In a turbulent day of trading, stocks retreated sharply on Thursday following an unexpectedly robust manufacturing survey, heightening fears of potential interest rate hikes. The Dow Jones Industrial Average experienced its most severe decline in a year, illustrating the market’s sensitivity to economic indicators and Federal Reserve signals.

Nvidia Shines Amid Market Gloom: Despite the overall market downturn, Nvidia emerged as a standout performer. The tech giant’s latest earnings report surpassed even the most optimistic forecasts, driving its stock up 9%. For the first fiscal quarter, Nvidia reported a staggering 262% year-over-year increase in sales, reaching $26 billion—a remarkable 18% rise from the previous quarter. Earnings per share soared to $6.12, excluding non-cash costs, marking a 461% increase from the same period last year and a 19% improvement from the prior quarter.

Nvidia’s dominance in the artificial intelligence (AI) sector was underscored by a more than fivefold increase in sales to cloud-computing data centers, which accounted for 87% of its total revenue at $22.6 billion. The company also announced a 10-for-1 stock split set for June 10, signaling confidence in its continued growth and accessibility to a broader range of investors.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Sector-Specific Movements: While Nvidia’s success buoyed the S&P 500’s tech sector, the gains were isolated. The other ten major sectors within the S&P 500 saw declines, exacerbated by the latest Purchasing Managers’ Index (PMI) surveys, which indicated stronger-than-expected manufacturing activity. This data fueled concerns about potential interest rate hikes aimed at cooling an overheating economy.

Bond Yields and Commodities: Bond yields reacted sharply, with the 10-year Treasury yield spiking to 4.474%. Boeing was notably impacted, emerging as the Dow’s biggest loser due to disappointing cash flow results. Additionally, gold futures dropped 1.8% to $2,349 per troy ounce, continuing a downward trend initiated by the Federal Reserve’s hawkish commentary on monetary easing from Wednesday’s minutes.

Fed Minutes Impact: The release of the Federal Open Market Committee (FOMC) minutes had a profound impact on market sentiment. The minutes revealed a willingness among some participants to consider further policy tightening if inflation risks materialized, contradicting the more dovish tone struck by Federal Reserve Chair Jerome Powell earlier in May. This revelation prompted traders to reassess the likelihood of a rate cut in September, with odds of no rate cut rising to 40.1% from 27.6% a week ago.

Retail and Housing Market Updates: In the retail sector, Target faced a significant setback, with its stock poised for the largest drop in two years following an earnings miss attributed to weak demand for discretionary goods. The housing market also showed signs of cooling, as existing-home sales fell 1.9% in April, marking the slowest pace since January and falling short of expectations.

