Thursday saw stocks plummet after the latest employment data revealed that the labor market is strong. As investors perceived this as a sign of the Federal Reserve having to proceed with rate hikes in order to limit rising inflation, triggering the selloff. The next major data point will be the payroll, unemployment, and average hourly earnings reports which are due Friday; it is expected that the U.S. will add 200,000 jobs to nonfarm payrolls in December. Next week, earnings season officially kicks off with major banks reporting their quarterly data.

Employment data remained marquee this week with Thursday’s releases and Friday’s final labor data of 2022. Following Thursday’s release stocks dropped rapidly as investors grew concerned the Federal Reserve would persistently raise interest rates to counter expected inflation rising from ADP’s private sector jobs report which showed a remarkable 235,000 job additions in December- far surpassing forecasts of 150,000.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Yesterday’s FOMC minutes revealed that the Federal Reserve is concerned about inflation. But, despite this news of rising interest rates meant to quench economic demand and reduce prices, stocks gained ground at Wednesday’s close. The Fed intends to take aggressive action in order to keep a tight rein on inflation by limiting consumer spending power. This, however, was undone on Thursday with rejuvenated fear that inflation concerns would remain prominent throughout the year.

Despite investors’ high hopes of the Fed reducing or even pausing its current rate-hiking process, The Federal Reserve is set to continue raising interest rates in an attempt to counter inflation and limit economic demand. As per the minutes released by the Fed recently, there are statements that could be worrying for stock and bond traders – as it demonstrates that there’s still no proof yet that higher rates have effectively curbed inflation levels significantly.

The current inflation rate has fallen significantly since its apex of 9% in 2022, dipping below 7%. This remarkable decrease could be near enough to reach the Federal Reserve’s goal of a 2% target as high levels of inflation have frequently been linked with diminished economic activity. The ISM index also disclosed that manufacturing output continues to falter in December as well.

Also on Wednesday, Coinbase’s stocks soared after reaching a key settlement while Salesforce’s shares sharply rose due to their planned layoffs. Today, Bed Bath & Beyond’s share prices plummeted by double digits following news of substantial doubt about its future. Friday’s employment data as well as next week’s Consumer Price Index data could have a major effect on the market’s trajectory moving forward. With the latest levels in mind, I’ve identified a symbol I believe is positioned to prosper in the coming days, but before I make a move – let’s double-check with my A.I. data:

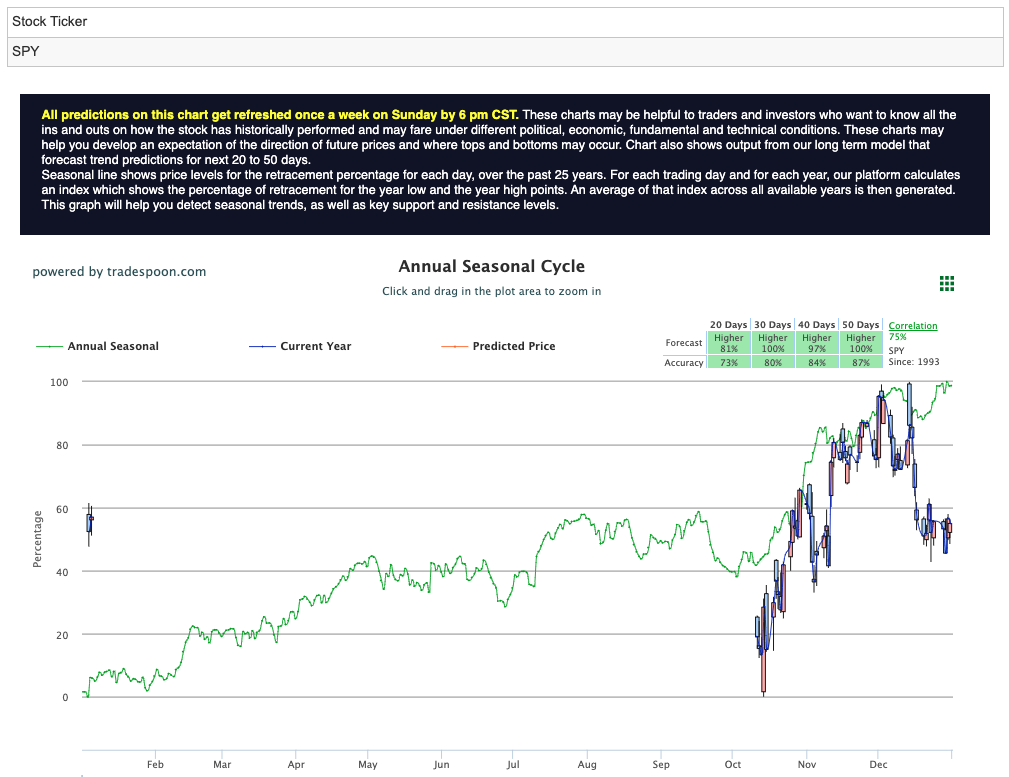

Presently, the overhead resistance levels for the SPY are situated at $390 and then $402. Additionally, its support is placed at $376 and then further down to $370. My current outlook on this market indicates that it will likely experience more lows in a span of two to eight weeks from now. In light of such circumstances, I highly advise investors to exercise caution by hedging their investments against potential losses.

