RoboStreet – October 6, 2022

Markets Dip After OPEC and Fed News

All three major U.S. indices closed lower on Thursday after a volatile session that included comments from Fed officials and unemployment data. Traders responded to data showing a greater-than-expected increase in jobless claims and comments from senior Federal Reserve officials who stated that the central bank is possibly powerless to pause its rapid interest rate hikes. Following today’s reports, Friday is scheduled to include several major job reports which can further illuminate the current state of the economy.

Stocks continued Wednesday’s selloff with a choppy trading day on Thursday that ultimately ended with shares closing in the red. Released on Thursday, data showed the number of Americans applying for unemployment benefits last week climbed by 29,000 to a five-week high of 219,000 — more than economists had expected. Losses were elongated as it became apparent Fed interest rate hikes have softened the job market; this then was reinforced by the Fed comments in which additional hikes were forecasted.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

On Friday, the majority of September labor data will be released with average hourly earnings, employment rate, and payroll reports. Core CPI and FOMC minutes headline next week’s economic releases, as well as retail and PPI data. Tilray earnings are due on Friday as well while earnings season will officially kick off next week with major banks releasing Q3 data.

As it stands, I believe the market bottoming process has started. The market remained oversold to start October and while it can rally for a few weeks, we are also looking at the possibility of retesting recent lows. Employment data on Friday and CPI next week will be the primary directors of market movement and depending on results can send shares in either direction.

Still, I believe the easiest path forward is for shares to trade higher and I will be buying on these weaknesses going forward. As we just saw, rallies are still very possible – having recently repeated the end-of-July/August rally to end September. While the rally was primarily caused by optimistic sentiment and a few not-as-bad-as-expected reports, the upcoming earnings season offers us a similar opportunity to capitalize on any rallies following the ongoing dip.

The market, having started the bottoming process, has rapidly become oversold and thus presents a great opportunity for a multi-day rally to be built. In terms of investing, I’ll be looking to get involved in the energy sector according to my most recent study of the market, as well as previous patterns. Oil has been a topic of conversation throughout the summer, with prices rapidly fluctuating, and after the latest news on the commodity, I have spotted an opportunity I will be following closely.

The Organization of the Petroleum exporting Countries, OPEC, announced its latest initiative to scale back daily supply. On Wednesday, OPEC announced it would cut its oil production by 2 million barrels per day, sending a shock through the market and spiking oil rates higher. While still below its mid-summer peak, oil shares are under pressure from OPEC as well as the ongoing situation in Ukraine. As energy turns into a highly contested commodity, I will be looking at one particular ETF to guide my trades through this time.

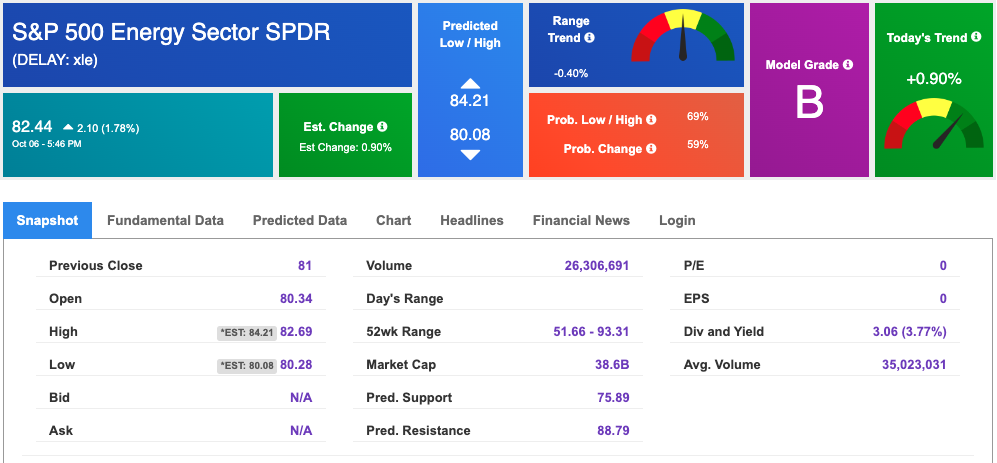

The Energy Select Sector SPDR Fund (XLE) is my go-to for the energy sector when it comes to ETFs. With nearly $40 billion in assets, the fund offers exposure to oil, gas, fuel, and energy equipment and services industries. The fund is the marquee energy ETF within the S&P and is one I trust to properly portray the energy sector. Trading below its 52-week high of $93.31, the current price of XLE at $82.44 offers a great opportunity, one I would like to invest in so long as my A.I. data agrees. Let’s check:

