On Monday, the Dow Jones Industrial Average soared to an intraday high, while the S&P 500 and Nasdaq also experienced gains, as bond yields edged higher. This bullish trend is driven by expectations of lower interest rates and the strong performance of technology stocks. Financial stocks received a boost from solid bank earnings reports, with Bank of America, Morgan Stanley, PNC, and United Health Group set to report on Tuesday, Johnson & Johnson on Wednesday, Netflix on Thursday, and American Express on Friday.

The stock market rally last week was sparked by the commencement of earnings season. On Friday, major U.S. banks like JPMorgan Chase, Wells Fargo, and Citigroup reported earnings that exceeded estimates, setting a positive tone for the market. Federal Reserve Chair Jerome Powell’s semiannual address to Congress on Tuesday and Wednesday highlighted that economic risks are now more balanced, allowing for a broader focus beyond merely reducing inflation. Powell emphasized monitoring potential weaknesses in both the job market and the broader economy. Despite some vulnerabilities, Powell noted that the labor market remains strong but not overheated, with conditions resembling pre-pandemic levels.

The June jobs report showed strong job creation but a rising unemployment rate of 4.1% and slower wage growth, suggesting a labor market moving towards better balance. On Thursday, the release of key inflation data brought a mixed market reaction. The Consumer Price Index (CPI) for June came in lower than anticipated, prompting a rally in bond prices while stocks showed mixed performance. The overall CPI increased by 3% year-over-year in June, slightly below the expected 3.1%. Month-over-month, the index decreased by 0.1%, the first decline since May 2020, while the core price index rose by 3.3%, just under the anticipated 3.4%.

This week’s market action is focused on a slew of corporate earnings reports and key economic data. On Monday, the Dow Jones Industrial Average hit an intraday high, fueled by positive earnings expectations and a tech sector rally. Tesla shares rose, along with other market giants such as Alphabet and Apple.

Federal Reserve Chair Jerome Powell is scheduled to participate in a moderated question-and-answer session on Monday, providing an opportunity to discuss the outlook for the U.S. economy and interest rates following the promising June inflation report.

On the bond side, the yield curve is becoming less inverted, with the 2-year yield falling in line with rate-cut expectations. The yield on the benchmark U.S. 10-year Treasury note rose to 4.22% on Monday morning. Last Thursday, the 10-year yield was around 4.3% before the benign consumer price index report raised hopes of a Federal Reserve rate cut as soon as September. The yield was above 4.4% before the June jobs report, which showed cooling wage growth, was released on July 5.

