RoboStreet – October 10, 2024

This week, Wall Street opened with heightened volatility as investors grappled with a combination of inflation concerns, geopolitical conflicts, and shifting expectations for future Federal Reserve rate cuts. The recent release of stronger-than-expected jobs data, along with global uncertainties, has left the market on edge, with all eyes now on key earnings reports and economic indicators that could shape the market’s trajectory through the final quarter of 2024.

The primary driver of this week’s market jitters stems from last Friday’s surprisingly robust jobs report. While the strong labor market is a positive sign for economic growth, it also sparked concerns that the Federal Reserve might delay its anticipated interest rate cuts. A resilient job market suggests inflationary pressures may persist longer than expected, forcing the Fed to keep rates higher for an extended period.

Federal Reserve Chair Jerome Powell addressed these concerns during the National Association for Business Economics (NABE) conference, where he indicated that the Fed would take a more measured approach. Powell emphasized that any future rate cuts would depend on incoming data and that the Fed would avoid aggressive policy changes, preferring instead to maintain stability. This led to a recalibration in market expectations, with investors now anticipating a more gradual pace of rate cuts rather than the swift reductions that were previously priced in.

One of the most closely watched pieces of economic data this week has been the release of September’s Consumer Price Index (CPI) and Producer Price Index (PPI), both of which play a pivotal role in shaping the Federal Reserve’s monetary policy decisions.

The September CPI report showed a year-over-year increase of 2.4%, slightly higher than the anticipated 2.3%, which signaled that inflation, while cooling, remains sticky. Core CPI, which excludes volatile food and energy prices, rose by 3.3% year-over-year—an uptick from August’s 3.2%. On a month-to-month basis, headline inflation rose by 0.2%, while core inflation climbed by 0.3%, exceeding expectations and hinting at continued inflationary pressures beneath the surface.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

This inflation data comes at a critical time, as the Federal Reserve has been under pressure to cut interest rates in response to slowing economic growth. However, persistent core inflation complicates this task. The Fed’s 2% inflation target remains elusive, especially given the resilience of prices in sectors like housing, healthcare, and services, which are more resistant to interest rate changes.

Rising bond yields have also played into the inflation narrative. Following the CPI report, Treasury yields climbed, reflecting a shift in market sentiment as investors recalibrated their expectations for future rate cuts. Higher bond yields generally place downward pressure on equities, adding to the volatility seen across major stock indices.

In addition to the inflation data, the Federal Reserve’s September meeting minutes were released this week, providing deeper insight into the central bank’s internal debates over the path forward for interest rates. The minutes revealed a divided Fed, with officials split between more aggressive and cautious approaches to monetary easing.

A “substantial majority” of Fed officials supported lowering rates by 50 basis points at the September meeting, reflecting concerns over cooling inflation and the need to support economic growth. However, some members advocated for a smaller 25-basis-point cut, arguing that inflation, while declining, was still too high to justify a larger reduction. This internal split underscores the delicate balance the Fed must strike between curbing inflation and fostering growth.

Interestingly, no Fed official has dissented from a rate decision in over two years—a remarkable streak in the central bank’s history. However, the minutes revealed that dissent is brewing beneath the surface, with some members favoring a more restrained approach to avoid fueling inflationary pressures further. This growing divergence among policymakers could influence the pace and scale of future rate cuts.

Fed Chair Jerome Powell, in a press conference following the September meeting, acknowledged the differing views but emphasized that there was “broad support” for maintaining a cautious stance. He reiterated that the size and timing of future cuts would depend heavily on upcoming economic data, including inflation figures, employment reports, and broader global risks.

The combined impact of the CPI report and the Fed minutes suggests that the Federal Reserve is in no rush to implement rapid rate cuts. The persistence of core inflation, coupled with internal divisions among policymakers, points to a measured, data-driven approach in the coming months. While some rate cuts are likely, they may come at a slower pace than markets initially expected.

For investors, this means heightened uncertainty, as inflationary pressures and geopolitical risks continue to weigh on sentiment. The rising bond yields in response to inflation data could also lead to continued pressure on equities, particularly in sectors sensitive to interest rates, such as real estate and utilities.

This week’s market focus shifted to earnings reports from several major companies. Investors are particularly keen on results from JPMorgan Chase, Delta Airlines, and PepsiCo, as these earnings will provide critical insights into the current health of the U.S. economy. Corporate earnings are often a bellwether for broader economic conditions, and the performance of these financial and consumer giants could give a clearer picture of where the economy is headed.

Delta Airlines, for example, reported adjusted earnings that fell short of expectations, largely due to operational disruptions caused by an IT outage in July. This miss, along with other headwinds faced by the airline industry, reflects the operational risks many companies are encountering in the current economic environment. Meanwhile, other sectors, like consumer goods, are expected to provide key updates on how they are navigating the ongoing inflationary pressures.

