In a choppy trading session, the Dow Jones Industrial Average managed to close at a record high, even as other major indices struggled. The broader market faced headwinds, particularly from the technology sector, as Wall Street grew jittery ahead of Nvidia’s highly anticipated earnings report scheduled for Wednesday.

Monday marked a slow start to the trading week, with many investors seemingly waiting for Nvidia’s earnings to set the tone. The company’s second-quarter results are expected to either bolster or dampen the ongoing rally in artificial intelligence (AI) stocks, a key driver of the market’s recent performance. Concerns are mounting that Nvidia may not deliver the robust results needed to sustain the AI-driven momentum, which could explain the weakness in chip stocks observed earlier this week.

While the Dow posted gains, other indices were less fortunate. The tech-heavy Nasdaq and the S&P 500 were weighed down by declines in major tech stocks. Intel, for instance, saw its shares drop 2% after a report from CNBC revealed that the company has enlisted advisors, including Morgan Stanley, to fend off potential shareholder activism. Intel’s stock has plummeted 59% this year as it struggles to keep pace with AI leaders like Nvidia, whose shares, despite a 2.3% dip on Monday, have surged 154% in 2024.

Boeing also faced challenges, with its shares falling 0.9% following news from NASA that two astronauts, initially brought to the International Space Station by Boeing’s Starliner spacecraft in June, will now return on a SpaceX vehicle. This development adds another setback to Boeing’s already troubled space program.

Investors are also keeping a close eye on the U.S. personal consumption expenditures (PCE) inflation data for July, set to be released on Friday. As the Federal Reserve’s preferred measure of inflation, the PCE report will be crucial in guiding market expectations for future rate cuts. Last Friday, Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole Symposium hinted that the era of high interest rates might be nearing its end, sparking renewed investor optimism. Powell suggested that the Fed could consider lowering interest rates if the labor market continues to cool and inflation moves closer to the Fed’s 2% target.