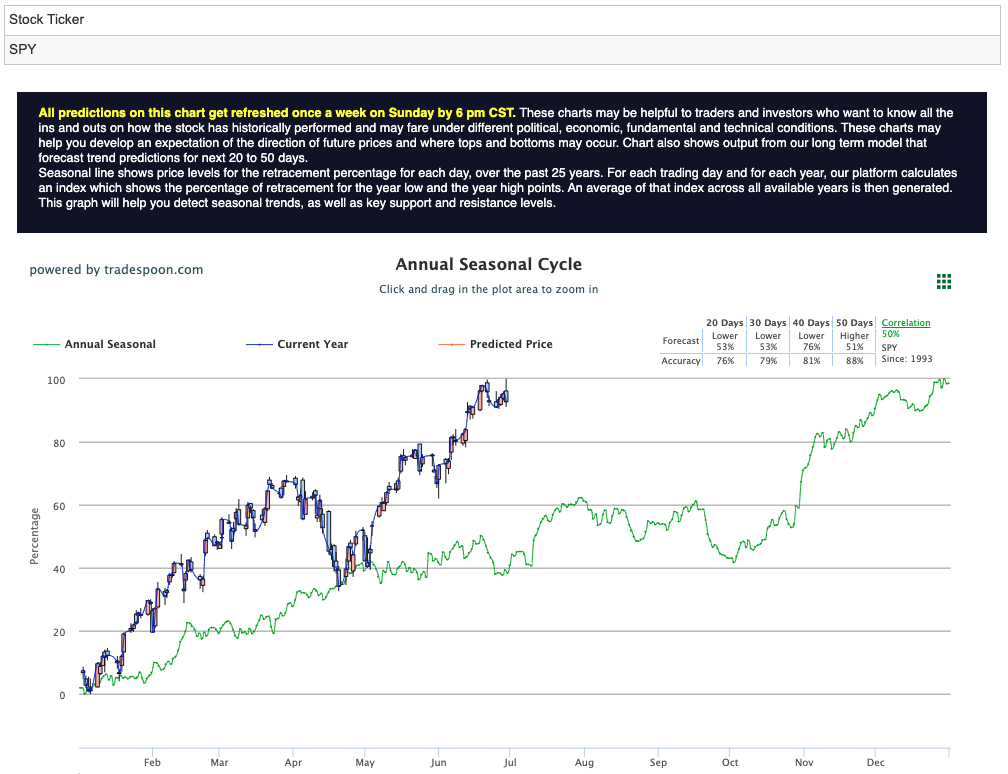

With inflation aligning with expectations and the earnings season starting on a high note, the market outlook remains bullish. However, potential risks loom as the economy cools, such as rising unemployment and potential failures of small banks exposed to commercial and residential real estate. I anticipate the SPY rally to be capped at $560-$575 levels, with short support around $520-$530 for the next few months, expecting the market to continue posting higher highs and higher lows. For reference, the SPY Seasonal Chart is shown below:

As we move into the heart of summer, investors should brace for potential volatility but can remain cautiously optimistic given the strong economic indicators and robust corporate performance observed so far.

