Today, all three major U.S. indices saw gains, buoyed by a decline in oil prices and a favorable start to what promises to be an eventful week for the stock market. Investor optimism is high, yet caution is warranted, as a series of key events unfold, each with the potential to influence sentiment and market direction. This week’s lineup includes crucial Big Tech earnings and significant economic data releases that will provide valuable insights into the health of the economy and the strength of market growth.

Big Tech earnings are set to dominate the market narrative, with industry giants Alphabet, Meta Platforms, Microsoft, Amazon, and Apple all reporting third-quarter results. As these companies reveal their financial performance, investors are especially interested in seeing evidence of continued growth in artificial intelligence (AI) monetization—a key area expected to drive future revenue streams and valuation strength. With these announcements expected to have an outsized impact, they could set the tone not just for tech but for broader market sentiment.

A packed earnings calendar extends beyond Big Tech this week, with financial results expected from major names across sectors, including Visa, McDonald’s, Pfizer, Advanced Micro Devices, Eli Lilly, and AbbVie. Each report will contribute to the overall sentiment, creating ripple effects across industries and potentially influencing sector-specific trends.

Alongside earnings, key economic data will also shape market outlooks. On Thursday, the Federal Reserve’s preferred inflation measure, the Personal Consumption Expenditures (PCE) index, will be released. Economists project a 2.1% year-over-year increase, which aligns closely with the Fed’s inflation target. This reading would reassure markets of the Fed’s control over inflation, keeping interest rate cuts a plausible scenario in the near term.

The week wraps up with October’s U.S. jobs report on Friday. Economists predict an increase of around 110,000 jobs—lower than September’s 254,000—a level that would suggest a gradual cooling in the labor market without sparking recession fears. Investors are on the lookout for data indicating a balanced, “soft landing” scenario: a job market that supports growth without pressuring the Fed to delay its anticipated rate cuts.

Several notable stocks responded to today’s economic climate, including Nvidia, which fell slightly by 0.2% after approaching record highs last Friday. With a valuation nearing $3.5 trillion, Nvidia ranks just behind Apple in market cap. Apple itself posted a 1.2% gain today following the launch of Apple Intelligence, a suite of AI features for iPhone, iPad, and Mac. Both Apple and Nvidia will report later in the week, with Apple and Amazon expected to release earnings after Thursday’s closing bell, while Alphabet, Microsoft, and Meta report earlier in the week, creating a crescendo of tech earnings releases.

Meanwhile, WTI Crude oil prices declined by over 5%, dropping to just under $68 per barrel. A recent Israeli strike on Iran did not impact oil supply, which alleviated fears of supply shortages and offered a welcome reprieve from inflationary pressures. Lower oil prices, when driven by stable supply rather than weakened demand, generally bode well for economic stability and consumer confidence.

In light of recent economic developments and stabilizing inflation, I’m shifting to a cautiously bullish stance on the broader market. Signs of inflation aligning within the Fed’s target range add credibility to discussions of future rate reductions, possibly moving from isolated cuts to a broader easing cycle through the coming year. Recent indicators of a “soft landing,” along with yield curve normalization, underscore a resilient economy, lending support to this outlook.

