This week in the financial markets was defined by a series of surprising economic data releases that reignited investor optimism, fueling a broad-based rally across sectors. From stronger-than-expected retail sales to cooling inflation, the narrative of a soft landing for the economy is gaining traction, giving the bulls the upper hand. However, as the week progressed, the underlying market volatility and the upcoming Jackson Hole Symposium kept the mood cautious. While the bulls are enjoying their moment, there’s a lingering sense that the correction might not be over just yet.

The week kicked off with Walmart’s earnings report, which set a positive tone for the markets. As the world’s largest retailer, Walmart’s performance is a key indicator of consumer health, and their solid earnings dispelled fears of a slowdown in consumer spending. This was further supported by July’s retail sales data, which exceeded expectations and indicated that American consumers remain resilient despite broader economic concerns.

The retail sector’s strong showing sparked what would become an “everything rally,” with stocks across the board seeing gains. This early optimism was bolstered by a decline in weekly jobless claims, suggesting that the labor market remains robust despite the slight uptick in unemployment reported in July. As a result, both the S&P 500 and Nasdaq Composite began extending their winning streaks, setting the stage for what would be a week of impressive gains.

By midweek, attention turned to inflation as the Bureau of Labor Statistics released its Consumer Price Index (CPI) data for July. The data showed a 2.9% year-over-year increase in inflation, slightly below the expected 3%. This marked the smallest annual rise since March 2021, suggesting that inflationary pressures may finally be easing. On a monthly basis, headline inflation rose by 0.2%, meeting expectations, while core inflation (excluding food and energy) also saw a modest 0.2% increase month-over-month and a 3.2% rise year-over-year.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Following the CPI data, the Producer Price Index (PPI) was released, further reinforcing the narrative of cooling inflation. The PPI, which measures wholesale prices, increased by just 0.1% in July, down from June’s 0.2% rise and below the 0.2% gain anticipated by economists. Core PPI remained flat, signaling a slowdown in price pressures at the wholesale level. These inflation readings added fuel to speculation that the Federal Reserve might consider cutting interest rates sooner rather than later.

Despite the positive inflation data, the market’s response was cautious. Equities fluctuated throughout the day as investors weighed the benefits of cooling inflation against broader economic concerns. Bond yields rose slightly, reflecting uncertainty about the Federal Reserve’s next move, while tech stocks, which had been leading the market gains, began to stall as broader market resistance emerged.

As the week drew to a close, the “everything rally” gained momentum, with technology stocks and small-caps leading the charge. The Nasdaq Composite rose by 2% on Thursday, driven by strong retail and jobless claims data that dispelled fears of a recession. Nearly 400 companies in the S&P 500 saw gains, with the “Magnificent Seven” megacap firms joining the rally. Tesla stood out with a 6.7% gain, while other tech giants like Microsoft, Apple, Meta Platforms, Nvidia, and Amazon also posted strong performances.

At the sector level, consumer discretionary and technology stocks led the way, up 3.1% and 2.1%, respectively. Meanwhile, the Dow Jones Industrial Average climbed 450 points, or 1.1%, as investor sentiment continued to improve.

However, the bond market told a different story. The 10-year Treasury yield remained volatile, trading within a range of 3.6% to 4.4%. This week, the yield retested 3.8%, coinciding with a market rebound after the Bank of Japan decided to hold off on increasing rates. Notably, the 2-year yield fell below the 30-year yield for the first time in two years, a development that some analysts believe could contribute to renewed market volatility, particularly as the Japanese yen (FXY) staged a strong move to the upside.

Looking ahead, all eyes are on the Jackson Hole Symposium next Friday, where expectations are high for hints about future interest rate cuts. The narrative of a soft landing is gaining traction, and the bulls are enjoying their moment in the spotlight. However, with market volatility still present and concerns about a potential correction looming, investors should approach the coming weeks with caution.

