RoboStreet – March 17, 2022

One More Big Pull Back In-Store For Stocks

The market is enjoying a three-day rally based on the Fed making known the game plan for fighting inflation while leaving the door open for all manner of flexibility to dial back rate tightening if the economy shows sudden signs of slowing. Fed Chair Jerome Powell commented correctly that the impact from the Ukraine war, sanctions, a spike in Covid-19 cases in China, and ongoing supply chain constraints are all fluid factors that put the Fed in a highly-data-dependent position.

Following a reprieve from a torrid rally, commodities are turning higher once again following reports that the talks between Ukraine and Russia are bogged down with little progress being made on key issues. Oil prices are right back up over $100/bbl as a deal with Iran remains questionable, Saudi Arabia isn’t answering Joe Biden’s phone calls and there is no movement by Congress or the White House on increasing supply from U.S. producers, despite the national average for gas is up to $4.30/gallon.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Typically, a three-day rally into an options expiration Friday invites fresh volatility where a good dose of the short-covering has run its course and traders like to raise cash going into the weekend at a time when geopolitical risk is very elevated. Being long oil, gold and bonds is the best defense against headline risk, of which there is plenty of between Ukraine and China. It’s been a great reflex rally, but one that should give way to another retest of the recent lows that sets up the market for a resumption of the primary uptrend.

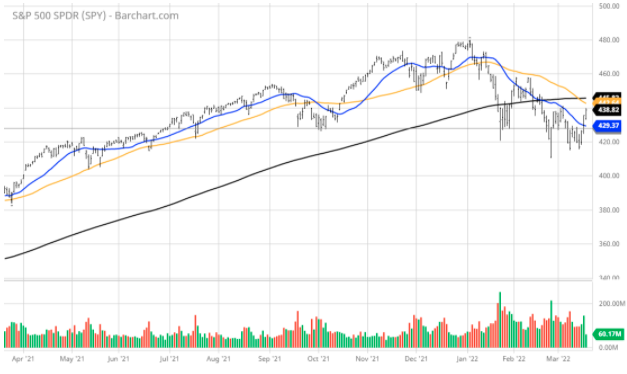

The $SPY traded up at $438, right at the January downtrend line. The value/reflationary ($VTV) closed higher 1.1%, at $145, approaching the 50 DMA resistance. The technology sector ($QQQ) closed higher 3.7%, at $342, and tested the January lows as the next resistance level.

The $DXY closed lower, near the $98, at the June 2020 high. The $TLT closed higher 1.0% and near the March 2021 lows. The ten-year yield closed lower 2.17%. The $VIX closed lower near the 26 level.

The $SPY short-term support level is at $420 (key long-term support) followed by $410. The SPY overhead resistance is at $445 and then $460.

Due to the geopolitical risks in Ukraine, one has to assume that the $SPY January lows will be re-tested again and most likely continue the downward momentum in the next couple of weeks.

I would be a seller of the high beta stocks into the rallies and have market NEUTRAL portfolio at this time.

I would consider rebalancing portfolio at this time and have an overall market NEUTRAL portfolio. I do not expect the $SPY to post new all-time highs in the first half of this year. There is a high probability that the $SPY main long-term support at the $420 level will not hold. All eyes are on the geopolitical risk in Ukraine.

If you are trading options consider selling premium with May and June expiration dates.

