RoboStreet – July 21, 2022

Earnings Support Market Ahead of FOMC

Coming off the heels of a third straight positive session, U.S. investors are wondering if the latest boom is a violent rally in a bear market or the restart of the bull market. Early earnings results have returned positively and subsided recession fears at the moment with all three major U.S. indices seeing solid weekly gains. Aside from the alarm provided by last month’s CPI data released earlier this month, the market has responded favorably to the most recent employment, retail, and now earnings news.

Netflix and Tesla earnings this week impressed investors, causing shares to boom; and although some earnings have disappointed, AT&T for example, along with questionable economic releases, weekly unemployment rose and the leading economic index slumped, U.S. markets still found sectors to impressively rally around. With the U.S. markets trading higher, and still a load of major name earnings to drop, to question now becomes: how valid is this rally?

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside the next 3 months, so my weekly updates are timely enough for you to act.

Looking ahead, next week will feature the latest Federal Open Market Committee meeting where another rate hike is expected. Likewise, corporate earnings will also be plentiful with Microsoft, Google, Visa, Coca-Cola, and McDonald’s releasing next Tuesday, while Apple, Amazon, Meta Platforms, Boeing, Qualcomm, MasterCard, and Pfizer will round the week in headline reports. As I previously stated, investors are looking at the latest boom, and now looking at the fodder-rich week ahead, and wondering if a bull market could manifest. Unfortunately, I do not believe so; in my eyes, this boom is simply a rally in a bear market.

Still, there is plenty of opportunities to be had, and money to be made. I am keeping my eye on a specific sector while looking to move on one symbol in particular. But before we discussed that, let’s break down the latest market conditions.

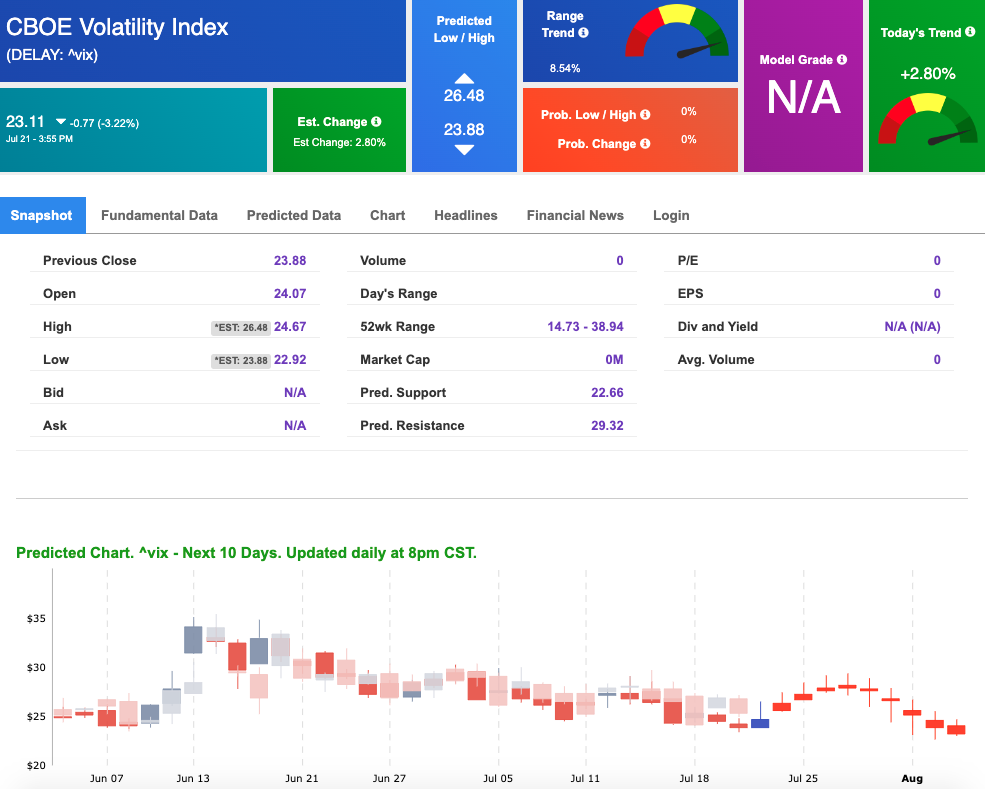

The $VIX is trading lower, near the $23 level now. Overhead resistance levels in the SPY are presently at $396 and then $409. The $SPY support is at $380 and then $372.

Looking at the SPY Seasonal Chart above, I expect the market to continue the short-term rally for the next couple of weeks.

I would be a seller into the rally and have a NEUTRAL portfolio at this time. Short term the market is oversold and undergoing the bottoming process.

If you are trading options consider selling premium with November and December expiration dates.

