Thursday witnessed a decline in stock prices as the latest economic data revealed that the labor market continues to thrive. Bond yields, however, experienced a rally in response to the news. It is becoming increasingly evident that the Federal Reserve’s battle with inflation is far from over, leading traders to speculate that the central bank will raise the headline interest rate at the upcoming Federal Open Market Committee meeting scheduled for July 25-26.

Although job openings declined more than economists had anticipated, the labor market remains robust. The Job Openings and Labor Turnover Survey reported a decrease in the number of job openings, which dropped to 9.8 million in May from 10.3 million in April. Despite this dip, the number of hires and total separations remained relatively stable at 6.2 million and 5.9 million, respectively. Notably, quits saw an increase while layoffs and discharges experienced little change.

Private-sector job growth, on the other hand, surged in June, showcasing the resilience of the labor market. ADP’s report on Thursday revealed a significant rise of 497,000 private sector jobs, surpassing expectations of 250,000 and marking a substantial increase from the previous month’s gain of 278,000. Conversely, jobless claims saw a slight increase in the latest week, with the Labor Department reporting a rise of 12,000 to 248,000 for the week ending July 1.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The Federal Reserve is closely monitoring the labor market, aiming for a cooling effect as wage growth continues to impact persistently high inflation. In an effort to combat rising prices, the central bank has already increased interest rates ten times. With strong private-sector job data reinforcing expectations, more investors believe that the Fed will resume interest rate hikes in July after pausing in June.

Market sentiment remains cautious as the market trades sideways, with anticipation of increased volatility in the second half of the year. Analysts recommend reviewing unemployment data, services PMI, and the Federal Reserve’s June meeting notes to gain insights. The Fed’s stance appears more hawkish, with the potential for additional rate hikes based on inflation data during the summer. As a result, a rotation into value stocks has been observed, while the growth of technology stocks has slowed down. Despite the market being overbought, there is a possibility of further gains, particularly in value stocks.

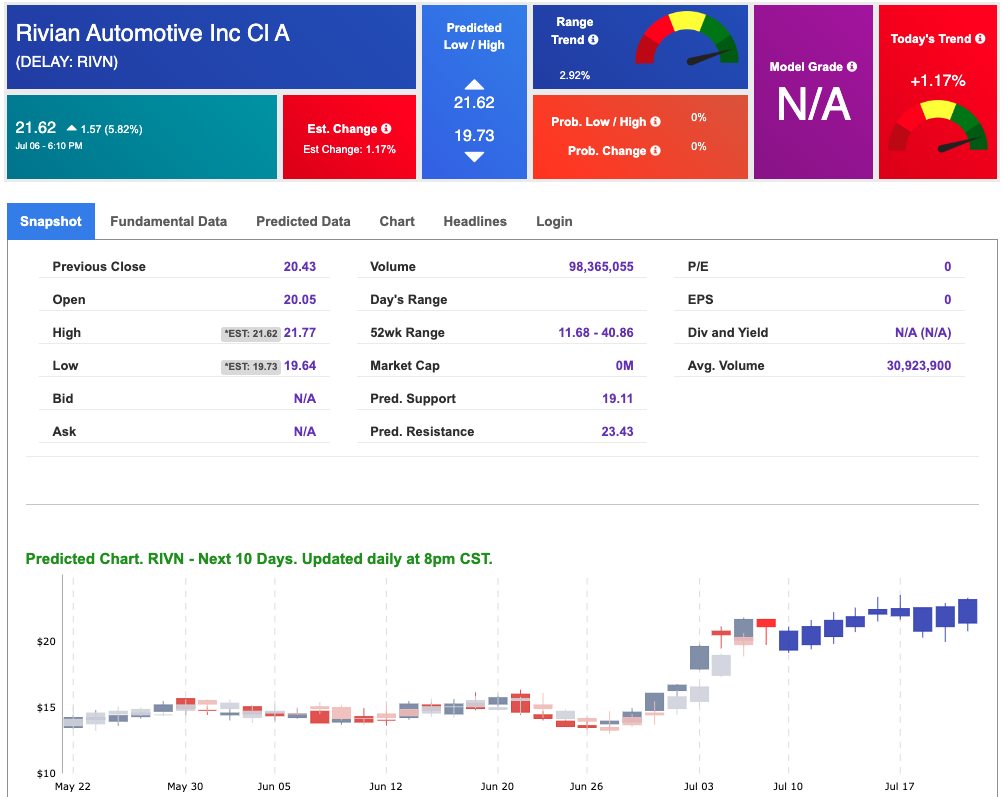

Furthermore, the electric vehicle (EV) sector continues to gain attention. EV manufacturers, particularly Chinese companies, have enjoyed strong performances, with record monthly deliveries being reported. The demand for EVs is expected to grow further as countries prioritize sustainability and aim to reduce carbon emissions.

One notable player in the EV market is Rivian (RIVN), an American automotive company specializing in electric adventure vehicles. Founded in 2009 by Robert “RJ” Scaringe, Rivian has gained significant attention for its innovative electric pickup truck, the R1T, and its SUV, the R1S. The company has secured substantial investments from major players like Amazon and Ford, enabling Rivian to expand its production capabilities and gain a competitive edge in the EV market. With its commitment to sustainable transportation and cutting-edge technology, Rivian has emerged as a key player in the rapidly evolving electric vehicle industry.

