Investor uncertainty took center stage on Monday, with both stocks and bonds reflecting apprehension as the U.S. presidential election tightens to a razor-thin margin. All three major indices ended in negative territory after brief gains, particularly in the Nasdaq, which saw a midday rally only to close down. This week, the nation’s focus turns to the high-stakes election between Vice President Kamala Harris and former President Donald Trump, a race marked by heightened economic and market implications.

Markets started the week with some recovery from session lows as investors cautiously navigated a pivotal week. However, Monday’s movement underscored how unpredictable market sentiment can be amid political tension. Earlier in the session, economic data revealed that U.S. factory orders dipped by 0.5% in September—the fourth decline in five months—adding to broader concerns about a potential slowdown. While the initial market reaction to the election’s outcome may be swift, analysts caution that the full impact on stocks and policy-driven shifts may unfold over the coming months.

Last week, the stock market staged a notable rally fueled by a weaker-than-anticipated jobs report. The U.S. economy added only 12,000 jobs in October, falling significantly short of forecasts. This underperformance signals a potential cooling in labor market growth, which could lower inflation further and push the Federal Reserve toward a more dovish stance. Lower interest rates would enhance economic activity, boost corporate profits, and make equities more appealing relative to bonds, especially as Treasury yields dip.

Corporate earnings also played a role in last week’s market sentiment, especially from major tech players. Apple ($AAPL) reported a modest earnings beat, though its stock slipped after the release of Apple Intelligence, the company’s latest software upgrade aimed at driving future device sales. AMD ($AMD) demonstrated strong revenue growth, largely fueled by AI-driven demand, yet its stock fell on weaker-than-expected forward guidance, creating ripple effects across the semiconductor sector. Alphabet ($GOOGL) offered a more positive note by exceeding revenue forecasts thanks to robust growth in its cloud division, propelling its stock upward.

October also saw a sharp rise in consumer confidence, with the Conference Board’s index climbing to 108.7—its highest since early 2021. This uptick, alongside robust retail activity, contributed to an increase in the Atlanta Fed’s GDP forecast for Q3, now at an estimated 3.4%. Yet, there are signs of caution: job openings dropped from 7.86 million in August to 7.44 million, suggesting that analysts remain wary of overestimating consumer strength amid softening labor dynamics.

The Personal Consumption Expenditures (PCE) inflation measure, closely watched by the Fed, rose by 0.2% in September, aligning with expectations. However, core inflation is still slightly above target, signaling continued vigilance by the Fed. Though ADP payroll data showed resilient private-sector hiring, the broader October jobs miss, exacerbated by labor strikes and natural disasters, reveals underlying market weaknesses that could shape Fed policy and investor sentiment in the coming months.

In the bond market, attention will be on a $58 billion auction of three-year notes scheduled for later today. With the Federal Reserve widely expected to cut interest rates by 25 basis points this week, investors are considering locking in the current rate, especially as yields on three-year notes have surged by over 60 basis points from September lows. If the Fed proceeds with the rate cut, these bonds could offer an attractive opportunity for long-term positioning in fixed income.

The dollar showed signs of weakening as the election neared, with investors anticipating that potential shifts in trade policy could influence foreign exchange markets. Analysts suggest that, depending on the election’s outcome, FX markets may see volatility if tariffs and trade priorities are revised.

As earnings season winds down, market watchers will be keeping an eye on reports from companies like CVS, Shopify, Arm Holdings, Fidelity, Marathon Oil, and DraftKings. Meanwhile, U.S. economic data this week will provide further direction, with key reports on the trade deficit, ISM Services, and the Federal Open Market Committee’s interest rate decision on Wednesday. Fed commentary throughout the week could also offer additional clues on the direction of monetary policy.

Given inflation trends and a robust earnings season, the outlook is shifting bullish as we move forward. The market appears primed for potential growth, supported by inflation stabilizing within expectations and better-than-expected earnings from some sectors. Yet, there remains an underlying risk, with signs of a cooling economy, rising unemployment, and the possibility of small bank failures due to exposure to commercial and residential real estate.

