After rising impressively last week, all three major U.S. indices finished the red to start the week today. On Monday, all three major stock indexes were lower as Fed Chairman Jerome Powell signaled at the potential of bigger rate increases to combat inflation. Treasuries were also down on Monday, with Powell, addressing the National Association for Business Economics, repeating that the Fed could raise rates by more than 25 basis points each at future meetings if policymakers believe it is necessary for their effort to keep inflation under control. Boeing saw shares drop over 3% following news of the passenger plane crash in southern China, which killed 132 people. Covid returned onto investors’ radars as the latest variant, currently spiking in Europe, looks to have an increase in the U.S. in the coming weeks. Geopolitical risks in Ukraine remain at the forefront of the market, and global news, as Russia continues its offensive into the neighboring nation. Ukrainian authorities rebuffed a Russian demand that their forces in Mariupol lay down arms, despite the fact that the U.K. Ministry of Defense confirmed that fierce fighting persists north of Kyiv. It has also been reported that Ukraine is receiving secretively acquired Soviet-era air defense gear from the United States.

Earnings remain light this week with Nike, Adobe, and Tencent headlining earnings reports; economic reports releasing this week also remain light while several key Fed members are scheduled to speak publicly. Looking at the current market conditions, we expect the market to continue to trade higher in the next two to four weeks. The $VIX is trading near the 25 level. The Geopolitical risks in Ukraine should be monitored as it can impact the next move in the market. We are watching the overhead resistance levels in the SPY, which are presently at $445 and then $460. With the $VIX trading near the 25 level, the $SPY support is at $430. We encourage all market commentary readers to maintain clearly defined stop levels for all positions. For reference, the SPY Seasonal Chart is shown below:

