It was a mixed day of trading on Thursday, with choppy trading most of the day until stocks rallied in the afternoon. Economic data released was a mixed bag, with GDP growth in the fourth quarter revised lower to a 2.7% annual rate from 2.9% in January. However, chip stocks rallied as Nvidia reported strong fourth-quarter earnings results and an improved outlook. Other companies such as Alibaba, Domino’s Pizza, Dutch Bros, Etsy, Moderna, and Planet Fitness reported their earnings and saw their stocks move accordingly.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

This comes after a challenging week for the stock market, with indexes experiencing their largest year-to-date declines on Tuesday following a string of strong economic data. The Purchasing Managers’ Indexes, robust retail sales, and labor market reports have contributed to the narrative that the US economy is resilient. However, investors have become increasingly concerned about rising interest rates as the Federal Reserve is expected to continue to raise them and keep them higher than initially anticipated.

The recently-released minutes from the Federal Open Market Committee’s (FOMC) Jan. 31-Feb. 1 meeting shed further light on the endgame for interest rate hikes, with several officials predicting a slowdown in the federal funds rate as inflation cools. At present, the market has priced in two more 25-basis-point rate hikes for 2023, with a possibility of a third at the June meeting. As investors navigate these uncertain times, it is crucial to monitor economic indicators and Fed policy announcements carefully.

Looking ahead, Friday will feature PCE, Consumer Spending, Personal Income, and New Home Sales. Additionally, several key Fed members are due to speak on Friday, which may provide further insights into the future direction of the economy and the stock market.

With this in mind, I have identified one symbol I will be looking to become more involved in as we track the Fed’s latest actions. Before we commit, let’s review some of our A.I. data.

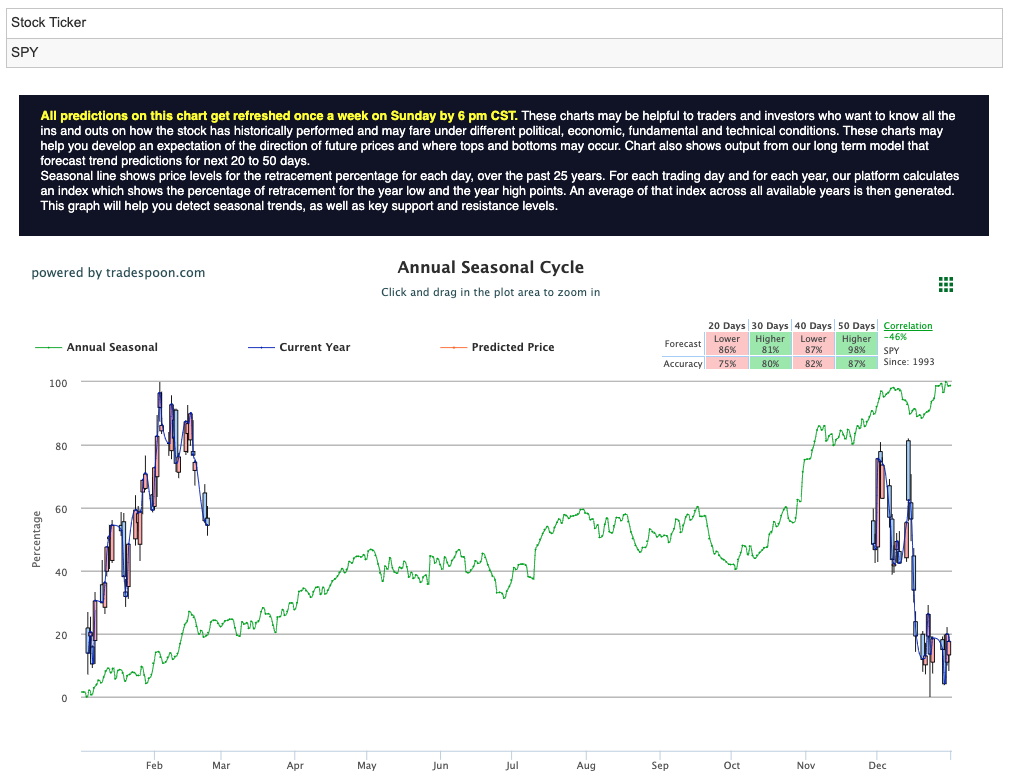

Currently, I am watching the overhead resistance levels in the SPY, which are presently at $408 and then $418. The $SPY support is at $400 and then $390. See $SPY Seasonal Chart:

I expect the market to trade sideways for the next 2-8 weeks and I would be MARKET NEUTRAL ON THE MARKET at this time. As always, encourages subscribers to hedge their positions. Market commentary readers should maintain clearly defined stop levels for all positions.

