In the focal point of the financial world this week were crucial economic indicators, corporate earnings, and the Federal Reserve’s pivotal decision. The market landscape saw a notable shift as investors redirected their attention to Treasury bonds ($TLT) while divesting from tech stocks like $QQQ. The catalyst for this move was the less-than-stellar forward guidance from major players such as $AMD and $GOOGL. With the earnings season for Fortune 500 companies concluding, the focus shifted to macroeconomic data and the ongoing debate between a soft landing and recession narrative.

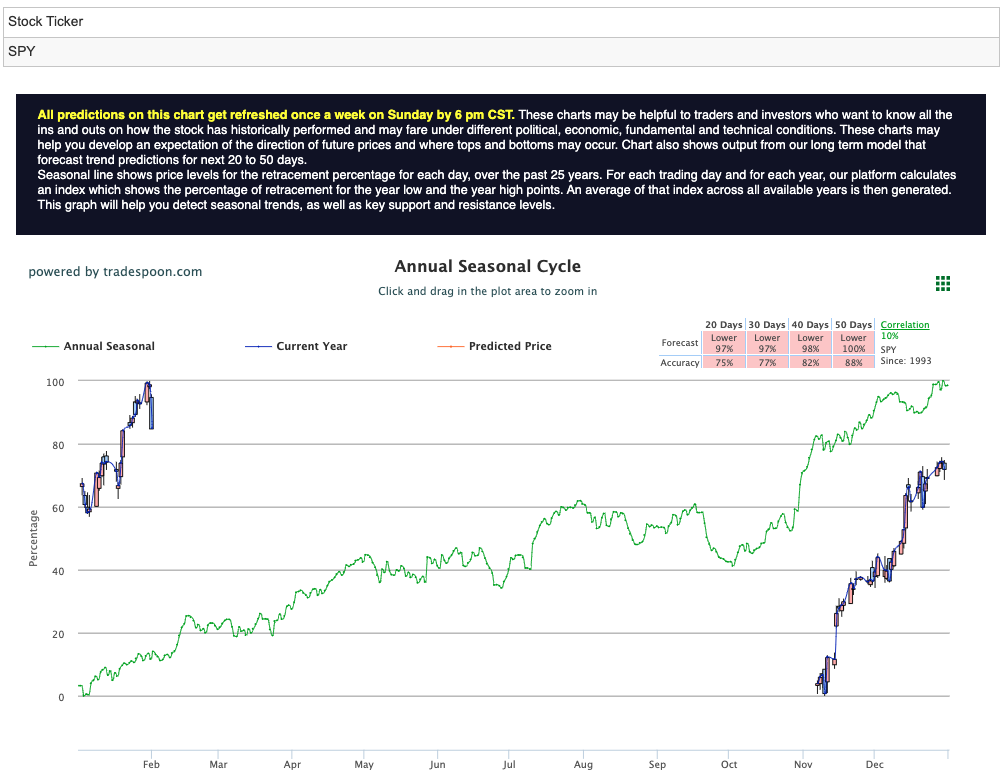

A significant development in Europe was the substantial drop in inflation, signaling a cooling economy in the region. Meanwhile, the U.S. markets reached all-time highs, with the S&P 500 nearing the 500 level. However, signs of a potential recession emerged as interest rates started to reverse, highlighting a shift in the correlation between treasuries and equities. The risk of a recession loomed large as the market grappled with patterns of higher highs and higher lows, while the consensus capped the SPY rally at $470-500 levels. To provide a visual reference, the SPY Seasonal Chart is presented below:

Amidst the cautious optimism, the week began with U.S. stocks showing minor fluctuations as investors braced for a flurry of corporate earnings releases and the Federal Reserve’s monetary policy decision. Tech giants Microsoft and Apple took center stage on Monday, contributing to a positive market sentiment. The upcoming earnings releases included major players like AMD, Google-parent Alphabet, Microsoft, Apple, and Amazon, collectively constituting 28% of the S&P 500 index.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Tuesday witnessed Big Pharma earnings kick-off with Pfizer beating expectations, while General Motors posted solid results. However, UPS announced a significant workforce reduction of 12,000 employees. Oil rebounded due to geopolitical risks in the Red Sea, involving Houthi rebels and affecting 10-15% of global oil shipping. Bitcoin stabilized around the key support level of $40,000. Gold (GLD) reversed its course on a dollar rebound.