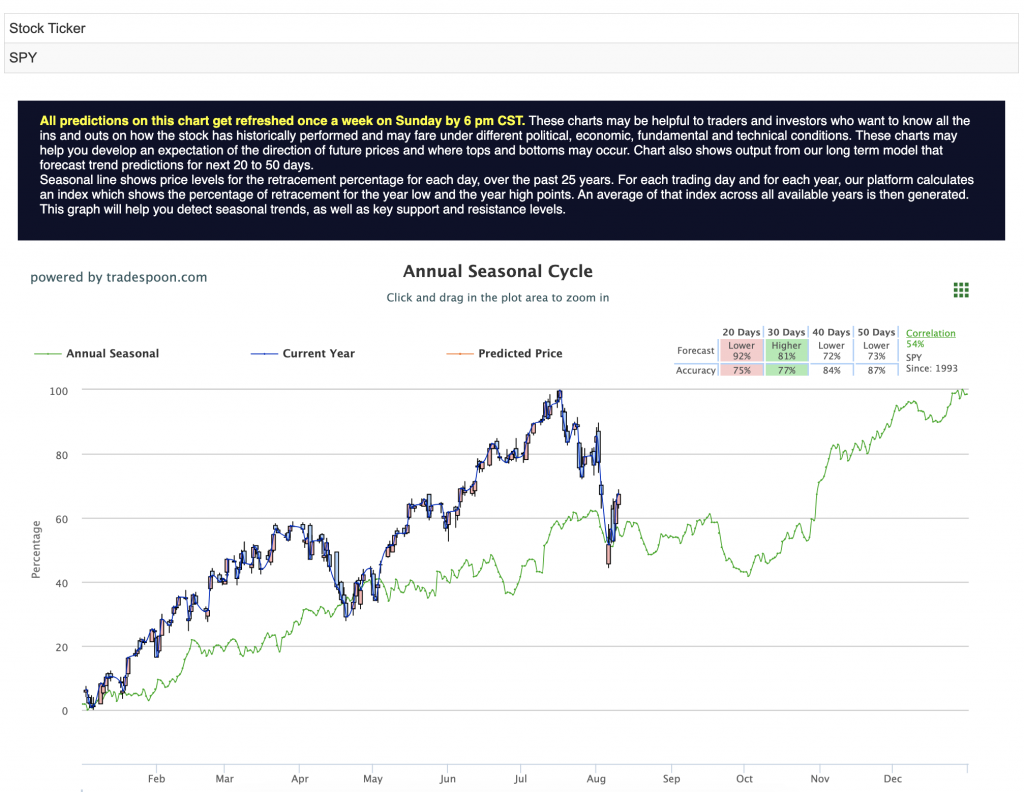

This week’s economic data provided a much-needed boost to investor sentiment, reinforcing the narrative of a soft landing and driving a broad-based rally across the markets. However, the SPY rally appears to be capped at the $560-$575 levels, with short-term support identified between $480 and $510 for the coming months. For reference, the SPY Seasonal Chart is shown below:

While the bulls currently have the upper hand, the market is likely to trade sideways in the short to medium term, despite the intact long-term trend. With underlying volatility and the upcoming Federal Reserve decisions, caution remains essential. The road ahead is filled with challenges, including rising unemployment, concerns about smaller banks, and ongoing geopolitical tensions. As we approach the Jackson Hole Symposium, investors should stay vigilant and prepared for potential market turbulence.

