RoboStreet – March 20, 2025

This week, the stock market was largely dictated by the latest Federal Open Market Committee (FOMC) decision, ongoing tariff escalations, and geopolitical developments, including discussions of a potential ceasefire between Russia and the U.S. After an initial rally following Fed Chair Jerome Powell’s press conference on Wednesday, the S&P 500 and Nasdaq lost some steam as Powell addressed key policy concerns, including trade, immigration, and fiscal regulation. Markets picked up momentum earlier in the week after the FOMC confirmed that interest rates would hold steady at its March meeting.

Adding to the volatility, earnings season played a significant role in market sentiment, with key reports from Micron Technology ($MU) and FedEx ($FDX). The VIX spiked to 24, reflecting increased uncertainty, while major indices consolidated near their 200-day moving averages, maintaining a 10% pullback from recent highs.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The Federal Open Market Committee (FOMC) held interest rates steady but signaled that two rate cuts are still expected this year. The Fed also updated its Summary of Economic Projections, commonly referred to as the “dot plot.”

While all policymakers voted unanimously to maintain the current rate, there was disagreement over the pace of balance sheet reduction. One key revision in the Fed’s outlook was an expectation for higher inflation in 2025. The Fed now forecasts gross domestic product (GDP) growth of 1.7% in 2025, a downgrade from the 2.1% projection in December, reflecting economic uncertainty.

The fourth-quarter GDP growth rate slowed to 2.3% annually, down from 3.1% in the third quarter. Forecasts for 2026 and 2027 also saw slight downward revisions, with 2026 now projected at 1.8% (down from 2%) and 2027 at 1.8% (previously 1.9%).

A key driver of the inflation outlook is the expected implementation of new tariffs next month, which could drive up prices. However, Powell suggested that inflation stemming from tariffs could be “transitory,” and the Fed does not anticipate responding unless inflation proves to be persistent. While consumer spending remains resilient, Powell noted early signs of a slowdown as Americans grow more cautious amid economic policy shifts. Uncertainty surrounding trade policies and their long-term effects has made forecasting economic conditions more challenging for policymakers.

In response to shifting economic conditions, the Fed will maintain its monthly redemption cap on agency debt and mortgage-backed securities at $35 billion. However, Fed Governor Christopher Waller dissented, preferring to continue the current pace of securities reductions. Powell also acknowledged that economic policy changes, such as increased tariffs, could have broader repercussions that are not yet fully understood. Policymakers remain cautious about their long-term forecasts, acknowledging the difficulty in predicting future economic outcomes given the uncertainty in fiscal policy and global trade relations.

Micron Technology ($MU): The semiconductor giant reported strong second-quarter earnings, surpassing expectations. Revenue guidance was particularly impressive, with a midpoint forecast of $8.8 billion—up 51% year-over-year and exceeding Wall Street’s consensus of $8.5 billion. Micron’s performance was driven by its NAND storage segment, which, while growing at a slower pace than DRAM, exceeded analysts’ expectations. As a result, Micron stock surged 4.5% in after-hours trading.

FedEx ($FDX): The logistics giant posted solid quarterly earnings but lowered its full-year financial guidance. Despite reporting higher year-over-year earnings and profit margins, FedEx faced significant headwinds, leading to a slight earnings miss. Investors reacted negatively, sending FedEx stock down 4.8% in after-hours trading to $234.50. Before the report, the stock had already declined about 12% year-to-date. The company continues to navigate challenges such as fluctuating shipping demand and cost pressures, making future performance uncertain.

Five Below ($FIVE): The discount retailer saw a modest 0.7% gain after reporting better-than-expected fourth-quarter earnings. While same-store sales declined by 3%, the drop was narrower than analysts’ forecasts of a 3.3% decline. Five Below also issued a stronger-than-expected revenue outlook for its fiscal first quarter, projecting $905 million to $925 million, surpassing estimates of $900 million. The company’s ability to outperform expectations despite economic pressures highlights resilience in the discount retail sector.

Thursday’s trading session opened lower but rebounded slightly as Wall Street attempted to extend Wednesday’s rally. Jobless claims and the Philly Fed Index came in better than expected, but major indexes struggled to maintain momentum as the day progressed.

Real estate stocks initially gained after a positive existing home sales report but lost ground later in the day, finishing down 0.1%. One factor behind this decline was the 10-year Treasury yield, which rose back to 4.24% after an earlier dip.

Labor market data showed that 223,000 Americans filed for initial jobless benefits last week, slightly up from 221,000 the previous week. Continuing claims—measuring the number of unemployed individuals receiving benefits—climbed to 1.89 million from 1.86 million. Despite federal government layoffs, the broader labor market remains relatively stable for now.

The 10-year Treasury yield remains highly volatile, fluctuating between 3.6% and 4.8%. This week, lower inflation data helped push yields lower, providing some relief for equity markets. However, concerns remain about whether the Fed will be able to deliver the anticipated rate cuts later this year given the mixed signals in economic data.

Market conditions remain neutral, with the S&P 500 trading sideways as inflation aligns with expectations and earnings season outperforms forecasts. However, risks persist, particularly with interest rates likely to stay elevated longer than initially anticipated and unemployment showing signs of gradual increase.

