The stock market’s year-end slump showed no signs of letting up as Monday morning trading painted a bleak picture for Wall Street. Major indexes extended their December declines, with the Dow Jones Industrial Average falling 604 points, or 1.4%, shortly after the market opened. The S&P 500 dropped 1.5%, while the Nasdaq Composite led the losses with a 1.7% decline.

Hopes for a seasonal “Santa Claus rally” have all but faded as December shapes up to be one of the worst months for markets in years. The Dow is already down 5.4% this month, heading for its worst December since 2018. Similarly, the S&P 500’s 2.3% decline puts it on track for its worst December performance in recent memory, while even the tech-heavy Nasdaq, which is still marginally positive for the month, has seen its gains eroded by recent losses.

Adding to the grim sentiment, Monday’s market breadth was abysmal. Only eight S&P 500 stocks were trading higher, a stark indicator of the widespread selloff. Nvidia stood alone as the only Dow component posting gains, underscoring the challenges for investors trying to find bright spots in an increasingly bearish environment.

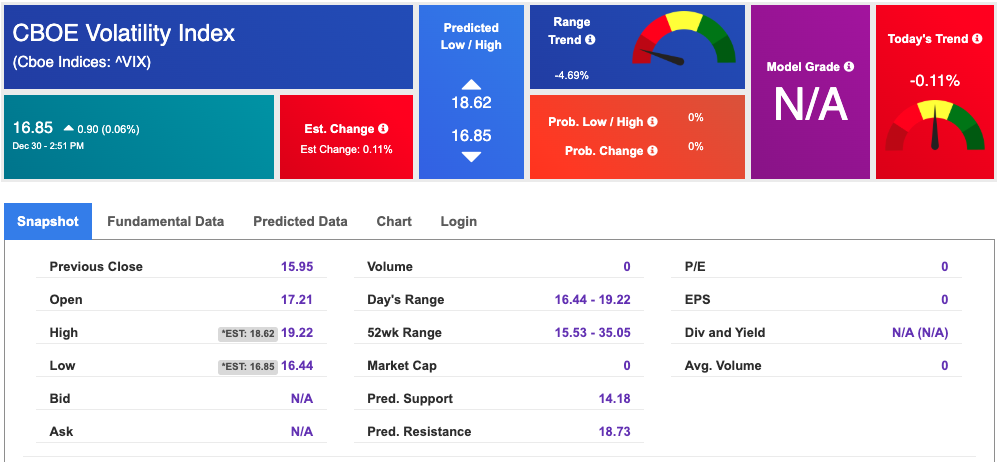

Volatility continues to climb, with the CBOE Volatility Index (VIX) surging 17% to 18.68, reflecting heightened fear among investors. The persistent uncertainty surrounding inflation, Federal Reserve policy, and the broader economic outlook has weighed heavily on sentiment, exacerbated by thin holiday trading volumes. Meanwhile, bond markets offered little relief, with the two-year Treasury yield slipping to 4.277% and the 10-year yield falling to 4.561%.

The broader market struggles can be traced to a mix of factors. Elevated interest rates remain a primary concern, with borrowing costs staying stubbornly high despite the Federal Reserve’s recent rate cuts. Long-term Treasury yields have remained elevated, keeping pressure on housing, financials, and growth-oriented sectors. Inflation has moderated but remains above the Fed’s 2% target, while fears of a potential recession loom as unemployment inches higher and vulnerabilities in smaller banks come into focus.

For investors hoping for a typical year-end rally, this December has been anything but normal. Instead of delivering the usual holiday boost, markets have faced consistent downward pressure, with the Dow and S&P 500 nearing some of their worst monthly performances in years. The volatility underscores the challenges facing Wall Street as it grapples with the potential for a more turbulent start to 2025.