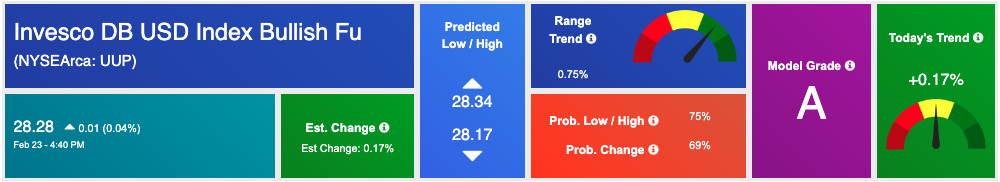

If markets are to remain choppy, and inflation a key driver of the uncertainty, I will be looking into the dollar which has shown recent strength.

The Invesco US Dollar Index Bullish Fund ETF ($DXY) is an exchange-traded fund that seeks to track the performance of the US Dollar Index (DXY). The DXY is a weighted index of the value of the US dollar relative to a basket of six major currencies, including the Euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc.

The $DXY ETF invests in futures contracts on these currencies, with the goal of providing investors with exposure to the US dollar and hedging against currency risks. As a popular hedging tool, the $DXY ETF has seen increased demand from investors seeking stability during times of market turbulence, as well as those concerned about inflation and rising interest rates.

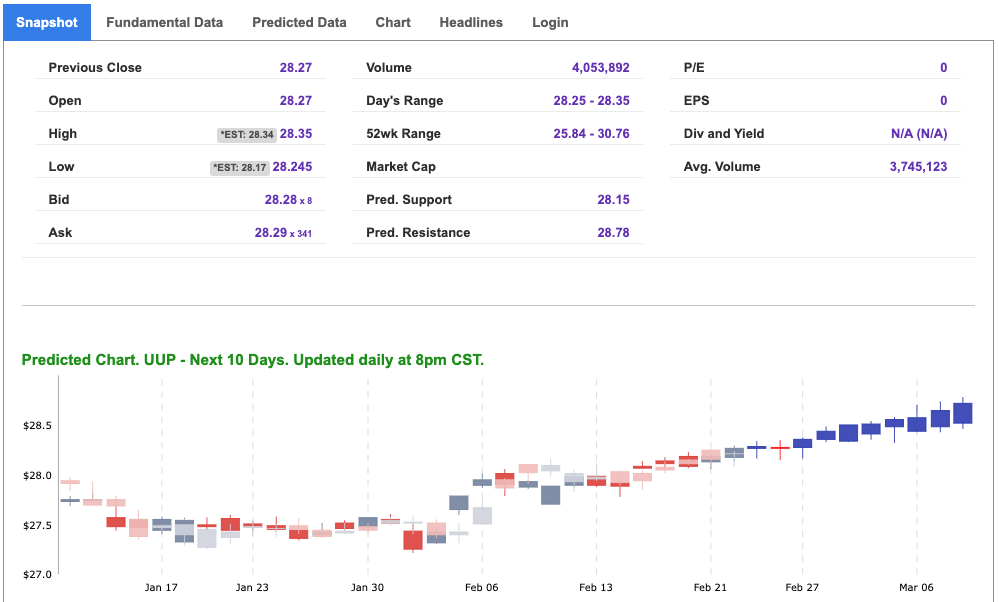

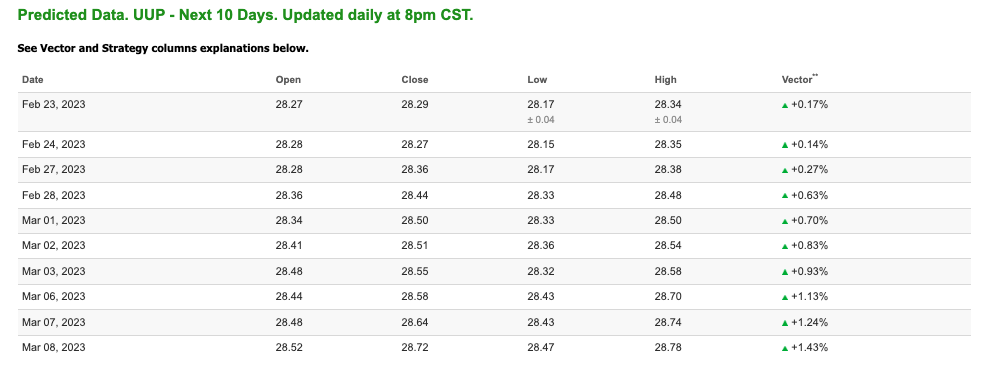

Looking at our Stock Forecast Toolbox 10-day forecast for UUP (the symbol used to identify DXY in our data universe) we see several promising signals. First of all, the symbol shows a model grade of “A” which puts in within our top 10% for accuracy. Additionally, the symbol is showing a strong trend towards the upside with a consistent vector that is moving higher over the forecast period. See 10-day predicted data:

