RoboStreet – July 14, 2022

Inflation Data Returns Higher Than Expected

Key inflation readings were released this week, topping expectations and once again pressuring markets. In June, U.S. consumers paid considerably greater prices for a range of products as inflation levels rose in a slowing US economy, according to the Bureau of Labor Statistics. The consumer price index, which tracks the cost of living for typical items and services, rose 9.1% from a year ago, more than the 8.8 percent forecast by the Dow Jones Industrial Average. On a monthly basis, headline CPI increased 1.3 percent and core CPI rose 0.7%, compared to expectations of 1.1% and 0.5%. This comes ahead of Friday’s key retail reports, in which experts expect a 0.9% growth in June, along with the CPI increase at 1.1%.

The spike in consumer prices highlights inflation that is widespread and severe throughout the economy, with real wages dropping to their lowest level since records began in 2007. The unexpectedly high inflation data will keep the Federal Reserve on a path to control demand, and it adds to the political pressure on President Biden and congressional Democrats as they head into midterm elections. On the plus side, the employment sector has remained robust, with almost 400,000 new positions created last month.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside the next 3 months, so my weekly updates are timely enough for you to act.

Looking at the latest inflation reading it is safe to assume the continued pressure faced by rising inflation will likely result in a Fed that is more active in the coming months. A second 75 basis-point interest rate rise is already expected by Fed policymakers later this month. And although traders had already completely priced in a 75-point hike before the data were revealed, they are now also considering the likely chance that it could be a full percentage point.

With this in mind, several economists are projecting that the faster the U.S. Federal Reserve moves, the more risks there are for a potential recession in the next year. Following the CPI report, retail data, due Friday, as well as the ongoing earnings season are set to dictate the upcoming market movement. Next week, look out for key earnings reports from IBM, Netflix, Tesla, AT&T, and Bank of America, as well as additional Q2 reports.

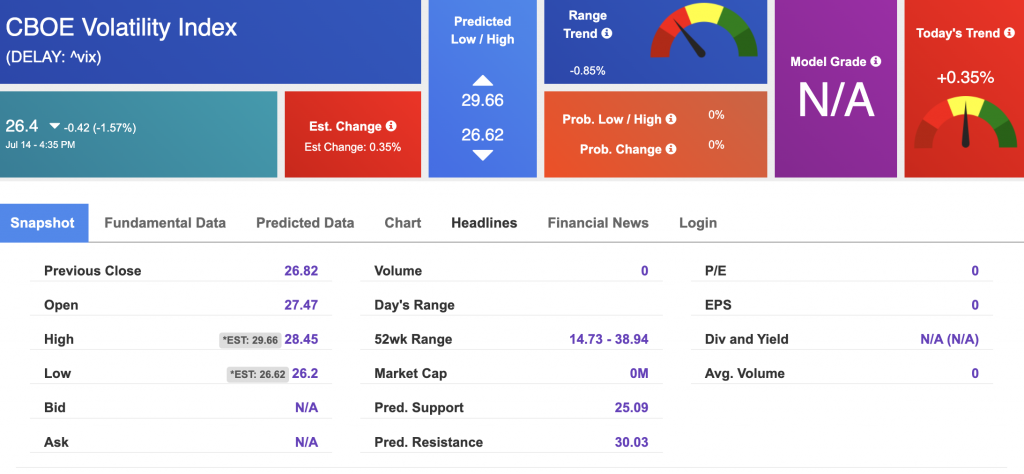

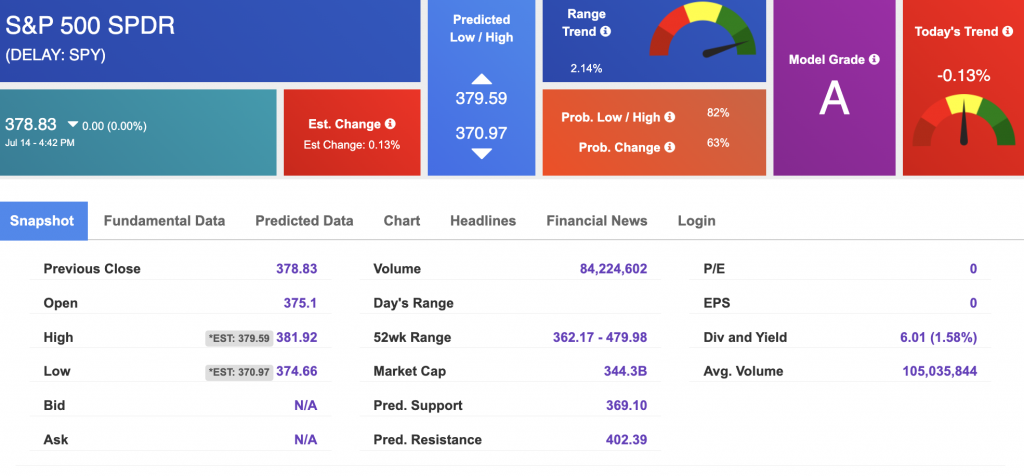

The $VIX is still trading at about $26, and it’s worth monitoring as well as long-term treasury notes. The 10-year note is slightly up while the 20 and 30-year notes trade lower. Along with the VIX, I am watching the overhead resistance levels in the SPY, which are presently at $396 and then $409. The $SPY support is at $380 and then $372.

