RoboStreet – February 17, 2022

Markets and Volatility

Unless short-term trading is your thing, the kind of extreme volatility being exacted on the stock market is not what most investors are at ease with. And that’s probably a big understatement. Lately, inflation, a few high-profile earnings misses and now the rising concern of a Russian invasion into Ukraine has the major indexes enduring wide price swings.

At the same time, roughly 80% of companies in the S&P 500 exceeded fourth-quarter earnings estimates while the latest data on Covid-19 caseload is downright bullish for the U.S. getting back to normal in the not-too-distant future. These two developments are big news for a market beset by a hawkish Fed reacting to some hot inflation data and the need for the global supply chains to free up so as to bring prices down.

It’s a real tug-of-war between the bulls and the bears, but I’m of the view that sales and earnings matter most to the market. The nervous market has bond yields in check with the 2-year Treasury yield around 1.5% and the 10-year T-Note yield at 1.93%. Crude oil continues to trade above $90/bbl and will likely hold that level given the geo-political risk environment, but could spike to $100+/bbl on negative Ukraine headlines.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

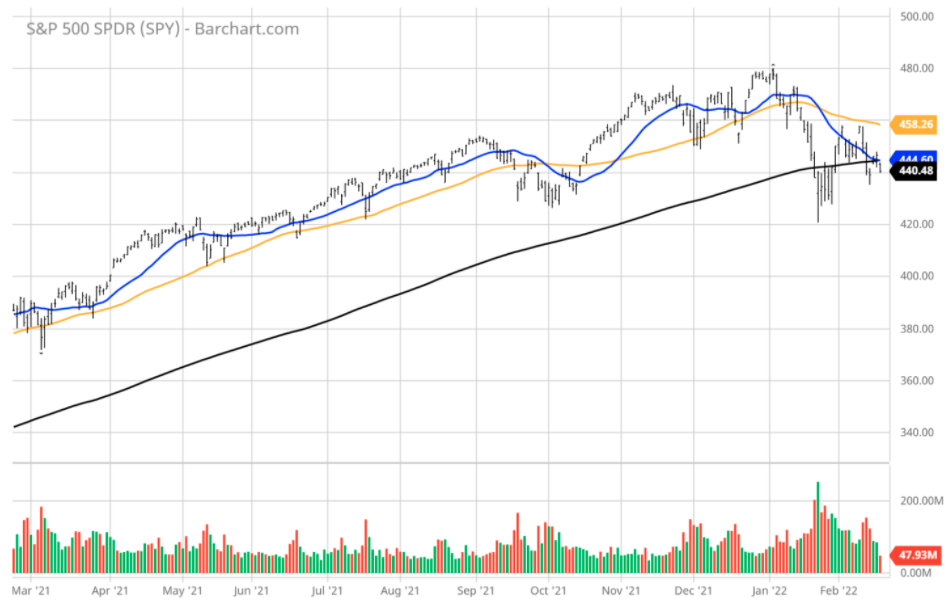

Per Wednesday’s close, the $SPY finished slightly higher, and closed at $446, above the 200 DMA. It dipped below this key level Thursday. The $SPY was up 0.2% and closed below the 50% retracement from 2022 low to high, key short-term resistance. The value/reflationary ($VTV) closed higher, up 0.2%, at the 50 DMA. The technology sector ($QQQ) closed flat, at $356 still below the 200 DMA.

The $DXY closed lower, at $96, below the 50 DMA. The $TLT was higher 0.4% and closed close near the April 2021 low. The ten-year yield closed near 2.0%. The $VIX trades higher at the 26 level.

The $SPY short-term support level is at $440 (key long-term support) followed by $430. The SPY overhead resistance is at $460.

