Thursday marked a notable upswing in the stock market, propelled by the robust performance of AI-related shares. This positive momentum not only brought an end to the three-day losing streaks of both the S&P 500 and Dow Jones Industrial Average but also painted all major stock indexes in a favorable light. Nevertheless, the energy sector encountered challenges throughout the trading day.

The Labor Department reported an uptick in weekly jobless claims, prompting vigilant investor scrutiny ahead of the U.S. jobs report scheduled for Friday, with an eye on potential signs of labor market weakness.

Contributing significantly to the day’s optimistic tone was the well-received launch of Google’s AI initiatives, resulting in a commendable 5% surge in shares of Alphabet, the parent company of Google. The S&P 500’s shining star for the day was Advanced Micro Devices, playing a pivotal role in shaping the overall positive trend.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Post-market activities featured earnings reports from Broadcom and Lululemon, drawing heightened interest from investors keen on evaluating their impact on market dynamics.

Looking forward, the upcoming week is poised to bring attention to Consumer Price Index (CPI) and Producer Price Index (PPI) data. The market’s current status as short-term overbought suggests an anticipated shallow pullback in the weeks to come.

A notable transformation in financial dynamics has materialized, with the 10-year yield dropping below October 2022 highs and recent breakout levels. While this shift is deemed bullish for the long term, the short term presents oversold conditions. A parallel development is observable in the U.S. Dollar Index ($DXY), which has initiated a rebound following a period of weakness.

Oil prices have faced a decline, nearing lows for the year due to weakened demand. The prevailing sentiment leans toward the belief that the Federal Reserve is unlikely to raise rates this year or the next, with a high probability of interest rate cuts in the first half of 2024. This prevailing sentiment is considered bullish for the market, with high BETA risk-on asset classes continuing to outperform.

The U.S. Dollar Index and longer-dated treasuries have dipped below the 50-day moving average (DMA) and are approaching the 200 DMA. The weak dollar, coupled with declining yields towards the end of the year, is expected to contribute to the continuation of the market rally.

Reflecting on the opening week of December, the stock market exhibited caution following a sustained rally fueled by optimism about potential Federal Reserve interest rate cuts in the coming year. Monday witnessed declines in the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite, interrupting their impressive five-week winning streak.

Federal Reserve Chair Jerome Powell, in a significant address, acknowledged progress in taming inflation but maintained a cautious stance, emphasizing the Fed’s readiness to tighten monetary policy further if necessary. Notable economic indicators, including the core PCE index and uncertainties in the economic outlook, were highlighted.

On Wednesday, stocks experienced an afternoon decline, and oil prices reached their lowest since the end of June, with WTI falling to $69.38 a barrel. The 10-year Treasury yield dropped to 4.121%. ADP’s report showed a lower-than-estimated addition of 103,000 private-sector jobs in November.

In the cryptocurrency space, Bitcoin and others continued their advance, reaching fresh 20-month highs. However, JPMorgan’s Jamie Dimon expressed opposition to crypto, stating that if he were the government, he would “close it down.”

Amidst economic data indicating a low probability of a recession, the author is shifting to a market-neutral stance. Despite anticipating short-term pullbacks, the expectation is for a pattern of higher highs and higher lows to emerge in the coming weeks. The author suggests that the best part of the rally may be behind us and emphasizes the need for a catalyst to drive the market higher. The first two weeks of December, featuring CPI, PPI, unemployment data, and Powell, are expected to provide insights, and the author anticipates the continuation of the pattern as long as signs of a recession remain scarce.

Taking a prudent stance amidst evolving economic data, I am transitioning to a market-neutral perspective. The indicators currently suggest a low likelihood of a recession, prompting a reassessment of my market outlook. While I maintain the belief that the SPY rally is capped within the $450-470 range, I foresee short-term support levels between 400-430 in the coming months. Anticipating the emergence of patterns characterized by higher highs and higher lows in the next few weeks, it is essential to acknowledge that the pinnacle of this rally may already be in the rearview mirror. As we navigate the market landscape, a cautious approach aligns with the nuanced economic landscape, and the need for a catalyst to propel the market higher becomes increasingly apparent.