With the upcoming week being rich in key telecom and tech earnings reports, and the latest SPY levels, I am liking the looks of the tech sector but specifically its likely beneficiary – semiconductors. Overall, semiconductors have fared well in these types of circumstances, and recent developments suggest as much.

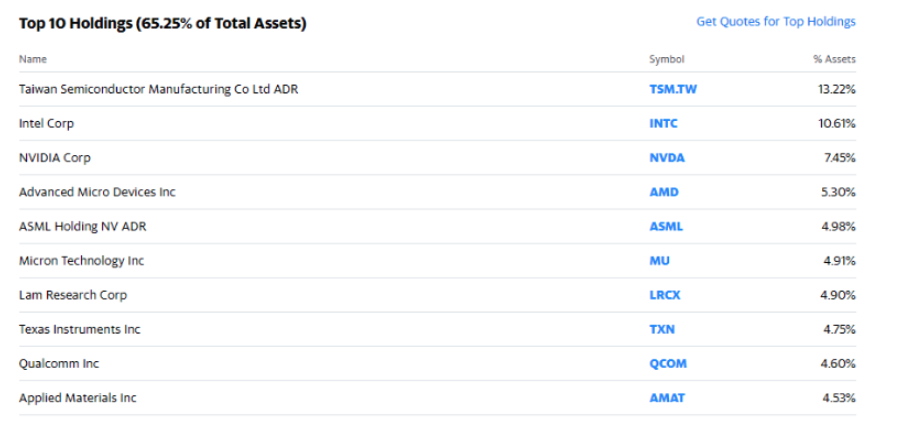

I’m seeing that the market’s recent developments indicate that this sector is in a great position to outperform the market during this timely rally. Specifically, I am monitoring the VanEck Vector Semiconductor ETF (SMH). Shares of the VanEck Vectors Semiconductor ETF (SMH) are the most widely traded and most popular ETF with both professional and retail investors. This ETF owns the best-of-breed basket of semiconductor stocks.

Running SMH through Tradespoon’s elite A.I. tools I am seeing several signs I like. In just the past couple of days, the Tradespoon Seasonal Chart is showing no less than four “higher” probability readings for the next 20, 30, 40, and 50-day periods.