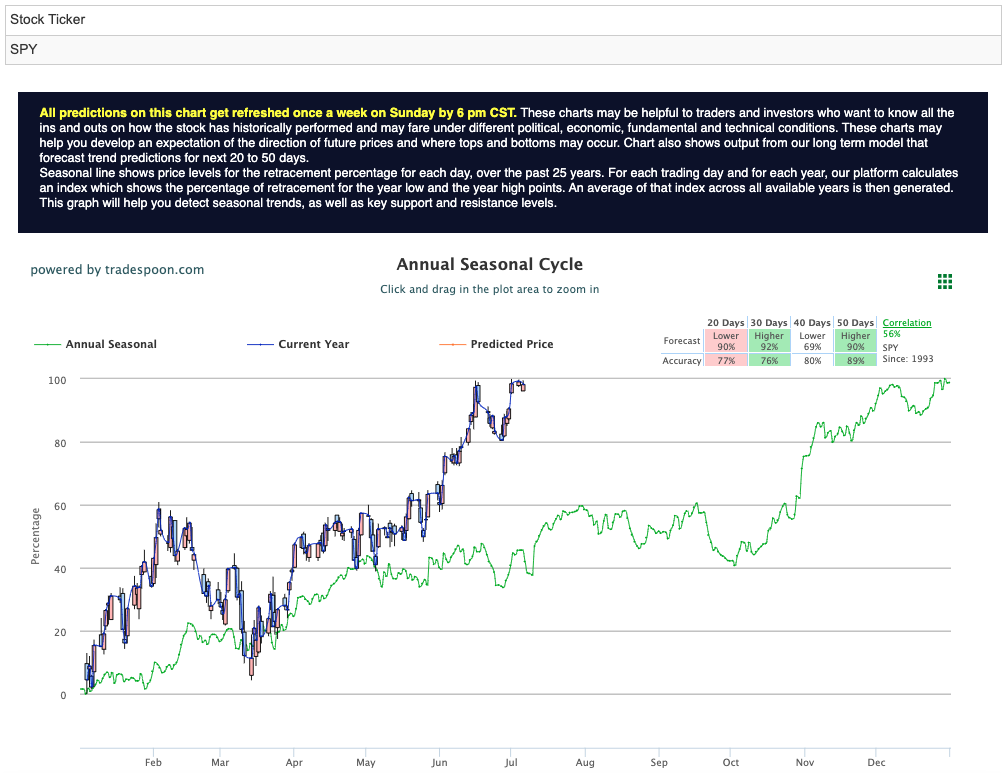

As the market looks ahead, caution lingers among investors due to concerns about an overbought market and the potential retest of recent levels. Currently, the SPY is trading between 445 and 447, with the August high serving as a critical threshold for sustaining the bullish trend. However, a dip below 432 might trigger a quick retest of previous levels. Many market analysts maintain a bearish outlook for the second half of the year, with the Q2 earnings season playing a vital role in shaping market direction, as results are compared to the previous quarter. For reference, the SPY Seasonal Chart is shown below:

Investing in electric vehicle (EV) stocks has become an increasingly attractive option, and one company that stands out in this space is Rivian. Here are a few reasons why buying EV stocks, like Rivian, is considered a wise decision in the current market:

While reviewing our A.I. models we see a solid trend forming for RIVN and one we are looking to take advantage of in the coming days.

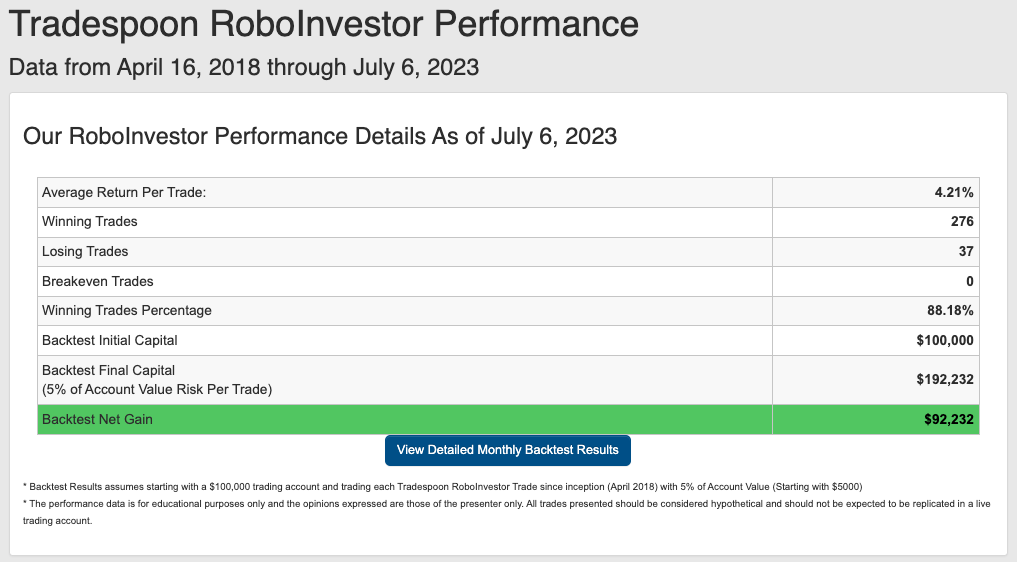

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.18% going back to April 2018.

As we enter the second half of 2023, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!