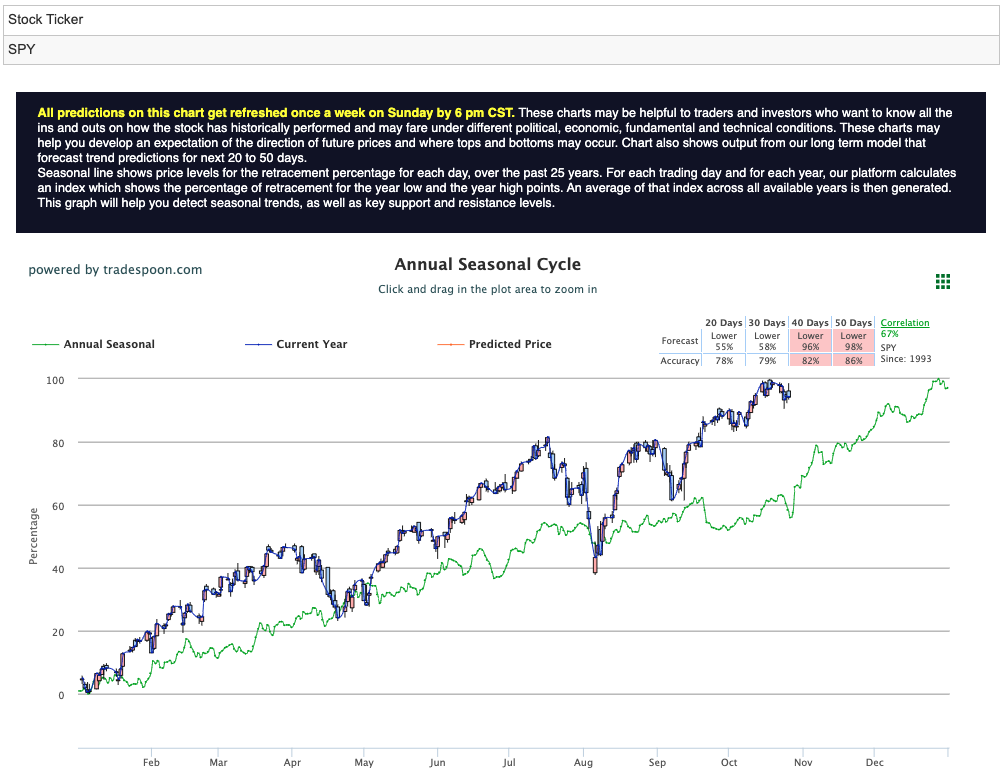

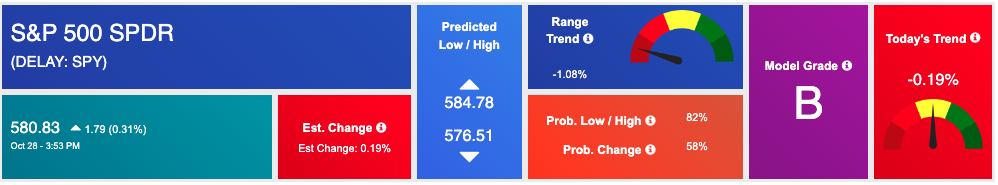

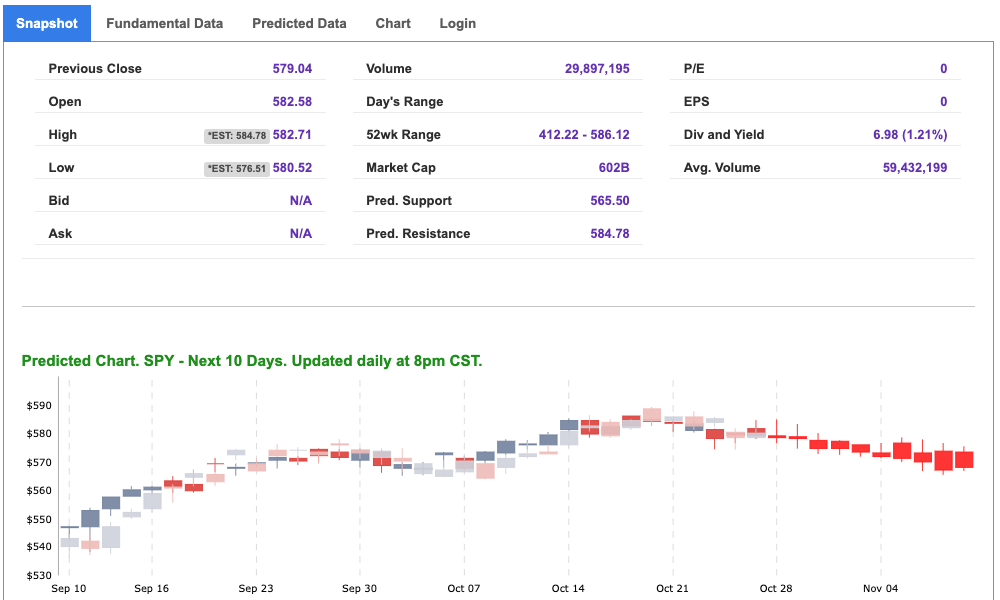

Looking ahead, I expect the S&P 500 to rally toward the 600–610 range over the coming months, with short-term support levels between 540 and 550. While the long-term uptrend appears to remain intact, there are risks ahead, including the impact of cooling in commercial and residential real estate markets, particularly on smaller banks. Current signs of economic moderation and a slight rise in unemployment suggest a controlled slowdown rather than a severe downturn, with shallow pullbacks potentially offering buying opportunities in sectors that demonstrate strength. For reference, the SPY Seasonal Chart is shown below:

The combination of Big Tech earnings and key economic data this week presents investors with a timely opportunity to assess both growth and inflation trends. Potential pullbacks or cooling sectors may create attractive entry points in resilient areas like tech, healthcare, and consumer goods, where strong fundamentals and favorable outlooks persist.

With a dynamic week ahead, investors should remain flexible and vigilant, ready to adapt to changing conditions and capitalize on emerging opportunities. This week’s developments could define the market’s path into the year-end, providing critical insights into how corporate America and the economy at large are positioned for the next phase of growth.