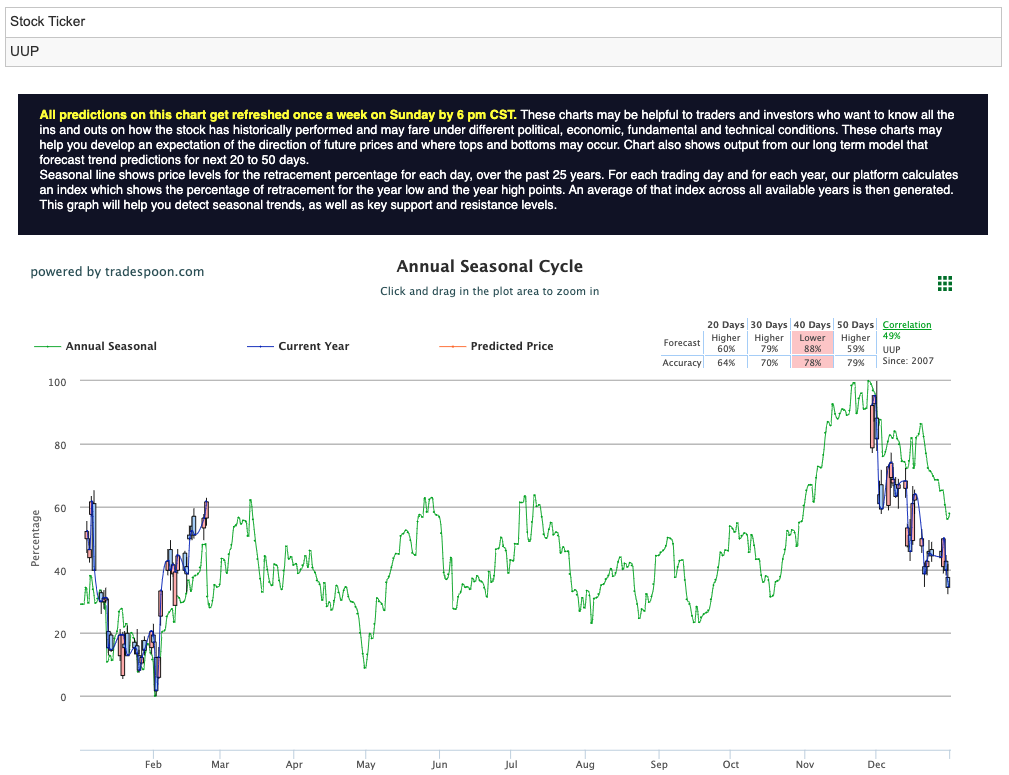

Furthermore, when looking at our Seasonal Chart, primed for long-term forecasts, UUP is showing 3 out of the 4 four forecasted time frames to trade higher. See $UUP Seasonal Chart:

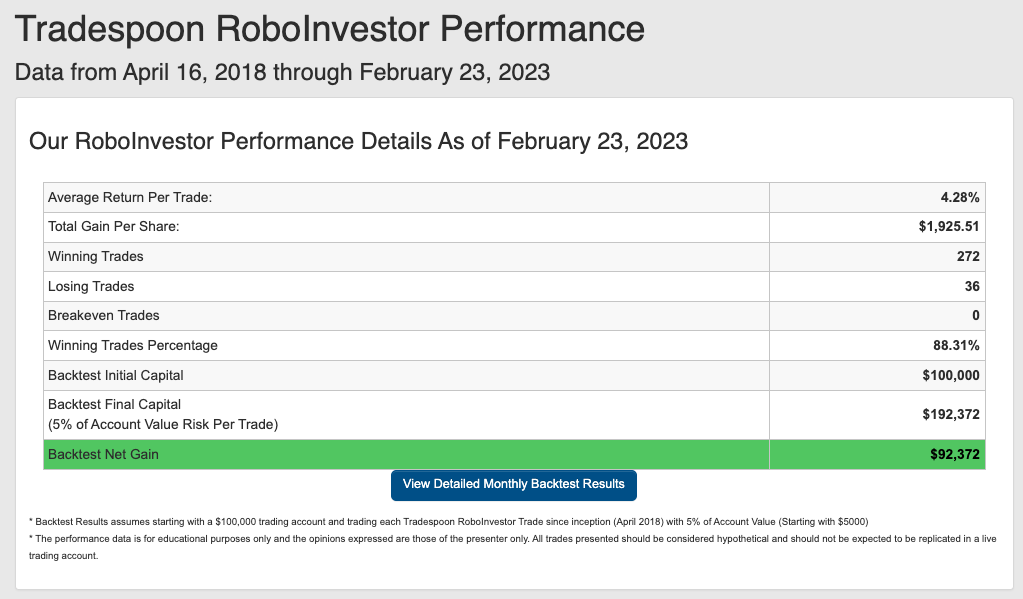

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.31% going back to April 2018.

The interplay between inflation, Fed policies, geopolitical tensions, and the ongoing conflict in Ukraine is making waves in the financial markets, making 2023 an eventful year for investors. To navigate this complex landscape, it is important to have a partner whom you can trust. RoboInvestor offers the expertise and tools you need to confidently manage your portfolio and seize opportunities in today’s fast-moving market.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!