This week, financial markets were captivated by the latest earnings reports and insights from the Federal Reserve’s Beige Book. Semiconductor stocks faced a significant selloff after Bloomberg reported that the Biden Administration is contemplating tighter export restrictions to China. Meanwhile, interest-sensitive stocks, such as small caps ($IWM) and banks ($XLF), rallied strongly following a lower-than-expected CPI print last week. Small caps are now on the brink of retesting their 2021 highs, driven by a catch-up trade.

By Thursday afternoon, the stock market was broadly lower, with technology shares leading the decline and pulling the Dow down with them. Investors, anticipating a Federal Reserve rate cut in September, have been rebalancing their portfolios away from tech stocks towards other sectors. Lower interest rates are expected to stimulate the broader economy, benefiting various non-tech industries.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The week commenced with significant earnings reports from major banks, setting the stage for the second-quarter earnings season. JP Morgan Chase led the way with earnings and revenue that surpassed Wall Street expectations, signaling robust performance. However, the results from other large U.S. banks were mixed, reflecting ongoing challenges posed by high interest rates. Wells Fargo reported better-than-expected earnings and revenue, yet its stock dipped in premarket trading. In contrast, Citigroup shares rose after exceeding earnings expectations, highlighting investor confidence in its financial stability.

UnitedHealth’s stock surged on Tuesday after the health insurance giant posted better-than-expected earnings, easing investor concerns about potential cost increases stemming from a February cyberattack on a subsidiary. Retail sales in June, meanwhile, provided a mixed but insightful picture. Contrary to Wall Street’s forecast of a decline, retail sales remained flat, suggesting resilience in consumer spending. Economists had predicted a 0.3% decrease, but the actual data showed no change, underscoring the unexpected strength of consumer behavior despite economic uncertainties.

May’s retail sales were revised higher to a 0.3% increase, further bolstering the narrative of sustained consumer activity. June’s retail sales, excluding auto and gas, saw a notable 0.8% rise, surpassing the consensus estimate of a 0.2% increase. The control group within the retail sales report, which excludes volatile categories and directly impacts GDP calculations, experienced a 0.9% increase, significantly higher than the anticipated 0.2% rise. These figures indicate that consumer spending remains robust, driven by sectors beyond the automotive and gas industries.

On Wednesday, stocks traded mostly lower, with chip stocks suffering significant losses. Investors shifted their focus from mega-cap tech names to small-cap stocks amid fears of further trade restrictions. The Nasdaq Composite dropped by 2.8%. Market breadth improved following last week’s mild inflation report, with small-cap stocks gaining as investors anticipated a rate cut benefiting a broader range of sectors beyond technology.

The Federal Reserve’s Beige Book, released Wednesday, painted a picture of a softening U.S. economic activity over the past two months. Five of the 12 Fed regions reported flat or declining activity, an increase from the previous report. This deceleration was attributed to slowing economic growth, a cooling labor market, and uncertainties arising from upcoming elections and geopolitical conflicts.

Labor market conditions showed signs of improvement as labor turnover declined, reducing the demand for new workers. While most districts reported slight to modest growth, the increase in regions noting flat or declining activity highlights growing economic concerns. Consumer spending saw reductions in several districts, reflecting increasing economic uncertainty. The overall economic outlook for the next six months remains uncertain, with potential headwinds from geopolitical tensions, inflation, and domestic political developments.

Thursday witnessed a broad market downturn, with the tech selloff extending to other sectors. Despite an initial rebound, the Nasdaq struggled under the weight of potential stricter export curbs to China. President Biden’s comments on a possible trade war in the semiconductor industry further unsettled the market. Major tech stocks like Amazon, Apple, and Alphabet saw significant declines, while Nvidia remained relatively stable.

Seasonally adjusted initial jobless claims rose by 20,000 in the latest week, and June’s CPI increased by 3.0% year-over-year. The Conference Board’s Leading Economic Index (LEI) dropped by 0.2% to 101.1 in June, marking its fourth consecutive monthly decline. Although the rate of decline has slowed, the long-term growth outlook remains moderately negative.

