RoboStreet – January 30, 2025

U.S. stock futures saw slight gains Thursday morning, as investors processed a mix of earnings reports, central bank policy updates, and key economic data. The market, currently in a consolidation phase, is grappling with a blend of corporate performance, inflation trends, and global monetary policy decisions, all of which contribute to cautious optimism and ongoing uncertainty.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Earnings season has kicked off with mixed results from major tech companies, reflecting both optimism and caution across the sector. Some companies exceeded expectations, showcasing robust growth and strong performance, while others revealed challenges that weighed on sentiment.

Meta Platforms stood out with impressive fourth-quarter results, surpassing expectations in both earnings and revenue, driven by an increase in ad prices and volume. However, despite this growth, a cautious outlook for the first quarter tempered investor enthusiasm, highlighting uncertainty in the advertising landscape.

Microsoft’s earnings were solid, yet concerns surfaced regarding the slower-than-expected growth in its Azure cloud-computing division. Though the company beat overall earnings projections, rising capital expenditures led to some investor unease, which contributed to a decline in stock value.

Tesla, on the other hand, posted weaker-than-expected earnings, with revenue falling short of projections. The company continued to face pressure from shrinking automotive profit margins, but CEO Elon Musk maintained an optimistic long-term growth outlook, which may have offered some reassurance to investors looking ahead.

In other notable reports, IBM experienced a boost in stock price due to strong AI-driven revenue growth, while United Parcel Service saw a decline in its stock value despite surpassing earnings expectations, following its announcement to reduce volume with Amazon in the coming years. Caterpillar also issued a cautious sales forecast for 2025, which contributed to a dip in its share price.

Overall, while some tech giants demonstrated resilience, the mixed performance underlines the sector’s volatility and the challenges that could lie ahead for companies navigating shifting market conditions.

Inflation remains a key factor influencing market sentiment. In the U.S., the Federal Reserve held its benchmark interest rate at 4.25%-4.50%, pausing after a series of rate cuts in 2024. The Fed’s cautious approach reflects ongoing inflation pressures, especially in services and shelter, while acknowledging the need to balance curbing inflation with supporting economic growth. Chair Jerome Powell emphasized a data-dependent approach, leaving the door open for future adjustments.

Despite inflationary concerns, the U.S. labor market remains resilient. Initial jobless claims fell to 207,000, signaling continued strength, even as broader employment trends suggest a normalization from the post-pandemic boom. Meanwhile, U.S. fourth-quarter GDP growth slowed to 2.3% from the prior quarter’s 3.1%, reflecting tightening financial conditions and moderation in consumer spending.

In contrast, the European Central Bank (ECB) took a different approach, cutting its deposit rate by 25 basis points to 2.75%. This decision was driven by stagnant GDP growth in the eurozone, which showed zero growth in the fourth quarter of 2024. ECB President Christine Lagarde expressed optimism that inflation would return to the 2% target by 2025, signaling a continued commitment to monetary easing to support economic recovery in the region.

The divergence between the Fed’s cautious stance and the ECB’s accommodative policy underscores the varying challenges faced by different regions. While the Fed is focused on managing inflation without derailing growth, the ECB is navigating a fragile economic recovery and subdued inflation in Europe. These contrasting approaches create complexities in global markets, with the Fed’s actions supporting the strength of the U.S. dollar, while the ECB’s measures contribute to a weaker euro.

