RoboStreet – December 19, 2024

The final full trading week of 2024 delivered a rollercoaster of market activity, with mixed results across major indexes and a surge in volatility driven by critical central bank decisions, corporate earnings reports, and economic data. While the Nasdaq Composite hit a record high, the Dow Jones Industrial Average was weighed down by weakness in the healthcare and energy sectors, snapping a 10-day losing streak only late in the week. Meanwhile, the S&P 500 posted modest gains, underscoring the market’s resilience amid uncertainty.

On December 18, the Federal Reserve delivered its third consecutive interest rate cut, lowering the federal funds rate by 25 basis points to a range of 4.25%–4.50%. While widely anticipated, the move was accompanied by signals that the pace of rate cuts in 2025 would be slower than markets had hoped. Fed Chair Jerome Powell emphasized “policy uncertainty” surrounding President-elect Donald Trump’s proposed tax reforms, tariffs, and immigration policies, penciling in only two rate cuts for next year versus the four expected by investors.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

This cautious stance sent shockwaves through equities. The Dow dropped over 1,100 points, the Nasdaq Composite fell 3.6%, and the S&P 500 suffered a 2.9% decline—the steepest in four months. Treasury yields also spiked, with the 10-year yield rising to 4.561%, further pressuring stocks. The yield on the 2-year Treasury note climbed to 4.363%, reflecting heightened concerns about sticky inflation and a slower path to monetary easing.

Inflation, as measured by the Personal Consumption Expenditures (PCE) price index, remains a central focus for the Federal Reserve. The core PCE, due Friday, is expected to reflect persistent price pressures. Fed officials project inflation to end 2025 at 2.5%, higher than the 2.1% estimated in September. Powell acknowledged that while progress has been made, inflationary trends remain stubborn, and the central bank is committed to achieving its 2% target.

Despite this, some market participants remain optimistic. Cooling inflation data earlier in the quarter and better-than-expected earnings results from major corporations have bolstered the bullish case.

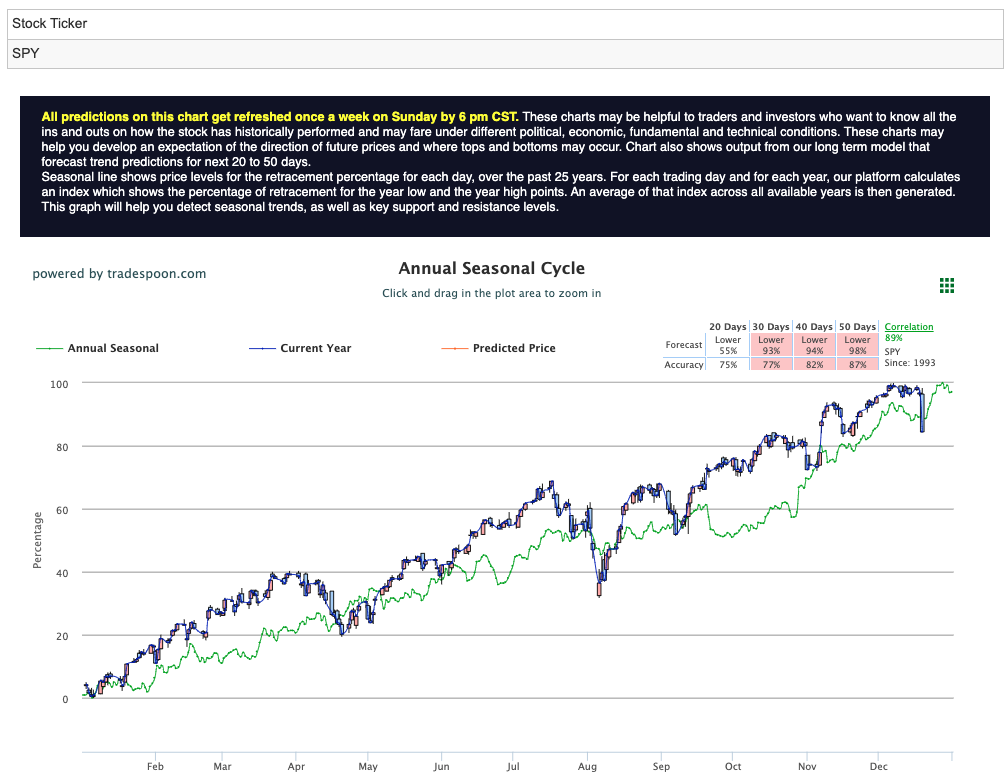

From a technical perspective, the S&P 500 (tracked by the SPDR S&P 500 ETF, SPY) continues to eye significant resistance at $620–$640, with short-term support between $560–$580. Analysts anticipate a potential year-end rally, supported by the market’s long-term upward trend and historical patterns following Fed pauses. For reference, the SPY Seasonal Chart is shown below:

However, risks remain. The broader economy is cooling, unemployment is ticking up, and small banks face potential challenges due to exposure to commercial and residential real estate. The possibility of a recession in 2025 looms large, adding to investor caution.

