On Monday, U.S. markets exhibited resilience as major indices, including the Dow Jones Industrial Average, S&P 500, and Nasdaq, inched higher following a tumultuous week. The Dow closed up 24 points, remaining mostly flat, while the S&P 500 gained 0.2%, approaching its record high. The Nasdaq Composite also made a modest rebound, rising 0.1%. However, this calm was briefly disrupted by weaker-than-expected U.S. manufacturing data, with the S&P Global Flash U.S. Manufacturing PMI for September falling to 47 from 47.9 in August, signaling ongoing contraction in the sector. As the news broke, the Dow dipped momentarily but recovered to close up 17 points, reflecting a 0.1% increase, while the S&P 500 and Nasdaq saw gains of 0.2% and 0.3%, respectively.

This week, several Federal Reserve officials, including Chicago Fed President Austan Goolsbee and Minneapolis Fed President Neel Kashkari, are set to address the markets, and their remarks will be closely monitored following the Federal Open Market Committee’s (FOMC) unexpected half-point interest rate cut. Initially welcomed by investors, this aggressive move has since raised concerns that it may signal deeper economic troubles ahead.

As Treasury yields continued to climb last week, market participants grappled with the notion that the rate cut could serve as a defensive strategy against a potential recession or a reaction to slowing economic growth. Compounding the uncertainty, the economic calendar is packed, highlighted by the upcoming release of the Personal Consumption Expenditures (PCE) price index on Friday—a key inflation measure the Fed closely monitors. This data is expected to significantly influence the market’s trajectory, with lingering questions about whether inflation will ease enough for the Fed to consider further rate cuts.

Across the Atlantic, weak manufacturing data weighed heavily on European markets. The manufacturing PMIs for France and Germany both came in below expectations, with readings under 50 signaling contraction in business activity. This disappointing data triggered a selloff in the euro, which dropped as much as 0.7% against the U.S. dollar before recovering slightly.

The euro’s decline highlights investor fears that the European Central Bank (ECB) may be forced to cut interest rates sooner than anticipated to support the struggling eurozone economy. If the ECB moves more aggressively to lower borrowing costs while the U.S. holds steady or raises rates further, the euro could become less attractive to investors seeking higher yields, exacerbating its weakness.

Last week, the Fed’s surprising half-point rate cut sent shockwaves through financial markets. Many had anticipated a more measured reduction, but the Fed’s decision to take a bolder step reflected growing concerns about a slowdown in economic growth. The market, already trading near all-time highs, saw heightened volatility as expectations for deeper rate cuts sparked fears of a potential hard landing.

Despite the Fed’s dovish stance, the overall market correction appears far from over. The rate cut, while initially celebrated by some bulls, has introduced a new layer of uncertainty, and the bears seem to have gained control in the aftermath. As I’ve cautioned before, chasing rebounds with additional capital during corrections remains risky, and I maintain a cautious approach for the time being.

On a more positive note, U.S. jobless claims fell to 219,000 last week, indicating that the labor market remains relatively stable. This improvement, coupled with moderating inflation, provides the Fed with some breathing room to focus on stimulating economic growth without immediate concerns about rising prices.

However, the rally in equities has been tempered by ongoing volatility in the bond and currency markets. The dovish comments from Fed Governor Christopher Waller last week suggested that the Fed could act quickly to cut rates further if inflation continues to settle below the 2% target. This dovish sentiment briefly eased concerns in the bond market, causing short-term U.S. Treasury yields to fall.

This week’s earnings calendar is packed, with key reports expected from Costco Wholesale, Accenture, AutoZone, KB Home, Thor Industries, Progress Software, Jefferies Financial, Jabil, and CarMax. Of particular interest will be the performance of Costco and Micron, both of which could provide valuable insights into consumer spending and the state of the tech sector.

Looking ahead, key economic reports, including flash PMI data, consumer confidence, and earnings from major retailers, will play a crucial role in determining the market’s direction. While the long-term uptrend remains intact, I continue to maintain a market-neutral stance given the risks of a deeper correction.