Looking at the data, I would be a seller into the rally and have a NEUTRAL portfolio at this time. Short term the market is oversold and undergoing the bottoming process.

If you are trading options consider selling premium with November and December expiration dates.

Considering the latest inflation reports, I am looking at a specific sector to move on with already a few notable examples in the works. Looking at Qualcomm’s recent boom ahead of their earnings report as one such indicator. Qualcomm is one of the world’s most recognized and important wireless technology inventors, as well as the driving force behind 5G’s development, launch, and expansion. Up over 8%, the symbol experienced an impressive month after JPMorgan increased its evaluation while also seeing a boost overseas, specifically in China.

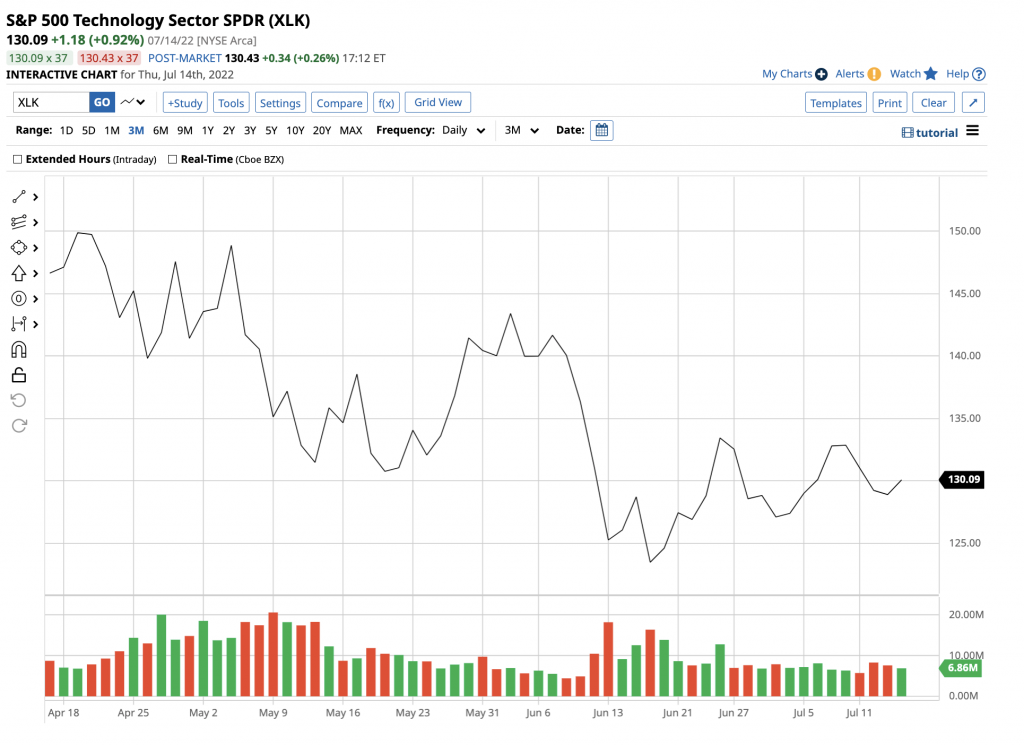

Overall the technology sector has fared well in times like these and recent trends indicate just as much. Factoring in the market’s latest movements, I am seeing the tech sector is in a great position to outperform the market. Looking at the S&P Tech Sector SPDR ETF, XLK, I am seeing signs of a sector that is currently underperforming.