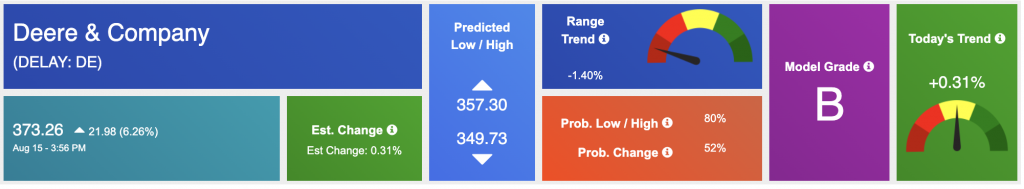

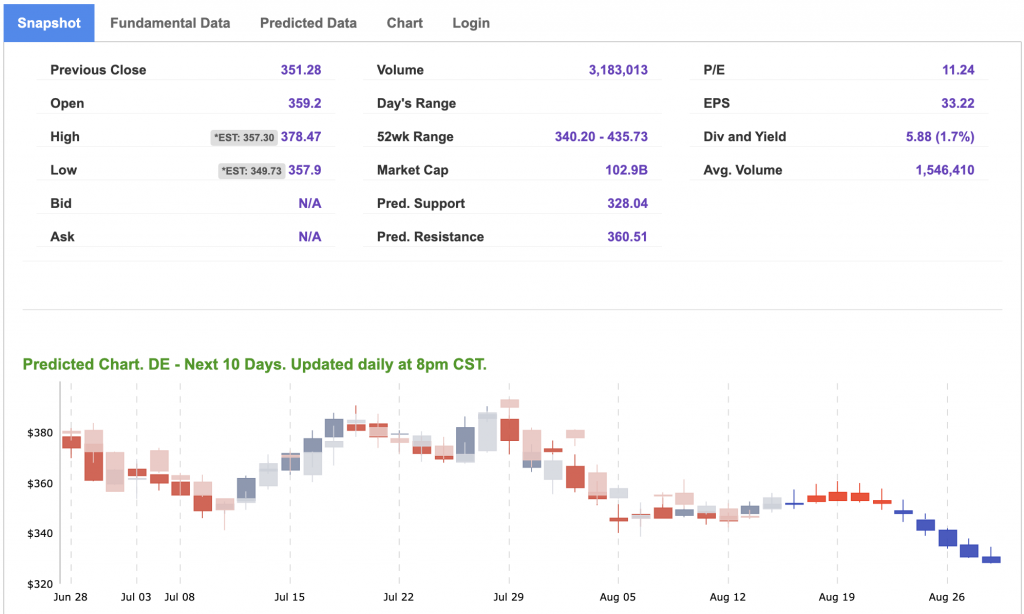

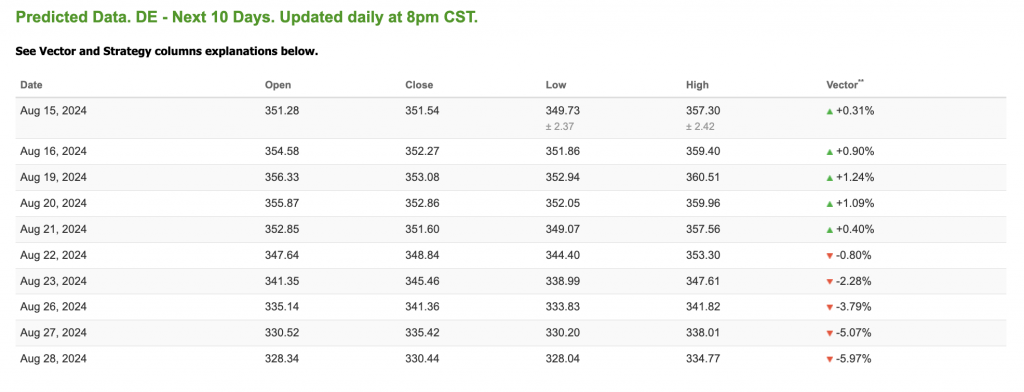

As we transition from a week of surprising economic data and market rallies, investors are naturally looking for opportunities to capitalize on the momentum while remaining cautious about potential volatility. One stock that stands out as a strong candidate for the upcoming week is Deere & Company (DE). Known for its leadership in agricultural machinery, DE has several factors working in its favor, making it a compelling buy in the current market environment.

This week’s retail data revealed that consumer spending remains robust, despite broader economic uncertainties. Walmart’s strong earnings and July’s retail sales data, which exceeded expectations, suggest that consumers are still willing to spend. This is good news for companies like Deere & Company, which benefits from healthy consumer and business investment in agriculture and construction sectors.

The resilience in consumer spending implies continued demand for food and commodities, driving farmers and agricultural businesses to invest in high-quality equipment to meet production needs. DE, with its industry-leading products and services, stands to benefit from this ongoing demand. The company’s strong market position and brand recognition make it well-suited to capitalize on the sustained investment in agriculture.

The cooling inflation data released this week adds another layer of appeal to DE. The lower-than-expected CPI and PPI readings have fueled speculation that the Federal Reserve may soon pivot to cutting interest rates, a scenario that could bode well for industrial and capital goods companies like Deere. Lower borrowing costs would make it easier for farmers and construction firms to finance new equipment purchases, potentially boosting DE’s sales.

Furthermore, if the Federal Reserve does move towards a rate cut, it could provide additional support to the broader stock market, encouraging more investment in companies with strong growth prospects like DE. With its stable earnings, strong cash flow, and exposure to key economic sectors, DE is positioned to perform well in a lower interest rate environment.