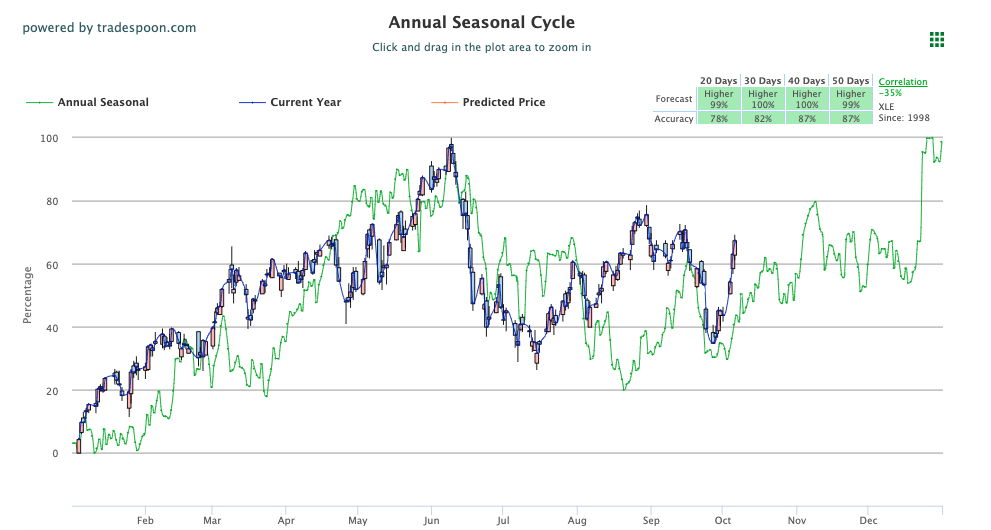

Reviewing the $XLE Seasonal Chart above, we see that just recently the annual season price, marked in green, dipped below the current year price, marked in blue. The symbol is showing potential to go higher in all four time ranges of the Seasonal Chart forecast which is a great sign. Not only is the symbol projected higher for the next 20, 30, 40, and 50 day periods, it is also forecasting that with an impressive and escalating accuracy score.

With this in mind, I’d like to go even a step further and pick out what I think is a great opportunity in the energy sector with this specific company.

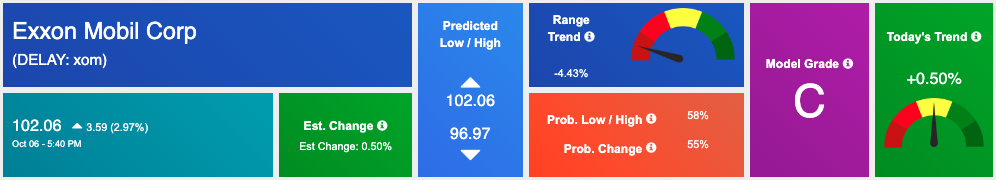

ExxonMobil Corporation (XOM) is a leader in the oil field and flashing some great signals for the upcoming quarter. XOM is the largest direct descendant of the Standard Oil empire and, just like the rest of the energy sector, saw a fairly volatile 2022. Trading as low $63 in January, shares have steadily climbed with a few pullbacks after creating new 52-week highs. Looking at the latest trends, I believe we might have a similar opportunity on our hands.

As of Thursday, XOM traded near $102, just below the 52-week high of $105. Considering the latest from OPEC, and the continued pressure from inflation, I believe this symbol has a shot to top its annual high and my A.I. arsenal is in agreement.