Wednesday marked a crucial juncture as the Federal Reserve announced its decision to maintain interest rates, aligning with widespread expectations. The Federal Open Market Committee, in a unanimous decision, kept the target range for the federal funds rate at 5.25%-5.50%. Notably, the decision lacked language implying imminent interest-rate increases, signaling a shift in the central bank’s stance.

Fed Chair Jerome Powell, in the post-meeting press conference, reiterated concerns about persistently high inflation, emphasizing that it was “still too high.” Powell dismissed the possibility of a rate cut in March, providing clarity on the central bank’s approach. This communication led to a strengthening of the dollar and a dip in the 10-year yield to 3.95%. Market participants absorbed Powell’s statements, adjusting expectations for future rate cuts, with the implied probability dropping to 35%, the lowest in over two months, according to Deutsche Bank.

Investors now closely watch the Fed’s forward guidance, seeking insights into the central bank’s strategy amid economic uncertainties. The consensus among market participants leans towards the belief that the Fed has concluded its rate-hiking cycle for the current year and the next. This sentiment is perceived as favorable for the market, with a potential impact on various asset classes, especially the “magnificent 7” stocks.

Following the Fed decision, the market exhibited a recovery as investors digested Powell’s comments and the decision to maintain the federal funds rate. Despite short-term pullbacks, the pattern of higher highs and higher lows was expected to persist into the next year. The focus shifted to earnings releases from major tech companies like Amazon.com, Apple, and Meta Platforms.

The earnings season kicked off with a focus on major tech players, contributing to 28% of the S&P 500 index. Tech giants such as Microsoft and Apple were in the spotlight on Monday, setting a positive tone for the market. However, the week unfolded with a mixed bag of earnings results. Notable beats came from Pfizer in the pharmaceutical sector, while General Motors posted solid results. On the other hand, tech giants like Microsoft and Alphabet disappointed with their earnings reports, triggering a Wednesday market plunge.

The spotlight then shifted to Apple, Amazon.com, and Meta Platforms on Thursday, offering a comprehensive view of the health of both the tech sector and the broader market. These earnings reports held particular significance as they provided insights into consumer behavior and the overall economic landscape. Investors awaited these reports to gauge the momentum and sustainability of the market rally, especially in the wake of the Federal Reserve’s decision.

Thursday saw a rise in stocks as investors awaited earnings reports from major technology companies. Apple, Amazon.com, and Meta Platforms were set to report, offering insights into the health of small businesses and consumers. The market continued to digest the Federal Reserve’s decision, which dampened hopes for an immediate rate cut.

Amidst the corporate earnings and Fed decision, the Institute for Supply Management’s Purchasing Managers Index (PMI) provided a glimpse into the health of the manufacturing sector. The PMI for January came in at 49.1, surpassing the December reading of 47.1 and beating economists’ expectations of 47.2. While this indicated an improvement, it also highlighted that the U.S. manufacturing sector had contracted for 15 consecutive months.

The data suggested a slower rate of contraction, with more orders flowing into the manufacturing industry. This offered a measure of comfort to investors, indicating a potential stabilization in a key driver of the U.S. economy. Despite the positive shift, the manufacturing sector’s prolonged contraction underscored the challenges and uncertainties prevailing in the broader economic landscape. Investors closely monitored this data point as part of the broader effort to assess the overall health and trajectory of the economy.