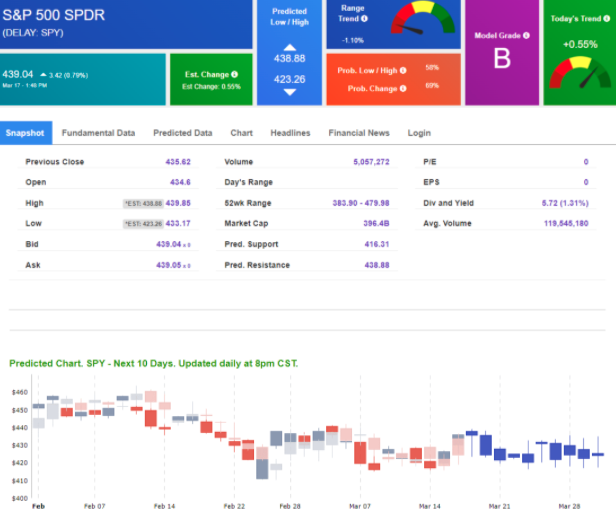

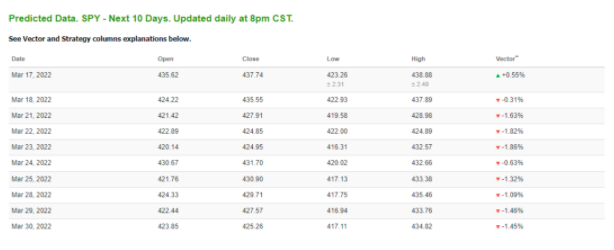

Based on our models, the market (SPY) will trade in the range between $400 and $470 for the next 2-4 weeks.

Staying on point with how to play this current investing landscape, my work is forecasting another retest of the lows for SPY, and possibly taking out the February 24 low of $411 in what would be a full capitulation sell-off that would clean out all the stops underneath, take the VIX above 40.0 and usher in a point where a true bottom is in a place where those with cash will have a superior entry point to buy into.

Our RoboInvestor advisory service is all about timing when to have capital fully deployed when to dial it back, and when to have cash in the event of a material corrective move lower for the market. Our AI-driven Forecast Toolbox takes into account the present market conditions and will put forth data on Predicted Support and Predicted Resistance. As of Thursday, SPY hit up against the $438.88 resistance level noted. A move down to technical support at $416.31 would account for a 5.1% pullback that would test the February 24 low in textbook fashion.

I want to encourage all readers of this column to consider putting RoboInvestor to work right away so as to have this kind of pin-point near-term guidance to navigate through challenging this market. Our AI platform identifies trades in blue-chip stocks and ETFs that encompass indexes, market sectors, sub-sectors, commodities, precious metals, currencies, interest rates, volatility, and shorting opportunities using inverse ETFs.

RoboInvestor is unrestricted in identifying high-probability investments where our portfolio will typically have between 12 and 25 holdings, depending on a number of factors. Lately, we’ve maintained a smaller number of positions, respecting the volatility while keeping a laser focus on those assets that the market favors.

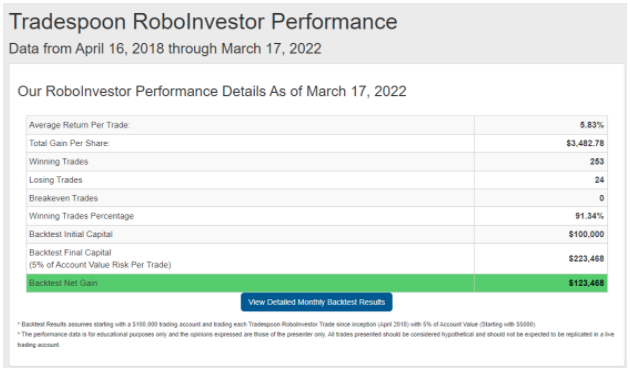

For 2022, RoboInvestor has not logged a losing trade year-to-date. Granted, some trades that went against us initially required some patience to work out of, but we did and booked profits as a result of exercising some patience, a key to successful investing.

As a RoboInvestor subscriber, you will receive an online newsletter every other week that hits your inbox over the weekend with two new recommendations to take action on when the opening bell rings on Monday morning. Within the newsletter, I lay out the market landscape, update our current holdings and provide details on each of the two new recommendations.

It is a very straightforward investing service utilizing only the best-of-breed blue-chip and liquid stocks and ETFs that have produced an enviable track record. Our Winning Trades Percentage is an impressive 91.34%, something we take a lot of pride in, where our AI platform is always learning and always crunching data 24/7.

Take the next step to bringing timely performance tools to your portfolio and put RoboInvestor to work for your hard-earned investment capital. I personally invest in every trade I recommend, so I am right there with you on this wealth-building journey that began with the creation of my AI system. Timing and asset selection are the two most important aspects of winning in the markets. Join our winning team and make 2022 a year where you put the power of AI into your portfolio strategy.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!