In a week marked by a lack of major macroeconomic data, financial markets were far from quiet, as investors grappled with a myriad of developments spanning FOMC speculation, earnings surprises, and heightened volatility across various asset classes.

FOMC Speculation Takes Center Stage

The week commenced with unexpected remarks from Minneapolis Fed President Neel Kashkari, injecting uncertainty into market sentiment. Kashkari’s suggestion that the next move from the Federal Reserve might entail a rate hike diverged from prevailing expectations of a status quo stance. Consequently, stocks experienced a loss of momentum, while bond yields fluctuated as investors digested the implications of potential monetary policy adjustments.

Earnings Reports Drive Market Sentiment

Amidst the FOMC chatter, earnings reports from corporate behemoths provided additional fodder for market dynamics. Despite disappointing figures from Walt Disney mid-week, which initially rattled investor confidence, the broader indices managed to hold steady. Disney’s underwhelming guidance for its streaming division sent shockwaves through the market, reflected in a significant drop in its stock price. However, brighter spots emerged, notably in the form of upbeat earnings from Uber, offsetting some of the gloom.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Volatility Amidst Oil Rebound and Geopolitical Tensions

Mid-week witnessed a rebound in oil prices alongside heightened volatility, driven by geopolitical uncertainties. However, the market mood was tempered by lackluster earnings reports from Uber and Shopify, compounded by concerns surrounding Intel’s China export licenses. With VIX expiration week and May expiration on the horizon, market participants braced for potential turbulence, with implications for broader market sentiment.

Interest Rates and Yield Volatility

Throughout the week, discussions surrounding interest rate trajectories and Treasury yield fluctuations remained in focus. The 10-year Treasury yield’s dip below the critical 4.5% level sparked concerns, with some speculating about the possibility of it breaching the 5% threshold, thereby exerting downward pressure on equities. Against a backdrop of strong earnings tempered by weak guidance from key companies like Disney, uncertainty surrounding interest rates added to market jitters.

Disney’s Earnings: A Disappointing Turn

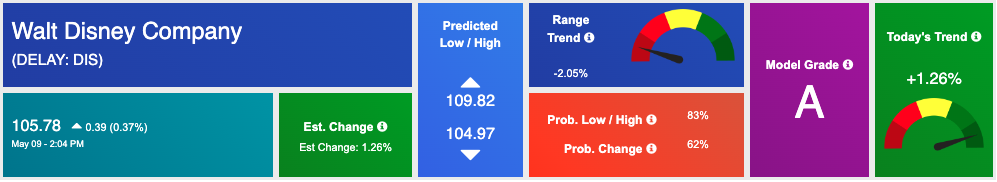

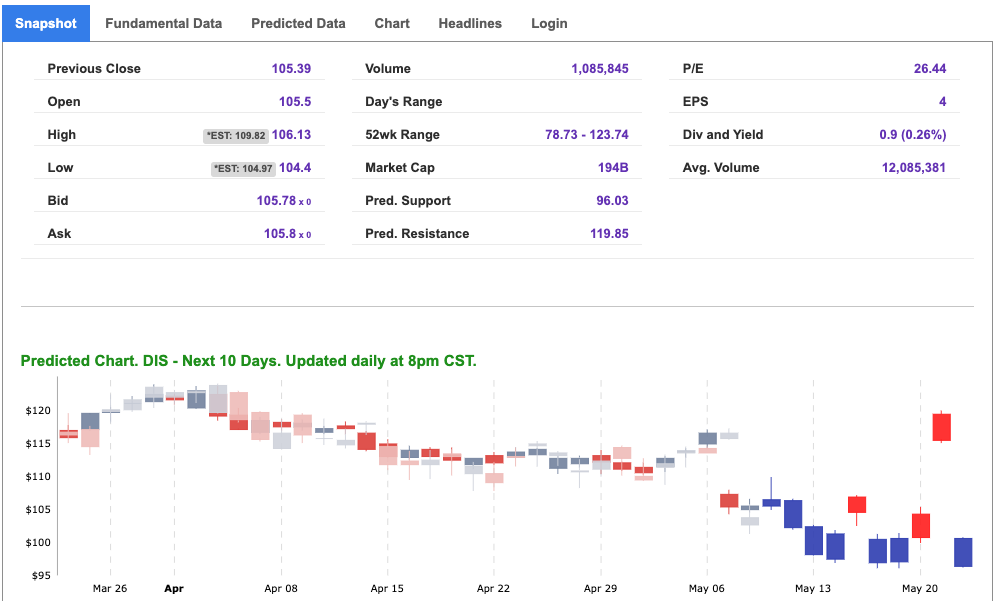

Walt Disney released its latest data, however, what unfolded was far from the anticipated success story, instead marking a sharp downturn for the entertainment giant. Disney’s stock took a significant hit, plunging 9.9% to $104.98 in afternoon trading following its release. The disappointment stemmed from the company’s direct-to-consumer streaming business, which, despite improvements, fell short of expectations.