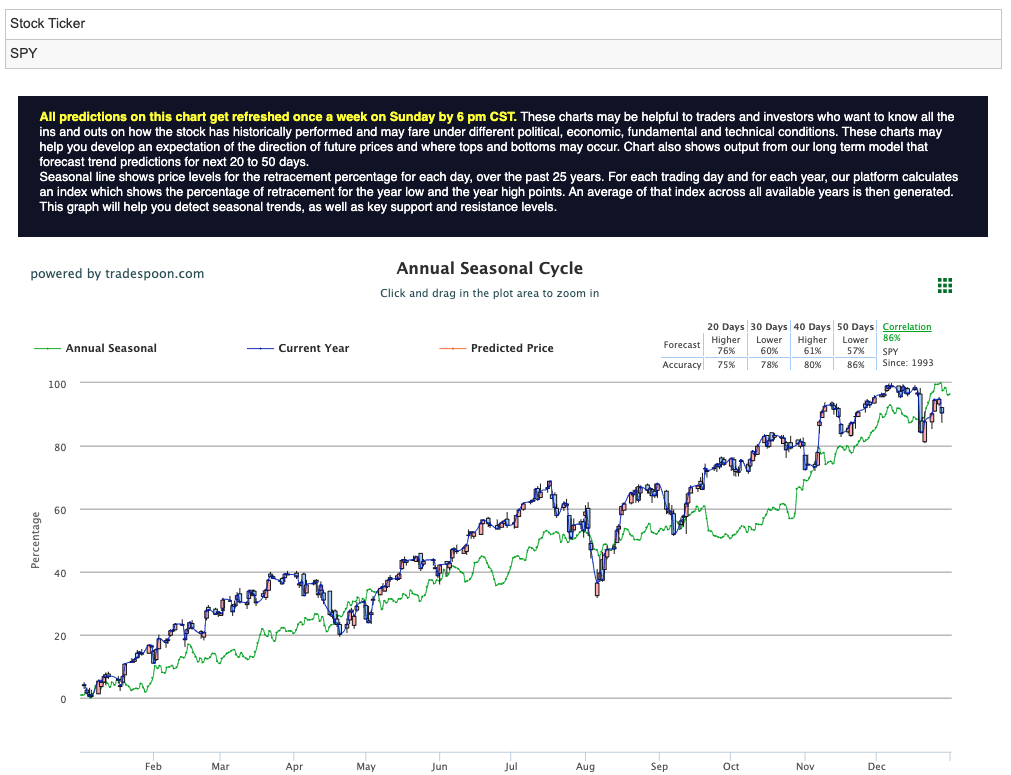

Despite the grim headlines, there are glimmers of resilience beneath the surface. The SPY (S&P 500 ETF) is holding near key support levels of $560-$580, reflecting some underlying strength amid the chaos. Looking ahead, potential upside targets of $620-$640 remain on the radar for 2025, provided market fundamentals stabilize and fears of recession begin to subside. For reference, the SPY Seasonal Chart is shown below:

For now, however, the focus remains on navigating the turbulence. December is shaping up to be a sobering reminder that markets can defy seasonal norms, forcing investors to recalibrate their strategies in the face of heightened volatility and uncertainty. As the year closes, Wall Street finds itself bracing for a potentially rocky road ahead.

