Financial markets witnessed a tumultuous day as stocks fell on Thursday, and the yield on the 10-year Treasury note inched closer to the dreaded 5% mark. In the backdrop of this market turmoil, traders are bracing for more volatility in the second half of the year. While some foresee interest rates holding steady through January, a wave of geopolitical risks and dwindling demand for treasuries is pushing rates higher, with long-term yields soaring to levels reminiscent of the Global Financial Crisis.

The financial community is closely reviewing the Beige Book data, which indicates that most parts of the country have seen little to no change in economic activity since the September report. The U.S. economy is showing signs of “stable” to “slightly weaker” growth, which is somewhat relieving the tight labor market and easing inflation pressures. However, higher wages, rising oil prices, and insurance costs are keeping inflationary pressures alive.

One critical piece of the market puzzle is the Beige Book, which offers insights into economic activity across the country. The latest Beige Book data indicates that most regions reported little to no change in economic activity since the September report. The U.S. economy appears to be undergoing “stable” to “slightly weaker” growth, which is alleviating the tight labor market and the burden of inflation.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Despite the persistent upward pressure on inflation due to higher wages, increased oil prices, and elevated insurance costs, businesses have been unable to pass on these cost increases to price-sensitive consumers. This has resulted in declining profit margins for many companies. While firms still anticipate price increases in the coming quarters, they expect them to occur at a slower rate than in previous periods.

The current inflation rate stands at 3.7%, well above the Federal Reserve’s target of 2%. As a result, the central bank is considering its options to address this challenge.

Federal Reserve Chairman Jerome Powell’s latest speech has been pivotal in shaping market sentiment. Powell has paved the way for the central bank to keep interest rates unchanged at its November meeting, acknowledging positive signs in the fight against inflation. Still, he raised concerns about rates not being high enough for long enough, signaling the possibility of more rate hikes.

Earnings reports have been a mixed bag. Despite banks posting good earnings, the overall stock market is struggling to sustain its high valuation. Investment banking entities like Morgan Stanley, BlackRock, and Goldman Sachs, have reported underwhelming results.

Morgan Stanley, for instance, saw its shares plunge over 6% as its wealth management results fell short of expectations. While the bank’s overall third-quarter results exceeded profit estimates, it was the better-than-expected trading revenue that saved the day. However, this wasn’t enough to maintain the firm’s stock prices at their peak.

On the other hand, Netflix presented a more favorable picture, with its third-quarter earnings beating expectations and a significant rise in subscribers due to a crackdown on password sharing. The streaming giant added a remarkable 8.76 million global subscribers during the quarter, far surpassing Wall Street’s predictions. This positive outcome has buoyed the company’s stock, boosting investor confidence.

Tesla, a heavyweight in the electric vehicle sector, offered a cautious outlook during its third-quarter conference call, setting the stage for a negative market reaction. The company cited concerns about the macroeconomic environment, which included rising interest rates and waning consumer strength, leading to a 9.3% drop in its stock price.

AT&T, in contrast, reported earnings and revenue that exceeded analysts’ estimates. The telecommunications giant even raised its target for free cash flow for the year, demonstrating growth in subscribers after four consecutive quarters of declines. This performance drove AT&T shares up by 6.6%.

The tech sector, represented by the Technology Select Sector SPDR Fund ($SMH), has faced turbulent times. Small caps, technology, cyclicals, and regional banks continue to underperform, while the broad-based S&P 500 ($SPY) is grappling with its 50-day moving average. Furthermore, the Dollar Index ($DXY) has been on a multi-month rally.

Interest rates are experiencing an overshoot, driven by weak demand for treasuries, notably from Japan and China. This lack of demand has caused treasury prices to drop, pushing yields higher and putting pressure on equity valuations. The yield on the 10-year Treasury note has surged to levels reminiscent of the Global Financial Crisis, while 30-year mortgages are now above 8%.