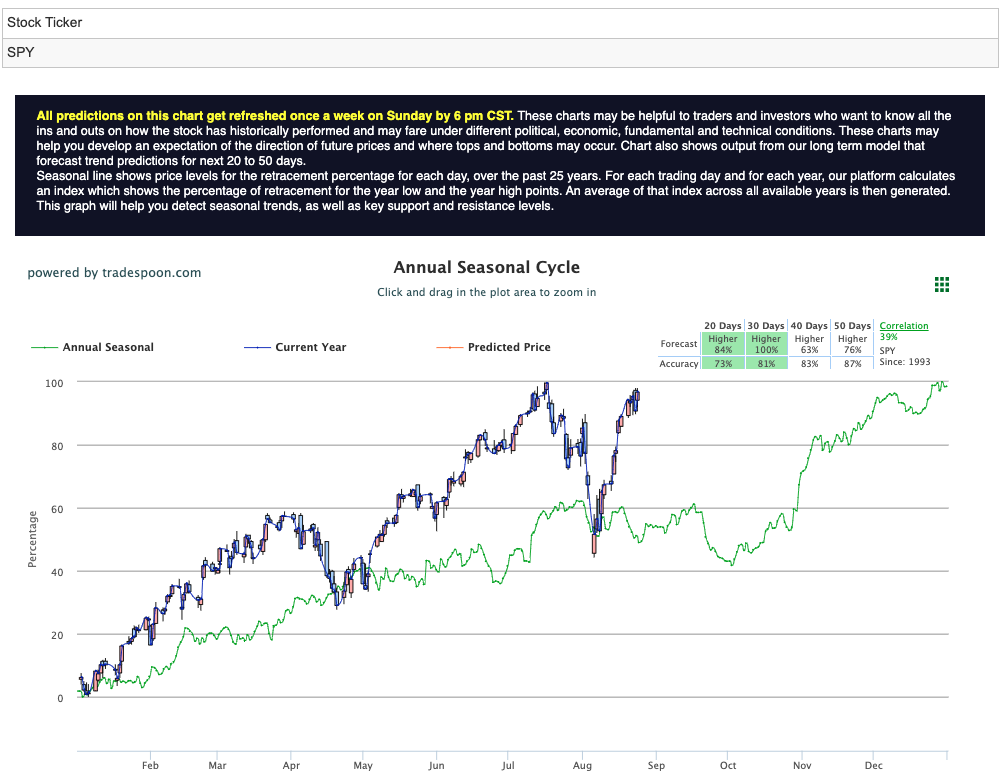

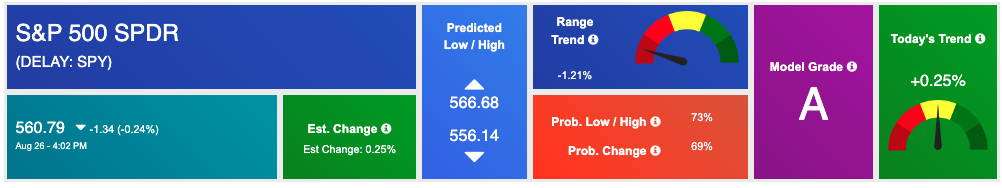

However, Powell’s cautiously optimistic tone was met with mixed reactions. While the broader market showed resilience, with the Nasdaq and S&P 500 maintaining their upward momentum, some analysts remain cautious. The SPY, a key ETF tracking the S&P 500, is currently trading within a defined range, encountering resistance between $560 and $575, with short-term support levels observed at $480 to $510. This range-bound movement reflects the market’s uncertainty, as traders weigh the potential for a dovish shift in Fed policy against ongoing economic risks. For reference, the SPY Seasonal Chart is shown below:

Global geopolitical tensions also loom large, particularly in the Middle East. Investors are monitoring the situation between Israel and Iran-backed militia Hezbollah after a heavy exchange of fire on Sunday. Any escalation in this conflict could have significant implications for global markets, particularly in the energy sector.

As the week progresses, attention will shift to key earnings reports and economic data releases. Nvidia’s earnings on Wednesday will be a pivotal moment for the tech sector, potentially setting the stage for market movements in the days ahead. Other major companies, including Salesforce and CrowdStrike, will also report earnings, providing further insights into corporate health amid a challenging economic environment.

In addition to earnings, investors will scrutinize durable goods orders on Monday, consumer confidence data on Tuesday, and the PCE inflation figures on Friday. These reports, along with speeches from several Federal Reserve presidents, will play a critical role in shaping market expectations and offering clarity on the Fed’s policy direction.

The current market landscape is marked by cautious optimism, with the potential for interest rate cuts and a cooling inflationary environment providing a bullish backdrop. However, risks remain, particularly in the technology sector, where volatility and high valuations could lead to sharp corrections. As we move through the week, staying informed and agile will be key to navigating the evolving market conditions and preparing for potential shifts in monetary policy and economic performance.