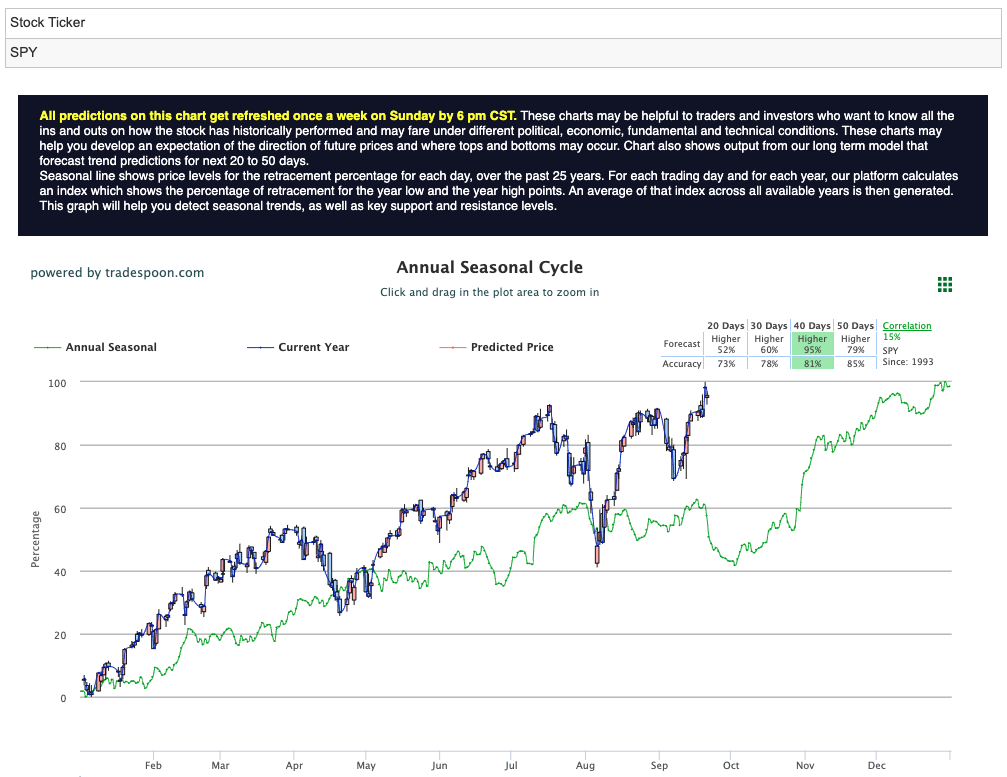

The S&P 500 found support in the $560-$575 range last week, and I anticipate short-term support between $480-$510 in the coming months. However, with uncertainty surrounding the broader economic outlook, it may be wise to hold off on deploying additional capital until we gain more clarity on the direction of inflation, interest rates, and economic growth. For reference, the SPY Seasonal Chart is shown below:

As always, caution is warranted. The market may continue to trade sideways in the short to medium term, and capital preservation should be a priority for investors during periods of heightened volatility.