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

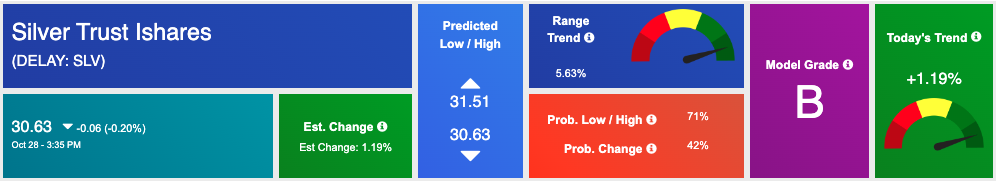

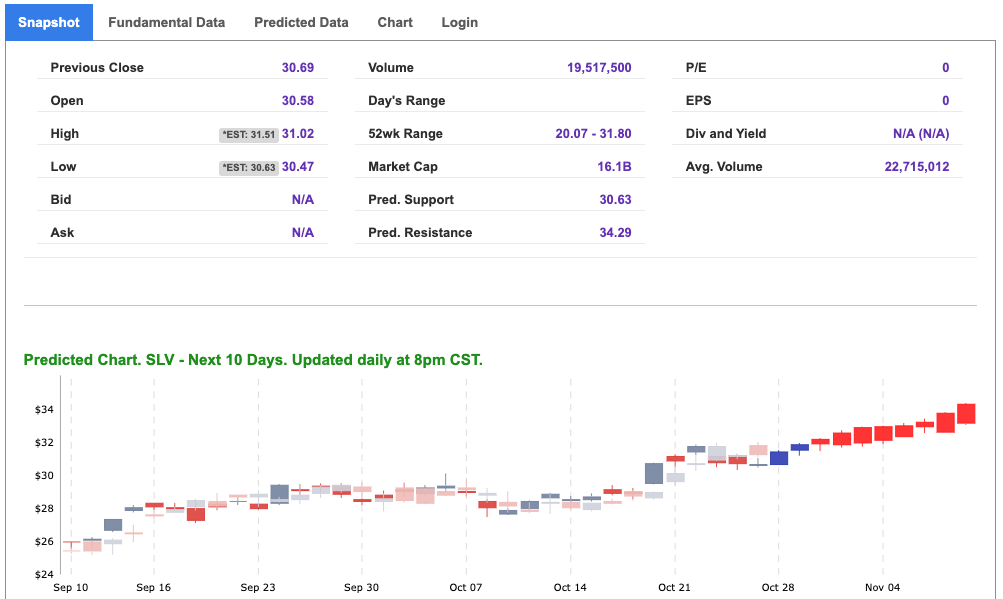

Our featured symbol for Tuesday is Silver Trust iShares- SLV is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $30.63 with a vector of +1.19% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, SLV. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

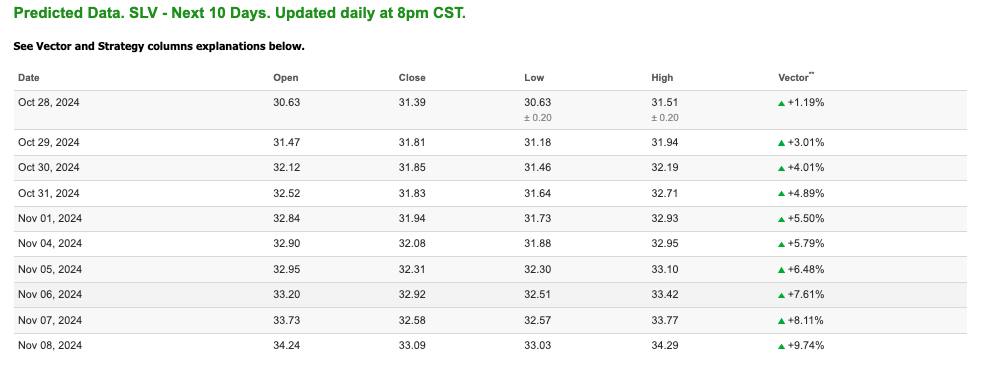

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $68.01 per barrel, down 5.24%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $70.43 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