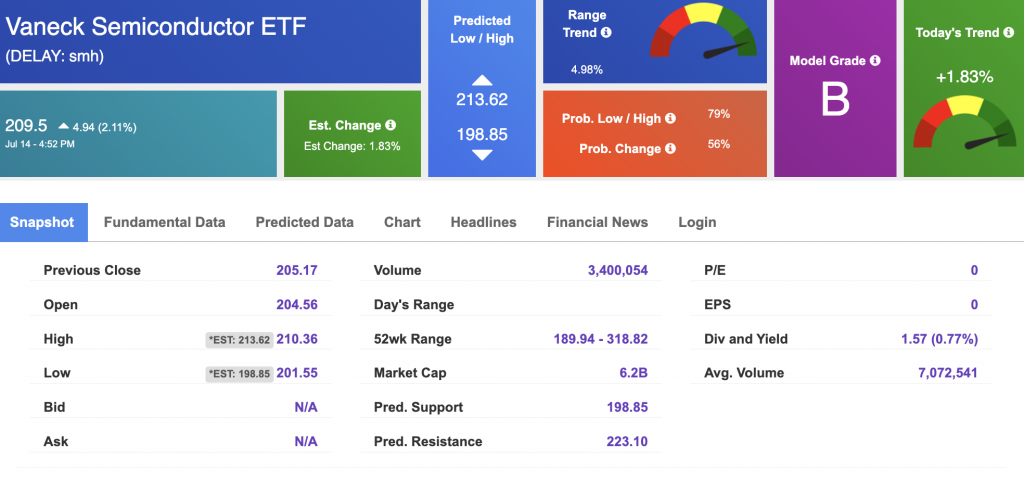

If the technology sector were to outperform the market, one symbol I am keeping my eye on is SMH. The VanEck Semiconductor ETF is a collection of equities and depository receipts from US stock market-listed firms in the semiconductor sector. The fund’s objective is to match the price and yield performance of the Market Vectors US Listed Semiconductor 25 Index.

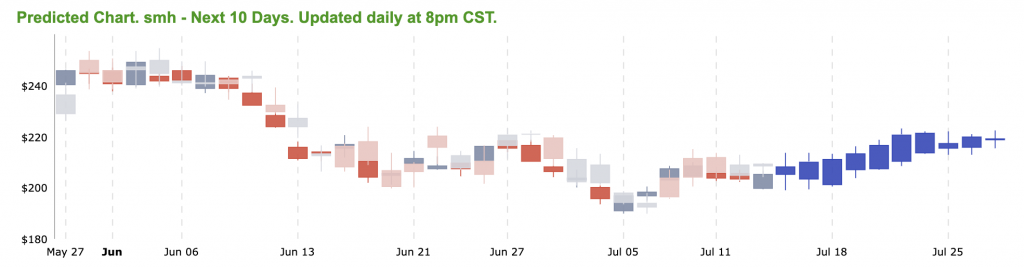

Looking at SMH’s Seasonal Chart, seen below, a noticeable gap is currently being represented between the current year price and the annual year price. With all four time ranges, 20-50 days, signaling that the symbol is likely to go higher, I am liking the looks of this trend. When tech outperforms, semiconductors follow suit. When the historical and recent data show trends that can fall in line with this outlook, I am also likely to follow suit.

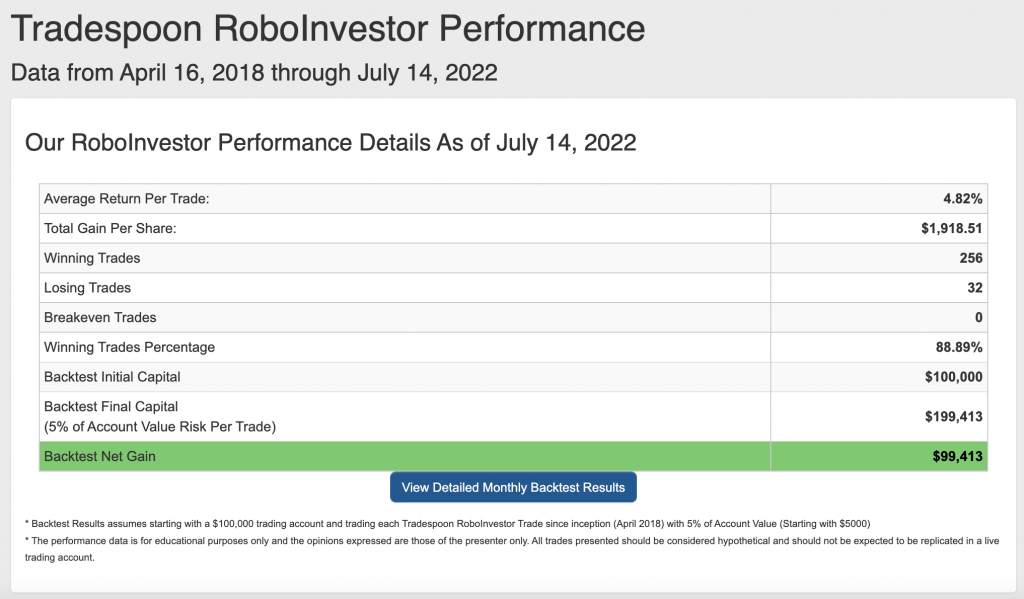

This is what the power of AI does for us and for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior. We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

To my knowledge, our track record of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.89% going back to April 2018.

The market is shaping up to be as unpredictable as I’ve seen since the pandemic broke out in early 2020. Inflation, upcoming Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!