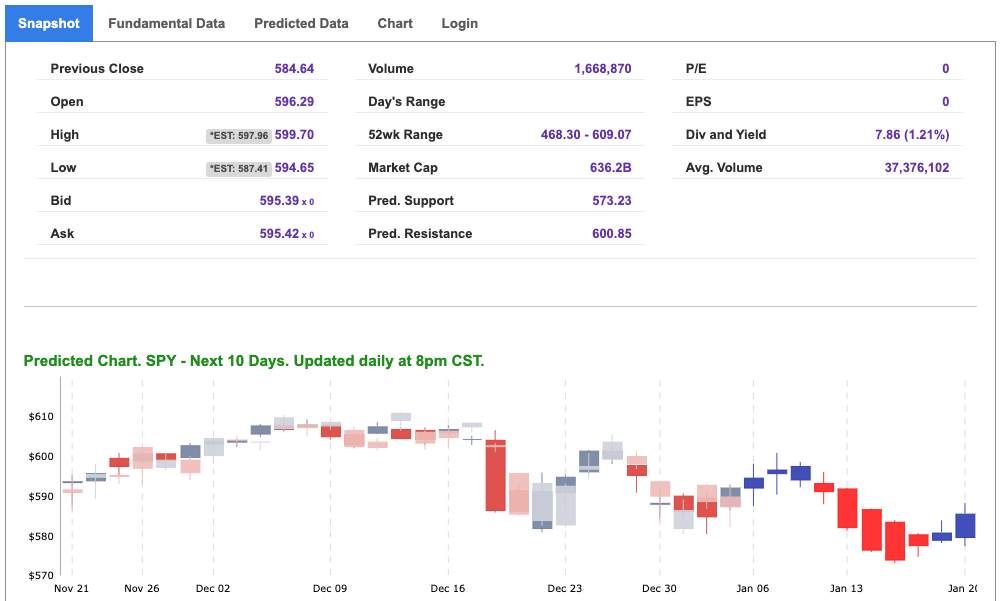

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

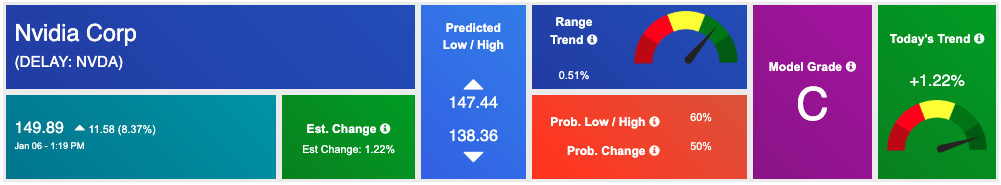

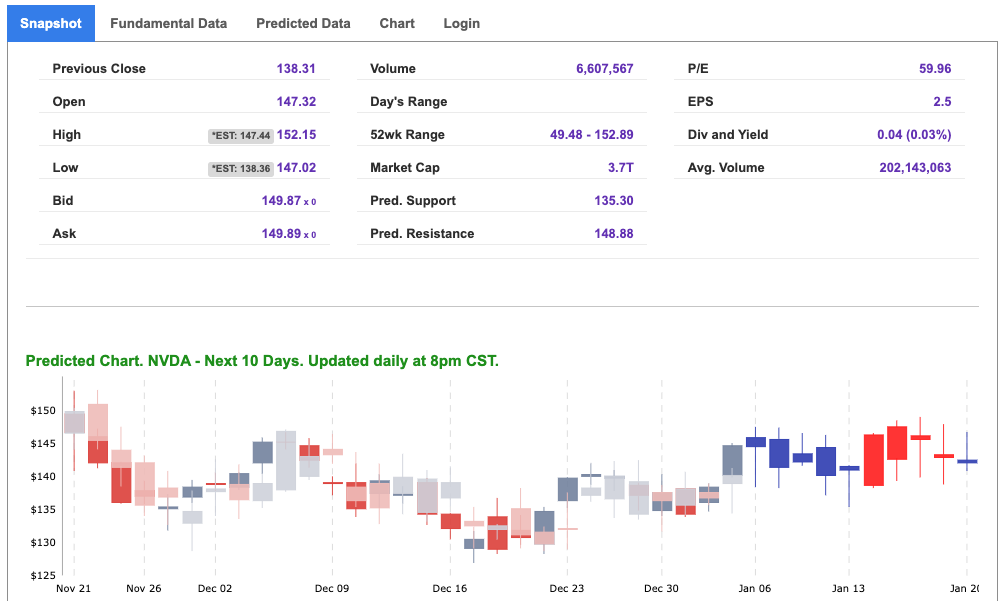

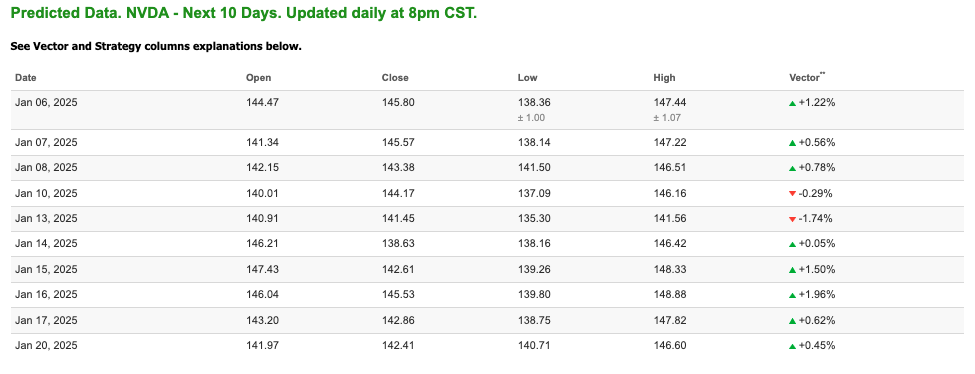

Our featured symbol for Tuesday is Nvidia Corp. – NVDA is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $149.89 with a vector of +1.22% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, nvda. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

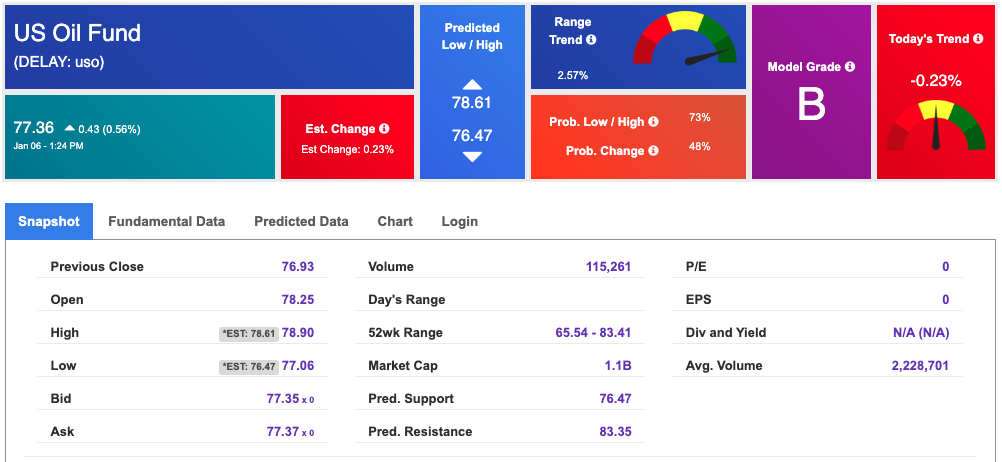

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $73.50 per barrel, down 0.62%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $77.36 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