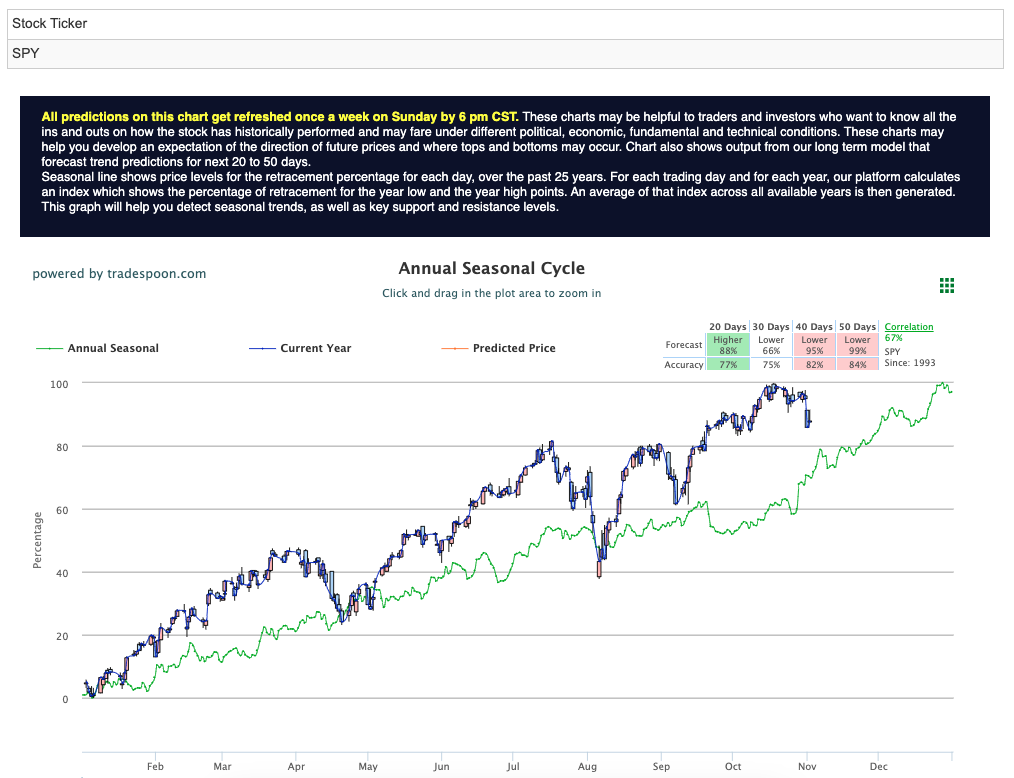

For the S&P 500 ($SPY), a rally could see the index approach the $600–$610 range, with short-term support in the $540–$550 zone over the next few months. Despite market fluctuations, the long-term trend remains intact, and the stage may be set for further gains as investor confidence returns and the Fed’s stance becomes clearer. For reference, the SPY Seasonal Chart is shown below:

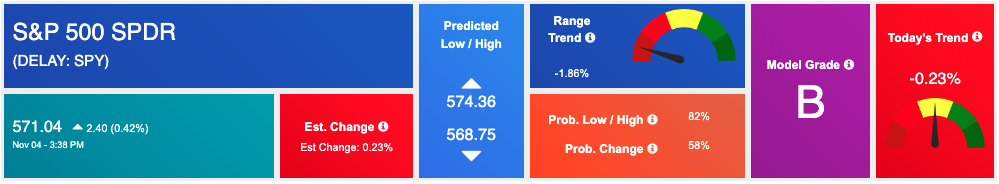

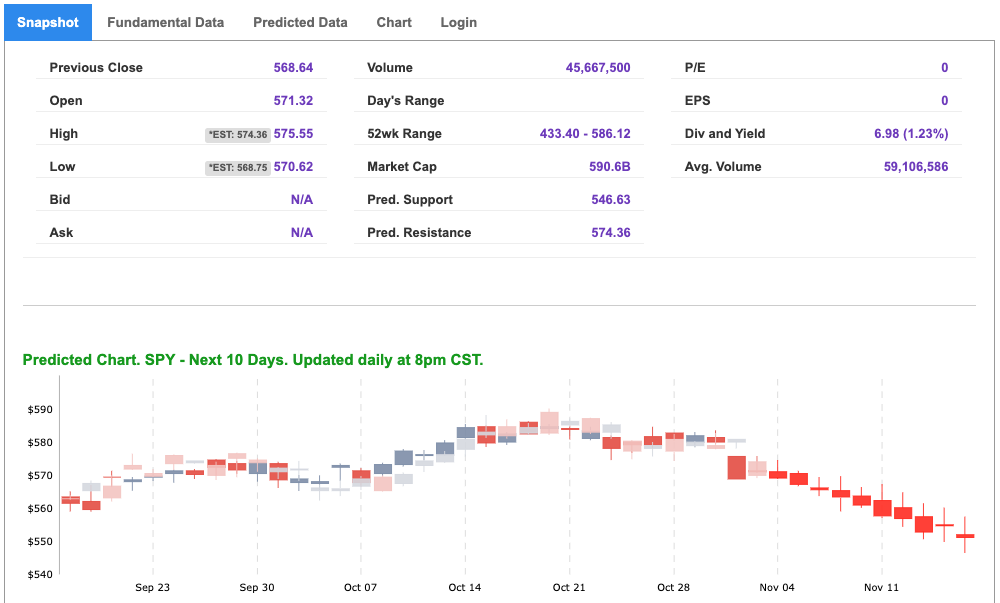

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

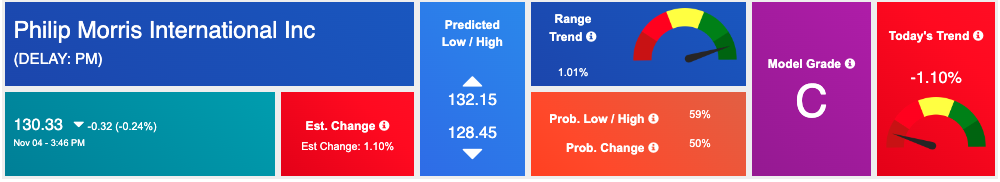

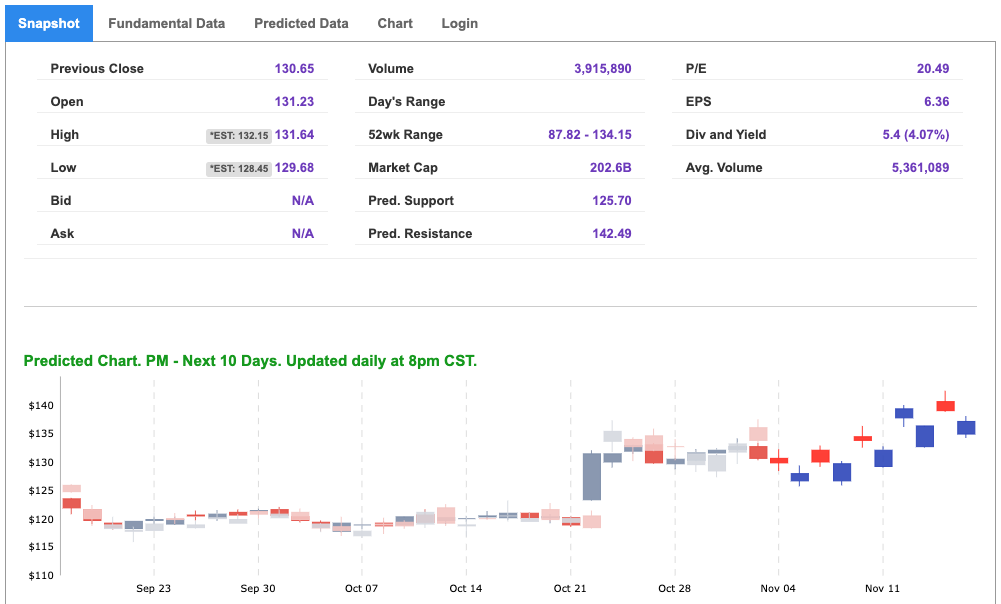

Our featured symbol for Tuesday is Philip Morris International Inc. – PMis showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $130.33 with a vector of -1.10% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does NOT have a position in the featured symbol, PM. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

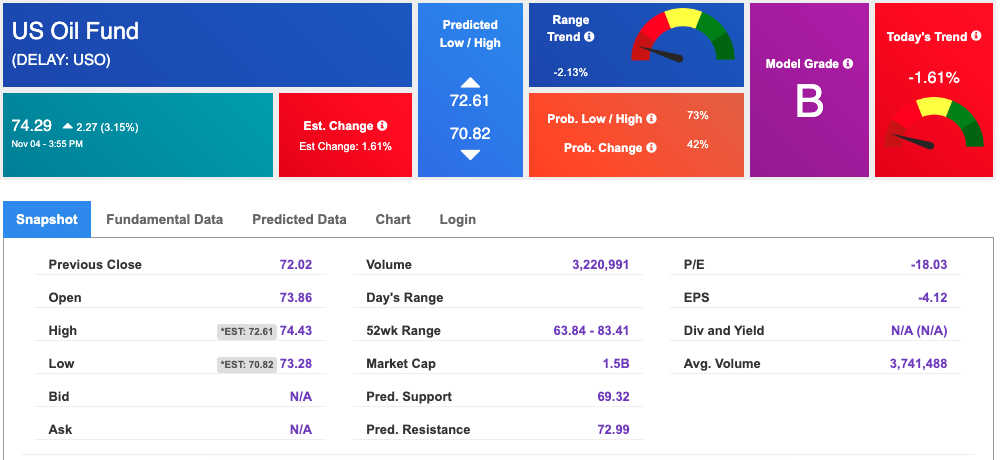

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $71.69 per barrel, up 3.17%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $74.29 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