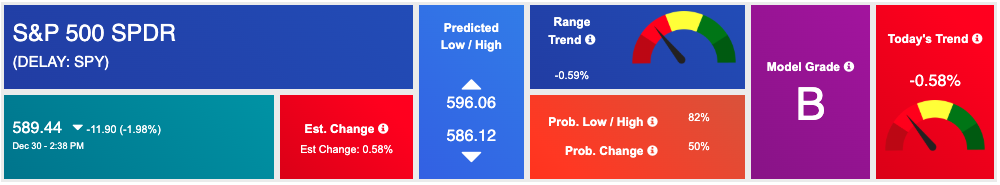

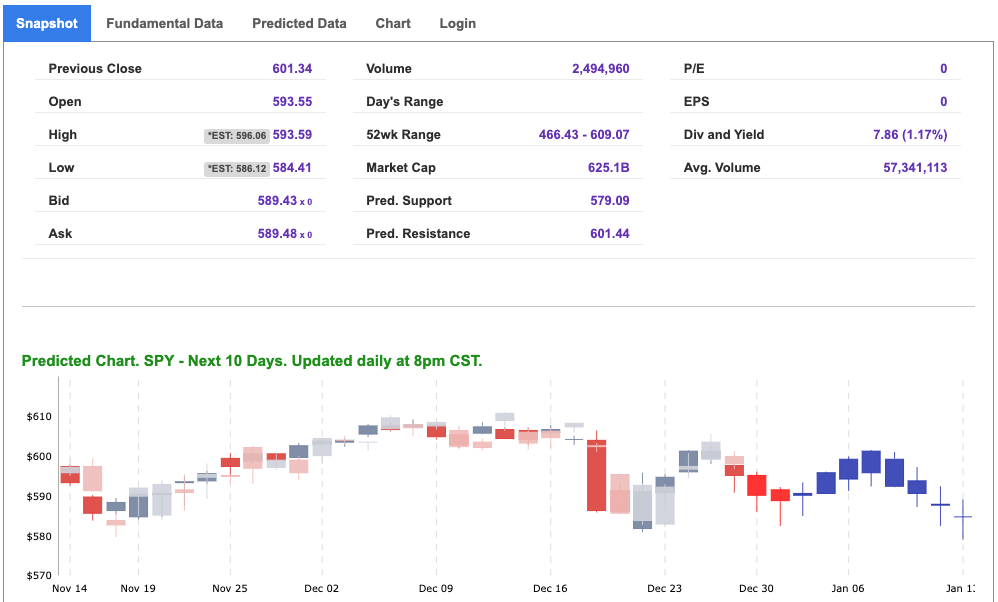

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

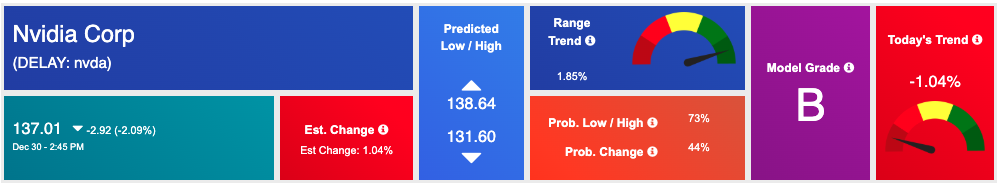

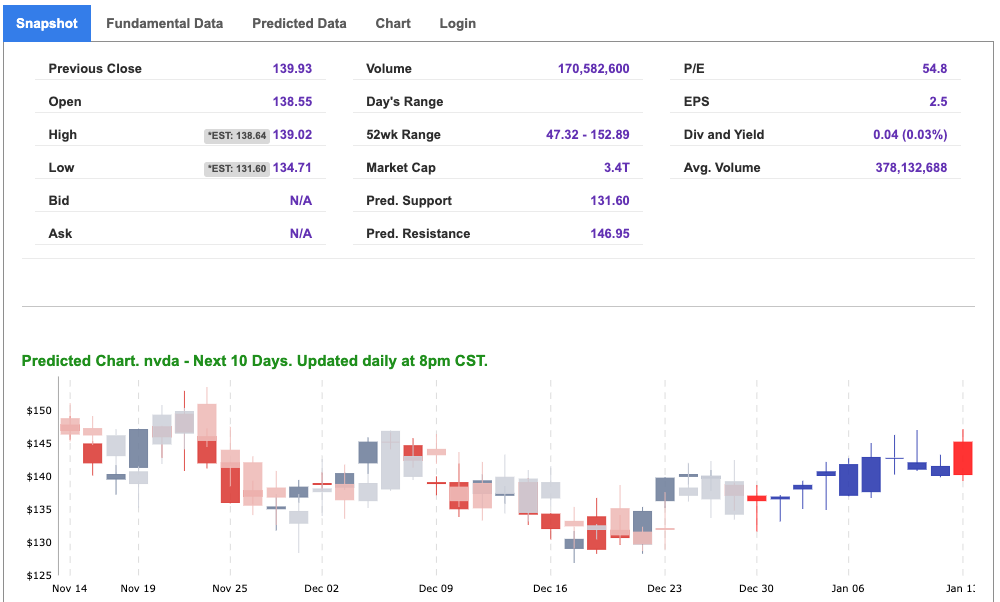

Our featured symbol for Tuesday is Nvidia Corp. – NVDA is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $137.01 with a vector of -1.04% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, nvda. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