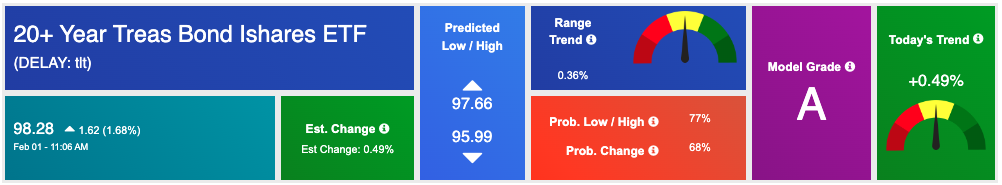

As market dynamics shift, I am strategically turning my attention towards Treasuries, notably the iShares 20+ Year Treasury Bond ETF ($TLT). TLT tracks long-term U.S. Treasury bonds, providing diversified exposure to government debt with maturities of 20 years or more. Recognized for its stability and income-generating potential, $TLT has become a focal point in times of economic uncertainty.

Given the intricate dance between interest rates, earnings reports, and economic indicators, $TLT emerges as an attractive investment in the current market landscape. As the Federal Reserve maintains a cautious stance and the specter of recession looms, investors seek refuge in the relative safety of long-term Treasuries.

The inverse correlation between treasuries and equities, which has reversed course in the last two years, adds weight to $TLT’s appeal. With the potential signs of a recession influencing interest rates, $TLT stands out as a strategic choice. Investors are recalibrating portfolios, shifting away from riskier assets like tech stocks ($QQQ) after weaker earnings guidance, and towards the stability offered by long-term Treasuries.