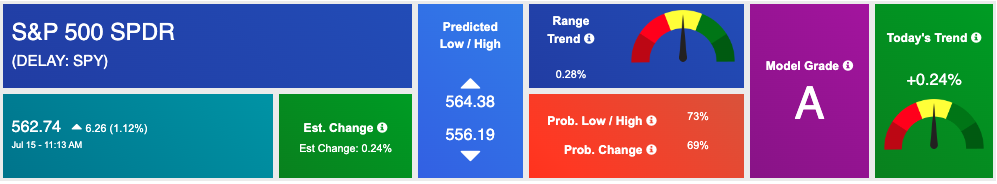

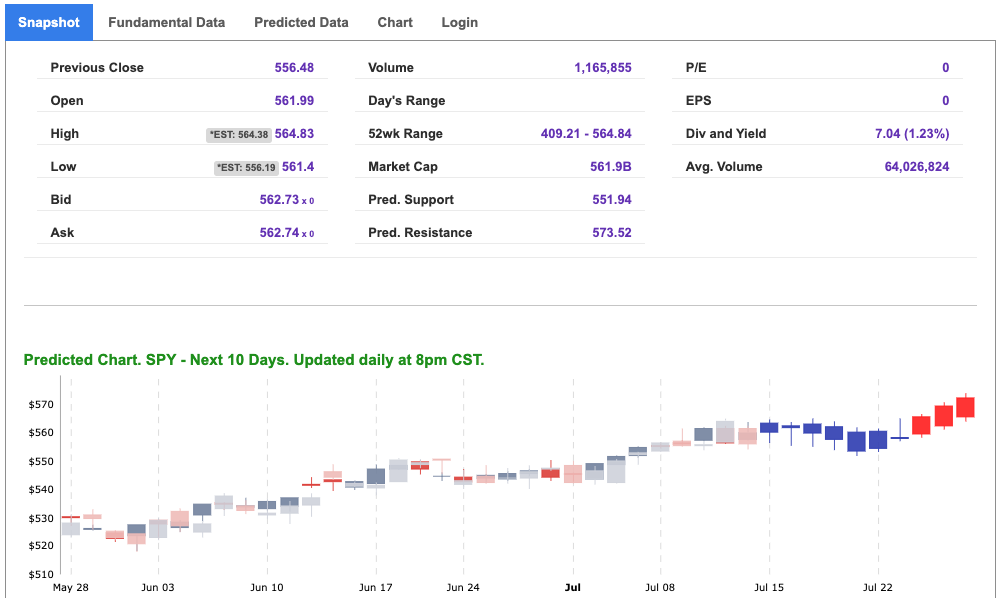

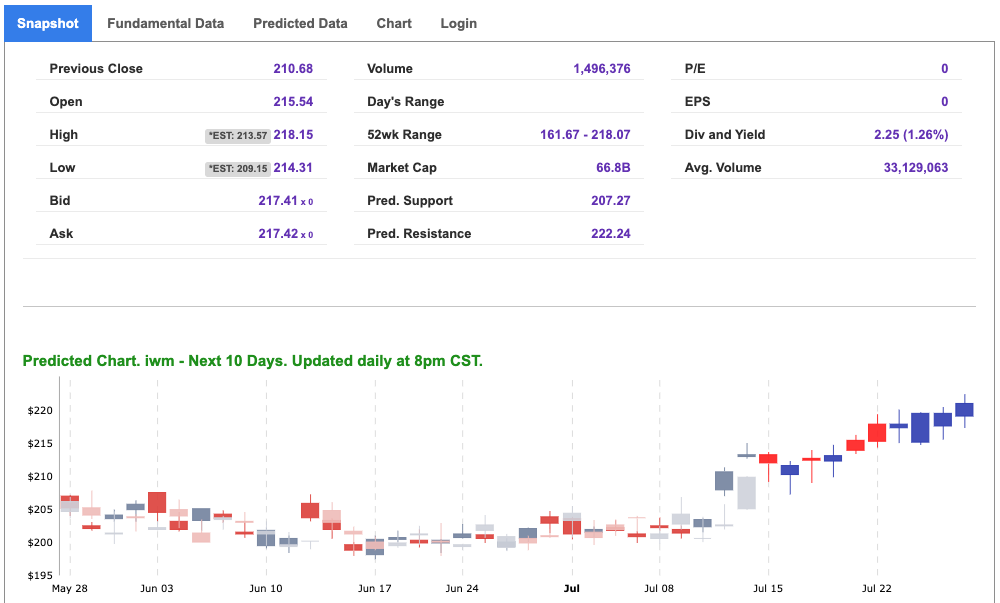

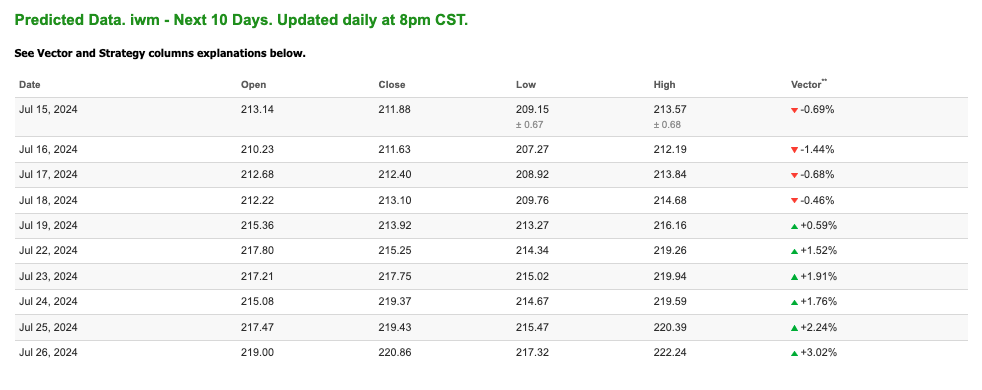

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

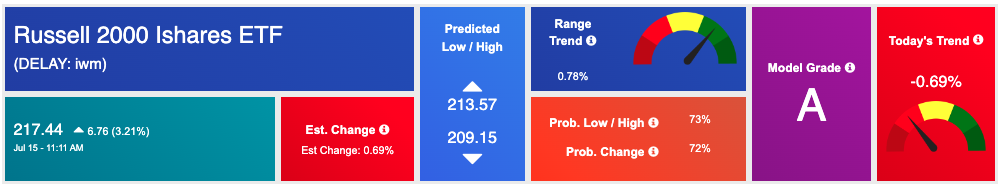

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, IWM. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

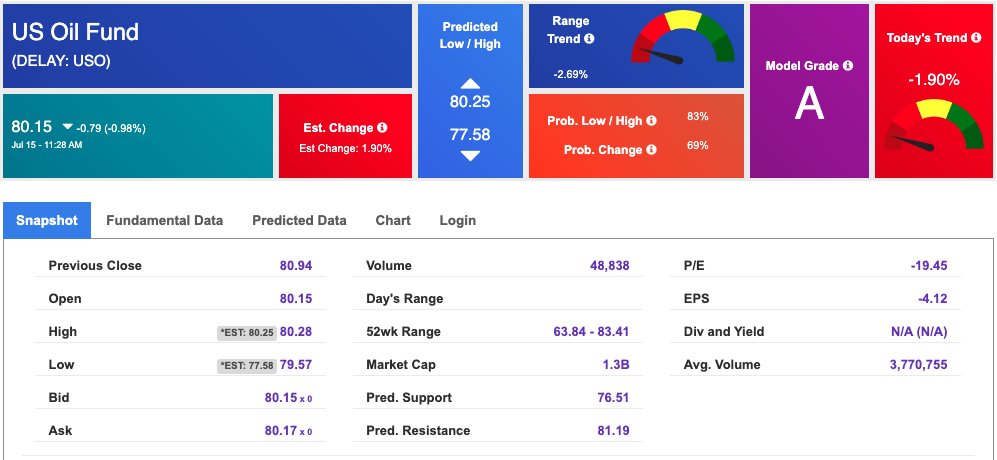

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $82.16 per barrel, down 0.06%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $80.15 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