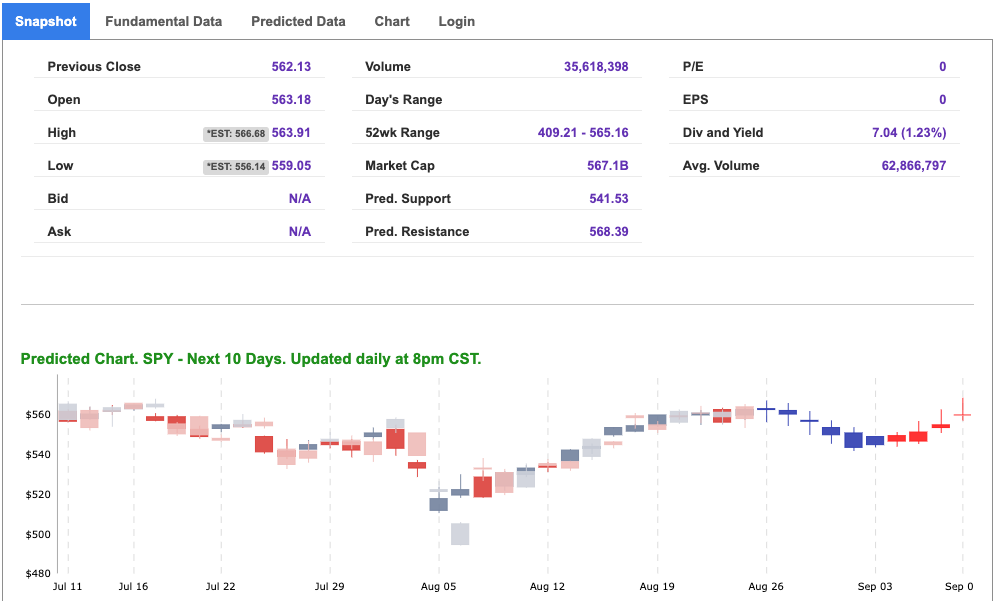

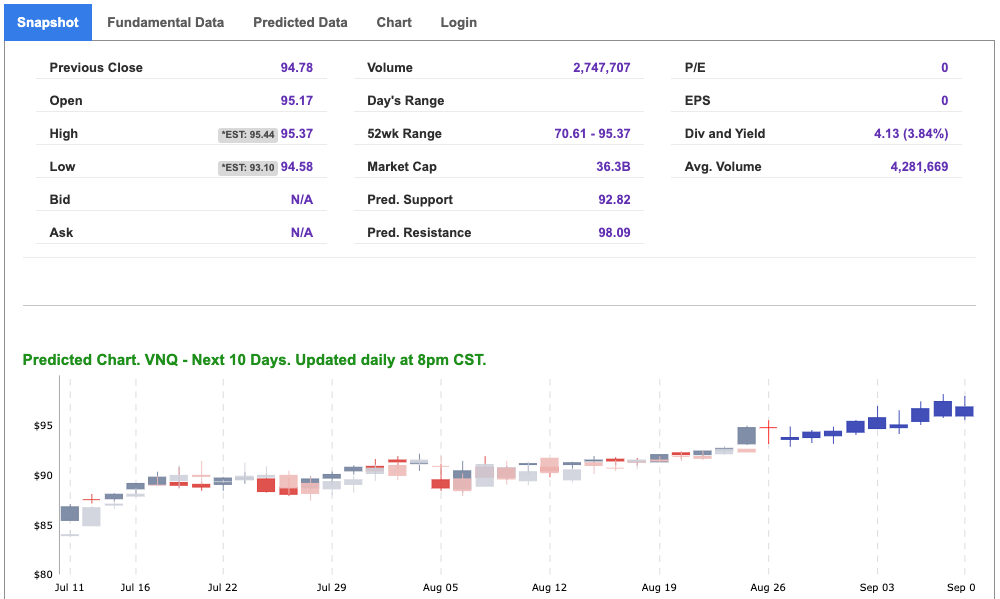

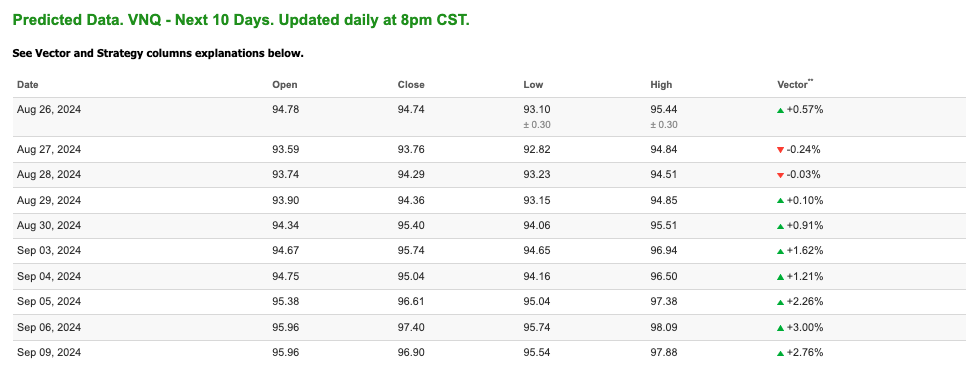

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

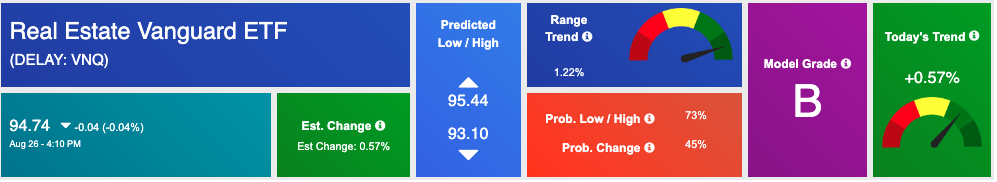

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, VNQ. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

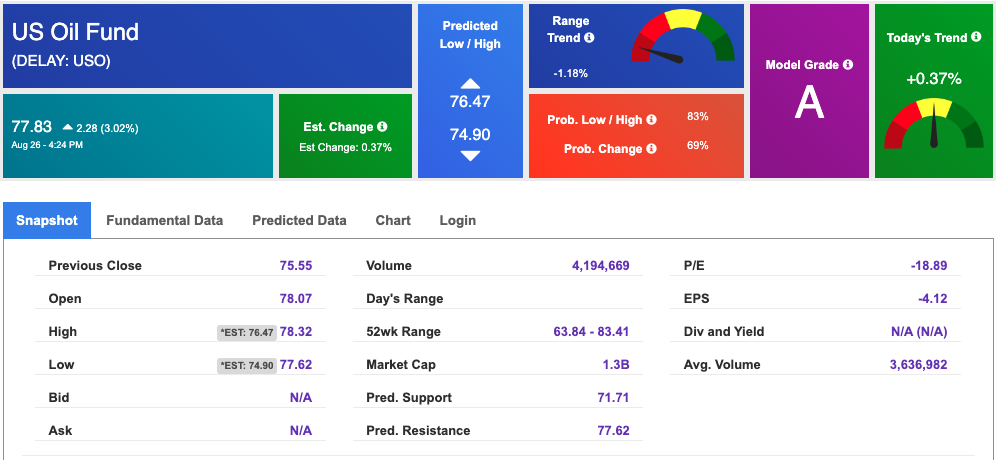

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $77.16 per barrel, up 3.11%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $77.83 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

