In a positive response to the Federal Reserve’s decision to maintain interest rates, the stock market experienced gains on Thursday. The Dow reached 2023 high, and all three major US indices saw positive movements. However, investors remain cautious as one more rate increase in July remains a possibility. Despite this uncertainty, market sentiment remains optimistic, anticipating an economic and earnings recovery. In contrast, the European Central Bank (ECB) recently raised its key interest rate by a quarter of a percentage point, indicating a different approach to monetary policy.

The Federal Reserve announced on Wednesday that it would not raise interest rates at the moment, citing moderated inflation rates and economic growth. The market responded favorably to the news, interpreting it as a positive development for the ongoing recovery. The Fed did acknowledge the potential for a rate increase in July if inflation exceeds expectations, but the stock market appears confident that most of the rate hikes are behind us. Federal Reserve Chair Jerome Powell emphasized that rate cuts are not on the horizon, reinforcing the central bank’s stance.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The European Central Bank echoed the Federal Reserve’s message of a potential rate hike as it raised its key interest rate by a quarter of a percentage point. This decision indicates a shift towards a less accommodative monetary policy stance in Europe. While the US markets reacted positively to the Fed’s decision, European shares retreated in response to the ECB’s impending borrowing cost increase.

Retail sales data for May showed encouraging signs of consumer resilience. Despite expectations for a decline, retail sales rose 1.61% year over year, slightly surpassing April’s result of 1.6%. The Commerce Department’s Census Bureau reported a 0.3% increase in retail sales for May, exceeding economists’ projections of a 0.2% decline. This marks the second consecutive month of spending increases, with April witnessing the first upswing since January. The data indicates that consumers are still actively participating in the economy, bolstering market confidence.

Jobless claims remained steady at 262,000, matching the previous week’s revised number. This figure exceeded economists’ expectations of 250,500 claims. Additionally, continuing claims rose less than anticipated, suggesting some stability in the labor market. However, it remains important to monitor employment trends as the recovery progresses.

The current market outlook suggests a more hawkish stance from the Federal Reserve, which skipped a rate hike this month but may implement further increases based on inflation data in the summer. The market also experienced some turbulence due to regulatory scrutiny on cryptocurrency exchanges, leading to a pullback in Bitcoin. Investors have been rotating their investments into value stocks and reducing exposure to the technology sector.

While small caps, banks, and industrial stocks showed a marginal bounce back this week after recent sell-offs, market support remains narrow. Only 20 out of the 500 companies in the S&P 500 index accounted for a significant portion of the overall market gains. Additionally, China’s decision to lower interest rates and stimulate its weak economy contributed to a rally in the Chinese stock market.