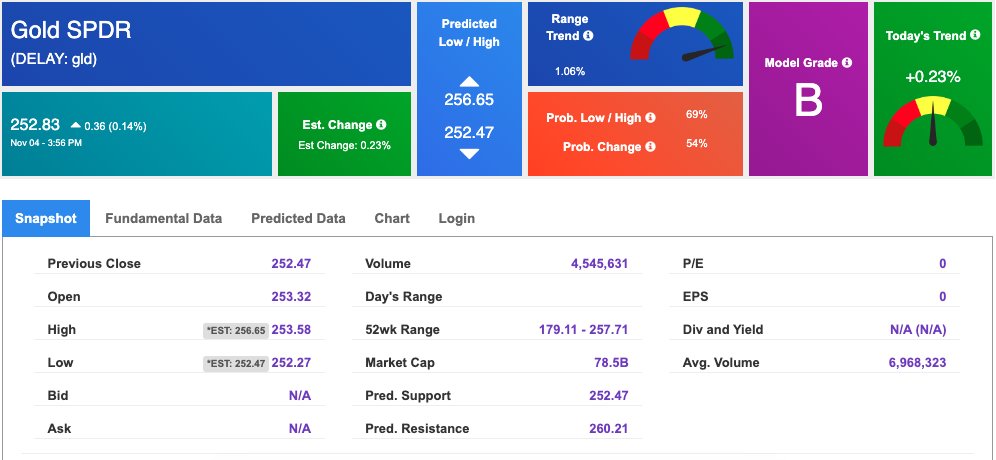

The price for the Gold Continuous Contract (GC00) is down 0.12% at $2,745.80 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $225.83 at the time of publication. Vector signals show +0.23% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

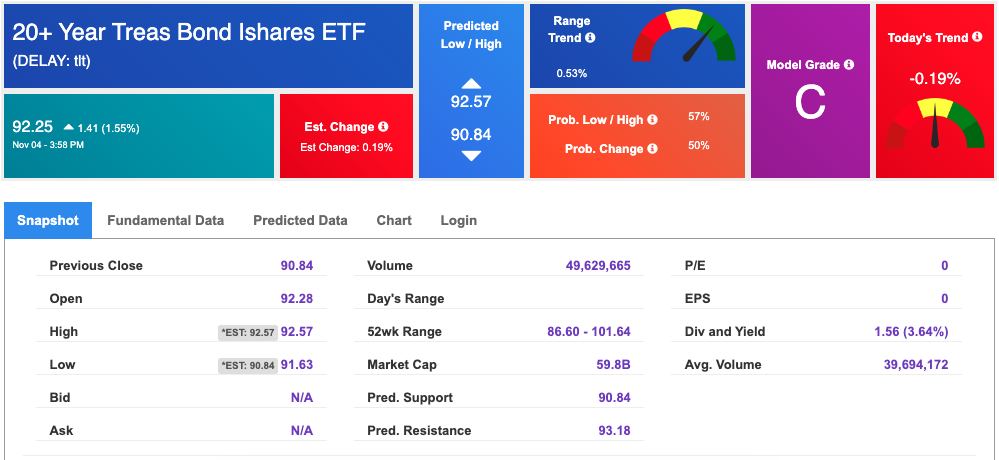

The yield on the 10-year Treasury note is down at 4.289% at the time of publication.

The yield on the 30-year Treasury note is down at 4.467% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

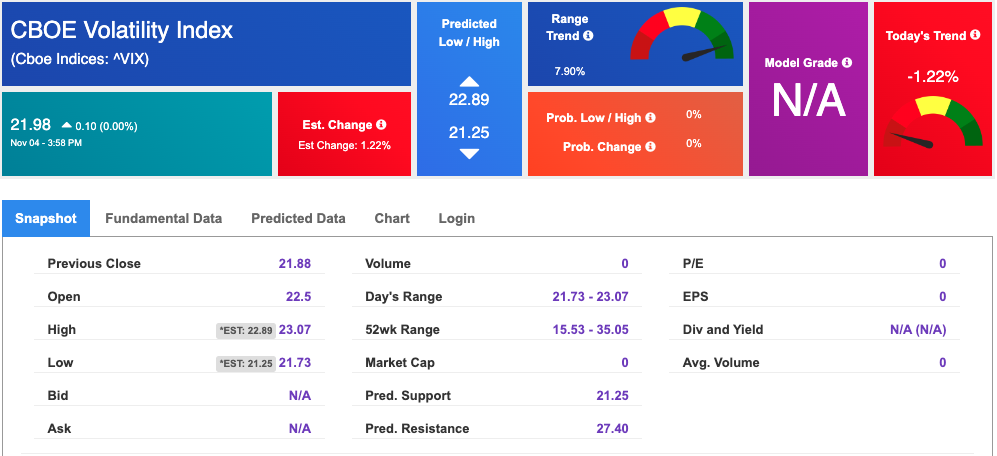

The CBOE Volatility Index (^VIX) is priced at $21.98 down 1.22% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!