In a striking turn of events, the stock market roared back to life on Thursday, defying the recent challenges it faced. Investors pinned their hopes on the belief that the Federal Reserve’s interest rate hikes may have come to a halt. The focal points of the week were Federal Reserve Chairman Jerome Powell’s speech following the Federal Open Market Committee (FOMC) meeting, the latest earnings data, and the eagerly awaited October unemployment data scheduled for release on Friday. At the same time, Treasury yields exhibited mixed behavior as speculation grew regarding a potential pause by the Fed.

The market displayed impressive performance on Thursday, with the Dow Jones Industrial Average surging by over 560 points, equivalent to a 1.7% gain. The S&P 500 recorded a 1.9% increase, and the Nasdaq Composite posted a substantial gain of 1.8%.

Treasury yields showcased contrasting movements as the 2-year Treasury yield climbed to 4.975%, while the 10-year yield dropped to 4.668%. These fluctuations occurred as the market prepared for the release of October employment data, coupled with the growing sentiment that the Fed might temporarily halt interest rate hikes.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

One of the key focal points driving market dynamics was Apple’s earnings report, and the subsequent reaction to the tech giant’s financial performance was nothing short of intriguing. Despite delivering slightly better-than-expected results, Apple faced a lukewarm reception from investors.

In the fiscal fourth quarter, which concluded on September 30, Apple reported revenues of $89.5 billion. While this represented a 1% decrease from the previous year, it managed to edge slightly above the Wall Street consensus forecast of $89.3 billion. Nevertheless, this marked the fourth consecutive quarter in which Apple reported declining year-over-year revenues, indicating persistent challenges in maintaining its impressive growth trajectory.

The market had been closely watching Apple’s earnings, not just for the financial figures, but also for insights into the company’s outlook and strategies. Investors were particularly interested in Apple’s vision for future product releases, expansion into new markets, and initiatives to drive revenue growth. The post-earnings investor call, scheduled to commence at 5 p.m. ET on Thursday, was expected to shed light on these critical aspects. The direction of Apple’s stock performance hinged on the guidance and comments provided during this call.

On the other side of the spectrum, the Federal Reserve’s actions and Chairman Jerome Powell’s statements also carried significant weight in influencing market sentiment. Investors eagerly clung to Powell’s words, searching for any indication of the Fed’s monetary policy direction. The market had been speculating whether the Fed would put a complete stop to the interest rate hikes, given the recent economic fluctuations and concerns about inflation.

Powell’s comments, characterized as dovish by some, emphasized the importance of closely monitoring inflation trends. While he didn’t entirely rule out the possibility of further interest rate hikes, Powell’s cautious stance implied that the Fed was willing to adopt a more measured approach, especially if inflation remained a persistent concern.

Market participants swiftly reacted to Powell’s remarks, with a prevailing belief that there was now an 85.5% likelihood that the Federal Reserve would maintain interest rates at their current levels throughout the rest of the year. This newfound sense of stability, emanating from the central bank, offered a sigh of relief for investors who had been grappling with uncertainty.

Likewise, a comprehensive evaluation of the economic landscape revealed significant underperformance in the Purchasing Managers’ Index (PMI) in the U.S., China, and Europe, with readings falling below the crucial 50-point mark. These figures point to a contraction in economic activity, a trend closely linked to ongoing geopolitical uncertainties.

Market participants closely scrutinized the earnings reports of technology giants Advanced Micro Devices (AMD) and Apple. The semiconductor (SMH) and small-cap (IWM) indices, meanwhile, faced challenges as they retested recent lows.

The market’s next critical test is set for Friday with the release of the jobs report. Investors continue to keep a watchful eye on Powell’s speech, the FOMC meeting, and the October unemployment data. In addition to these factors, reviewing PMI data, geopolitical risks, and earnings reports for AMD and Apple, as well as monitoring the performance of SMH and IWM, are expected to shape market dynamics.

The U.S. Dollar Index (DXY) continued its multi-month rally, while longer-dated treasuries surged, retesting October yield highs. The 10-year yield reached levels reminiscent of the Global Financial Crisis. A prevailing notion in the market is the expectation of “higher for longer” interest rates. However, if this persists, it may lead to prolonged inflation and a delay in interest rate reductions, potentially extending into the latter half of 2025. These factors are yet to be fully factored into current market evaluations.