Several stocks are facing their own unique challenges. NVIDIA ($NVDA) is shedding value, nearing its 200-day moving average, a critical support level. Tesla’s cautious commentary on the macroeconomic environment, coupled with other EV stocks, has led to substantial declines. These companies are grappling with issues like rising interest rates and declining consumer affordability.

Geopolitical risks remain a concern, with strikes spreading across various industries, even approaching major car manufacturers in Michigan. Prolonged strikes could exacerbate inflation pressures. A potential government shutdown looms large, adding to the uncertainty. In this environment, safe-haven assets like silver ($SLV) and gold ($GLD) have rallied, despite the strength of the U.S. dollar.

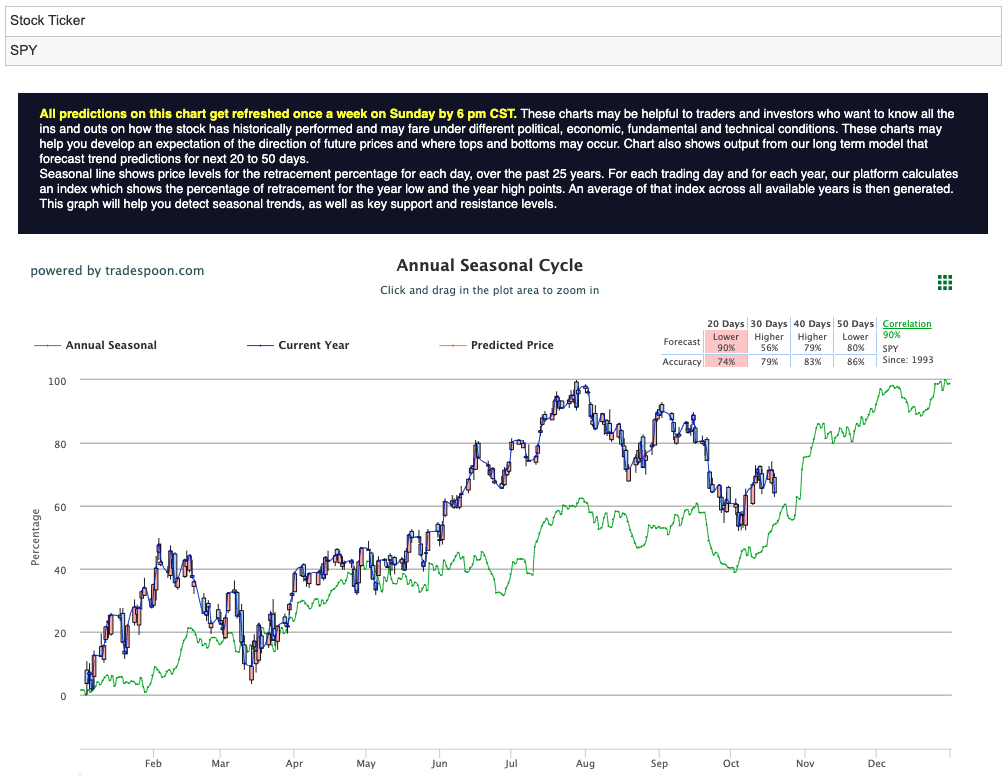

While the stock market remains on shaky ground, I still believe SPY might encounter resistance within the $450-470 range, with support likely at the $400-430 level over the coming months. The current market sentiment suggests further room for a downturn, with signs already pointing towards the breaking of August lows. I am closely monitoring key indicators like the iShares Russell 2000 ETF (IWM), the SPDR S&P Regional Banking ETF (KRE), and the SPDR S&P Retail ETF (XRT) to gauge market trends. For reference, the SPY Seasonal Chart is shown below:

Cyclicals, including those represented by these ETFs, are at risk of breaking their August lows, and it’s only a matter of time before this becomes a reality. October is expected to remain a volatile month, but there is a glimmer of hope on the horizon. As we approach the end of the year, there’s an anticipation of better-than-expected earnings reports and a seasonality effect that could create a market floor, particularly near the 200-day moving average (MA). This could provide investors with some much-needed stability in these turbulent times.”

