Wall Street kicked off the week on a high note, with the Dow Jones Industrial Average closing at a record high. Falling bond yields helped drive the rally, providing relief to investors as they speculated on the Federal Reserve’s next move. The S&P 500 also saw gains, while the Nasdaq lagged slightly ahead of a pivotal Federal Reserve decision later this week.

The focal point for markets is the growing debate around the Fed’s interest rate policy. Recent shifts have led to increasing expectations of a larger rate cut, with odds of a half-point reduction gaining traction. The possibility of a more aggressive rate cut is fueling speculation, as investors look to the Fed’s September meeting for clarity.

A Quiet Day for Economic Data, But Manufacturing Shines in New York

While Monday was light on economic data, there was a bright spot—an unexpected surge in business activity in New York’s manufacturing sector. According to a monthly survey, this is the first time since November of last year that New York’s manufacturing firms have reported growth. This data comes as companies grow more optimistic about the Fed’s potential interest-rate cut, which could provide a boost to economic activity.

However, the relative calm won’t last long. Wall Street is gearing up for a busy week ahead, with the release of key economic reports, including retail sales from the Census Bureau, which could shed more light on consumer demand. All eyes will be on the Fed’s much-anticipated September meeting, with the possibility of a rate cut setting the tone for the rest of the year.

Market Uncertainty and Rate Cut Expectations Dominate Sentiment

Uncertainty continues to dominate as the Federal Reserve’s monetary policy meeting approaches. Futures markets remained mixed on Monday, with investors speculating about the size of the upcoming rate cut. The increasing chatter of a more substantial cut is influencing sentiment, as the potential for the Fed to kick off a cycle of rate reductions has garnered attention.

Against the backdrop of this uncertainty, last week’s economic data releases have provided some valuable insight, though not without adding complexity.

Key Economic Data From Last Week: Inflation and Labor Market Updates

Last week’s key economic event was Wednesday’s Consumer Price Index (CPI) report, which added complexity to market expectations. The CPI, including volatile components like food and energy, rose 0.2% in August, aligning with forecasts. Year-over-year, consumer prices increased by 2.5%, slightly below the expected 2.6%, indicating some inflation moderation.

However, core CPI, which excludes food and energy, told a different story. Core inflation rose 0.3% month-over-month, exceeding expectations of 0.2%, and remained steady at 3.2% year-over-year. This uptick in core CPI, particularly in housing and medical care, suggests persistent inflationary pressures, complicating the outlook for a larger rate cut.

Thursday’s Producer Price Index (PPI) also offered insights into inflation at the wholesale level. August’s PPI rose 0.2%, in line with expectations, while year-over-year growth slowed to 1.7% from 2.2% in July. However, core PPI, excluding food and energy, rose 0.3%, surpassing expectations and fueling concerns about entrenched inflation in key sectors.

Labor market data added to the uncertainty. Initial jobless claims rose by 2,000 to 230,000, with continuing claims at 1.85 million, both slightly above estimates. Despite some signs of slack, overall conditions remain tight. The nonfarm payrolls report earlier in the month showed 142,000 jobs added in August, below the expected 160,000. While this cooling could give the Fed more flexibility, core inflation above target makes aggressive rate cuts unlikely.

A Pivotal Week Ahead: All Eyes on the Fed

This week promises to be a crucial one for markets, as the Federal Open Market Committee (FOMC) is set to announce its decision on Wednesday. Fed Chair Jerome Powell’s comments will be closely scrutinized for hints about future policy direction. Investors will also be watching for key data releases on retail sales, housing, and other economic indicators that could further inform the Fed’s next steps.

Additionally, a number of major companies are set to report earnings this week, including General Mills, FedEx, and Lennar. These earnings reports will offer a glimpse into how corporate America is faring amid the current economic climate and could add another layer of market-moving data to an already eventful week.