With the continued market sell-off, I anticipate higher volatility in the initial part of this year. Unemployment numbers released this week will be a major driving force for these fluctuations, as well as the start of earnings season reporting from companies. This makes one particular symbol of keen interest to me.

The healthcare sector has several reputable companies that often experience considerable price drops, and one of the most renowned names is UnitedHealth Group Inc. (UNH). As a member of the Dow Jones index, UNH is the largest provider of medical insurance in America and presents an opportunity for investors to take advantage of unique low prices.

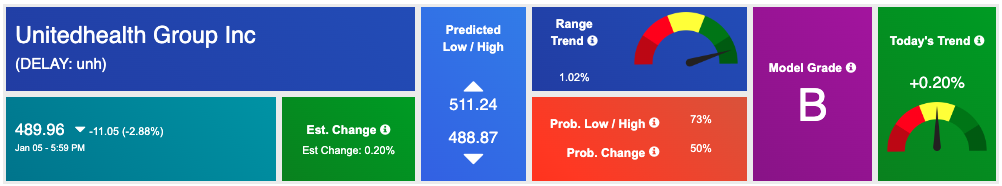

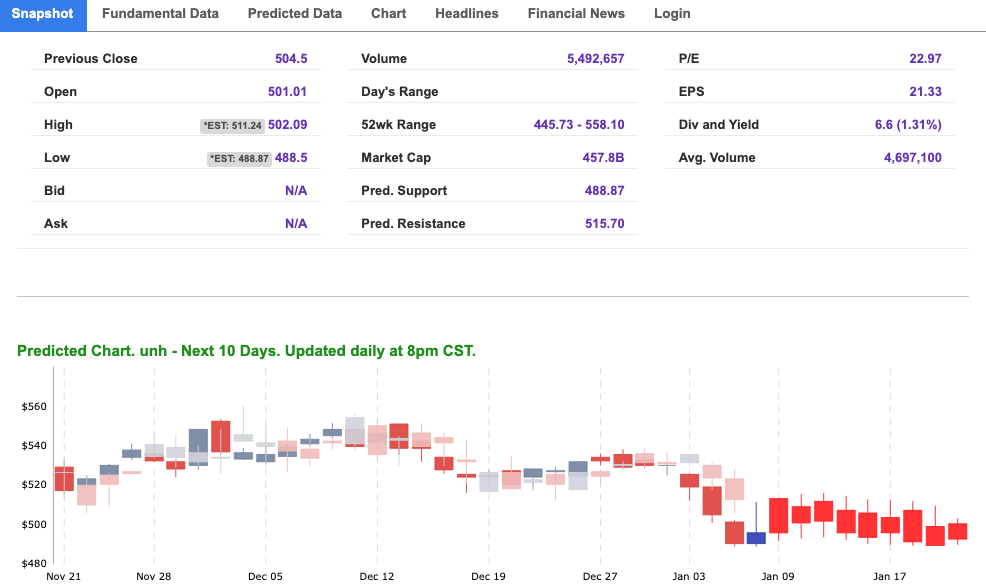

UnitedHealth Group Inc. (UNH) currently trades at $489.96 and sits right above its 52-week low of $488.87. With a selloff on the horizon but several timely rallies could be in effect makes this symbol of added interest to me. There is plenty of room for the upside and despite weakness in other sectors, healthcare should maintain its ground to start 2023 – and even set to book gains!

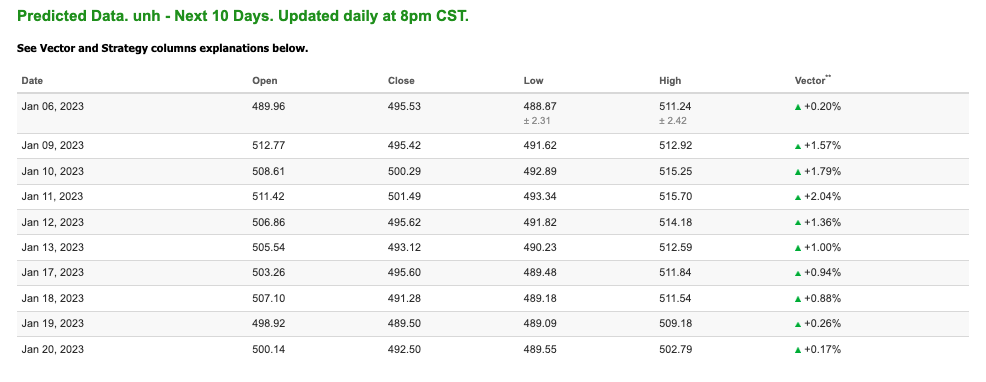

Looking at the 10-day forecast, UNH is showing a promising vector trend towards the upside which is steady and one-directional. Both are great signs for a forecast. Furthermore, UNH sports a “B” model grade which means the symbol is in our top 25% for accuracy.