This week’s earnings season contributed significantly to market volatility, with results shaping sector performance across the board. Electronics manufacturing giant Jabil delivered robust earnings that exceeded expectations, leading to a notable surge in its stock price. On the other hand, General Mills struggled, slashing its full-year guidance and dragging down other food industry stocks as investors reassessed growth prospects in the consumer staples sector.

Sector-wise, utilities, financials, and communication services led the way, benefiting from a combination of defensive positioning and optimism around economic resilience. In contrast, healthcare, materials, and real estate were the weakest performers, reflecting broader concerns about rising interest rates and ongoing challenges in commercial real estate markets. Adding to the mix, international central banks played their part: the Bank of England held rates steady while signaling caution for 2025, and the Bank of Japan maintained its ultra-loose policy as it awaited further wage data in the spring. These international decisions further influenced global financial sector dynamics.

Crude oil markets faced downward pressure this week, driven by concerns over weakening Chinese demand and the anticipation of increased U.S. production under the new Trump administration. This combination weighed heavily on energy stocks, amplifying sector volatility.

Treasury yields spiked after the Federal Reserve’s latest interest rate cut and guidance for 2025. The yield on the 10-year Treasury note climbed to 4.561%, reflecting lingering concerns about inflation and economic uncertainty. Meanwhile, the U.S. Dollar Index surged to its highest level in two years, buoyed by the Fed’s tempered outlook for future rate cuts.

Gold prices, traditionally seen as a hedge against inflation, dropped 1.1% following the Fed’s announcement. Investors appeared to move away from safe-haven assets, reassessing risk exposure in light of the Fed’s signals and global central bank activity.

Market uncertainty was on full display this week, with the CBOE Volatility Index (VIX) spiking 22% midweek to hit 19.36, before settling at 23.32—a level signaling elevated volatility. The surge was fueled by mixed signals on inflation, economic resilience, and the Federal Reserve’s cautious approach to rate cuts in 2025.

Adding to the sentiment shift, global factors played a role. The Bank of England’s rate pause and the Bank of Japan’s decision to maintain current policies highlighted contrasting international monetary stances, creating ripples across global equity and bond markets. The international backdrop, coupled with the Fed’s recalibrated expectations, underscored the complexity of navigating economic uncertainties heading into 2025.

As the markets digest these developments, investors remain focused on inflation metrics and central bank decisions, with heightened volatility expected to persist.

Looking ahead, analysts predict heightened volatility in the first quarter of 2025, with potential corrections offering opportunities for investors to reassess portfolios. The labor market, inflation trajectory, and Fed policy will remain key drivers.

While risks persist, I remain in the bullish camp as new market highs are within reach. With inflation coming within expectations and corporate earnings exceeding forecasts, the long-term trend remains intact. However, caution is warranted as we approach the new year, given economic cooling and potential stress in the banking sector.

As markets digest this week’s developments, investors should focus on maintaining a balanced strategy, seizing opportunities during pullbacks, and preparing for what could be a pivotal year ahead.

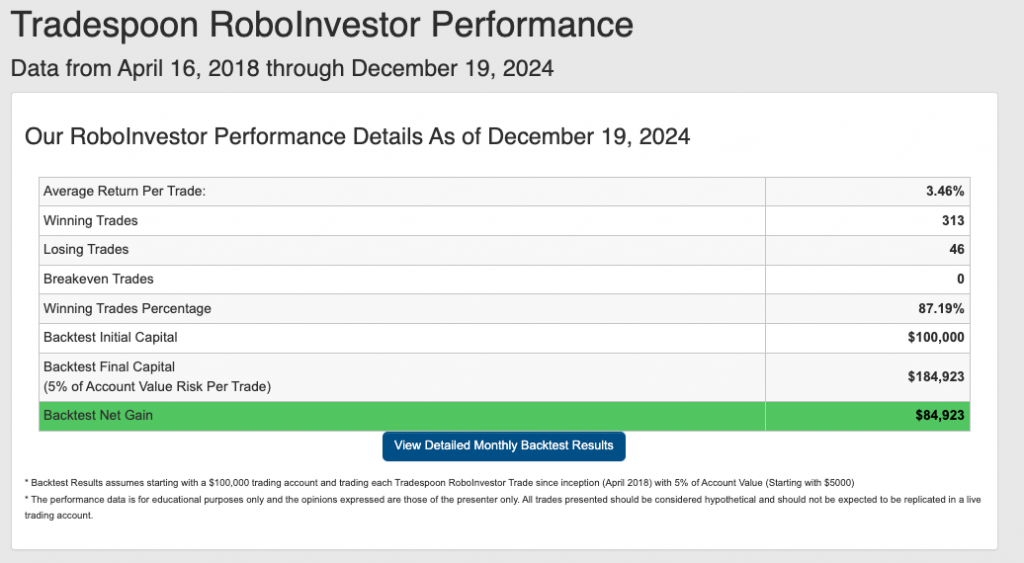

Enhance your investment decisions by leveraging the power of AI with our RoboInvestor stock and ETF advisory service. Utilizing advanced technology, this service identifies trades with a high probability of profitability. Our proprietary AI platform cuts through market noise and removes emotional biases, delivering clear, data-driven insights and strategies to help you succeed in today’s dynamic market environment.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.19% going back to April 2018.

As we near 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!