On Thursday, the Dow Jones Industrial Average recorded gains as fresh economic data highlighted the steady progress of the U.S. economy. Revised figures for first-quarter Gross Domestic Product (GDP) revealed stronger growth than initially expected, while weekly jobless claims declined beyond projections. This positive news reassured investors about the resilience of the U.S. economy.

According to the Bureau of Economic Analysis, the final revision of first-quarter GDP showed a remarkable 2% annual expansion, surpassing the previous estimate of 1.3% growth. Economists had anticipated no change, but the upward adjustments primarily stemmed from increased exports and consumer spending.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Major financial institutions, including Goldman Sachs Group and JPMorgan Chase, experienced significant stock gains after successfully passing the Federal Reserve’s stress test. This achievement instilled confidence in the stability of the banking sector.

However, not all companies shared the positive sentiment. Following a mixed earnings report, Nike’s shares fluctuated, while Micron Technology faced significant challenges, ranking as the worst performer in the Nasdaq 100 and the second-worst in the S&P 500 on Thursday.

Micron’s stock price plummeted by 4.1% to $64.29, marking its lowest close since May 16. Although the company reported better-than-expected results for the May quarter, concerns emerged due to reports suggesting the Biden administration may impose further restrictions on the sale of artificial intelligence chips to customers in China. As a result of the upward revision of U.S. GDP, bond yields climbed, with the 2-year Treasury note yield reaching 4.876% and the 10-year Treasury note yield rising to 3.852%.

The latest jobless claims data presented a positive outlook for the U.S. economy, as the week ending June 24 saw a decline to 239,000 claims, surpassing the anticipated 264,000. This further exemplified the economy’s resilience.

Across the Atlantic, European stock markets displayed a mixed performance as investors analyzed statements from leaders of regional central banks who, akin to Federal Reserve Chairman Jerome Powell, adopted a hawkish stance on monetary policy during a conference in Portugal.

Although all major U.S. indices experienced a decline on Monday, the tech-focused Nasdaq Composite was particularly affected. Nonetheless, the tech sector has delivered a robust performance in 2023, with substantial year-to-date gains registered by the Nasdaq.

Over the previous weekend, a failed rebellion attempt in Russia caused minor disruptions across global markets. While oil prices and gold experienced a temporary upswing, overall market volatility remained relatively subdued. Additionally, the Organization of the Petroleum Exporting Countries (OPEC) projected a sustained increase in global oil demand over the next two decades, forecasting a substantial 23% surge in overall energy demand by 2045.