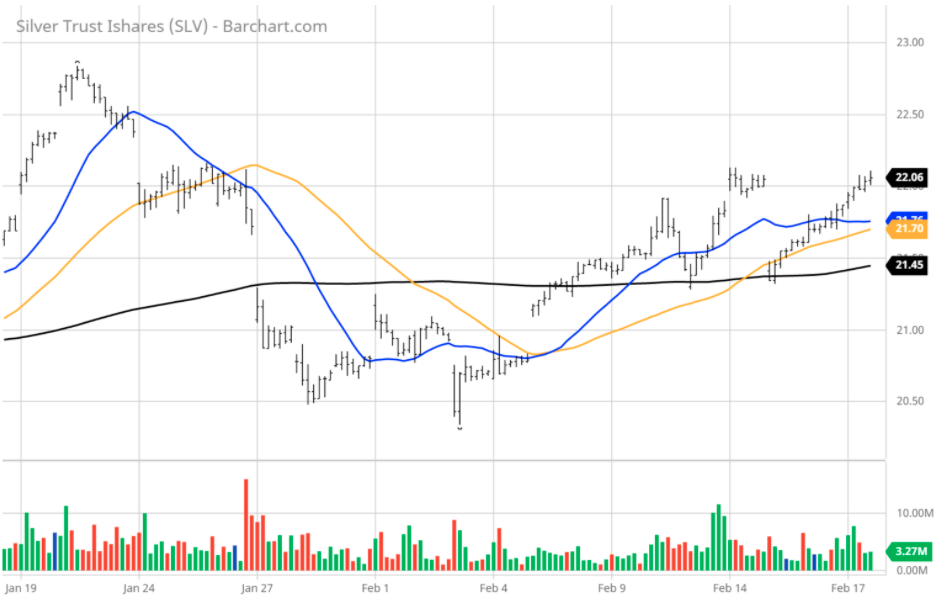

Investors seeking a hedge against the volatility are finding comfort in being long on silver, specifically the iShares Silver Trust ETF (SLV) that has made a sudden move higher this past week with the spike in inflation and headline risk. Commodities, in general, have performed well, but nothing rallies precious metals higher than currency devaluation and geopolitical upheaval.

SLV has roughly $13 billion in assets and tracks spot silver prices. The ETF charges 0.50% annually and trades about $500K of value daily and trades with a tight spread, averaging between 1-5 cents.

Additionally, silver has widespread industrial uses that make it much more than just a hedge or storehouse of wealth. Silver is in broad demand for its utilitarian properties, but this week it is being bought as a market and inflation hedge for sure. SLV is about to take out its January high that will invite further follow-on buying accompanied by heavy trading volume. It’s a bullish pattern that is building momentum.

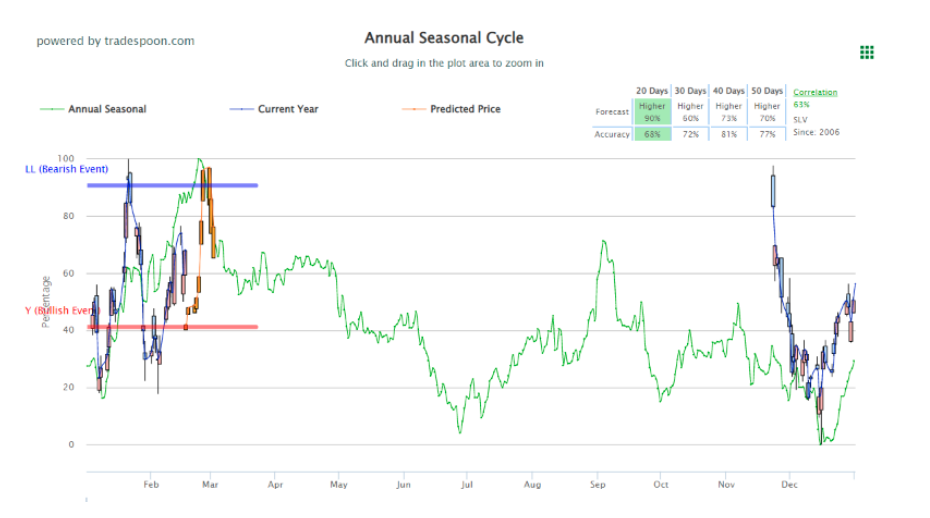

Where we get even more excited about the silver trade is when we apply our proprietary AI tools to SLV. Our AI-driven Seasonal Chart is registering “Higher” probability readings for the next 20, 30, 40, and 50-day periods. This kind of reading provides me with a high level of conviction to put this trade to work in our RoboInvestor portfolio.