Europe, small caps, technology, cyclicals, and regional banks exhibited relative weakness. The technology sector and the $SPY ETF have begun to challenge their 50-day moving averages. The dollar’s ongoing rally has put pressure on AI stocks.

Recent developments included a resolution in Michigan, ending a strike, which could potentially lead to increased inflationary pressures. The appointment of a new Speaker of the House and the looming threat of a government shutdown also factor into market sentiment. Geopolitical risks prompted a flight to safety, with silver (SLV) and gold (GLD) rallying despite the robust dollar.

Interest rates continued to be a focal point, with concerns about rates overshooting due to weak demand for treasuries. This lack of demand from Japan and China may drive prices down, causing yields to rise and placing additional pressure on equity valuations.

In the realm of commodities, WTI crude oil snapped a three-day losing streak, gaining 2.5% to reach $82.46 per barrel. This positive movement was attributed to shifting expectations regarding the U.S. Federal Reserve’s stance on interest rates. The fading likelihood of further rate hikes has reduced fears of an economic contraction, which could negatively impact energy demand. Markets have begun to price in faster rate cuts for the following year, potentially acting as a tailwind for economic activity and demand.

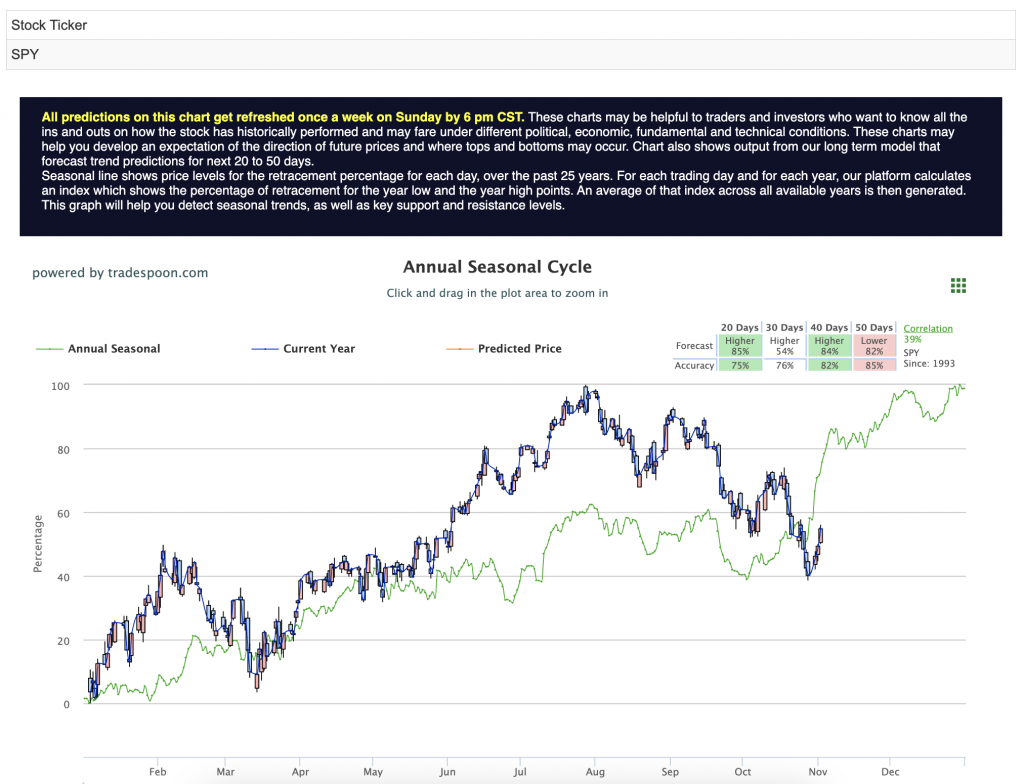

Conclusively, I am shifting to a market-neutral stance, citing economic data that suggest a low probability of a recession. It’s believed that the SPY’s rally may be capped at levels between $450 and $470, with short-term support ranging from $400 to $430 over the next few months. For reference, the SPY Seasonal Chart is shown below:

Currently, the market still exhibits more room to the downside, and a break of August lows is already underway. Cyclicals, represented by IWM, KRE, and XRT charts, are anticipated to break their August lows, and although October may prove volatile, the expectation of better-than-expected earnings and end-of-year seasonality is likely to create a market floor near the 200-day moving average.