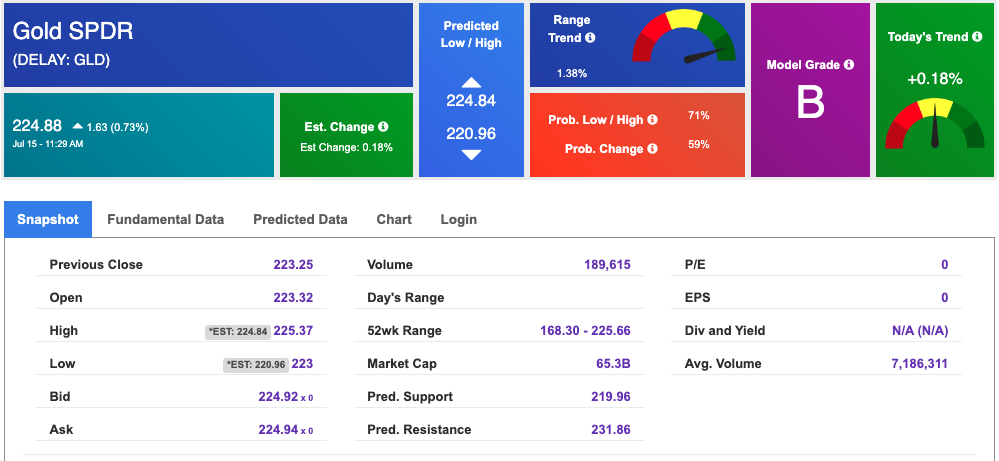

The price for the Gold Continuous Contract (GC00) is up 0.73% at $2438.30 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $224.88 at the time of publication. Vector signals show +0.18% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

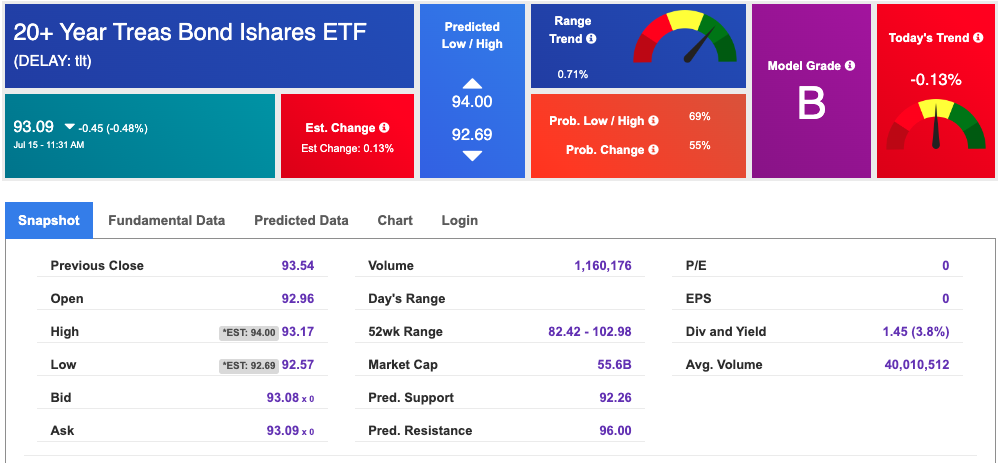

The yield on the 10-year Treasury note is up at 4.22% at the time of publication.

The yield on the 30-year Treasury note is up at 4.444% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

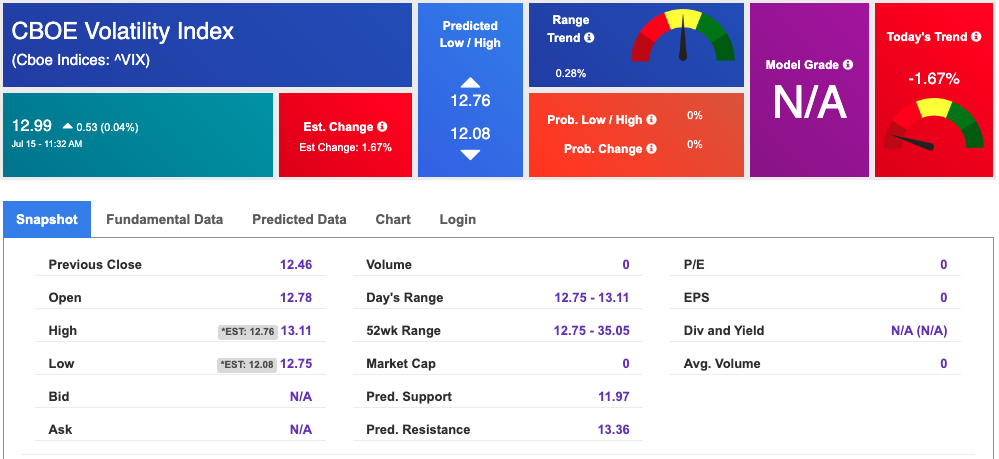

The CBOE Volatility Index (^VIX) is priced at $12.99 up 0.04% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!