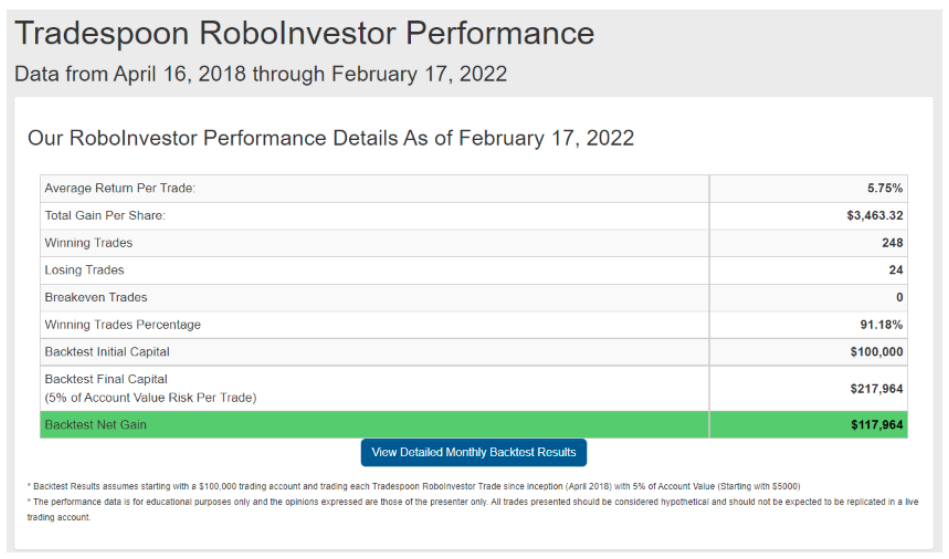

RoboInvestor is a dynamic AI-based portfolio of blue-chip stocks and ETFs that I personally invest in alongside our members. My algorithms sift through thousands of bits of data to formulate investible trades with exceptional risk/reward profiles where the probability of booking profits is better than 90% of the time capital is put to work. From the table below, going back to April 2018, our Winning Trades Percentage is 91.18%.

We achieve this torrid track record from having the flexibility to invest in an unrestricted manner, using blue-chip stocks and ETFs that represent the eleven market sectors, all the various sub-sectors, commodities, precious metals, currencies, interest rates, volatility, and shorting opportunities by way of utilizing inverse ETFs. There isn’t a day or week that goes by that we can’t find trades to consider for potential profits.

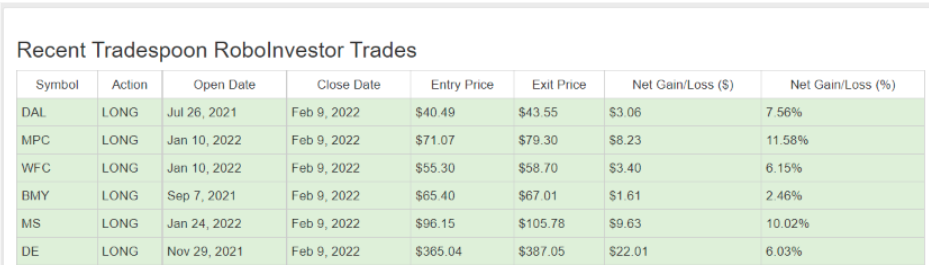

Every other week, we email out the RoboInvestor newsletter over the weekend with two new trade recommendations to act on Monday morning when the market opens. Just this week, we closed out four profitable trades we put on recently when the market was exhibiting elevated volatility. While investors are watching their portfolios lose value year-to-date, we’ve been busy booking profits in stocks like Delta Airlines Inc (DAL), Marathon Petroleum Corp. (MPC), Wells Fargo & Co. (WFC), Bristol Myers Squibb Co. (BMY), Morgan Stanley (MS) and Deere & Co. (DE).

I do expect volatility to persist, but the pattern of higher lows and higher highs should continue to emerge. Albeit, any Geopolitical risks, the market should continue the rebound this week. I would be a seller of the high beta stocks into the rallies and continue rotating the portfolio into the value stocks ($XLE, $XLI, $XME and $XLF).

I would consider rebalancing portfolio at this time, and have overall market BULLISH portfolio. I do expect the $SPY’s rebound to restart this week and continue for the next 1-2 month. I do not expect the $SPY to post a new all-time high nor break January low in the first half of this year. With the Fed minutes out of the way, all eyes are on the geopolitical risk in Ukraine.

Based on our models, the market (SPY) will trade in the range between $420 and $470 for the next 2-4 weeks.

In a market where headlines trigger stunning moves and high-frequency trading firms dominate the investing landscape, having the power of AI is an essential set of resources to navigate through the noise, wild price swings, and emotions that can make the business of investing extremely challenging. AI removes many elements of risk where human emotions can result in hasty and bad decisions.

This market has a lot of moving parts working simultaneously for both the bullish and bearish camps. The best approach is don’t take sides, just trade for profits in those stocks and ETFs where the data represents the highest probability of winning. With RoboInvestor, there is always a compelling strategy that hits our screens to take full advantage of.

I look forward to welcoming aboard all readers of this column to join our RoboInvestor community of wealth-building members that are on our collective journey to grow our portfolios in an unemotional and intelligent manner for years to come!

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!