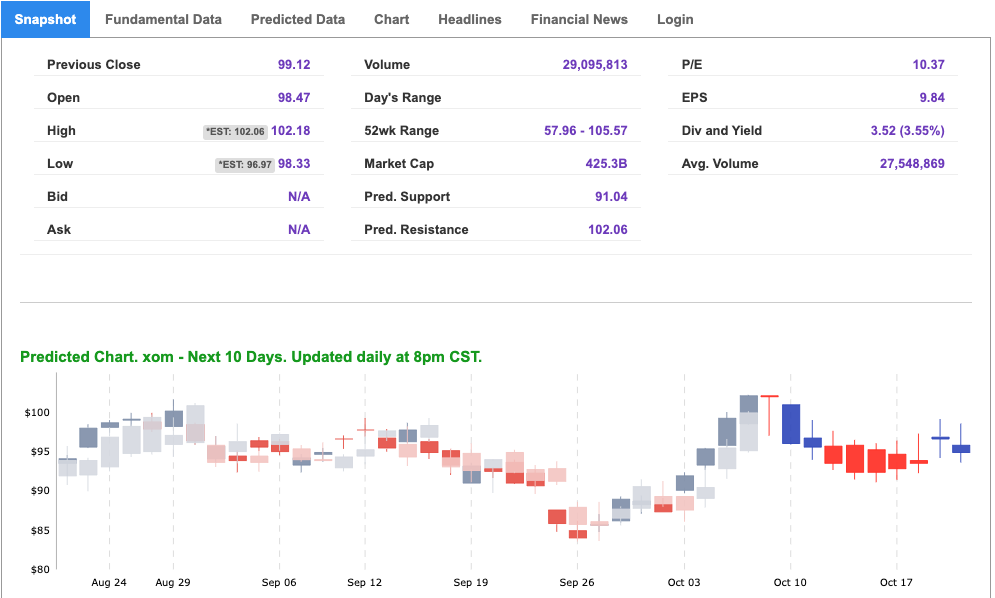

Using the Stock Forecast Toolbox, XOM is signaling an early trend upward in its 10-day forecast. The stock’s relative strength is in neutral territory, indicating that it has some room to run. The stock is nearing its 52-week high and suggesting that more gains are possible. The oversold nature of the market with the additional pressure of OPEC action makes this symbol path of least resistance up.

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

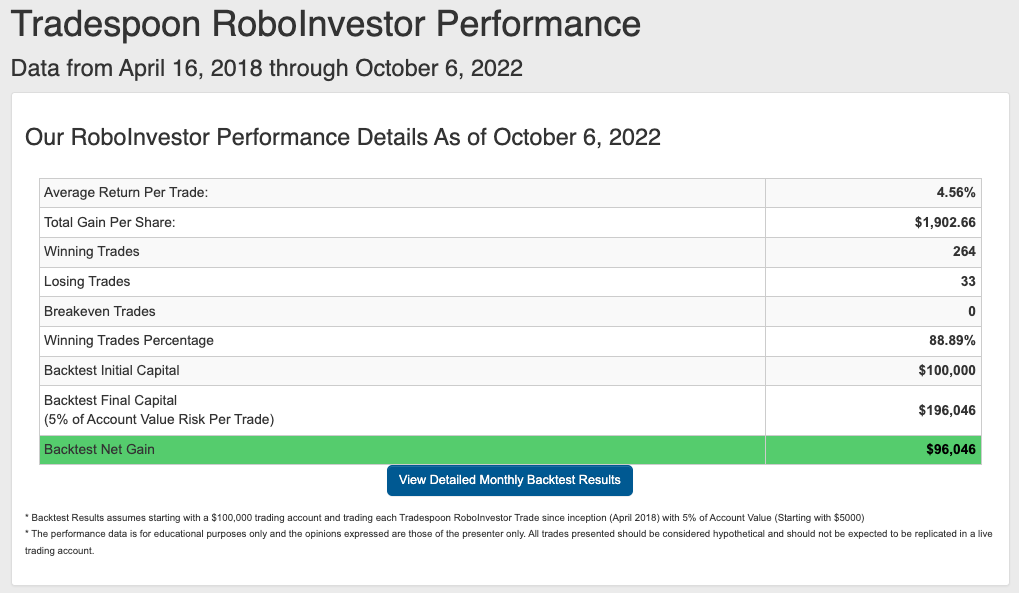

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.89% going back to April 2018.

The market continues to shape up to be as unpredictable as I’ve seen since the pandemic broke out in early 2020 – and we just started Q4! Inflation, Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!