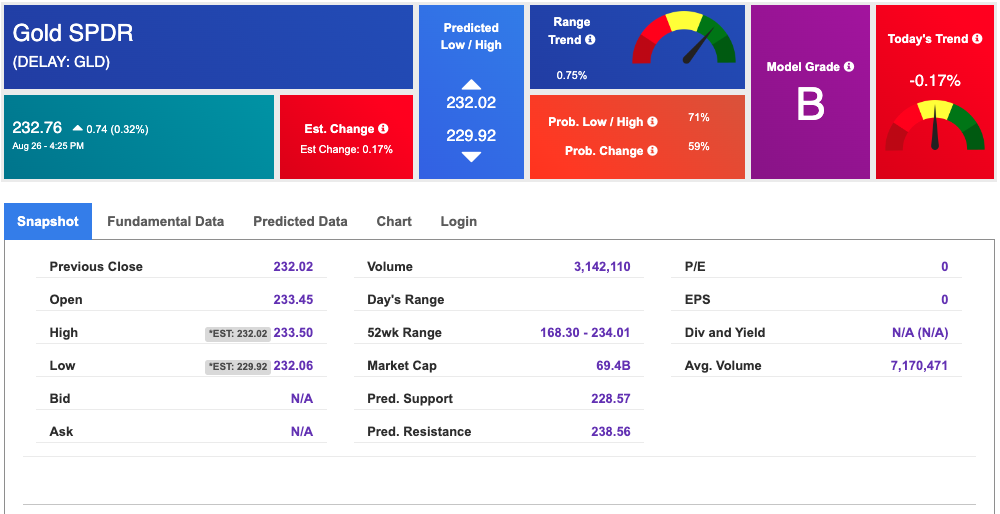

The price for the Gold Continuous Contract (GC00) is up 0.29% at $2,553.60 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $232.76 at the time of publication. Vector signals show -0.17% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The yield on the 10-year Treasury note is up at 3.818% at the time of publication.

The yield on the 30-year Treasury note is up at 4.108% at the time of publication.

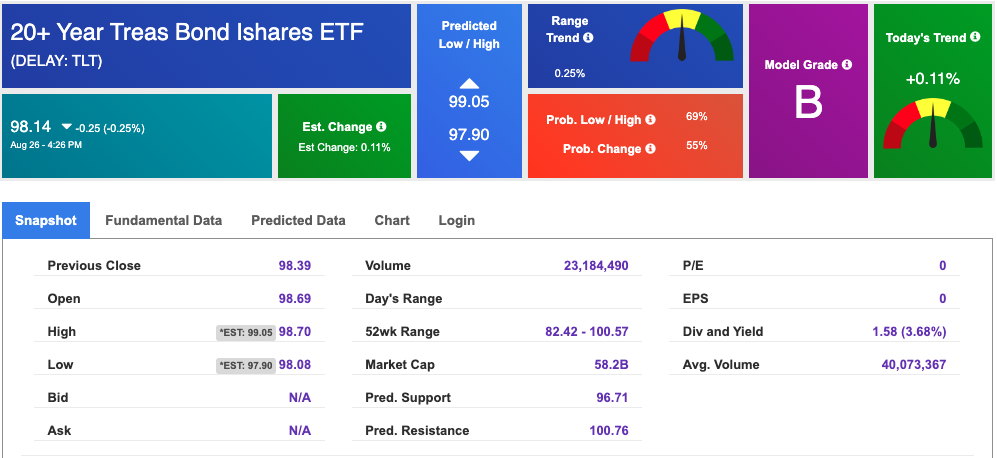

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

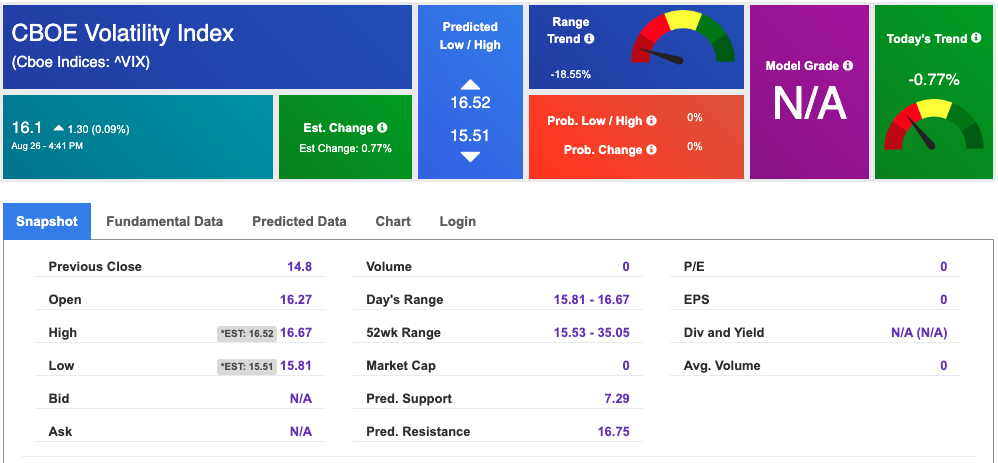

The CBOE Volatility Index (^VIX) is priced at $16.1 up 0.09% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!