Of particular concern was Disney management’s guidance for its streaming division, which left investors uneasy about the company’s future in a competitive landscape. This, combined with broader market uncertainties, painted a grim picture of Disney’s stock performance. For example, ESPN+ suffered an operating loss of $65 million.

Despite the setback, analysts are closely monitoring Disney’s next steps as it navigates the streaming arena. With its vast content portfolio and digital ambitions, Disney’s earnings trajectory will remain a key indicator of its resilience and adaptability in a rapidly evolving industry.

Global Market Dynamics and Central Bank Actions

Meanwhile, the Japanese yen’s ascent to multi-year highs and the Bank of Japan’s interventions underscored the interconnectedness of global markets. The currency’s volatility, coupled with ongoing debates on interest rate adjustments, contributed to overall market unease, accentuating the need for a nuanced understanding of global macroeconomic dynamics.

Looking Ahead: Navigating Uncertainty

As the week drew to a close, attention turned to the Bank of England’s decision to maintain interest rates unchanged, echoing the Federal Reserve’s cautious approach. However, persistent concerns about inflation dynamics and geopolitical risks tempered market optimism. Against this backdrop, expectations of choppy markets with a downward bias in the coming months gained traction, underscoring the importance of prudent risk management strategies amidst evolving market conditions.

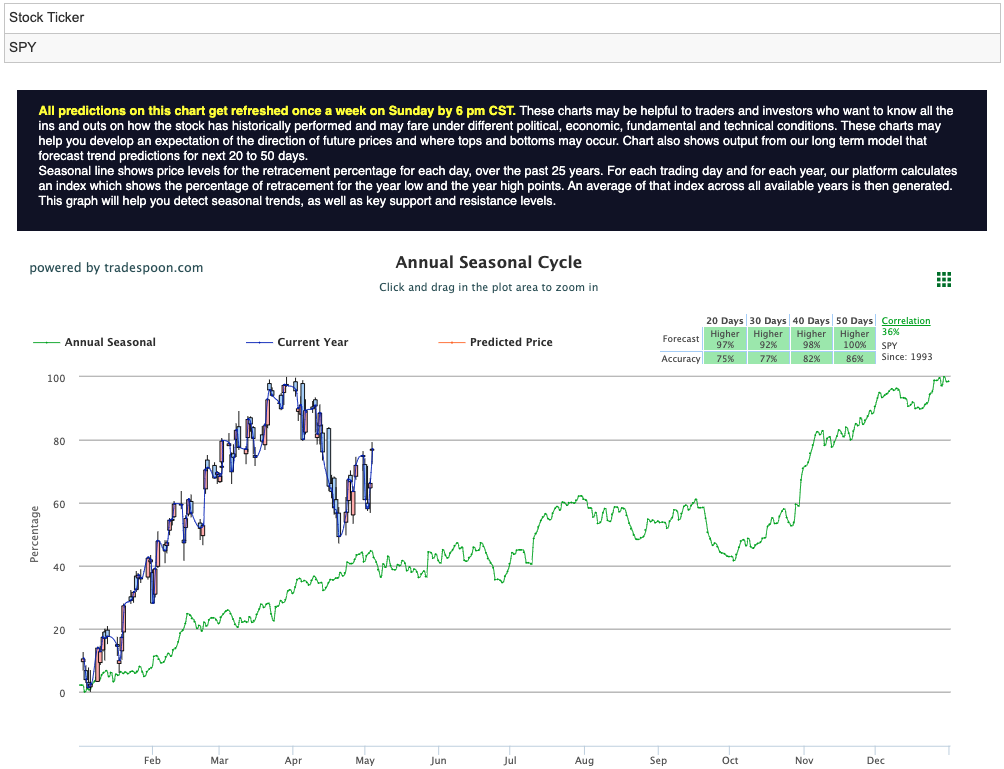

Keeping the latest market activity in mind along with my A.I. forecasts, I am seeing SPY levels fluctuating within a specific range in the coming weeks. While the recent momentum has propelled SPY to new heights, reaching as high as $525, there is growing apprehension that the rally may be reaching its peak. Forecasts suggest that SPY could face resistance around the $530-$540 levels—a critical juncture where market sentiment may shift. For reference, the SPY Seasonal Chart is shown below:

Amidst mounting geopolitical risks and persistent inflation concerns, a segment of investors has embraced a market-neutral stance to navigate volatile market conditions. This balanced approach allows them to maneuver through uncertain waters, neither excessively bullish nor bearish while awaiting clearer signals on market direction. Still, opportunity in the market continues to present itself.