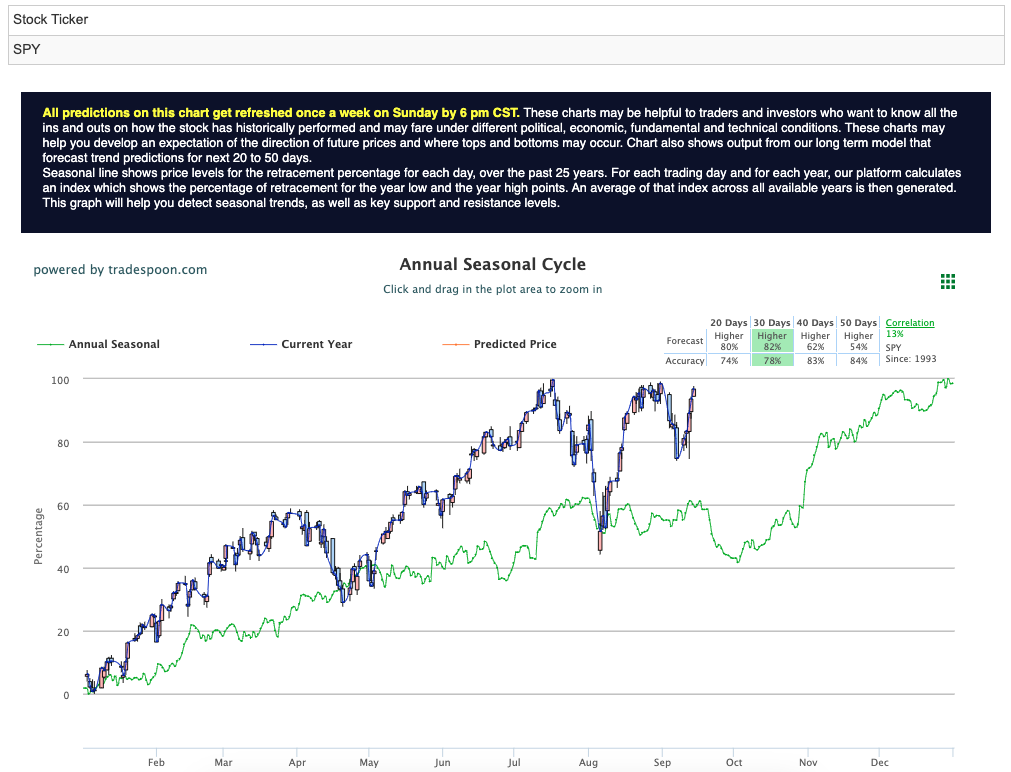

I remain in the market neutral camp as I believe the top is set, with inflation largely coming in as expected and earnings season performing better than anticipated. However, significant risks persist in the market. The economy continues to cool, unemployment is ticking up, and there’s an increasing risk of small bank failures due to their exposure to commercial and residential real estate. While the SPY rally appears capped at $560–$575, with short-term support between $480–$510, I expect the market to trade sideways in the short to medium term. Despite this, the long-term trend remains intact. For reference, the SPY Seasonal Chart is shown below:

As the markets brace for the Fed’s decision, volatility is expected to remain high. Investors are weighing the balance between inflationary pressures, a cooling labor market, and the Fed’s ability to manage economic growth without tipping the economy into recession. One thing is certain—the Fed’s decision this week will set the tone for the remainder of 2024.