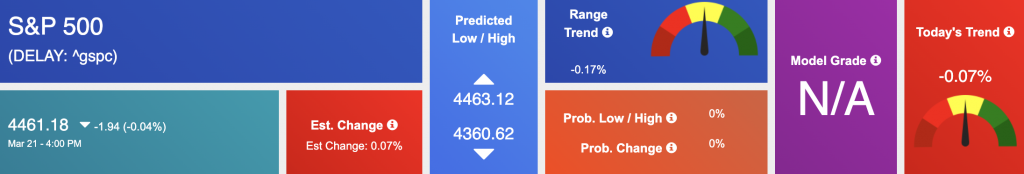

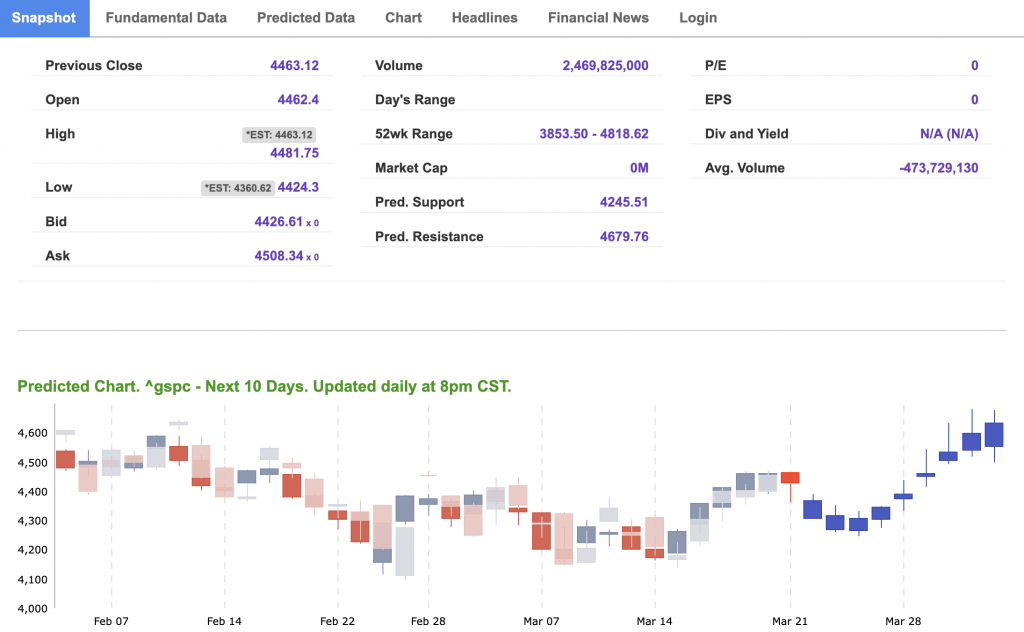

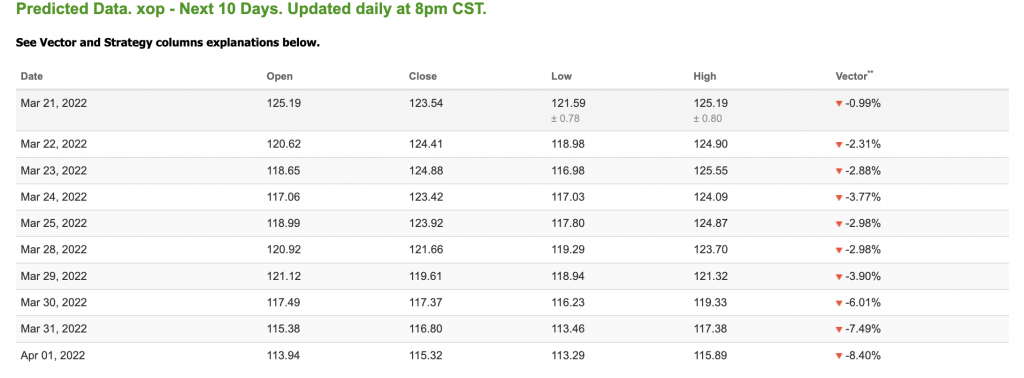

Using the “^GSPC” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term mixed outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

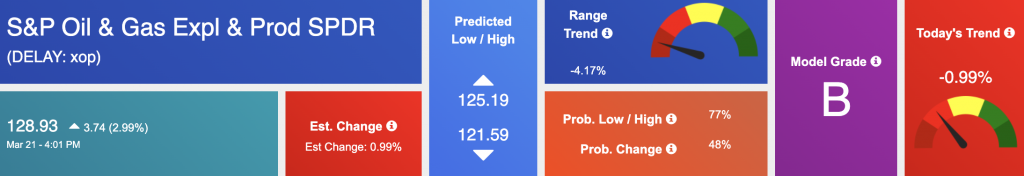

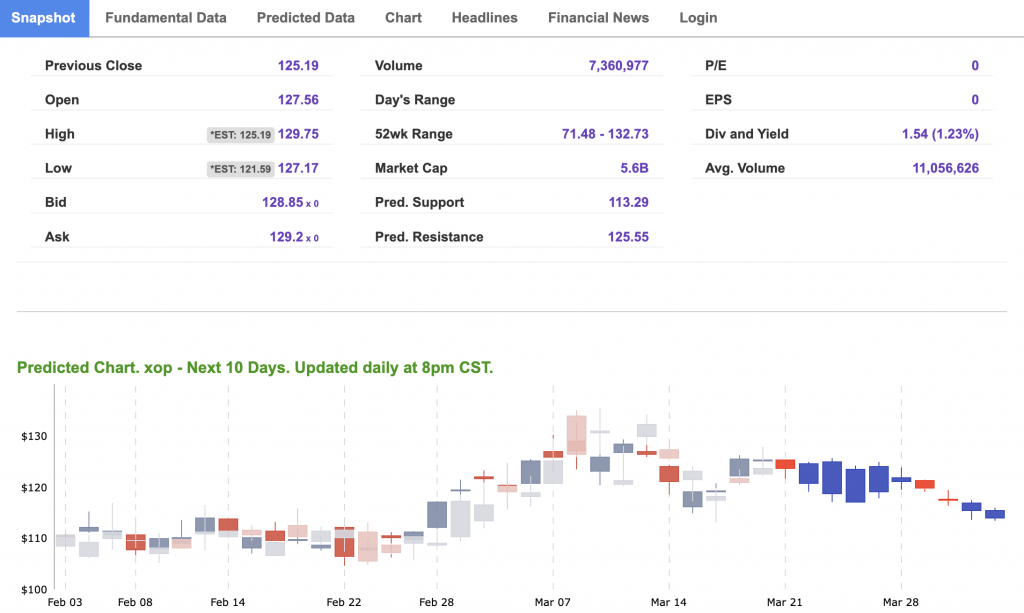

The symbol is trading at $128.93 with a vector of -0.99% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, XOP. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

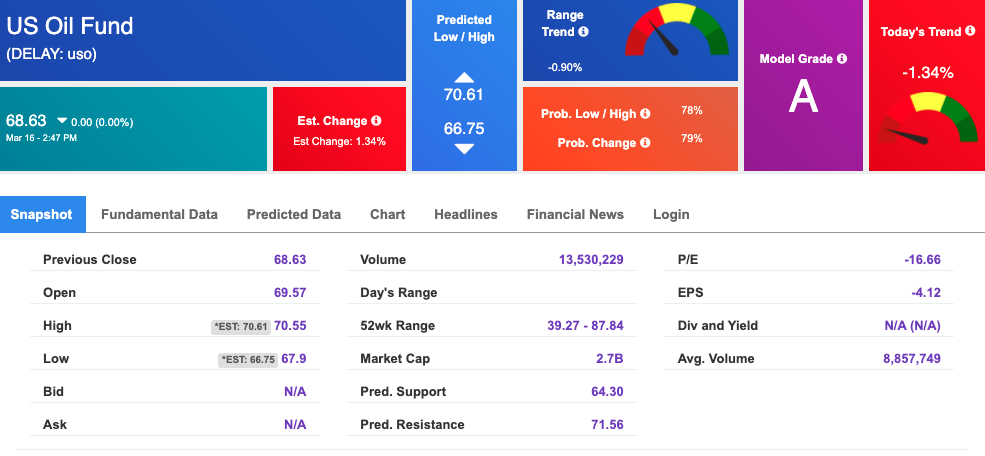

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $112.60 per barrel, up 7.55% at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $68.63 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