In light of Walt Disney’s recent disappointing earnings report and the subsequent downward spiral in its stock price, some investors may see an opportunity to capitalize on the negative momentum by shorting Disney ($DIS).

The rationale behind shorting $DIS lies in the company’s recent earnings performance, which fell short of market expectations and triggered a significant decline in its stock price. With Disney’s direct-to-consumer streaming business showing signs of weakness, particularly with ESPN+ reporting an operating loss, investor confidence in the company’s growth prospects may be wavering.

Shorting $DIS at this juncture could be perceived as a strategic move, especially amidst broader market uncertainties and concerns about the company’s ability to navigate the competitive streaming landscape. The lackluster guidance provided by Disney management further adds to the bearish sentiment surrounding the stock.

Additionally, in a market characterized by volatility and geopolitical risks, shorting $DIS may offer investors an opportunity to hedge their portfolios against potential downside risks. By taking a short position on Disney, investors could potentially profit from further declines in the stock price as market sentiment continues to sour.

However, it’s essential to acknowledge the inherent risks associated with shorting any stock, including $DIS. While weak earnings may indicate short-term challenges for Disney, the company’s long-term prospects and its ability to adapt and innovate cannot be overlooked. Moreover, market dynamics can change rapidly, and unexpected developments could lead to unforeseen reversals in stock price movements.

Ultimately, the decision to short Disney ($DIS) should be based on a careful analysis of the company’s fundamentals, market trends, and individual risk tolerance. While weak earnings may present a compelling case for shorting the stock, investors should exercise caution and conduct thorough due diligence before making any investment decisions.

In a week marked by a convergence of factors influencing market sentiment, investors grappled with uncertainty on multiple fronts. From FOMC speculation to earnings surprises and geopolitical tensions, staying nimble and attuned to global macroeconomic dynamics is crucial. As the market absorbs new data and evaluates central bank actions, adaptability, and resilience remain paramount for navigating through uncertain terrain.

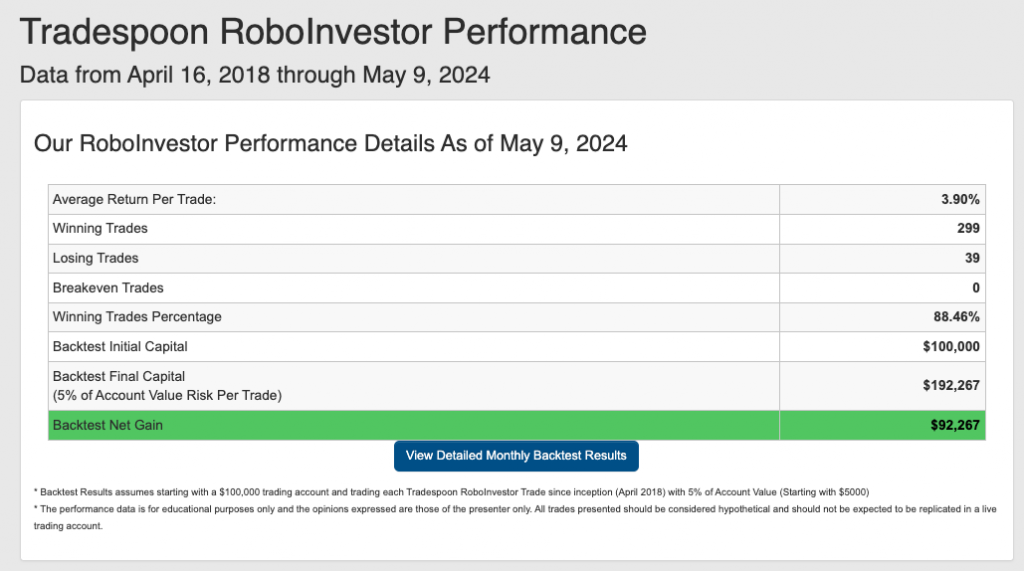

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.46% going back to April 2018.

As we navigate deeper into 2024, investors face a labyrinth of market challenges, from surging inflation to shifting Federal policies and geopolitical uncertainties like the ongoing conflict in Ukraine. In such turbulent times, having a trusted and informed investment partner becomes paramount. Enter RoboInvestor – your steadfast ally in the ever-evolving financial landscape. Offering a comprehensive array of resources and expert insights, RoboInvestor empowers you to navigate your portfolio with confidence and seize promising opportunities amidst the rapid pace of market dynamics.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!