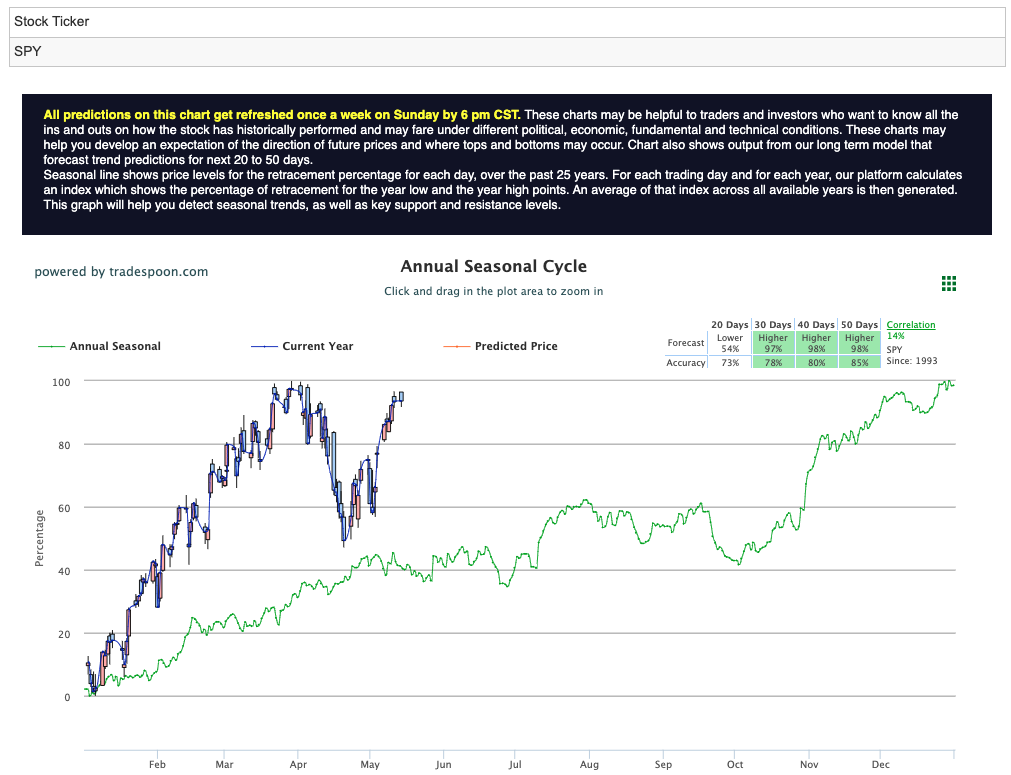

Market Outlook: Despite recent volatility, the market has generally rallied since early May, driven by expectations of stable interest rates. The 10-year yield remains within the 4.3% to 4.7% range, and the VIX, a measure of market volatility, has dropped to an 11 level, indicating low fear among investors. The S&P 500 (SPY) rally is expected to encounter resistance at $540-$550 levels, with short-term support anticipated around $500-$510. Market analysts predict a pattern of higher highs and higher lows in the coming months, suggesting cautious optimism among investors. For reference, the SPY Seasonal Chart is shown below:

As the market continues to navigate economic data and Federal Reserve communications, the interplay between inflation concerns and interest rate expectations will remain a critical driver of stock market performance. With this in mind, one sector, and one symbol in particular, comes to mind.

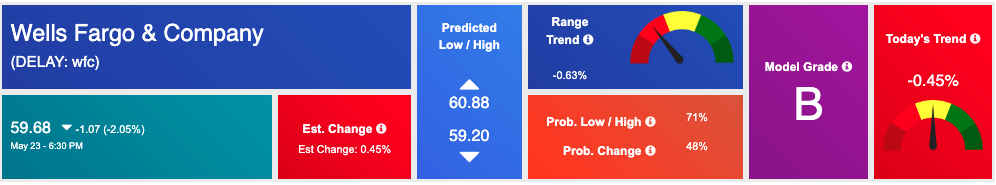

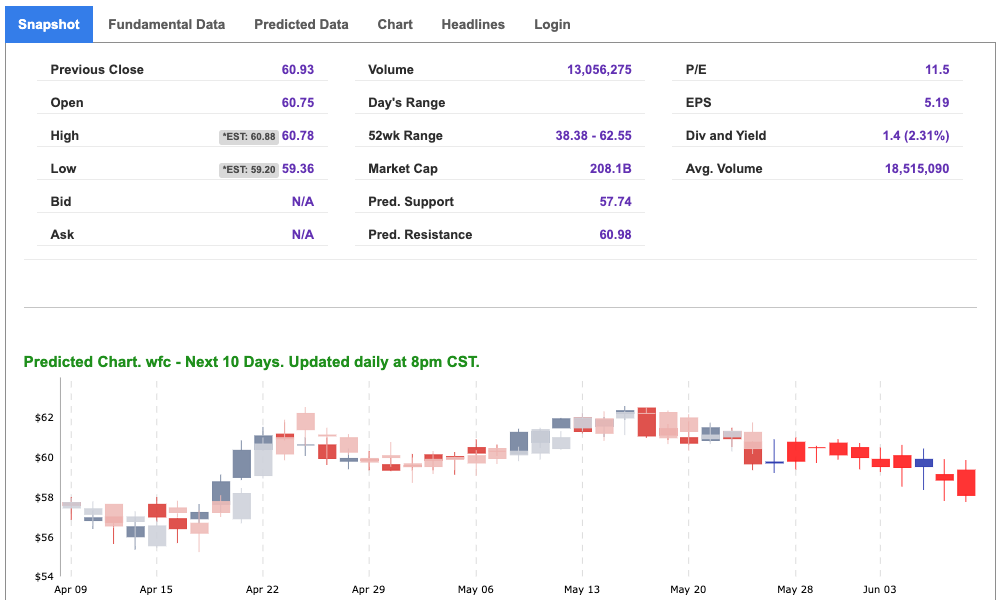

Wells Fargo & Company (WFC) is a diversified financial services company, providing banking, insurance, investments, mortgage, and consumer and commercial finance. With roots dating back to 1852, Wells Fargo is one of the “Big Four” banks in the United States, known for its comprehensive range of services and significant presence in the financial sector.