In addition to domestic economic pressures, global factors are contributing to market volatility. Tensions in the Middle East, particularly concerning Israel’s response to missile strikes from Iran, have caused oil prices to spike. Although supply disruptions have been avoided so far, the market remains jittery, and further escalations could disrupt energy markets and stoke inflation.

At the same time, China’s recent economic stimulus measures have provided a temporary boost to global commodities and markets. While these efforts have alleviated some concerns over a global economic slowdown, the sustainability of China’s recovery remains uncertain, adding another layer of complexity to an already uncertain market outlook.

The first few days of the week have revealed a market balancing between optimism and caution. Inflation remains stubborn, corporate earnings send mixed signals, and geopolitical tensions only heighten global uncertainty. With the Federal Reserve adopting a more cautious stance on rate cuts, external risks are likely to keep volatility elevated as we head toward the end of 2024.

In this environment, investors should remain focused on the long-term, avoiding the temptation to chase short-term market rebounds. While the outlook may seem uncertain, a well-researched, balanced approach can help navigate these turbulent conditions.

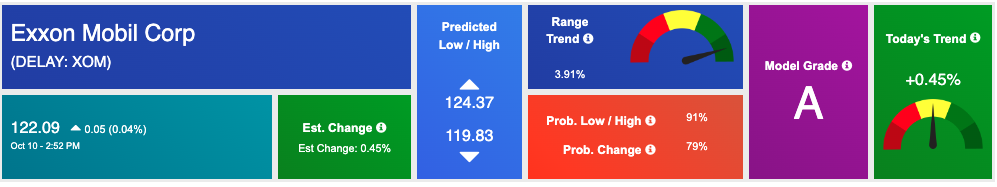

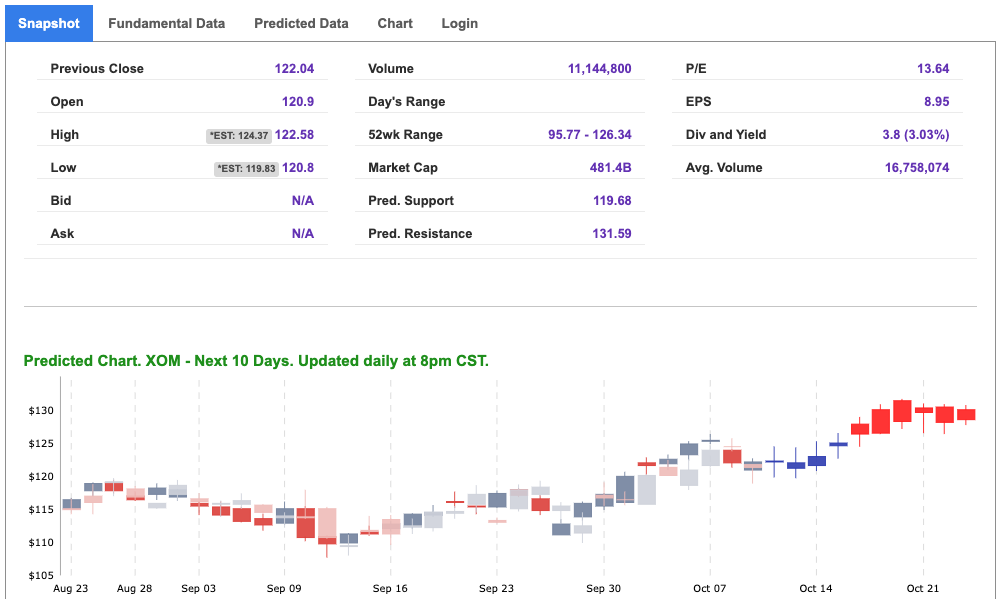

Amid the current market volatility, the energy sector is emerging as a strong contender, with ExxonMobil (XOM) at the forefront. With oil prices surging due to geopolitical unrest and increased global demand, XOM presents a compelling opportunity for the week ahead. External factors are driving the energy market, and ExxonMobil’s strong position allows investors to take advantage of these dynamics.

This past week, escalating tensions in the Middle East, especially between Israel and Iran, have heightened concerns over potential disruptions to oil supply. While a direct conflict hasn’t occurred, the mere threat of destabilization has pushed crude oil prices above $90 per barrel, up significantly from last week. With the possibility of further unrest, oil prices may remain elevated, offering a tailwind for ExxonMobil, one of the world’s largest integrated energy companies.

As a global leader in oil and gas exploration, production, and refining, XOM is well-positioned to benefit from rising oil prices. The company generates substantial revenue from its upstream operations, where higher crude prices can significantly boost profit margins.

ExxonMobil recently posted strong earnings, bolstered by improved performance in its upstream and chemicals businesses. The company exceeded expectations, with quarterly revenue of $82.91 billion and a net income of $9.07 billion, translating to earnings per share (EPS) of $2.27. Additionally, XOM offers an attractive dividend yield of around 3.3%, making it appealing for investors seeking both growth and steady income.