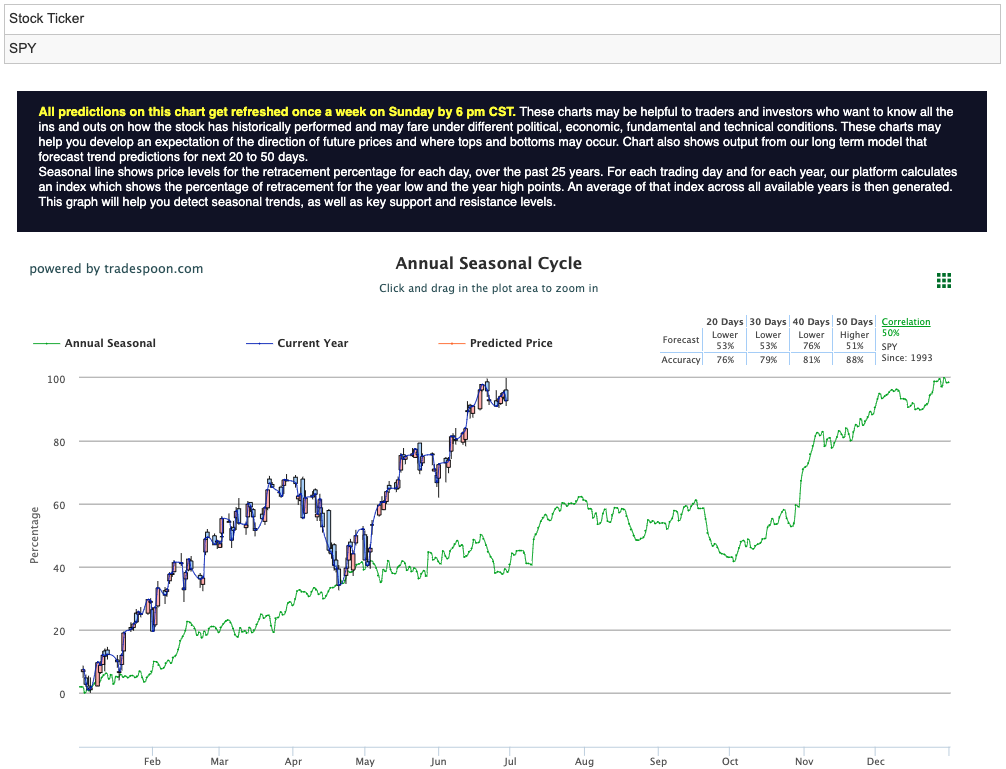

The market remains volatile as participants adjust their expectations for rate cuts. Despite this, the SPY is projected to see a rally capped at $560-$575, with short-term support at $520-$530 over the next few months. The outlook remains bullish, with anticipated higher highs and higher lows, though risks from a cooling economy and potential bank failures due to real estate exposure persist. For reference, the SPY Seasonal Chart is shown below:

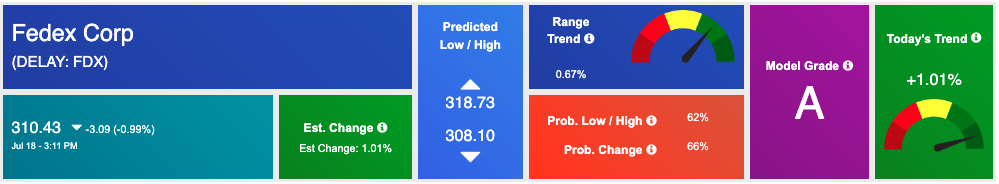

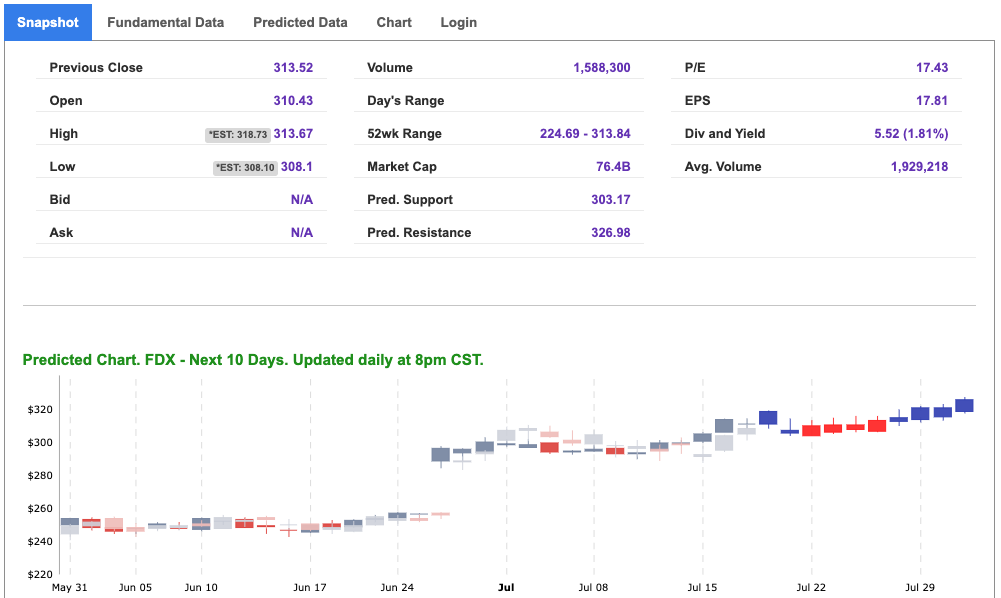

Amid the current market dynamics, one stock that stands out as a strong symbol is FedEx (FDX). The broader market’s shift away from tech stocks, coupled with positive earnings surprises in various sectors, sets the stage for potential gains in logistics and transportation stocks like FedEx.

Given the market’s reallocation from technology to sectors likely to benefit from a broader economic recovery, FedEx is well-positioned. As retail sales show unexpected resilience, with June’s retail sales excluding auto and gas rising by 0.8%, demand for logistics services is likely to remain strong. This increased consumer spending, particularly in e-commerce, directly benefits FedEx’s core business.

Additionally, the potential rate cuts by the Federal Reserve in September could further bolster economic activity, increasing shipping volumes and improving profit margins for logistics companies. FedEx’s extensive network and efficient operations make it a prime candidate to capitalize on these trends.

Moreover, with the Federal Reserve’s Beige Book indicating improved labor supply conditions and reduced labor turnover, operational efficiencies at FedEx are likely to improve, reducing costs and enhancing profitability. This is particularly pertinent as labor market stabilization helps FedEx manage its workforce more effectively, maintaining service quality while controlling expenses.

In summary, the combination of resilient consumer spending, potential economic stimulus from rate cuts, and improved labor market conditions makes FedEx a compelling buy for the upcoming week. Investors looking to diversify their portfolios away from tech and towards sectors with strong growth prospects could consider adding FedEx to their holdings.

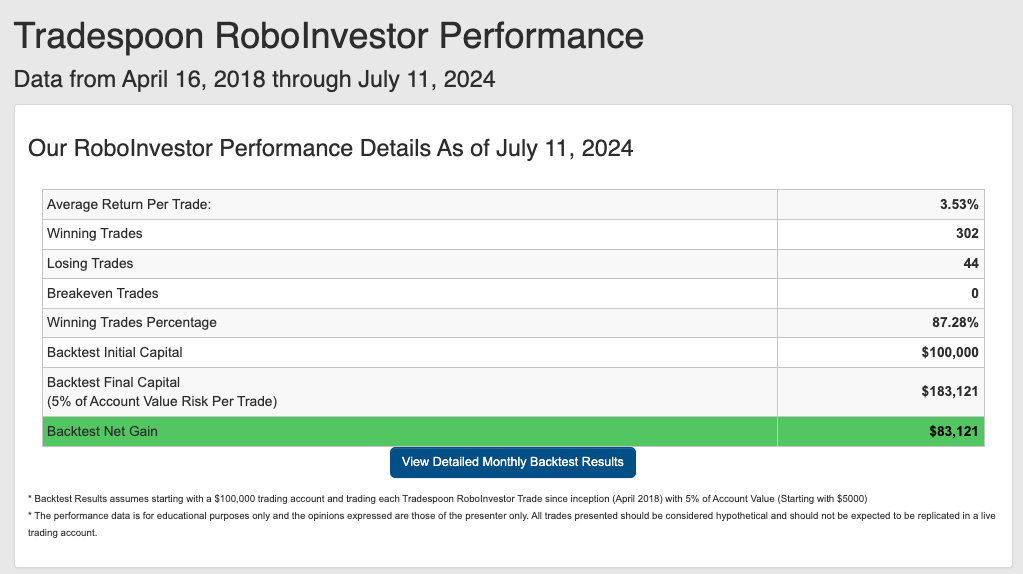

Harnessing the power of AI, our RoboInvestor stock and ETF advisory service leverages cutting-edge technology to pinpoint trades with a high probability of profitability. Our proprietary AI platform eliminates the noise and emotional factors that often influence investor decisions, providing our members with clear, data-driven insights and strategies for success.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.28% going back to April 2018.

As we move beyond the halfway mark of 2024 and into the dog days of summer, investors continue to navigate a challenging market landscape. Persistent issues like inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine, shape the current investment environment. In these uncertain times, the role of a reliable and knowledgeable investment partner becomes increasingly vital for making informed decisions amidst fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!