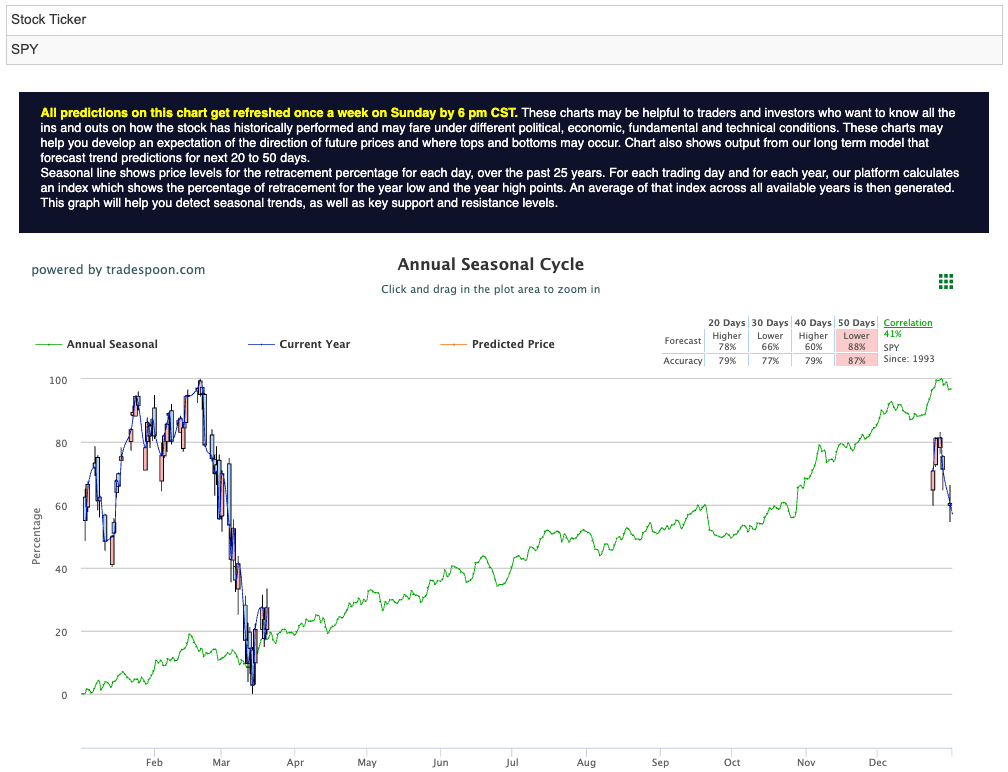

Looking ahead, the S&P 500 could rally toward the $580–$600 range in the coming months, while short-term support remains in the $530–$550 zone. In the near term, a continuation of sideways trading is expected, while the long-term trend remains under pressure due to ongoing economic and policy uncertainties. For reference, the SPY Seasonal Chart is shown below:

Investors will continue to monitor corporate earnings, inflation reports, and central bank policies for further direction. With the Fed maintaining a cautious stance, markets are likely to remain volatile as new economic data shapes expectations for future rate cuts.

A well-balanced, diversified strategy is crucial to navigate this complexity. Investors should remain agile—capitalizing on opportunities as they arise, while protecting against potential risks. Staying informed throughout earnings season and as macroeconomic conditions unfold will be vital for making sound decisions.

Despite challenges, the market presents opportunities for growth and strategic positioning. By monitoring key indicators and maintaining a disciplined approach, investors can confidently chart a course forward.

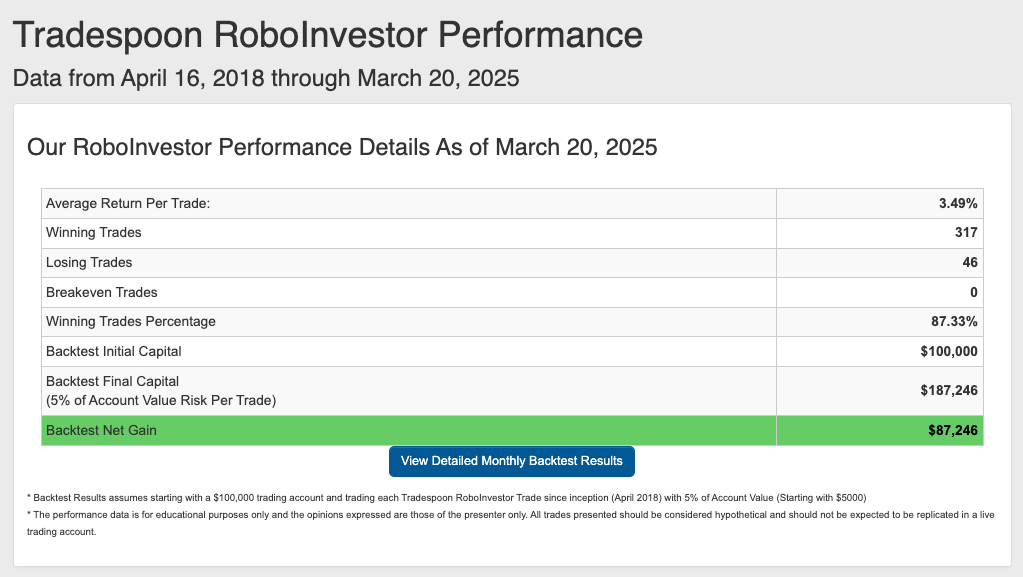

Unlock smarter investment decisions with our RoboInvestor stock and ETF advisory service, powered by advanced AI. This cutting-edge technology identifies trades with high-profit potential, cutting through market noise and eliminating emotional bias. With clear, data-driven insights and strategies, RoboInvestor helps you navigate today’s ever-changing market with confidence and precision.

Every other weekend, subscribers receive an exclusive newsletter packed with my market analysis, technical outlook, updates on existing positions, and one or two fresh trade recommendations to act on when the market opens on Monday.

RoboInvestor is a flexible, unrestricted service. I may recommend blue-chip stocks or ETFs representing major indexes, market sectors, commodities, currencies, interest rates, and even shorting opportunities using inverse ETFs. Our model portfolio typically holds between 12 to 25 positions, adjusting based on market conditions. Recently, we’ve adopted a more cautious approach, focusing on a smaller, more selective set of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.33% going back to April 2018.

As we enter 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!