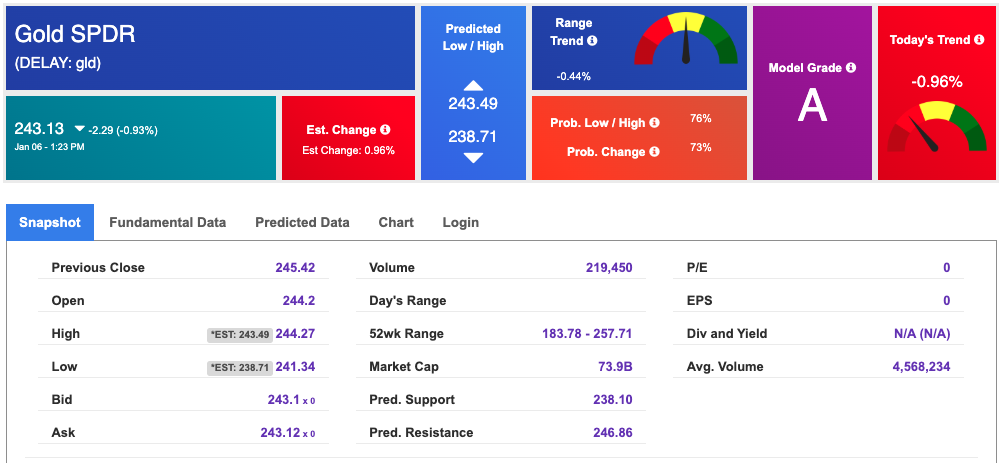

The price for the Gold Continuous Contract (GC00) is down 0.35% at $2645.60 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $243.13 at the time of publication. Vector signals show -0.96% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

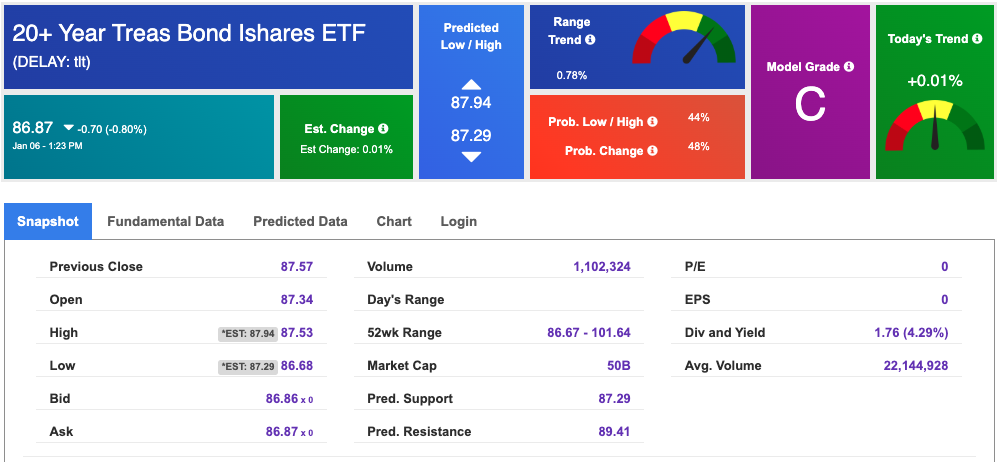

The yield on the 10-year Treasury note is up at 4.626% at the time of publication.

The yield on the 30-year Treasury note is up at 4.846% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

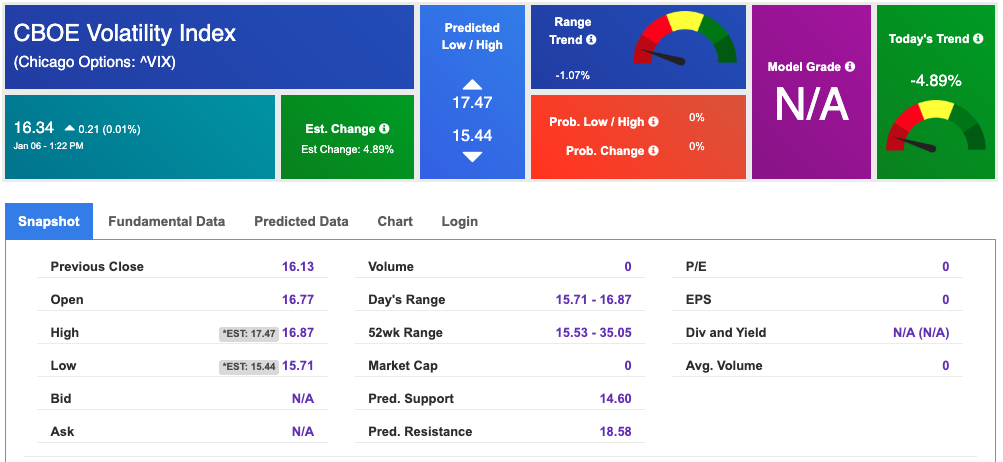

The CBOE Volatility Index (^VIX) is priced at $16.34 up 0.01% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!