The US stock market rallied on Thursday, propelled by strong earnings reports from Big Tech companies. The Dow Jones, S&P 500, and Nasdaq all closed in the green, with the potential to finish the week in positive territory.

Leading the charge was Meta Platforms, whose stock surged 14% after the social media giant surpassed sales and earnings expectations. Other companies, such as Comcast and Eli Lilly, also saw stock prices rise following strong earnings reports.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Amazon.com’s stock price increased by 5.2% ahead of its earnings report after the market’s close. The ongoing tech earnings season continued to ramp up, with Amazon’s results beating expectations and Intel providing an upbeat outlook.

However, despite Thursday’s gains, all three indices remained relatively flat at the market’s close. The Dow was up 0.05% for the week, while the S&P 500 had gained 0.04%, and the Nasdaq climbed 0.6%.

In addition to the earnings reports, new economic data was released on Thursday. The gross domestic product (GDP) growth for the first quarter of 2023 missed economists’ expectations, with a growth rate of 1.1%, below the forecast of 1.9% and lower than the previous quarter’s 2.6%.

The slower economic growth is partly attributed to the Federal Reserve’s interest rate increases, which have lowered demand to reduce inflation. Private inventory investment also dipped, as businesses are preparing for a weakening consumer outlook.

The lower-than-expected GDP growth rate has sparked concerns about a potential recession, and Treasury prices fell after the news. The market will be paying close attention to the Personal Consumption Expenditures (PCE) data, set to release on Friday, as well as the latest Federal Open Market Committee (FOMC) meeting scheduled for next week, which could have significant implications for the market.

While the tech sector is experiencing strong growth amid the ongoing pandemic, investors remain wary of some companies. First Republic Bank reported a significant drop in deposits, leading to a 30% drop in its shares on Wednesday, following a 49% drop on Tuesday.

Looking ahead, the market could experience more volatility in the first half of the year. The ongoing earnings season will likely continue to drive stock price movements, with Microsoft, Alphabet, and General Electric releasing results this week. Additionally, investors should watch for overhead resistance levels in the SPDR S&P 500 ETF (SPY), currently at $414 and $418, and support levels at $406 and $402. See $SPY Seasonal Chart:

Overall, while the market is expected to trade sideways for the next two to eight weeks, there is potential for a pullback in the near future depending on earnings reports and forward-looking guidance. We recommend that investors remain market-neutral at this time and hedge their positions to minimize risk.

with this in mind, we have identified our next RoboStreet symbol.

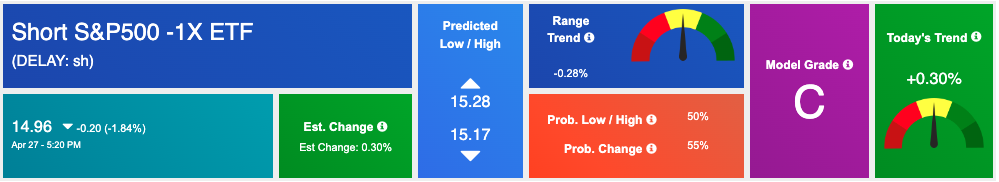

ProShares Short S&P500 ETF ($SH) is an exchange-traded fund that seeks to provide the opposite performance of the S&P 500 index. Essentially, it is a tool for investors to bet against the broader market, with the aim of protecting their portfolios during times of market volatility.

As we near the tail end of earnings season and approach the upcoming Federal Open Market Committee (FOMC) meeting, many investors are becoming increasingly cautious about the market’s future performance. With inflation on the rise and the Fed indicating potential interest rate hikes, there is growing uncertainty about where the market will go next.

This is why now may be a good time to consider buying $SH as a hedge against market volatility. While there are never any guarantees when it comes to investing, $SH could be a smart choice for those who want to limit their exposure to market risk in the short term – and our A.I. tools agree!