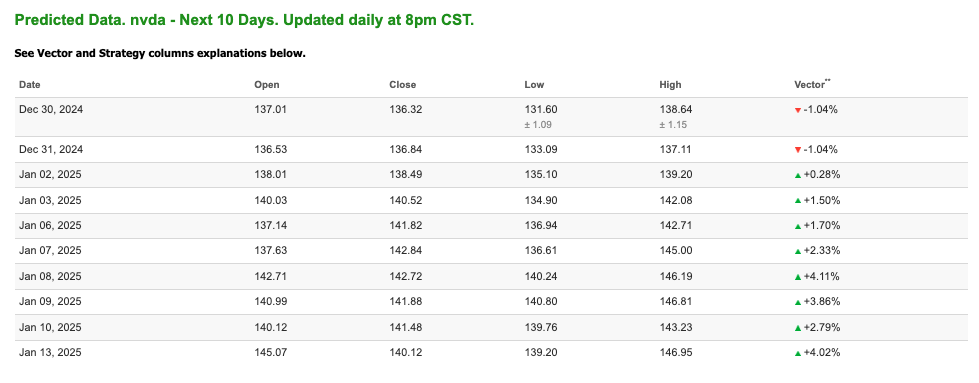

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $73.85 per barrel, up 0.98%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $73.857 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

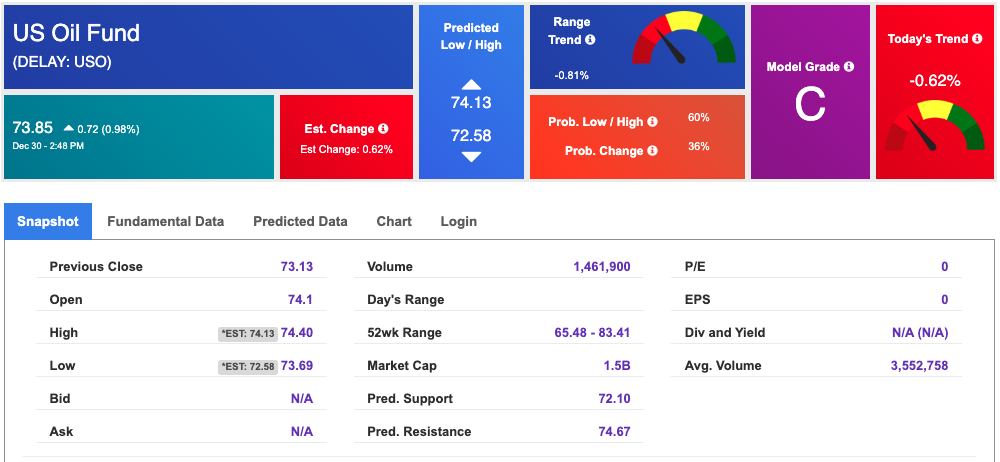

The price for the Gold Continuous Contract (GC00) is down 0.69% at $2629.40 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $241.4 at the time of publication. Vector signals show +0.40% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

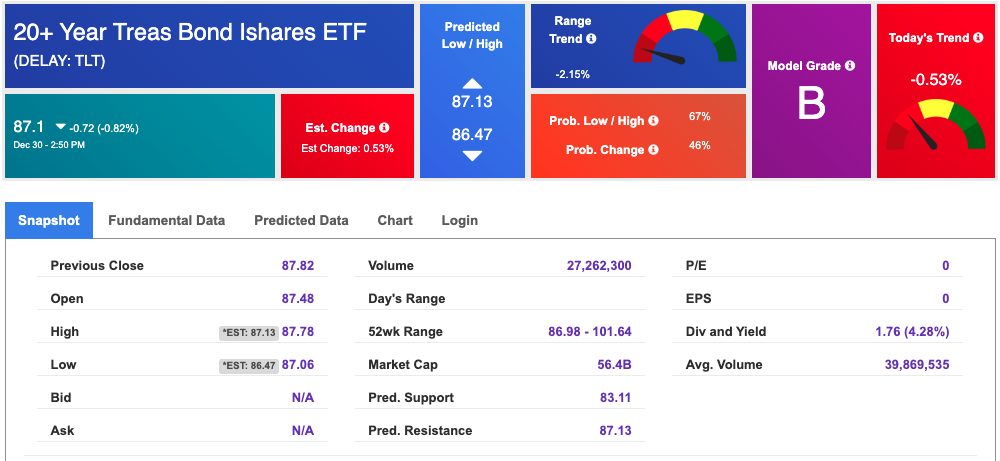

The yield on the 10-year Treasury note is down at 4.543% at the time of publication.

The yield on the 30-year Treasury note is down at 4.760% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The CBOE Volatility Index (^VIX) is priced at $16.85 up 0.06% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!