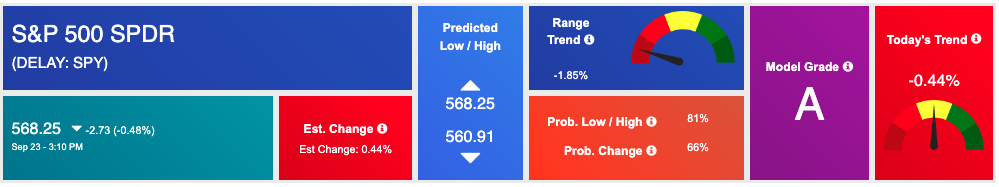

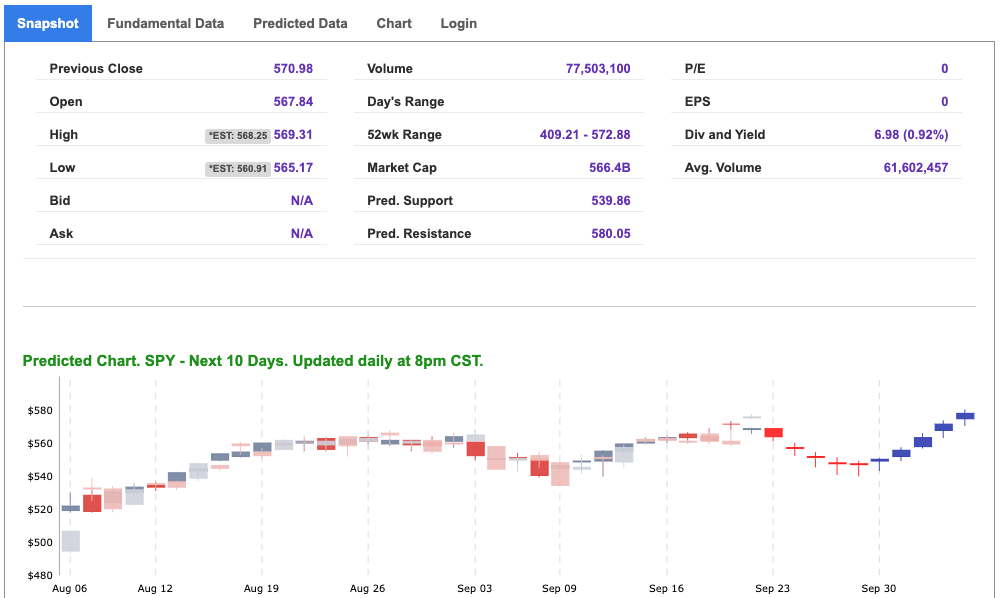

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

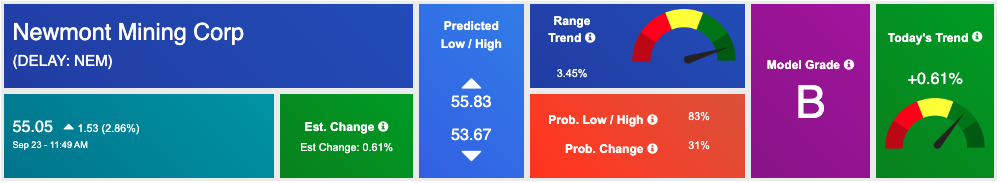

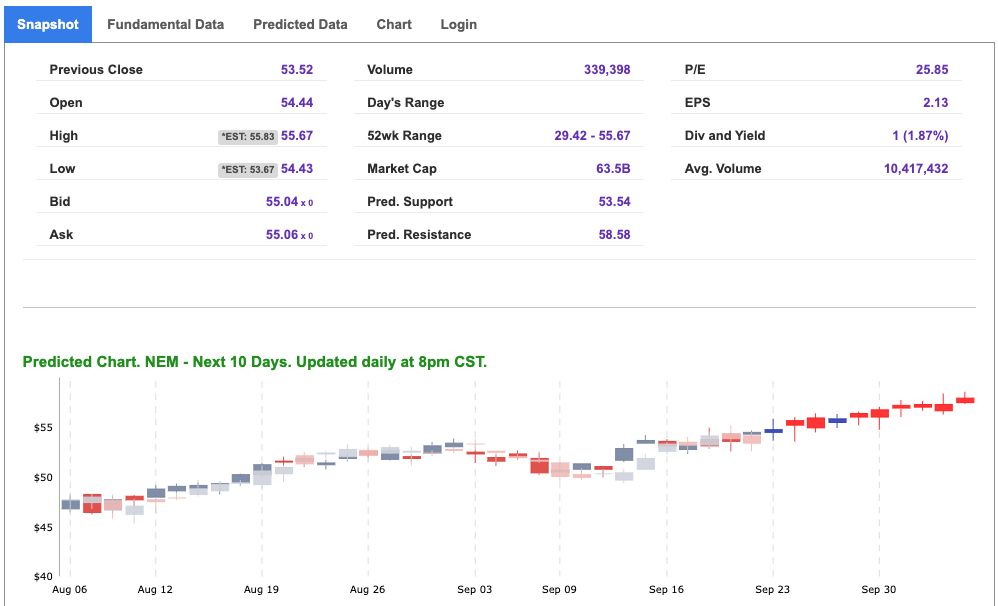

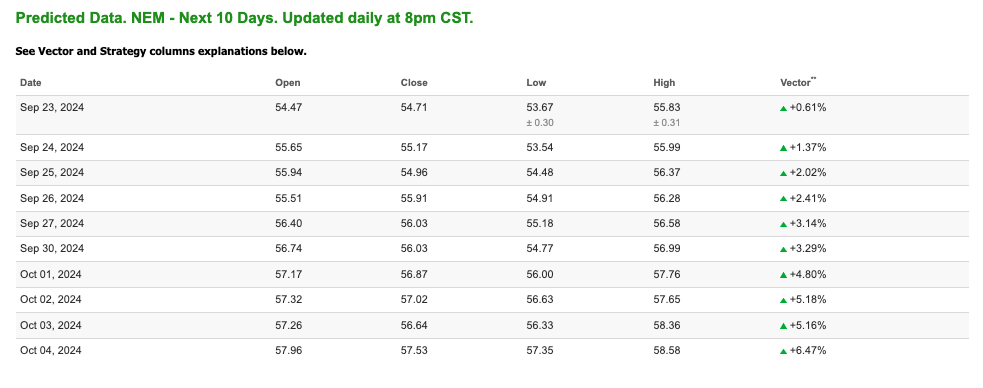

Our featured symbol for Tuesday is Newmont Mining Corp., NEM is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $55.05 