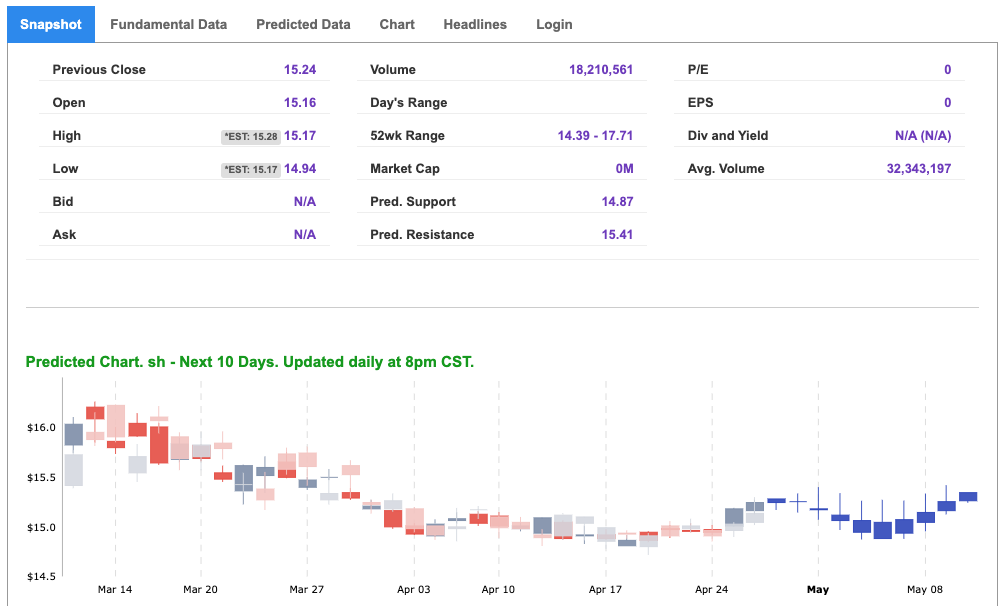

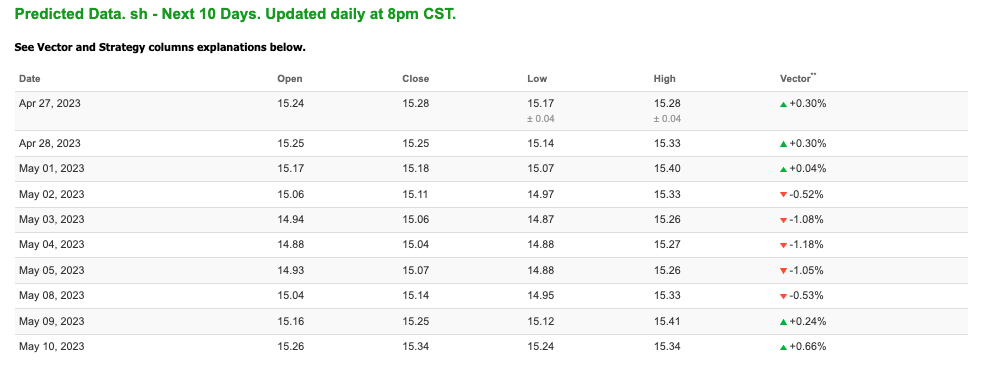

Looking at the 10-day Stock Forecast Toolbox we see a positive vector trend emerge that sees the symbol maintaining a bullish run. With a strong trend in the coming days, SH’s outlook could prosper further and see an elongated run. As the next FOMC is right around the corner, one in which the market will surely react, $SH provides a great opportunity to hedge. See 10-Day $SH Predicted Data:

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

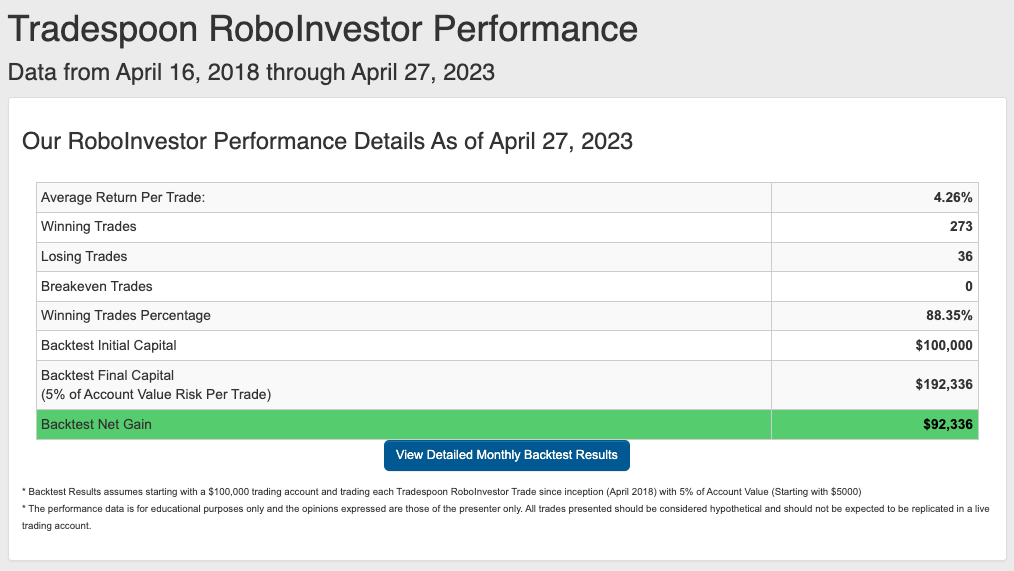

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.31% going back to April 2018.

In 2023, investors are facing a dynamic market affected by a combination of factors such as inflation, Federal policies, and geopolitical tensions, including the ongoing conflict in Ukraine. To successfully navigate this complex landscape, it is crucial to partner with a trustworthy and knowledgeable investment platform. RoboInvestor provides the necessary expertise and tools to help investors manage their portfolios with confidence and capitalize on opportunities in the fast-paced market.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!