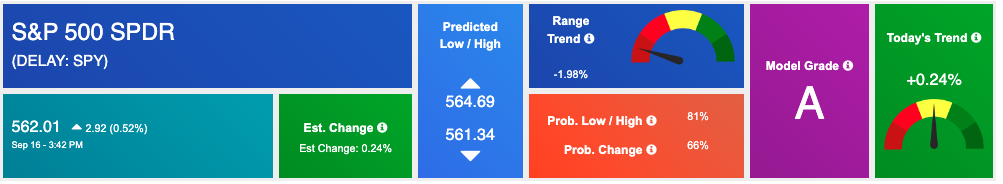

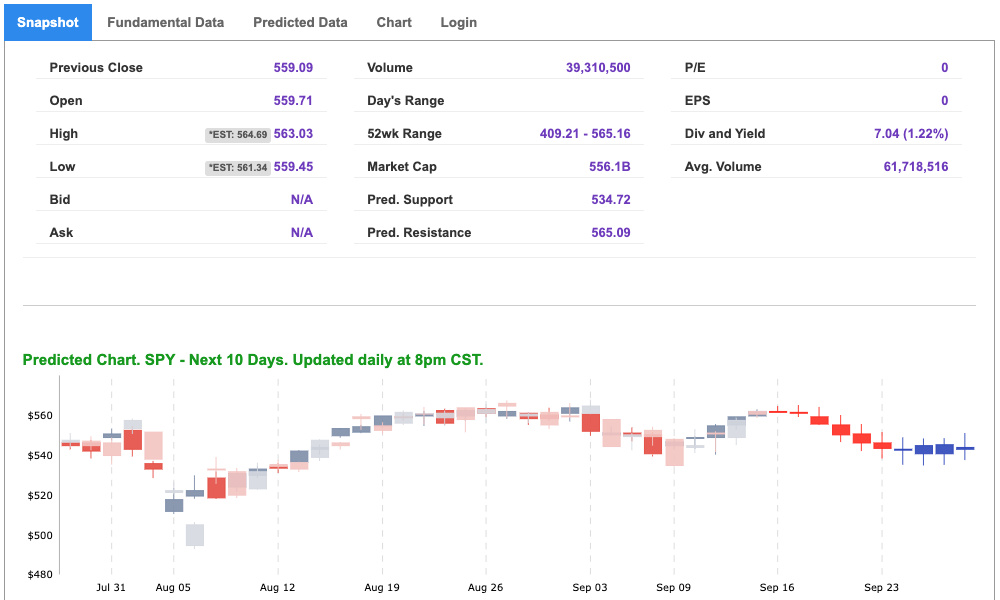

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

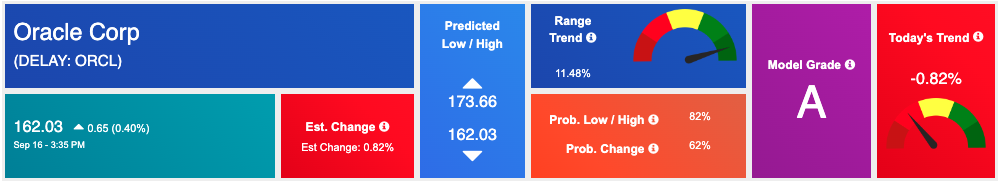

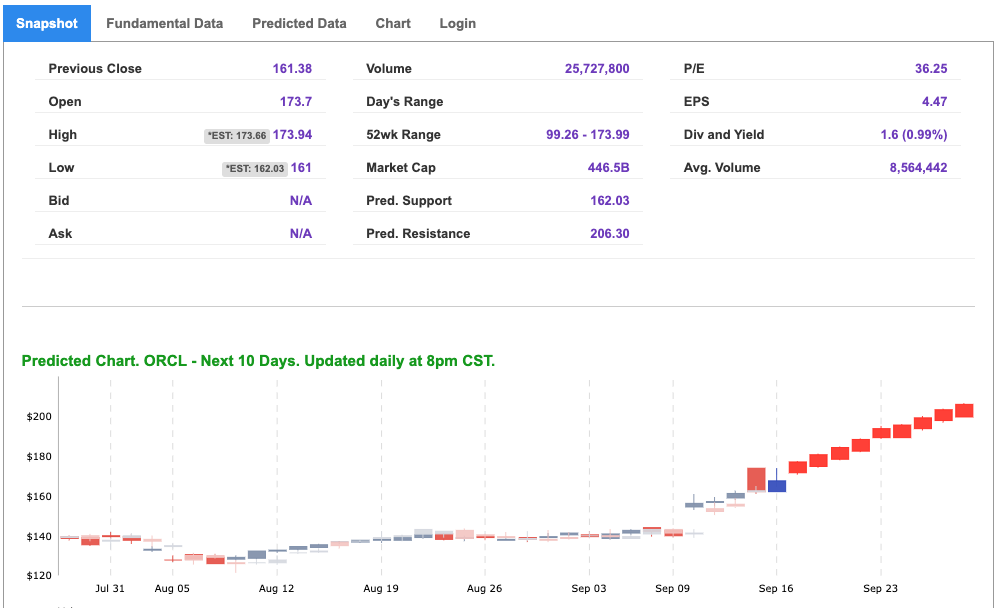

Our featured symbol for Tuesday is Oracle Corp. – ORCL is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $182.03 with a vector of -0.82% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, ORCL. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

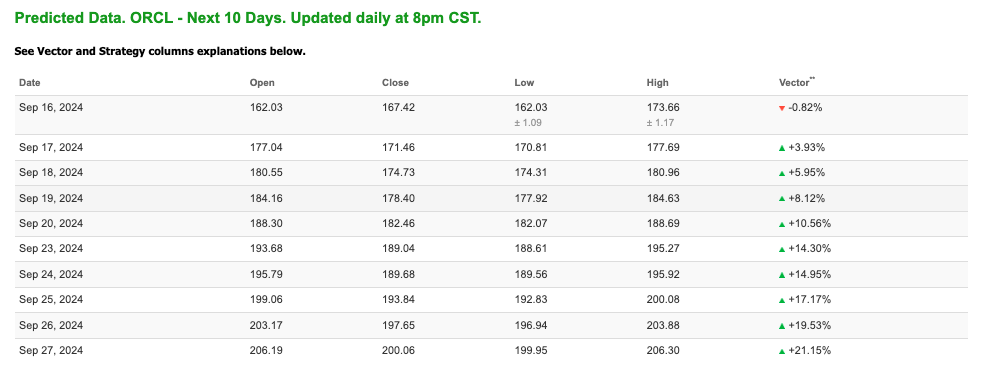

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $70.50 per barrel, up 2.69%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $70.88 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