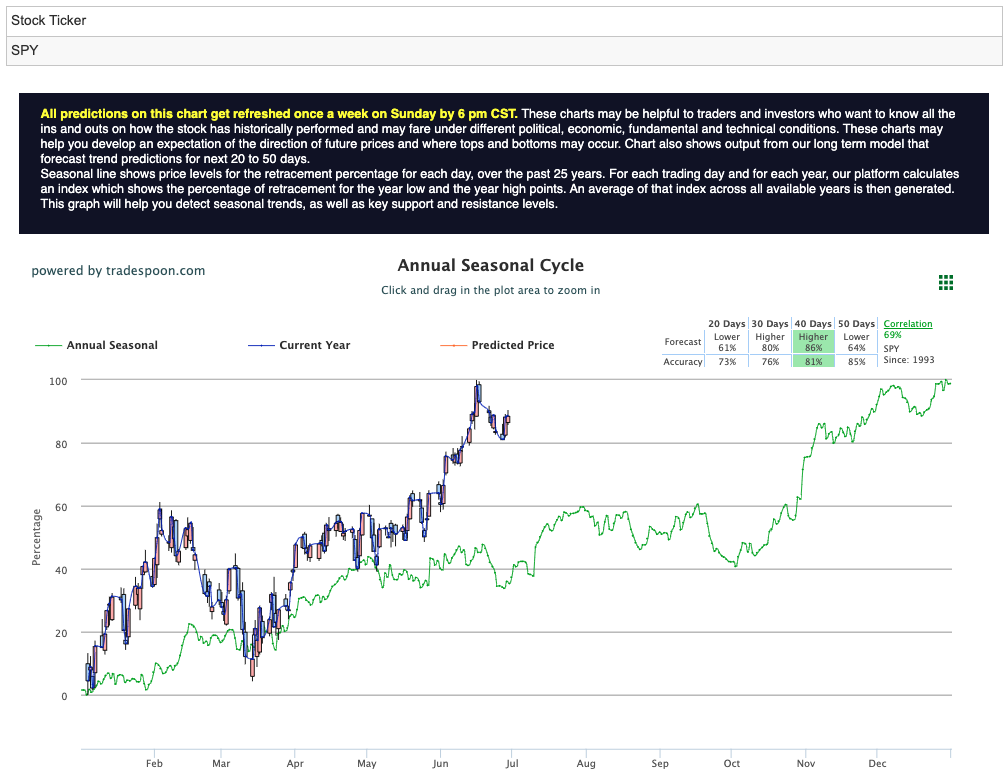

The market currently faces challenges as it tests critical support levels and grapples with overhead resistance. Our market models suggest a potential overbought scenario, signaling a looming negative trend. As we enter the second half of the year, heightened volatility should be anticipated. Key support levels for the SPY at $431-$432 were tested, while the market struggled to overcome overhead resistance at $434. Our market models indicate a looming negative trend, suggesting a potential overbought scenario. For reference, the SPY Seasonal Chart is shown below:

In conclusion, the latest economic data underscores the resilience of the U.S. economy, with GDP growth surpassing expectations and jobless claims declining. Investors maintain a cautious yet optimistic stance, closely monitoring forthcoming earnings reports and inflation data for valuable market insights. With this in mind, I have identified my next RoboStreet symbol – and one I’ll be looking to make a move on in the coming days.

Carnival Corporation (CCL) is a renowned and established cruise line company that operates a diverse portfolio of brands, including Carnival Cruise Line, Princess Cruises, Holland America Line, and others. With a history dating back to 1972, Carnival has grown to become one of the largest leisure travel companies globally, offering unforgettable vacation experiences to millions of passengers each year.

Despite facing significant challenges in recent years due to the COVID-19 pandemic, which led to prolonged cruise suspensions and financial setbacks, Carnival is positioned for a potential resurgence, making it an intriguing investment opportunity. Here are a few reasons why it could be a good time to consider buying CCL stock:

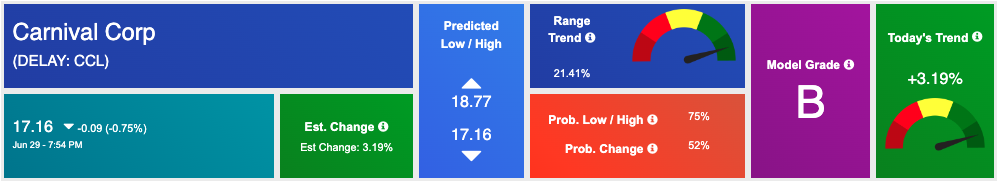

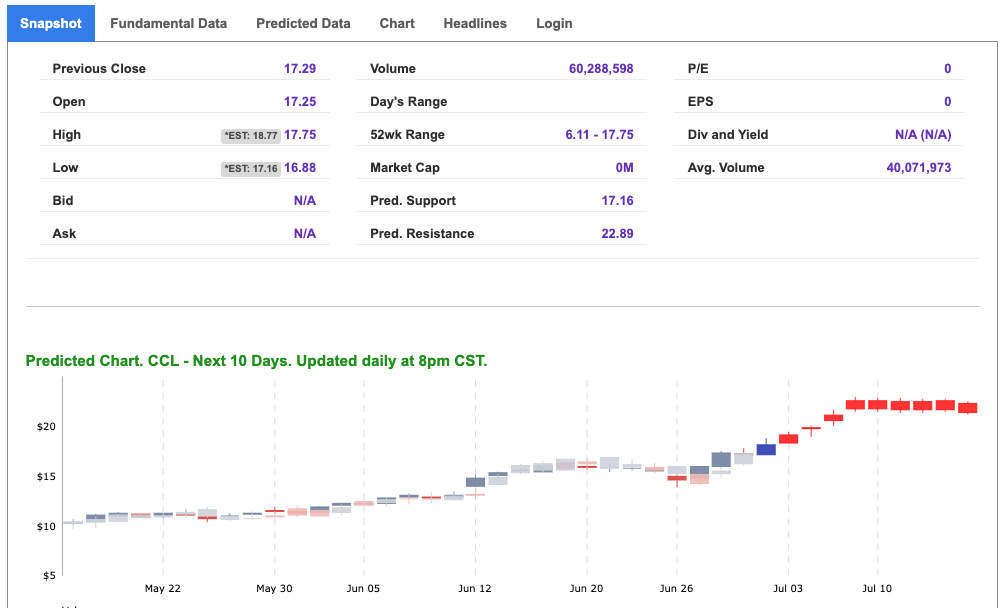

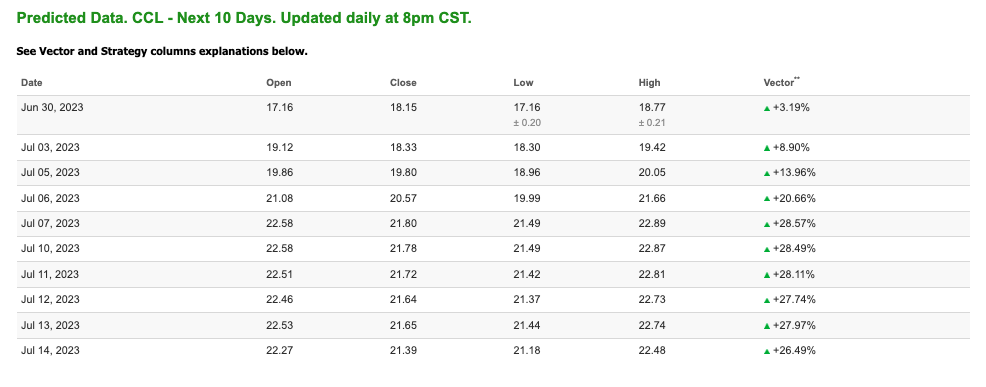

While these reasons allude to a prosperous run for CCL, my A.I. models are seeing similar results. Sporting a model grade “B” CCL sits in the top 25% of accuracy within our data universe. Furthermore, the predicted data for CCL is showing a strong bullish run based on a steady and one-directional, positive vector score. See 10-Day Predicted Data:

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

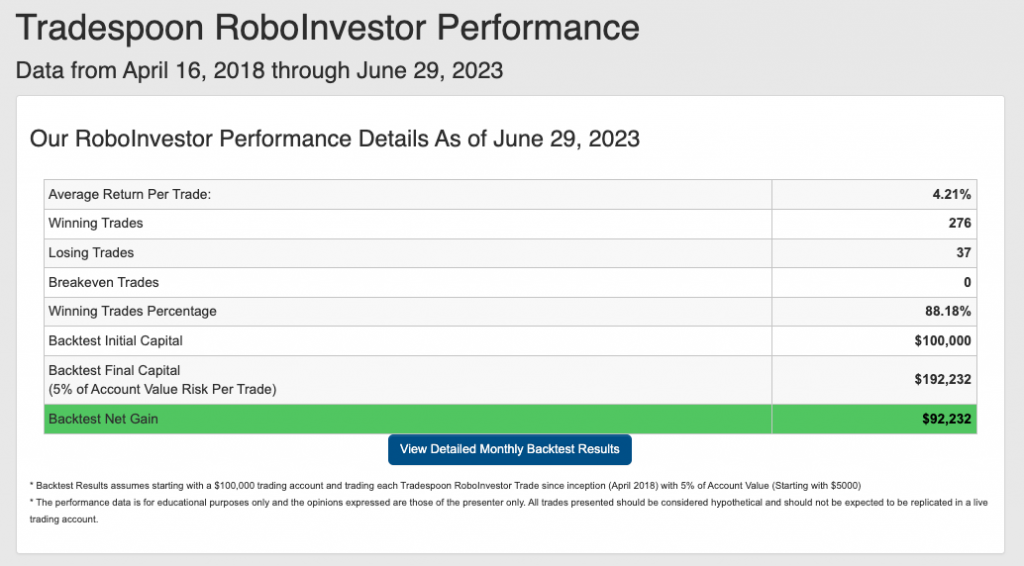

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.18% going back to April 2018.

As we enter the second half of 2023, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!