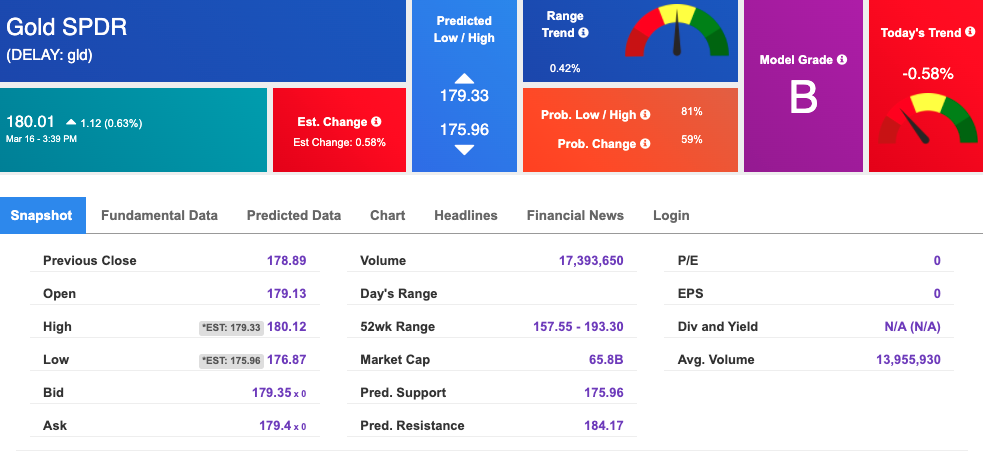

The price for the Gold Continuous Contract (GC00) is up 0.33% at $1935.70 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $180.01 at the time of publication. Vector signals show -0.58% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

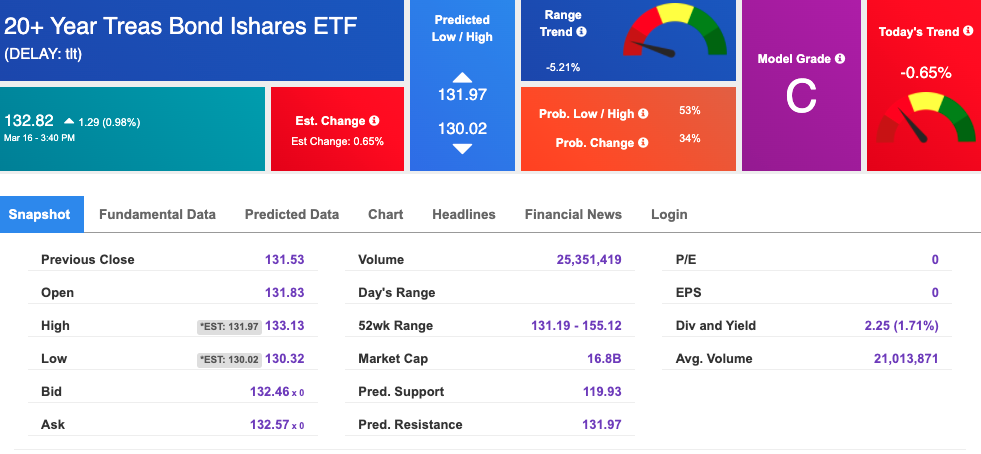

The yield on the 10-year Treasury note is up, at 2.294% at the time of publication.

The yield on the 30-year Treasury note is up, at 2.518% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

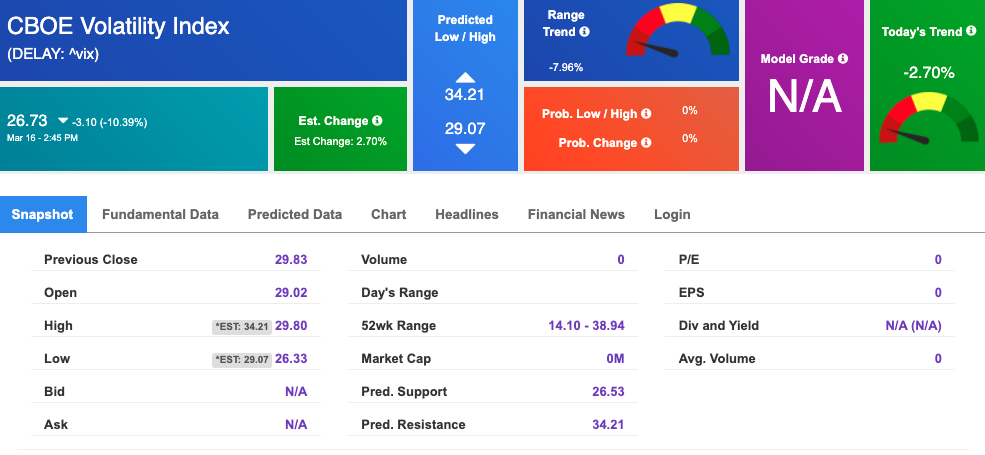

The CBOE Volatility Index (^VIX) is $26.73 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!