Following last week’s robust jobs report, the likelihood of the Federal Reserve lowering interest rates this year significantly decreased, making this week’s decision no surprise. However, there was still plenty for investors to focus on with this week’s pivotal events: the Federal Open Market Committee (FOMC) meeting, the Consumer Price Index (CPI) report, and significant corporate earnings.

On Monday, the Nasdaq Composite showed strong performance relative to other major indexes, propelled by robust activity in semiconductor stocks. The S&P 500 made slight gains across a significant portion of its components, while the Dow Jones experienced a modest decline. Leading sectors included energy and utilities within the S&P 500, each showing notable increases. The iShares Semiconductor ETF registered a solid rise, supported by Nvidia’s positive performance.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Investors were cautiously optimistic on Tuesday as they awaited crucial economic data and the outcome of the FOMC meeting. The market’s primary focus was on the upcoming CPI and PPI reports, which were expected to provide further insight into inflation trends. The Producer Price Index (PPI) for May fell by 0.2% from April, contrary to expectations of a 0.1% increase, indicating that the Federal Reserve’s measures to curb inflation were taking effect. On an annual basis, PPI rose by 2.2% in May. This data, coupled with the softer CPI reading, suggested that inflationary pressures were easing more rapidly than anticipated.

Wednesday was pivotal with the release of the latest CPI data and the conclusion of the FOMC meeting. The CPI report for May showed that inflation pressures were easing. The headline CPI for May remained unchanged from April, while core CPI, which excludes volatile food and energy prices, rose by just 0.2%. These figures suggested that inflation was cooling, providing some relief to markets and the Federal Reserve.

The Federal Reserve’s policy-making committee decided to keep the benchmark interest rate steady within the 5.25% to 5.50% range, a widely anticipated move. Fed officials emphasized their intent to maintain higher interest rates for a longer period to ensure inflation is on a sustainable path back to the 2% target. Chairman Jerome Powell highlighted the “balancing act” of lowering inflation, managing a strong labor market, and sustaining economic growth. The collective forecast for interest rates now implies only one quarter-point cut by the end of 2024, a significant shift from earlier this year when three quarter-point cuts were anticipated.

On Thursday, the market maintained its positive trajectory in response to the Federal Reserve’s unchanged stance and favorable inflation data. Concurrently, treasury yields declined, with both the 10-year and 2-year yields reaching their lowest points in more than two months. This trend underscored increasing confidence that U.S. inflation could be moderating at a quicker pace than previously anticipated.

Oracle’s May-quarter earnings report, although slightly below Wall Street forecasts, showed promising growth in cloud infrastructure deals, indicating robust demand for its services, especially in artificial intelligence (AI). Nvidia’s stock rose following Oracle’s earnings call, which referenced strong demand for Nvidia chips. Nvidia shares climbed 3% to $124.52, bolstered by a recent 10-for-1 stock split.

Broadcom also made headlines, announcing a 10-for-1 stock split and seeing its shares rise by 12% following strong second-quarter earnings. The S&P 500 and the Nasdaq Composite continued their upward trajectory, reaching new record highs.