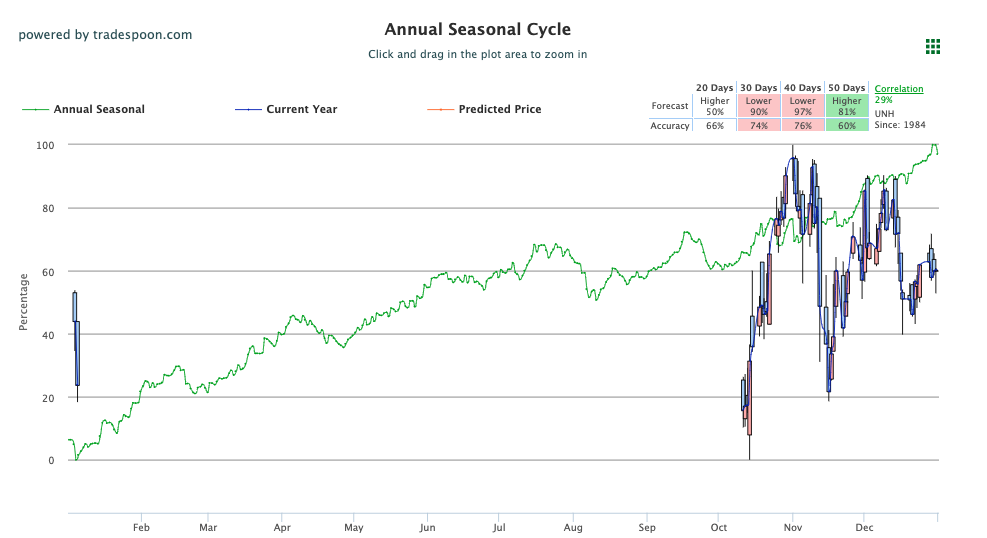

Not only does the chart pattern demonstrate potential, but our AI platform is also providing a ‘buy’ indication. Of the four time frames evaluated – 20 days, 30 days, 40 days and 50 days – Seasonal Chart readings are indicating strong results for two of them. Invest now to increase your chances of successful returns in the long run! See UNH seasonal chart below:

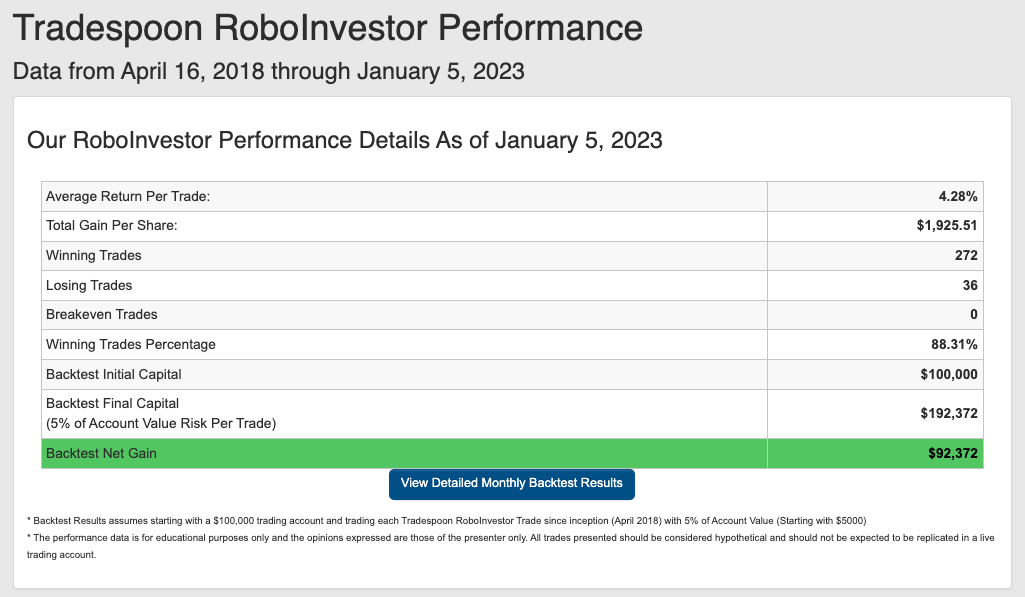

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.31% going back to April 2018.

Inflation, Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. 2023 is set up to be an eventful market year. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!