With this in mind, the banking sector is currently attracting significant attention. As investors and financial experts continue to navigate the uncertainties brought about by geopolitical risks, interest rate movements, and economic indicators, the banking sector has emerged as a potential focal point for market opportunities – and my A.I. agrees!

With the Federal Reserve signaling a more cautious approach to interest rate hikes and increasing the likelihood of keeping rates steady for the foreseeable future, banks are poised to benefit. A flatter yield curve and stable interest rates provide a favorable backdrop for banks to grow their net interest margins, a crucial source of revenue.

Despite concerns about global economic headwinds, the underlying economic fundamentals in the United States have remained resilient. As the economy continues to exhibit strength, banks are expected to capitalize on increased demand for loans, lending, and financial services.

JPMorgan Chase & Co. (JPM): A Strong Player in the Banking Sector

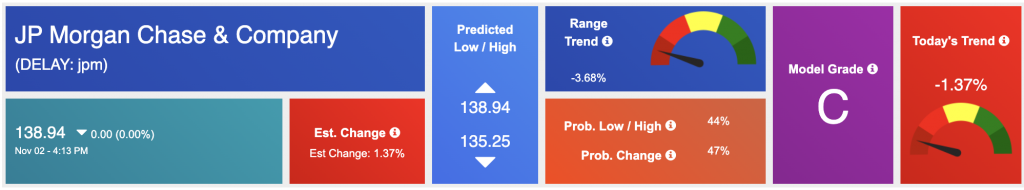

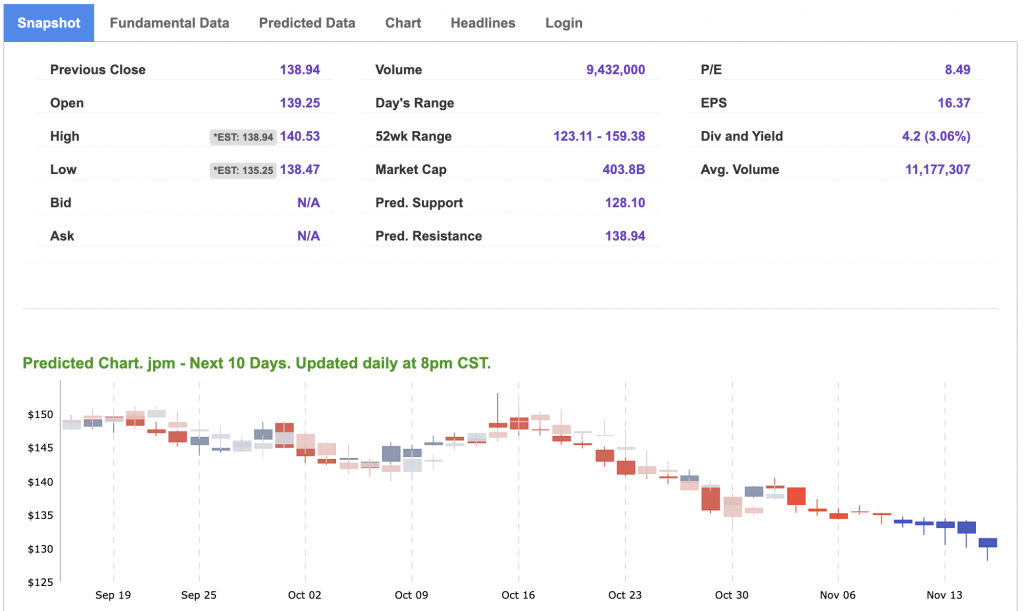

Among the notable institutions in the banking sector, JPMorgan Chase & Co. (JPM) stands out as a formidable financial entity with a storied history of resilience and innovation. JPMorgan Chase operates as a diversified financial services company, offering a broad range of services that include retail banking, investment banking, asset management, and more. Just take a look at my A.I.’s reading of JPM:

As an investment opportunity, JPMorgan Chase carries several factors that make it a compelling choice in the current market environment:

JPMorgan Chase consistently reports solid financial results, reflecting the bank’s resilience and ability to weather economic uncertainties. The bank’s financial stability and strong balance sheet are appealing to investors seeking stability.