with a vector of +0.61% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, NEM. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

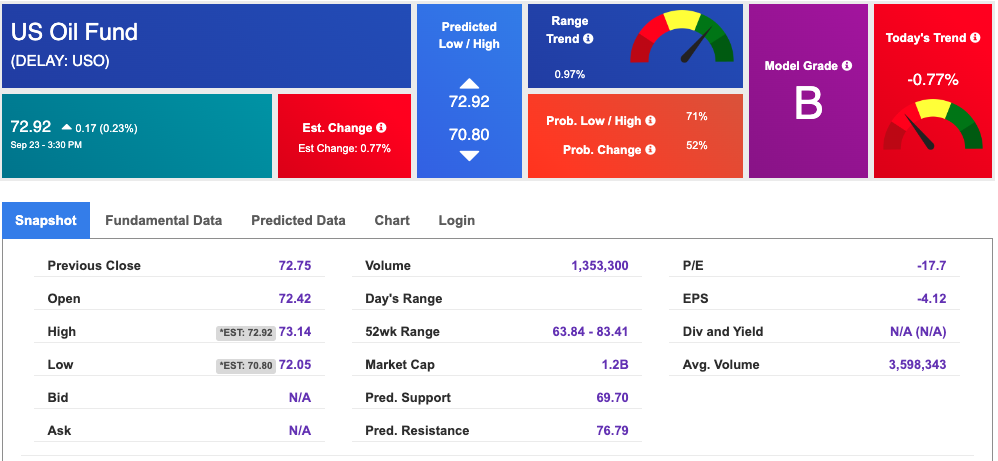

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $70.65 per barrel, down 0.51%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $72.92 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