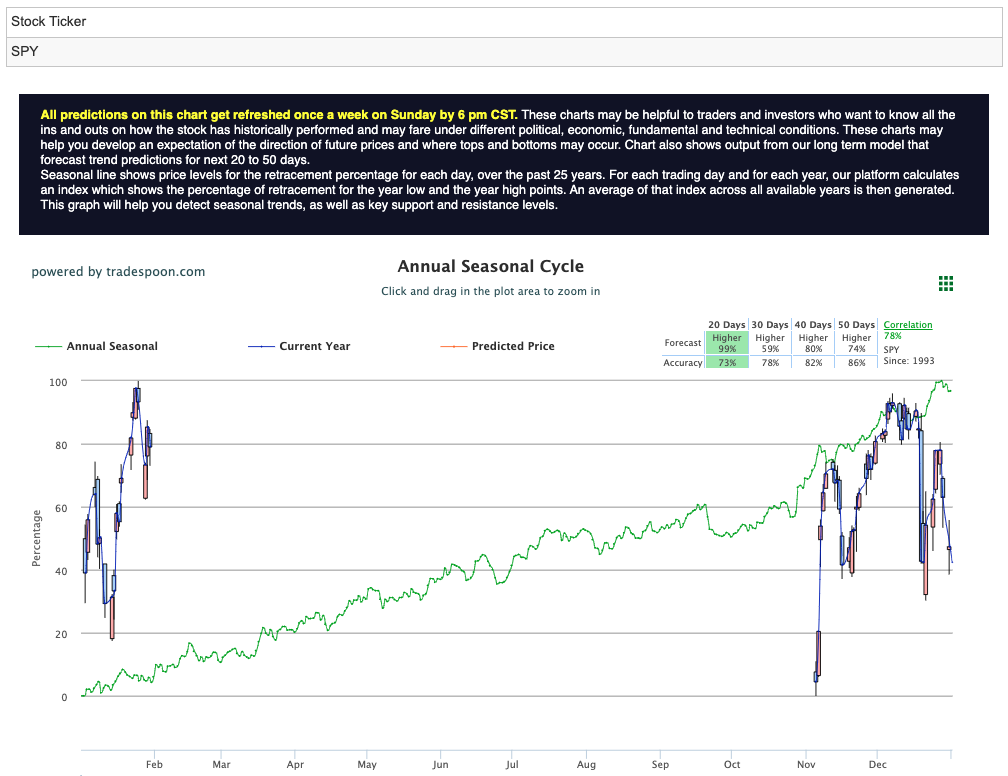

Despite the mixed earnings reports and economic uncertainties, investor sentiment remains cautiously optimistic. The broader U.S. market has been in consolidation mode, with the S&P 500 trading within a defined range. Analysts project potential upside for the S&P 500 ETF (SPY), with support levels near $560-$580 and resistance around $620-$640. For reference, the SPY Seasonal Chart is shown below:

However, the volatility index (VIX) remains subdued at 15, indicating a period of relative calm in the market, even as participants await further clarity from inflation data, earnings reports, and global policy decisions.

As earnings season progresses and economic data continues to unfold, market participants will closely monitor the balance between inflation trends, corporate performance, and central bank actions. In the U.S., the Fed’s cautious approach to interest rates, coupled with a resilient labor market, sets the stage for continued economic stability, though risks from inflation and potential labor market softening persist. Meanwhile, Europe’s economic recovery remains fragile, and the ECB’s easing policies aim to stimulate growth in a challenging environment.

For investors, the outlook remains neutral, as the market wrestles with the interplay of these factors. While there are signs of stabilization, uncertainties surrounding inflation, corporate earnings, and global monetary policies will likely continue to shape market direction in the weeks ahead. Whether the market breaks out of its current range or continues to trade sideways will depend on how these key factors evolve over time.

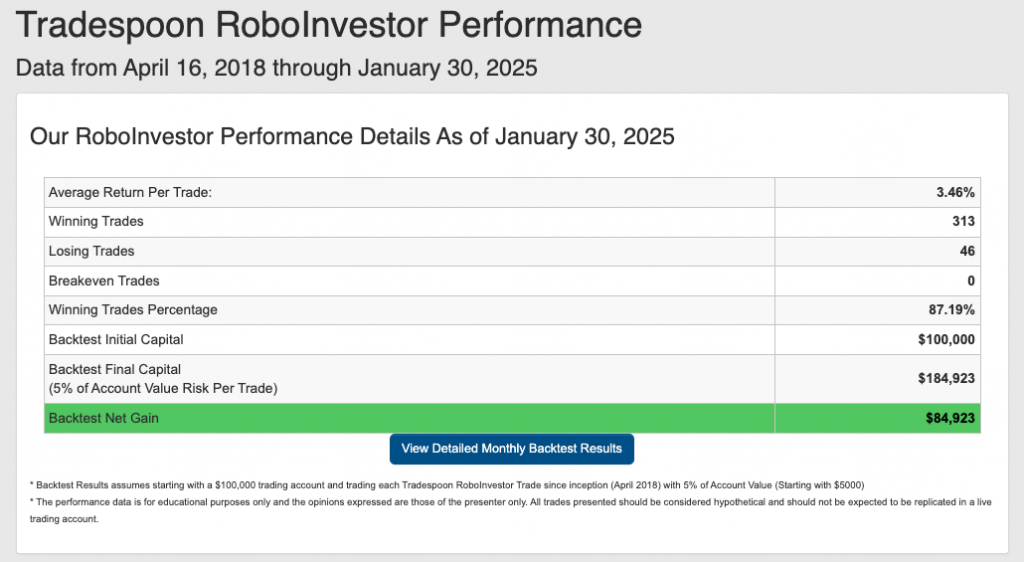

Unlock smarter investment decisions with our RoboInvestor stock and ETF advisory service, powered by advanced AI. This cutting-edge technology identifies trades with high-profit potential, cutting through market noise and eliminating emotional bias. With clear, data-driven insights and strategies, RoboInvestor helps you navigate today’s ever-changing market with confidence and precision.

Every other weekend, subscribers receive an exclusive newsletter packed with my market analysis, technical outlook, updates on existing positions, and one or two fresh trade recommendations to act on when the market opens on Monday.

RoboInvestor is a flexible, unrestricted service. I may recommend blue-chip stocks or ETFs representing major indexes, market sectors, commodities, currencies, interest rates, and even shorting opportunities using inverse ETFs. Our model portfolio typically holds between 12 to 25 positions, adjusting based on market conditions. Recently, we’ve adopted a more cautious approach, focusing on a smaller, more selective set of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.19% going back to April 2018.

As we enter 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!