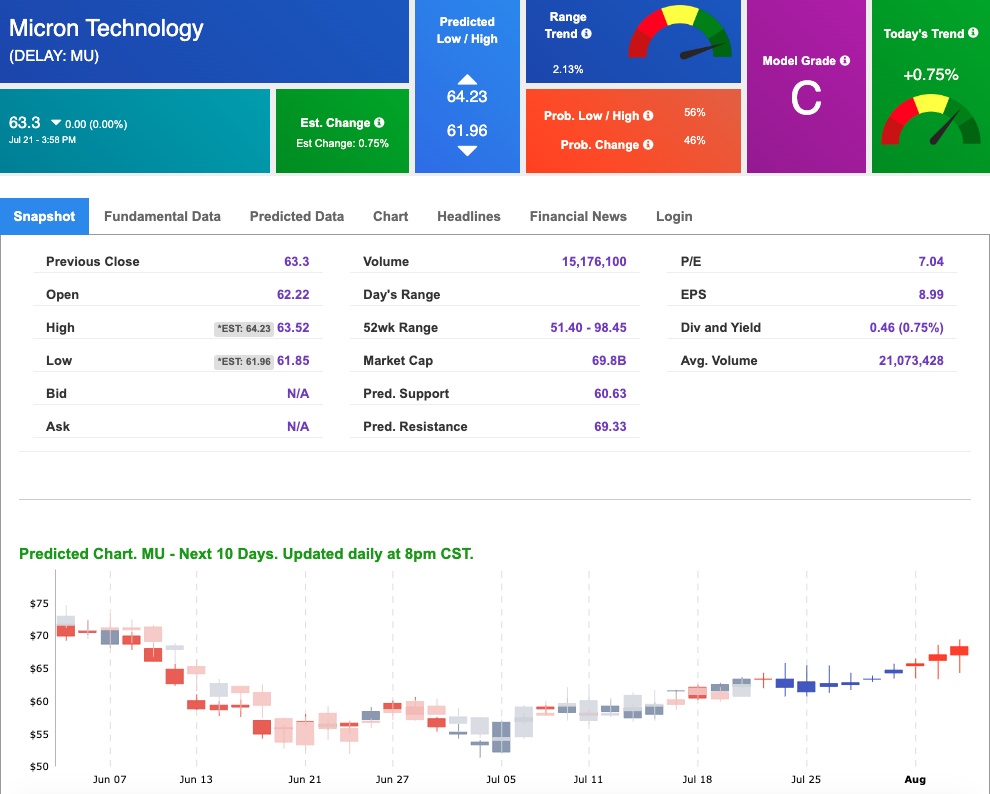

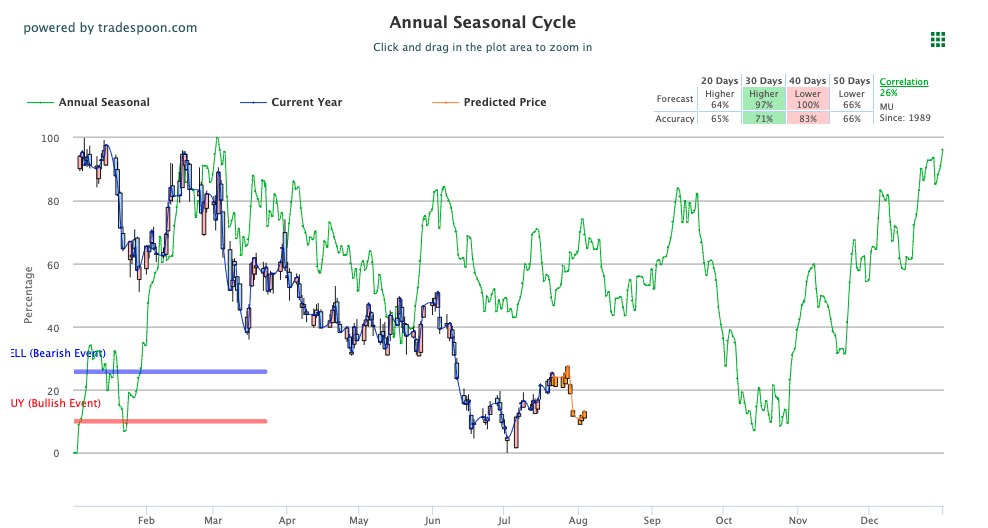

Keeping this in mind, there is one additional symbol I’d like to point out: Micron Technology (MU). This microchip and data storage producer is at the top of its field. MU is currently down on the year, which means there are plenty of opportunities to climb back up. Over the last 6 months, MU has dropped over 23% but in recent weeks found good footing for a rally: up 12% in the last month. Similar trends are highlighted in MU’s seasonal chart, seen below.

Looking at Micron’s Seasonal Chart, seen below, we see room to climb in the next few weeks in tune with the continued tech rally I believe can occur. Still a bear market, this is a good opportunity to take advantage if the semiconductor and tech sector to reap the benefits of the upcoming earnings and FOMC releases.

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior. We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

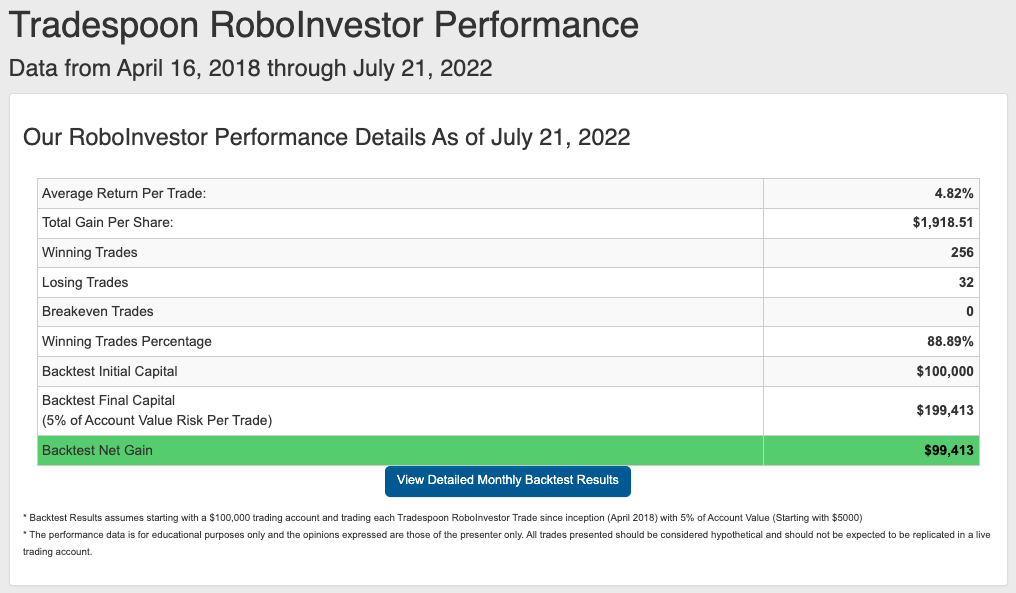

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.89% going back to April 2018.

The market continues to shape up to be as unpredictable as I’ve seen since the pandemic broke out in early 2020 – and we still have more than 5 months to go! Inflation, upcoming Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!