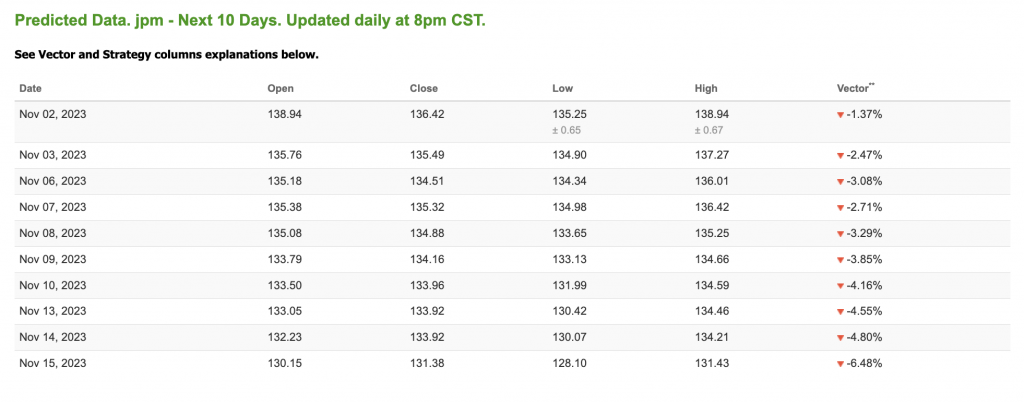

Chase offers an attractive dividend yield, making it an enticing option for income-oriented investors. The bank’s commitment to returning capital to shareholders is evident through its dividend payments and share buyback programs. Take a look out the 10-day predicted data for JPM via the Stock Forecast Toolbox:

In conclusion, the banking sector is currently experiencing favorable conditions that present investment opportunities. Among the prominent players in this sector, JPMorgan Chase & Co. stands as a strong and well-rounded choice for investors. Its financial stability, commitment to shareholders, and technological advancements make it a compelling option for those seeking to capitalize on the strengths of the banking industry in the current market environment.

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

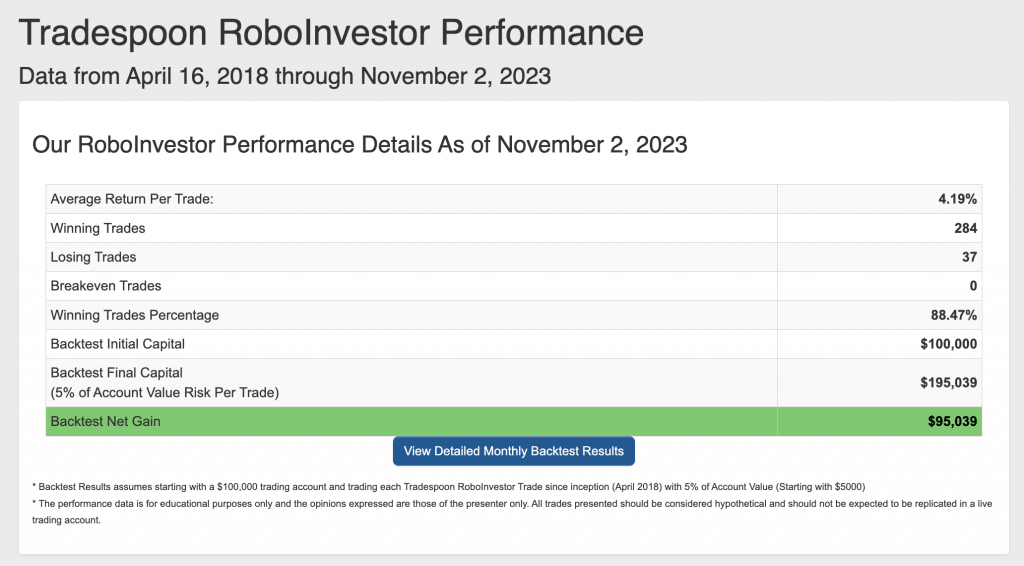

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.47% going back to April 2018.

As we enter Q4, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!