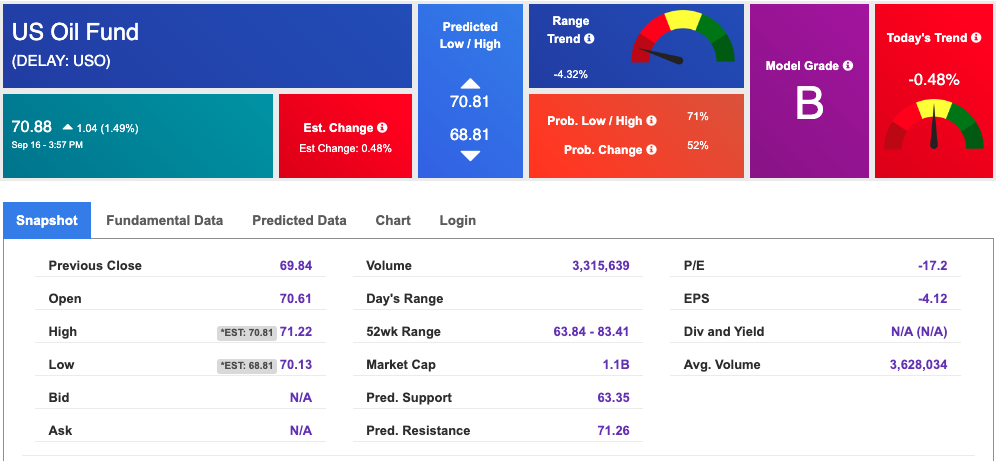

The price for the Gold Continuous Contract (GC00) is down 0.03% at $2,610.0 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $238.66 at the time of publication. Vector signals show -0.29% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

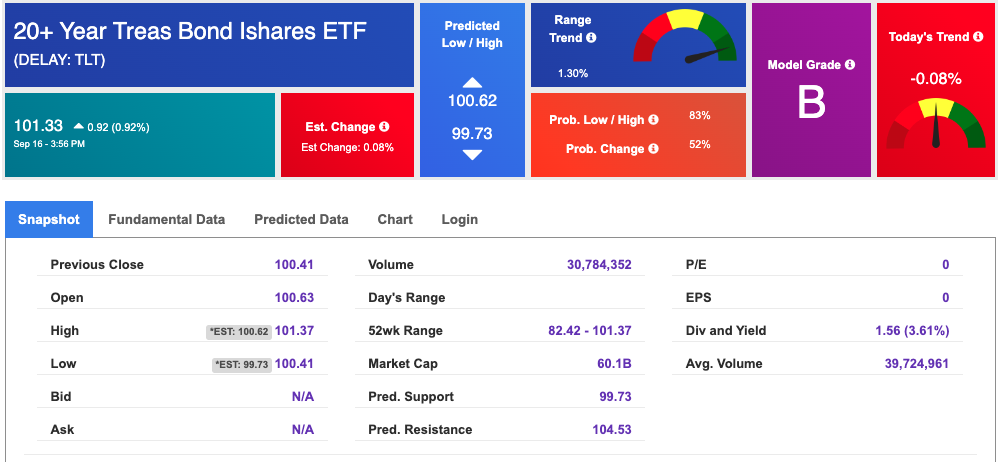

The yield on the 10-year Treasury note is down at 3.623% at the time of publication.

The yield on the 30-year Treasury note is down at 3.931% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

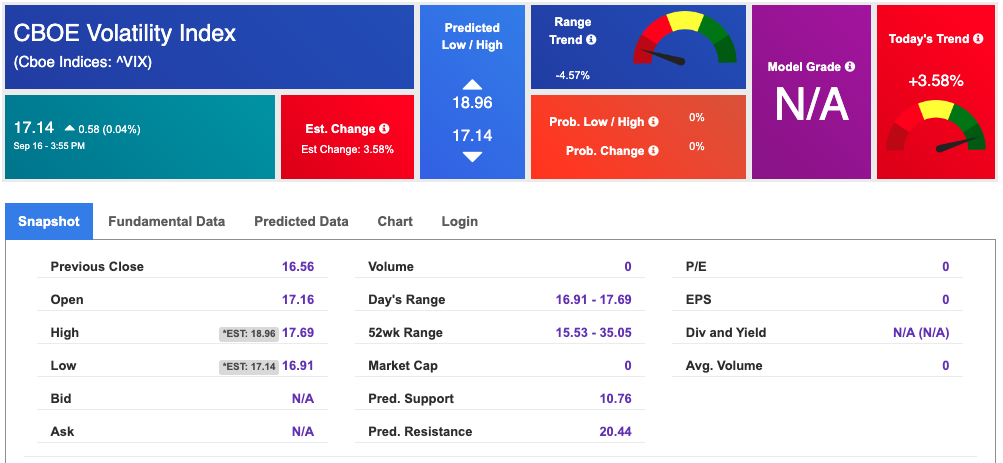

The CBOE Volatility Index (^VIX) is priced at $17.14 up 0.04% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!