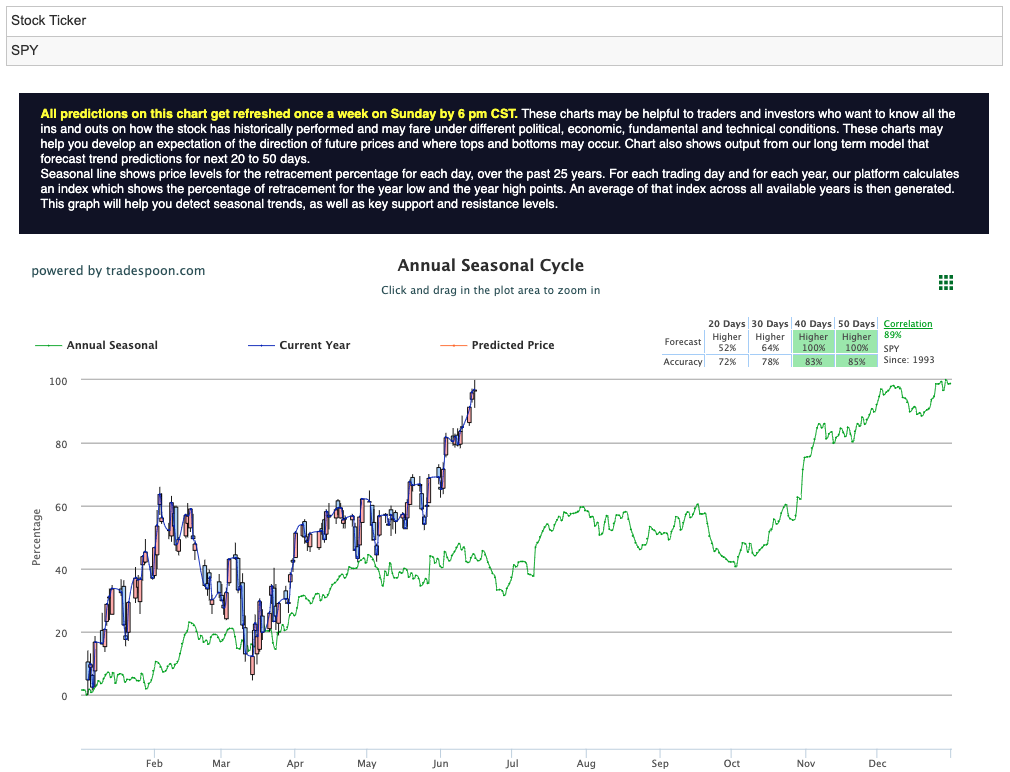

Going forward, I will maintain a cautious stance, anticipating a hard landing scenario, considering the Federal Reserve’s high-interest rates and the historically high value of the US Dollar. The outlook suggests that the SPY rally may be limited to the $440-450 range, with short-term support expected to be in the 400-430 range in the coming weeks based on the latest A.I. data. Furthermore, I believe that the bear market may resume in the second half of the year, urging investors to remain cautious. See SPY Seasonal Chart:

In conclusion, the stock market responded positively to the Federal Reserve’s decision to maintain interest rates, while the European Central Bank signaled a different approach by increasing rates. Retail data showed encouraging signs of consumer spending, while jobless claims remained steady. Investors should closely monitor market developments and remain mindful of potential risks in the coming months.

With this in mind, I am going to be looking to execute a specific kind of trade in the coming days. Similar to last week, I still believe in shorting the European market at the moment.