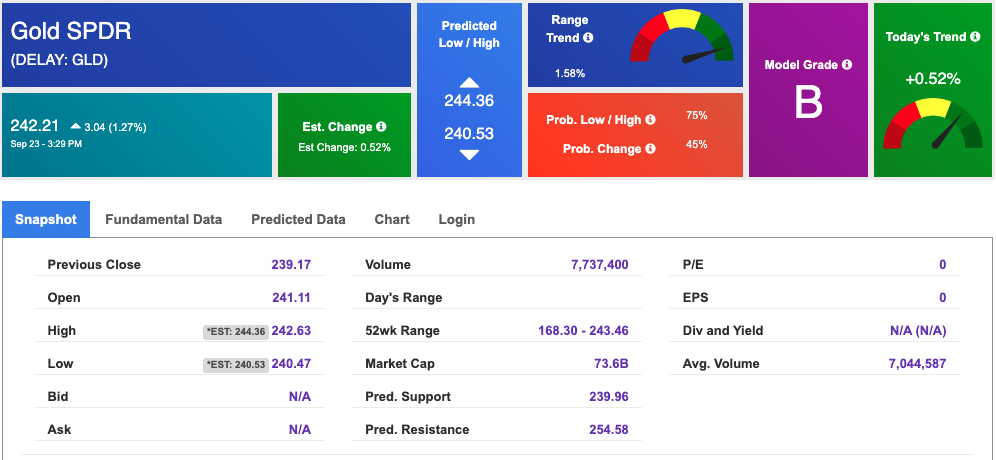

The price for the Gold Continuous Contract (GC00) is up 0.22% at $2,652.20 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $242.21 at the time of publication. Vector signals show +0.52% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

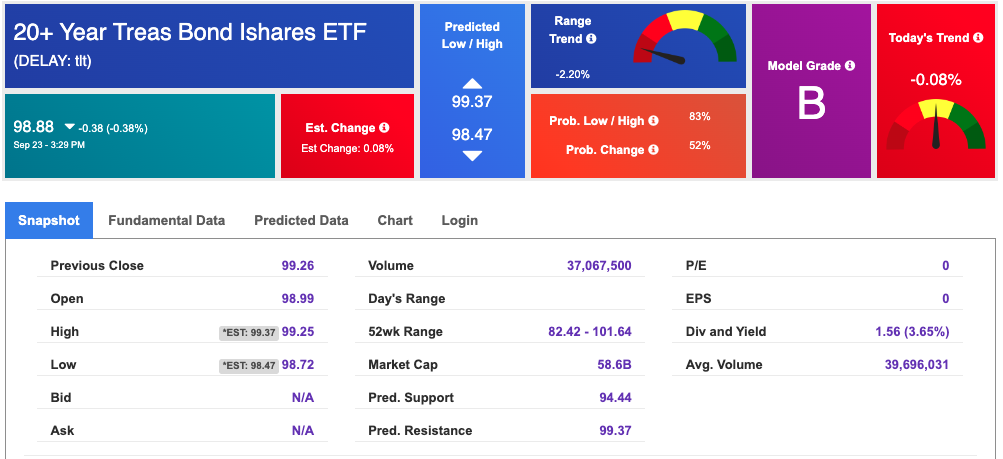

The yield on the 10-year Treasury note is up at 3.755% at the time of publication.

The yield on the 30-year Treasury note is up at 4.098% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

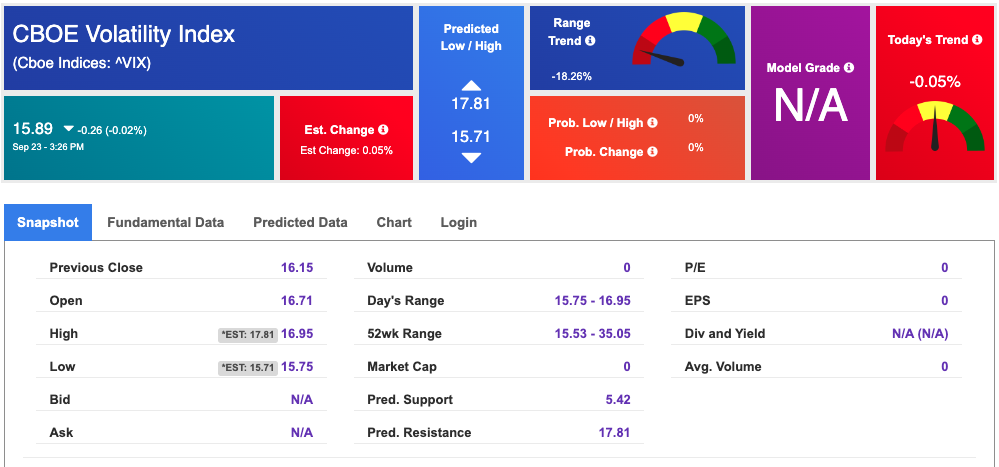

The CBOE Volatility Index (^VIX) is priced at $15.89 down 0.02% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!