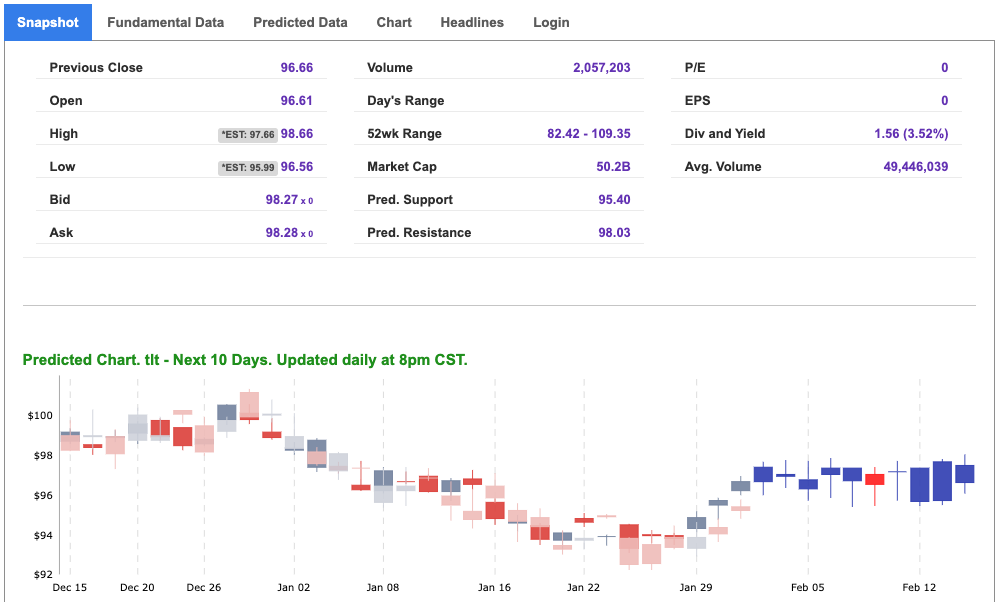

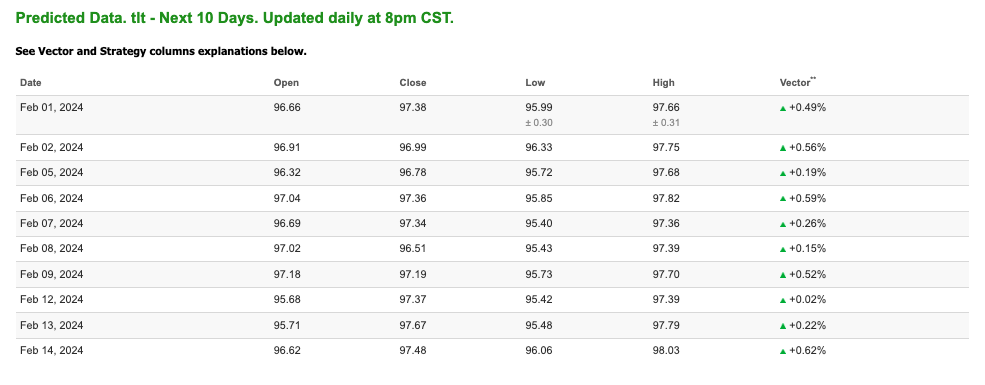

Moreover, the macroeconomic data, including a slowdown in Europe and the manufacturing sector’s contraction in the U.S., amplifies the attractiveness of $TLT. Its track record of providing a hedge against market volatility positions it as a prudent choice in times of uncertainty. Just take a look at my A.I.’s 10-Day Predicted Data for TLT:

In essence, $TLT emerges as a prudent investment amid the current market turmoil, offering a balanced blend of stability, income potential, and strategic positioning in response to the evolving economic landscape.

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

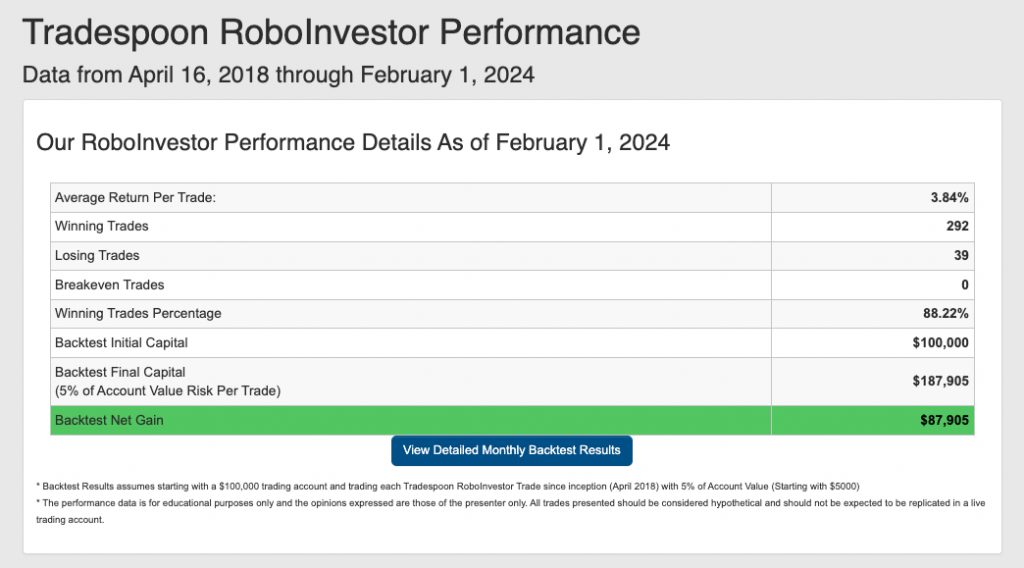

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.22% going back to April 2018.

As we step into 2024, investors are confronted with a complex market scenario shaped by elements like inflationary forces, evolving Federal policies, and persistent geopolitical tensions, such as the ongoing conflict in Ukraine. Successfully maneuvering through this intricate landscape demands a dependable and well-informed investment platform. This is where RoboInvestor proves its worth, acting as a reliable ally by providing a spectrum of invaluable resources and expert guidance. With RoboInvestor at your service, you can adeptly oversee your portfolio and capitalize on lucrative opportunities within the dynamic and fast-paced market environment.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!