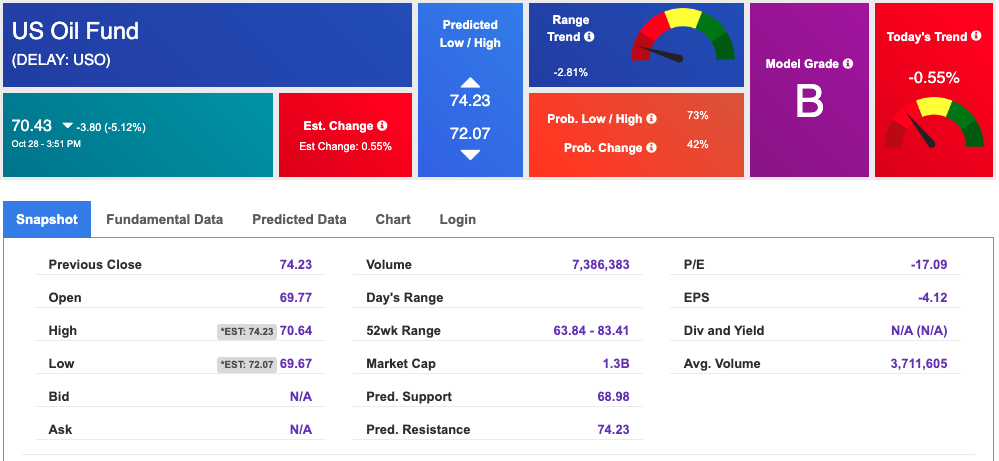

The price for the Gold Continuous Contract (GC00) is up 0.01% at $2,755.10 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $253.33 at the time of publication. Vector signals show +0.16% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

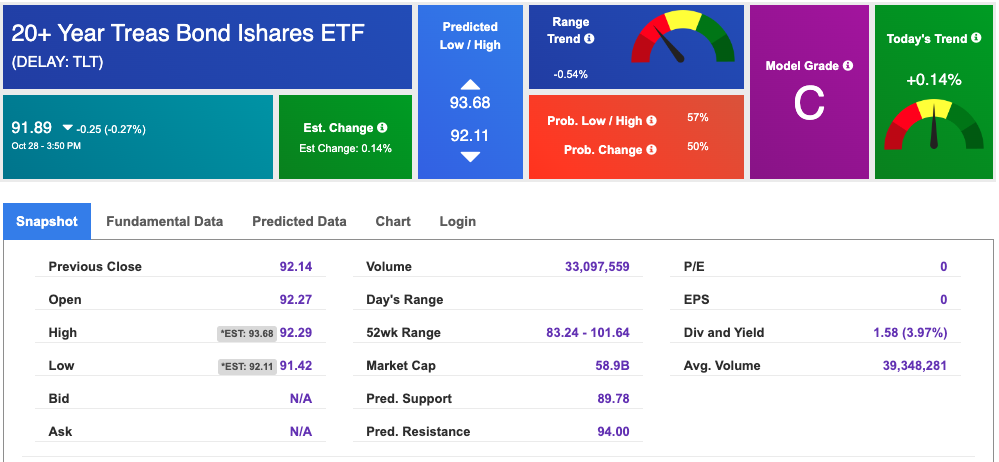

The yield on the 10-year Treasury note is up at 4.286% at the time of publication.

The yield on the 30-year Treasury note is up at 4.534% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

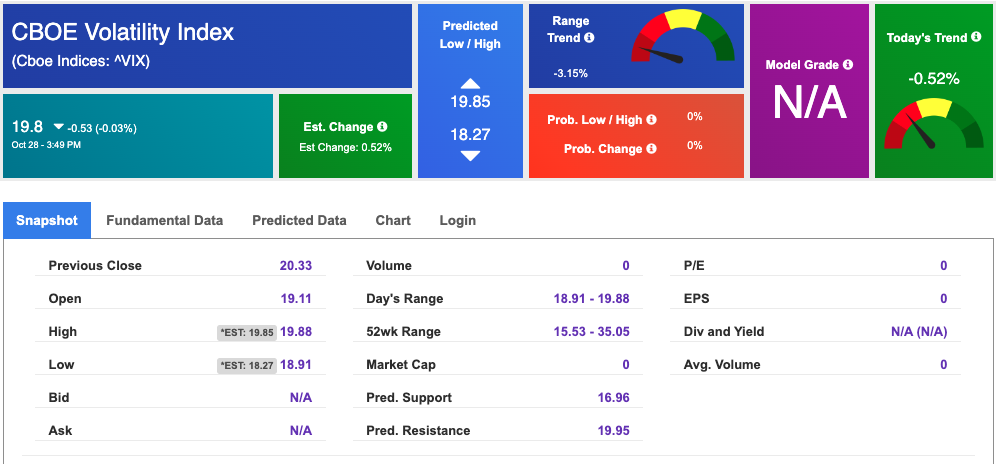

The CBOE Volatility Index (^VIX) is priced at $19.80 down 0.03% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!