The energy sector overall has been outperforming others in recent weeks, thanks to the rally in crude oil prices and strong earnings reports. The Energy Select Sector SPDR Fund (XLE), which includes ExxonMobil, has risen by 8.5% over the past month, outpacing flat or declining performances in sectors like technology and real estate. This momentum could persist into the coming week, especially with ongoing concerns about global oil supply.

Moreover, ExxonMobil is advancing its clean energy efforts, particularly in carbon capture technology. These long-term sustainability initiatives further solidify XOM’s position as a forward-thinking player in an evolving energy landscape.

From a technical standpoint, XOM is exhibiting strength, with support around the $110 level. The stock has seen increased buying interest, and indicators suggest a potential breakout toward its 52-week high of $120, driven by sector momentum.

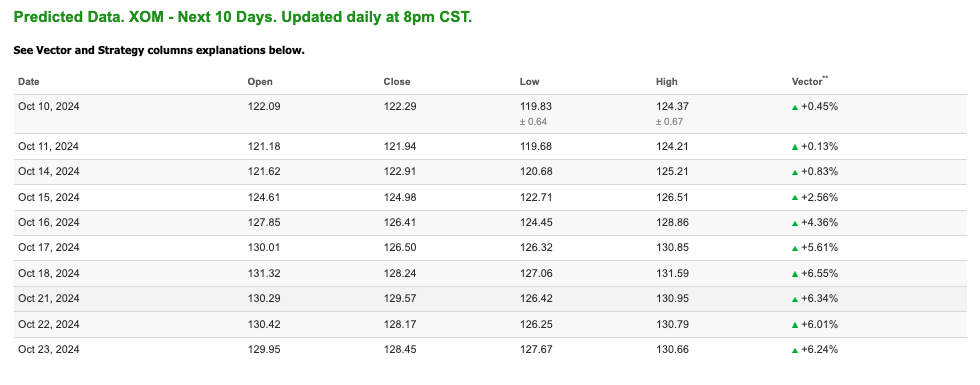

Our A.I.-driven models at Tradespoon have flagged ExxonMobil as a top pick for the coming week. With a bullish trend emerging and oil prices continuing to rise, XOM stands out as a favorable trade for both short-term profits and long-term investment. Just take a look at the 10-day predicted data for XOM:

Given the combination of rising oil prices, solid earnings, a reliable dividend, and technical momentum, ExxonMobil (XOM) is well-positioned as our Trade of the Week. Investors looking to capitalize on current market conditions and energy sector strength should consider adding XOM to their portfolios.

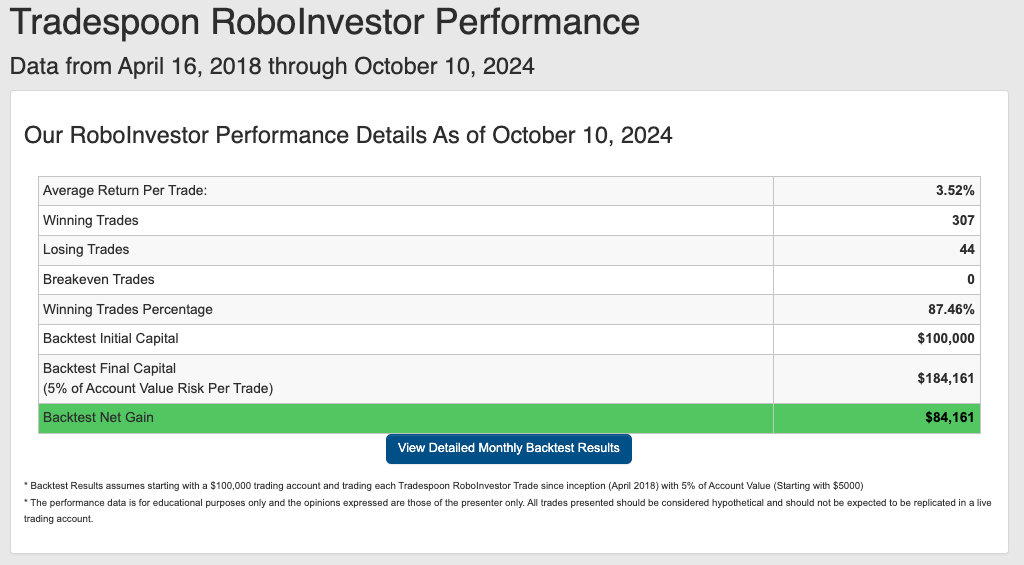

Enhance your investment decisions by leveraging the power of AI with our RoboInvestor stock and ETF advisory service. Utilizing advanced technology, this service identifies trades with a high probability of profitability. Our proprietary AI platform cuts through market noise and removes emotional biases, delivering clear, data-driven insights and strategies to help you succeed in today’s dynamic market environment.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.46% going back to April 2018.

As we advance further in Q4, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!