Given the nuanced market conditions highlighted earlier, the current landscape presents an opportune moment for investors to consider GLD (SPDR Gold Shares) as a strategic addition to their portfolios. As the stock market undergoes fluctuations and uncertainties, gold often emerges as a reliable safe-haven asset. The recent challenges in the energy sector, alongside cautious optimism regarding the labor market and potential economic headwinds, underscore the appeal of gold for portfolio diversification.

Given the nuanced market conditions highlighted earlier, the current landscape presents an opportune moment for investors to consider GLD (SPDR Gold Shares) as a strategic addition to their portfolios. As the stock market undergoes fluctuations and uncertainties, gold often emerges as a reliable safe-haven asset. The recent challenges in the energy sector, alongside cautious optimism regarding the labor market and potential economic headwinds, underscore the appeal of gold for portfolio diversification.

GLD, an exchange-traded fund (ETF) designed to track the performance of gold bullion, offers investors a convenient and cost-effective way to gain exposure to the precious metal. Each share of GLD corresponds to a fraction of an ounce of gold, providing an accessible entry point for investors seeking to hedge against market volatility.

Moreover, the observed weakness in the U.S. Dollar Index ($DXY) and the decline in longer-dated treasuries, combined with the anticipation of potential interest rate cuts by the Federal Reserve, further enhance gold’s attractiveness as an alternative store of value. As economic data suggests a low probability of a recession, the allure of GLD strengthens, offering investors a strategic hedge against market fluctuations and potential downturns. In essence, considering GLD aligns with a more neutral market stance, providing a solid foundation for investors seeking stability and resilience in their portfolios.

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

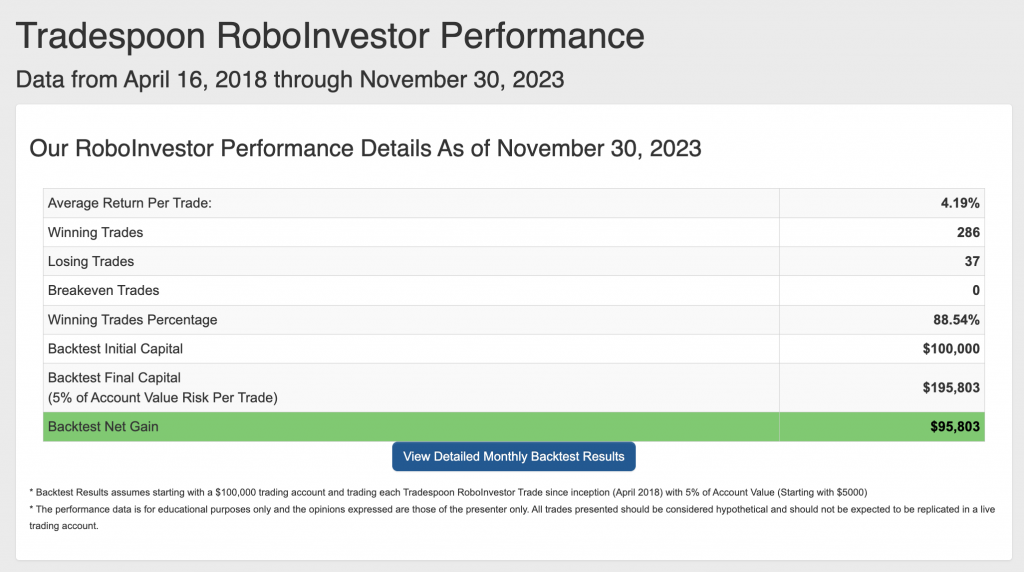

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.40% going back to April 2018.

As we enter Q4 comes to a close, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!