In a market characterized by heightened volatility, Wells Fargo stands out due to its stable and diversified business model. While tech stocks like Nvidia have shown significant gains, the overall market has been affected by concerns over interest rates and economic indicators. Financial institutions like Wells Fargo, with their diverse income streams, are generally more resilient to such fluctuations.

The recent spike in bond yields, with the 10-year Treasury yield rising to 4.474%, creates a more favorable environment for banks. Higher yields typically lead to increased net interest margins, which can boost profitability for banks like Wells Fargo. Despite the Federal Reserve’s mixed signals regarding future rate cuts, the current interest rate environment is advantageous for traditional banking operations.

Wells Fargo’s solid financial health, underscored by robust capital ratios and a focus on cost management, positions it well to navigate economic uncertainties. The bank has also been committed to returning capital to shareholders through dividends and share buybacks. With a current dividend yield that is attractive compared to the broader market, Wells Fargo offers investors a reliable income stream.

Additionally, Wells Fargo has been actively restructuring its business to enhance efficiency and profitability. Recent efforts to streamline operations and invest in technology are expected to yield long-term benefits. The bank’s strategic initiatives aimed at expanding its digital banking services and enhancing customer experience are likely to drive growth and market share gains in the coming years.

Compared to other sectors that have seen inflated valuations, particularly in tech, financial stocks like Wells Fargo offer a more attractive valuation. This makes $WFC a more compelling buy for investors seeking value amidst the current market dynamics.

Given the current market conditions and Wells Fargo’s strong positioning within the financial sector, $WFC represents a solid investment opportunity. The bank’s resilience, favorable interest rate environment, strong financial health, strategic initiatives, and attractive valuation all contribute to its potential for delivering stable returns and growth. Investors looking to balance their portfolios with a reliable financial stock should consider adding Wells Fargo to their holdings.

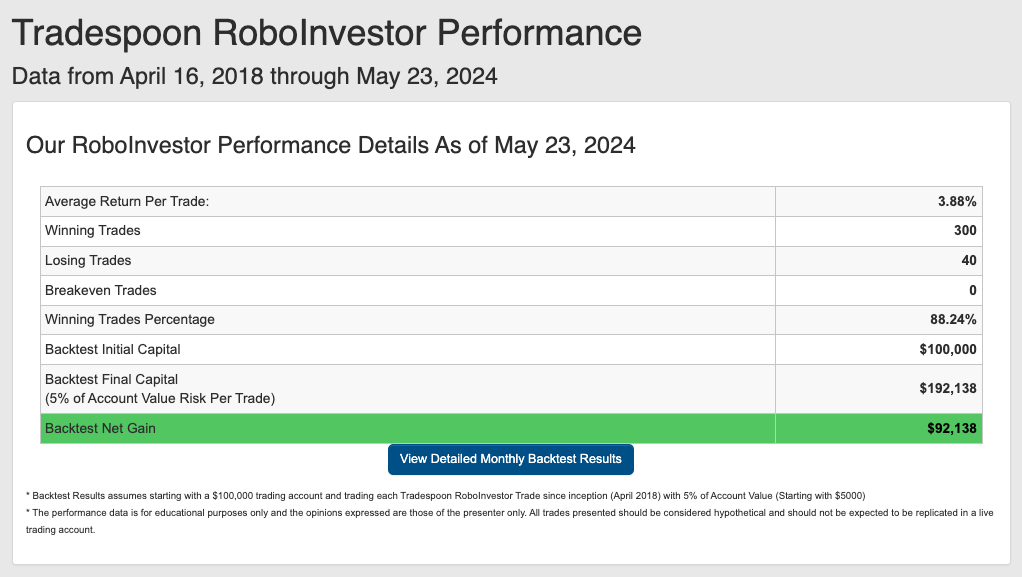

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.24% going back to April 2018.

As we navigate deeper into 2024, investors face a labyrinth of market challenges, from surging inflation to shifting Federal policies and geopolitical uncertainties like the ongoing conflict in Ukraine. In such turbulent times, having a trusted and informed investment partner becomes paramount. Enter RoboInvestor – your steadfast ally in the ever-evolving financial landscape. Offering a comprehensive array of resources and expert insights, RoboInvestor empowers you to navigate your portfolio with confidence and seize promising opportunities amidst the rapid pace of market dynamics.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!