Deere & Company has also been at the forefront of integrating technology into agriculture, a factor that sets it apart from its competitors. The company’s focus on precision agriculture—utilizing advanced technologies like GPS-guided equipment, AI-driven crop management, and data analytics—positions it well to meet the evolving needs of modern farming. As the agricultural sector increasingly turns to technology to improve efficiency and yields, DE’s innovative offerings make it a compelling investment.

Additionally, DE has been strategically expanding its footprint in global markets, particularly in emerging economies where agricultural mechanization is on the rise. This international growth strategy not only diversifies its revenue streams but also positions the company to benefit from global agricultural trends. As the world’s population grows and food demand increases, DE’s products and services will be in higher demand, supporting long-term growth.

Deere & Company’s solid financial performance is another reason to consider the stock. The company has consistently delivered strong earnings and revenue growth, underpinned by its dominant market position and operational efficiency. DE’s strong balance sheet and healthy cash flow allow it to invest in innovation and growth initiatives while also returning value to shareholders through dividends and share buybacks.

From a valuation perspective, DE remains attractive compared to its peers in the industrial sector. Despite its recent gains, the stock is still trading at a reasonable price-to-earnings (P/E) ratio, offering investors a good entry point. With the potential for continued growth and the possibility of tailwinds from a favorable interest rate environment, DE is well-positioned to deliver strong returns in the coming weeks and beyond.

In conclusion, Deere & Company (DE) emerges as a compelling stock to consider for the upcoming week. The combination of resilient consumer spending, cooling inflation, potential Fed rate cuts, and the company’s innovative and strategic growth initiatives makes DE a standout choice. Investors looking to capitalize on the current market conditions should keep a close eye on DE, as it offers a balanced mix of growth potential, financial stability, and market leadership. As always, while the stock market presents opportunities, it’s essential to remain vigilant and consider the broader economic context when making investment decisions.

Enhance your investment decisions by leveraging the power of AI with our RoboInvestor stock and ETF advisory service. Utilizing advanced technology, this service identifies trades with a high probability of profitability. Our proprietary AI platform cuts through market noise and removes emotional biases, delivering clear, data-driven insights and strategies to help you succeed in today’s dynamic market environment.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

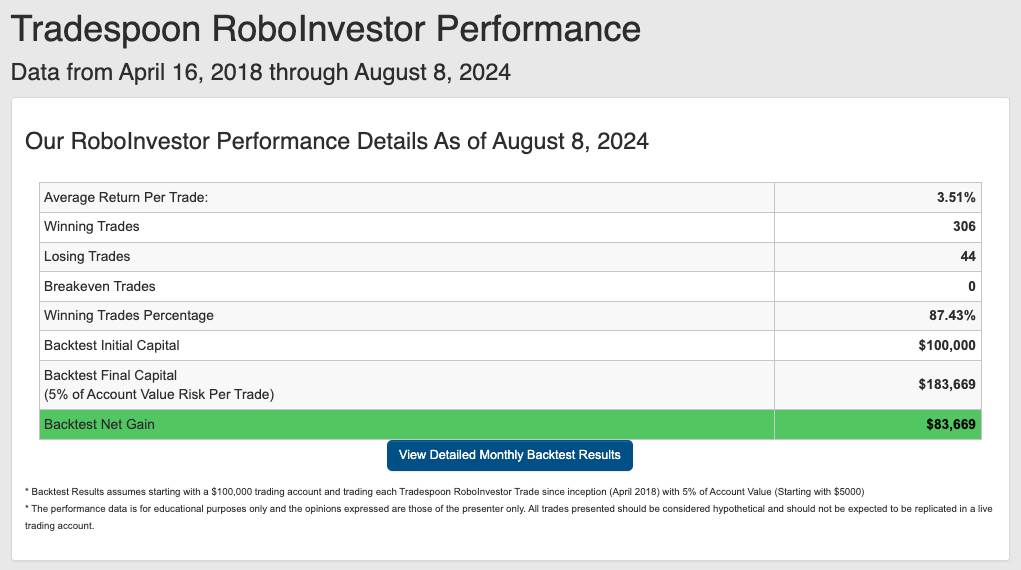

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.43% going back to April 2018.

As we advance through the summer of 2024, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and navigating the fluctuating market conditions effectively.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!