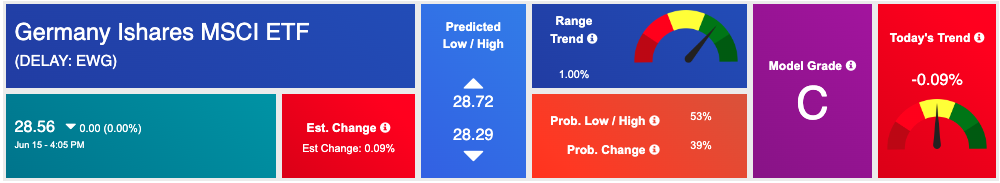

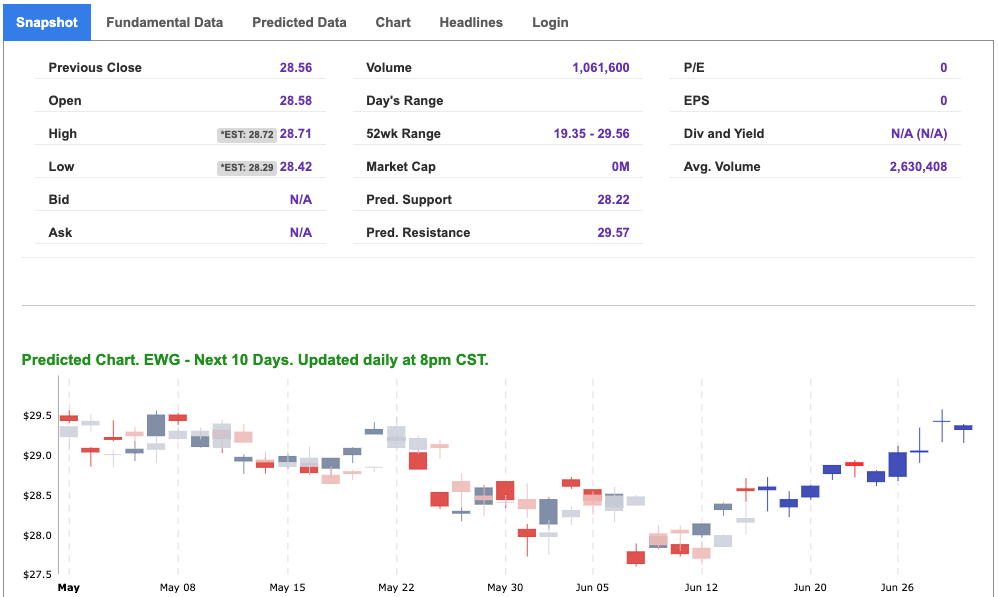

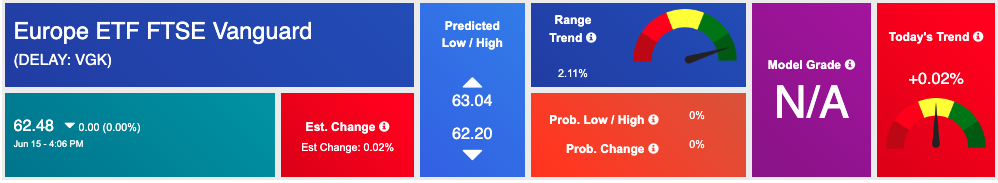

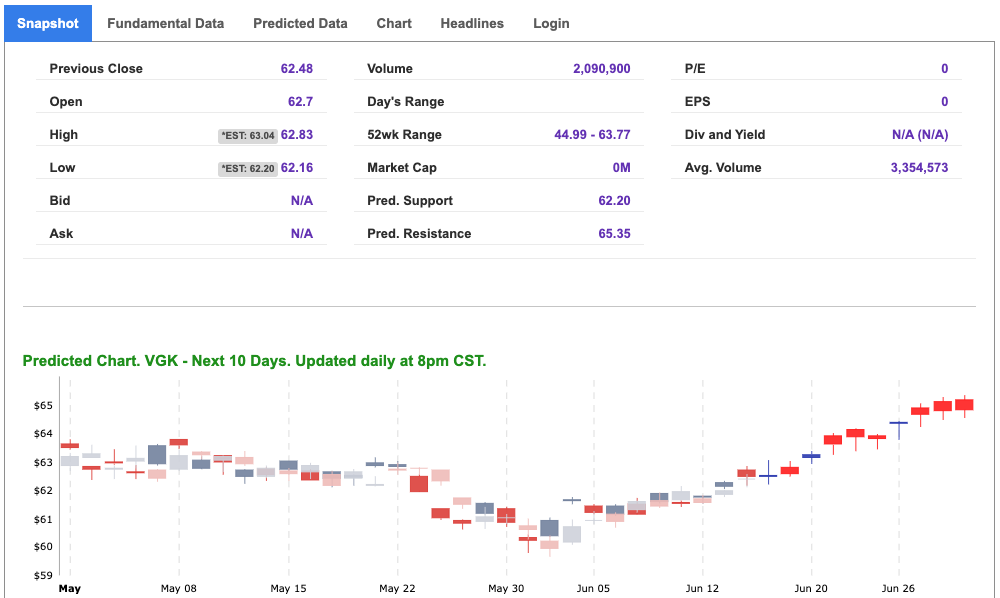

As we evaluate the recent decisions by the central banks in the United States and Europe and their impact on various assets and regions, one potential trade idea for the upcoming week is to consider short-selling European markets, specifically focusing on the iShares MSCI Germany ETF (EWG) and Vanguard FTSE Europe ETF (VGK).

EWG, an exchange-traded fund managed by BlackRock, tracks the MSCI Germany Index and offers investors exposure to a diverse portfolio of German stocks. While investing in EWG provides a convenient way to tap into Germany’s robust economy and varied sectors, investors should carefully assess their goals and market conditions before making any investment decisions.