Financial markets are grappling with multiple headwinds, including rising interest rates, earnings disappointments, geopolitical risks, and potential government actions. As investors navigate these turbulent waters, it’s crucial to remain vigilant and informed about the evolving economic landscape. The coming months are fraught with uncertainty, and market participants must be prepared for a roller-coaster ride ahead. With this in mind, I believe there is one sector due to resist the current down trend and hopefully, as our A.I. suggests, a boom in the coming days. This sector is often known as a stable and reliable option to safeguard their portfolios.

Consumer staples are essential products that people need, regardless of economic conditions. These products include everyday necessities such as food, beverages, household goods, and personal care items. The stability and consistent demand for these products make consumer staple stocks an attractive option in a volatile market environment.

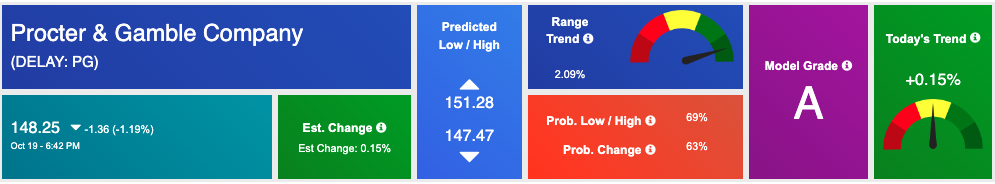

Procter & Gamble (PG): A Strong Candidate in the Consumer Staples Sector

Procter & Gamble (PG) is a global consumer goods powerhouse and a prime example of a company worth considering in the consumer staples sector. PG is one of the largest and most well-established players in the industry, with a history dating back to 1837. It’s the name behind a wide array of trusted household brands, including Pampers, Tide, Gillette, Crest, and many others.

Why It’s a Good Time to Buy PG:

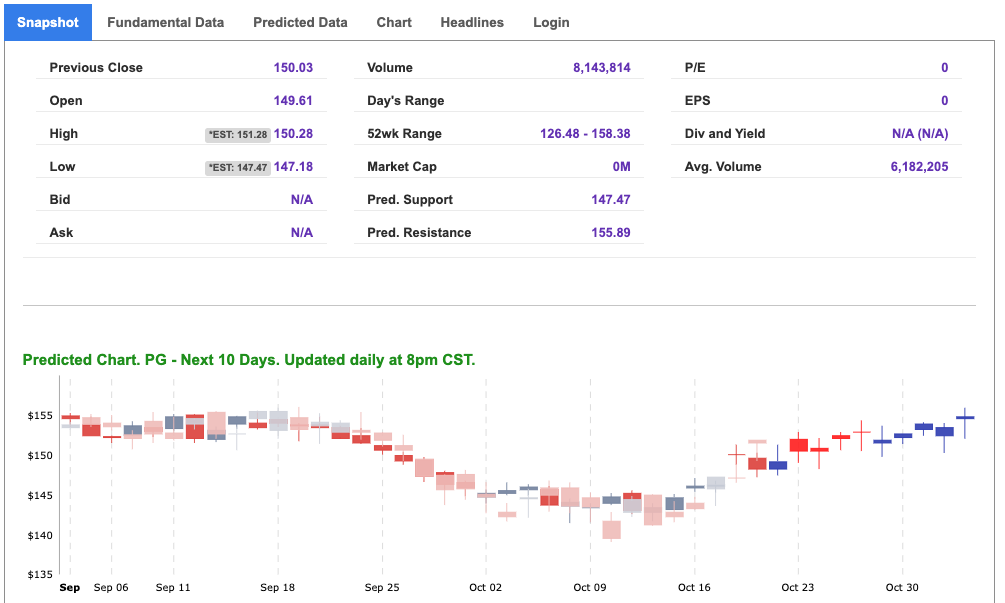

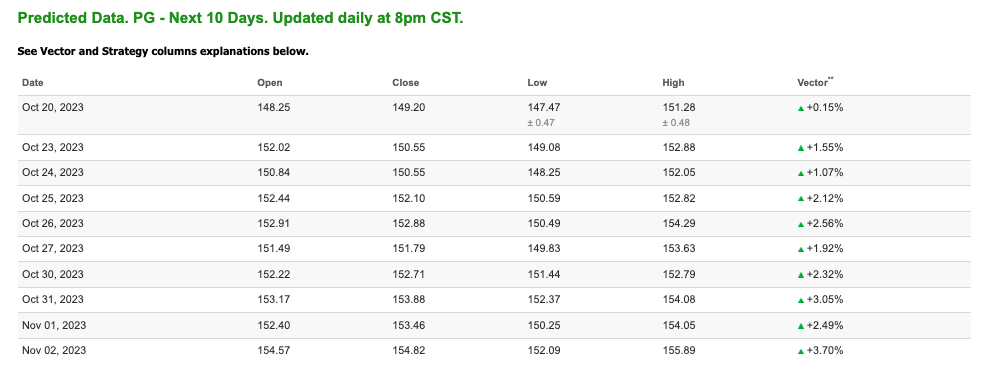

And that is exactly what I see when I review my Stock Forecast Toolbox’s data for PG. Not only does the symbol hold a model grade of A but the 10-day data shows a nice swing towards the upside that can be additionally supported by the oncoming earnings data. See 10-Day Predicted Data for PG:

Consumer staples like Procter & Gamble (PG) can be a smart addition to your investment portfolio, offering stability, consistent income, and the potential for long-term growth. In the current environment of market volatility and economic uncertainty, these stocks provide a safe haven for investors looking to safeguard their investments.

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

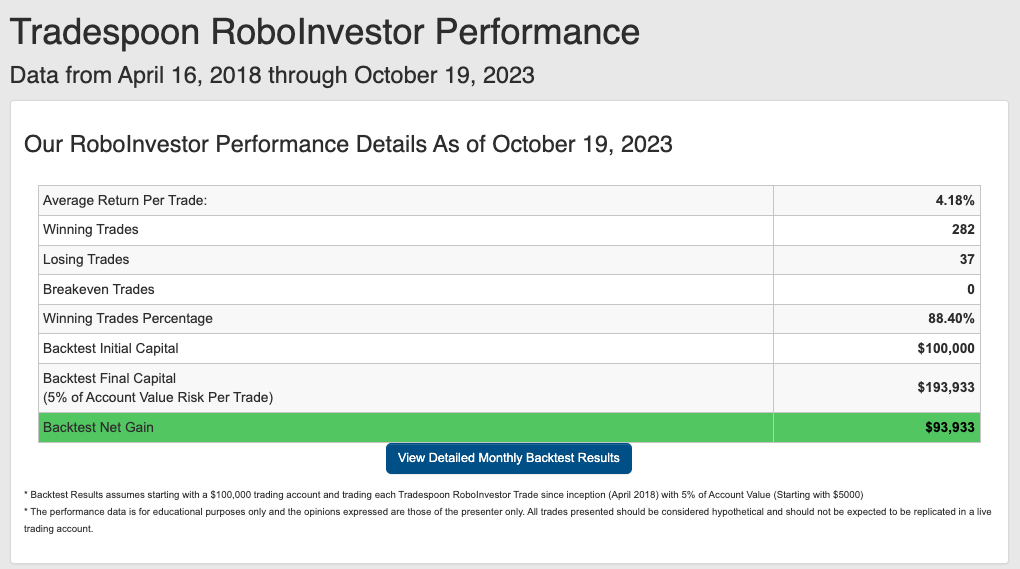

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.40% going back to April 2018.

As we enter Q4, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!