Recent events in Europe suggest potential volatility lies ahead, and ETFs like EWG have historically faced challenges during times of global uncertainty and market volatility.

On the other hand, VGK, managed by Vanguard, is an ETF designed to replicate the performance of the FTSE Developed Europe All Cap Index. It allows investors to gain exposure to a wide range of European companies across different sectors and market capitalizations. This index comprises large, mid, and small-cap stocks from developed European markets, including countries like the United Kingdom, France, Germany, and Switzerland. Sectors covered by the index include financials, consumer goods, healthcare, industrials, and technology.

Investing in VGK enables investors to participate in the European equity market as a whole, offering a diversified portfolio of European companies without the need to invest in individual stocks. The ETF structure provides liquidity and flexibility, allowing for easy buying and selling of shares on the stock exchange.

Given the current market conditions, shorting European markets has garnered attention. Factors such as sluggish economic growth, political tensions within the European Union, and the ongoing Ukraine-Russia conflict contribute to a cautious sentiment among investors. Moreover, concerns about rising inflation and potentially tighter monetary policies further support the rationale behind shorting European markets.

Our AI forecasted data reveals several encouraging signals regarding shorting European symbols. Both VGK and EWG have negative vector scores, indicating an immediate negative trend for these symbols.

Throughout this volatile year, targeted retracements have been observed in various asset classes and geographical regions, signaling a broader undercurrent of pessimism and selling momentum. While the U.S. markets have found stability following the resolution of the debt ceiling issue, Europe may face greater challenges due to ongoing geopolitical uncertainties that impact global markets. The recent decision by the Euro central bank and the current Ukraine-Russia situation further contribute to the uncertainties. Likewise, the ramifications of the prevailing circumstances in China seem to exceed initial expectations, adding another layer of concern to the equation.

With this in mind, I’ll be looking to short. Investors should carefully analyze market conditions, conduct thorough research, and consider their risk tolerance before engaging in any short-selling activities.

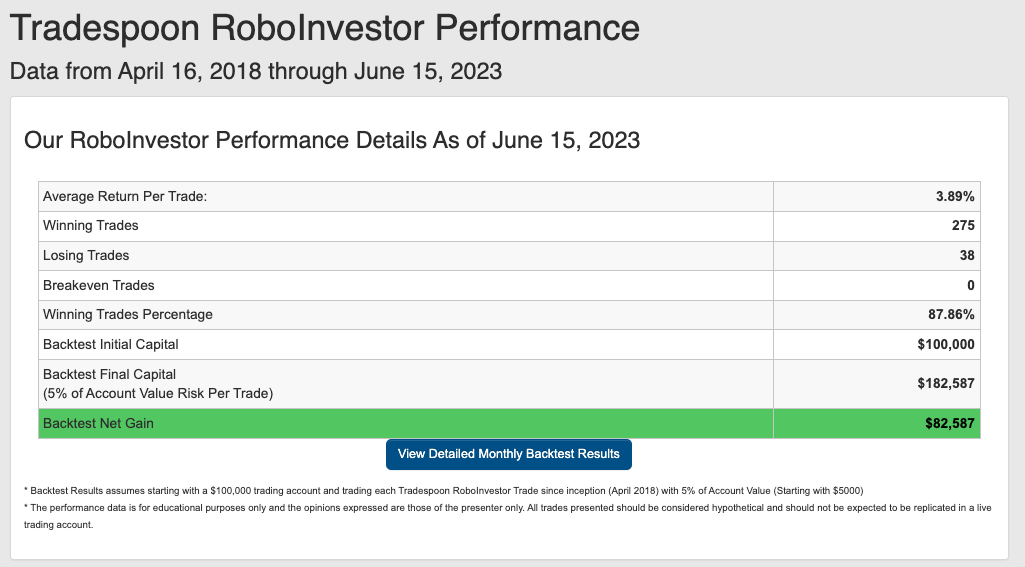

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.86% going back to April 2018.

As we enter the second half of 2023, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!