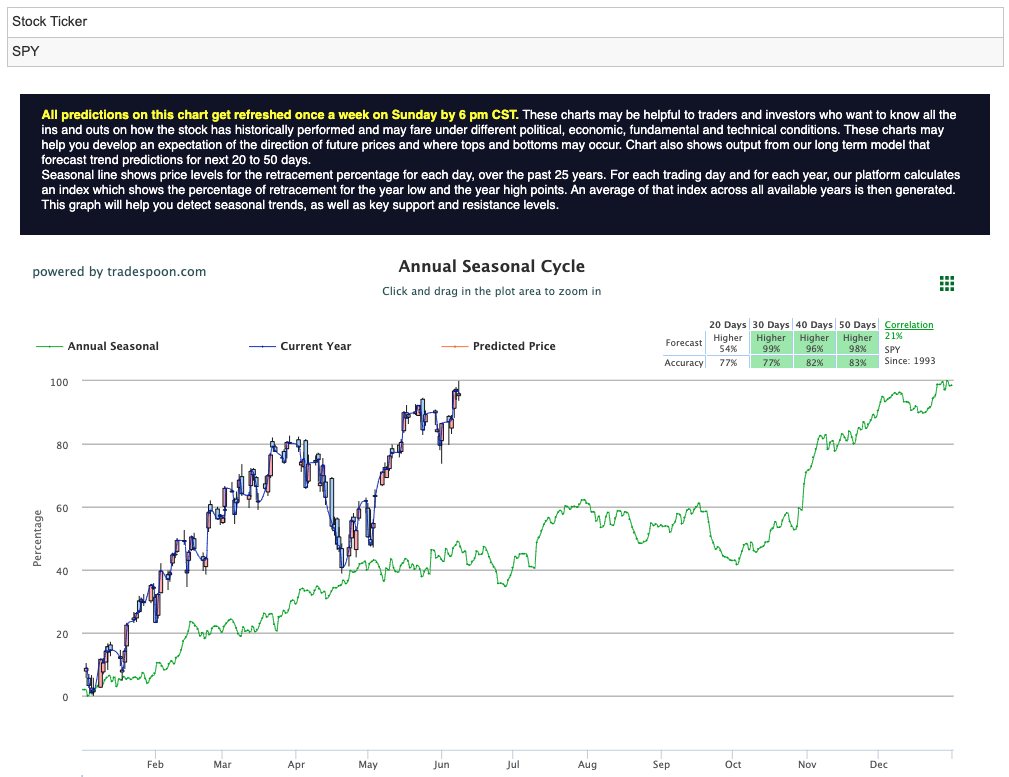

With the latest market conditions in mind, I am sticking with my bullish stance. Inflation is coming within expectations, and the earnings season is surpassing forecasts, creating a positive environment for stocks. Adding SLV to your portfolio offers a hedge against inflation, benefits from growing industrial demand, and provides strategic diversification. The market appears poised for further gains, with the SPY rally anticipated to be capped at $540-$550, with short-term support at $500-$510. I expect the market to continue posting higher highs and higher lows in the coming months. For reference, the SPY Seasonal Chart is shown below:

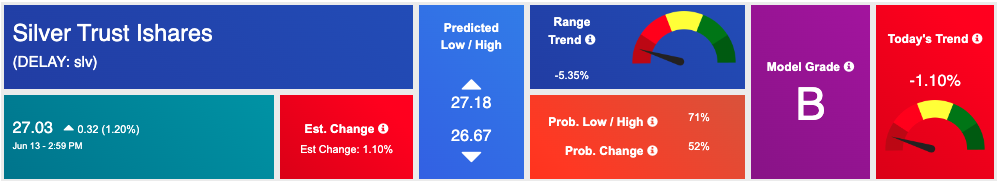

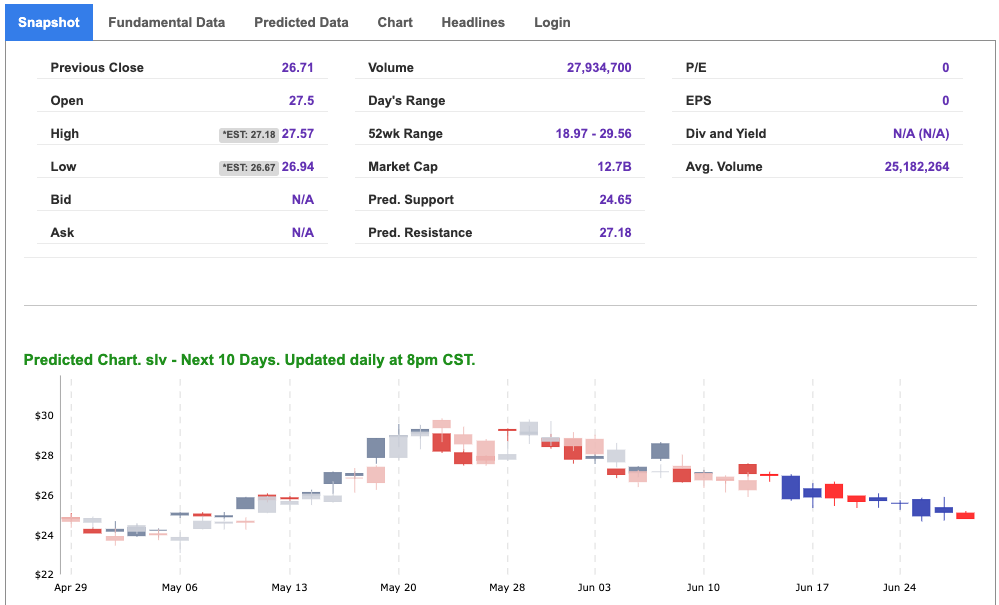

Given the current market conditions—cooling inflation, robust earnings, and strong industrial demand—SLV, the iShares Silver Trust presents a promising one I’ll be looking to add to my portfolio.

Recent volatility, particularly in Treasury yields, underscores the need for portfolio diversification. SLV offers exposure to silver without the need to hold physical bullion, providing a liquid and convenient investment option. Despite easing inflation, the Fed’s cautious stance on interest rates highlights the ongoing risk. Silver traditionally acts as a hedge against inflation, preserving wealth in times of economic uncertainty.

Silver’s extensive use in electronics, solar panels, and electric vehicles means its industrial demand is poised to grow as the global economy recovers, potentially driving up its value. Incorporating SLV enhances portfolio diversification, balancing the high performance of major indices like QQQ and SPY with assets driven by different factors. This strategic move can stabilize returns and protect against market corrections.

My AI Stock Forecast Toolbox also agrees with this assessment, highlighting SLV as a strong candidate for the coming days. The toolbox forecasts a positive trend for SLV, driven by the same market conditions—easing inflation, solid earnings, and increasing industrial demand—that support my bullish outlook!

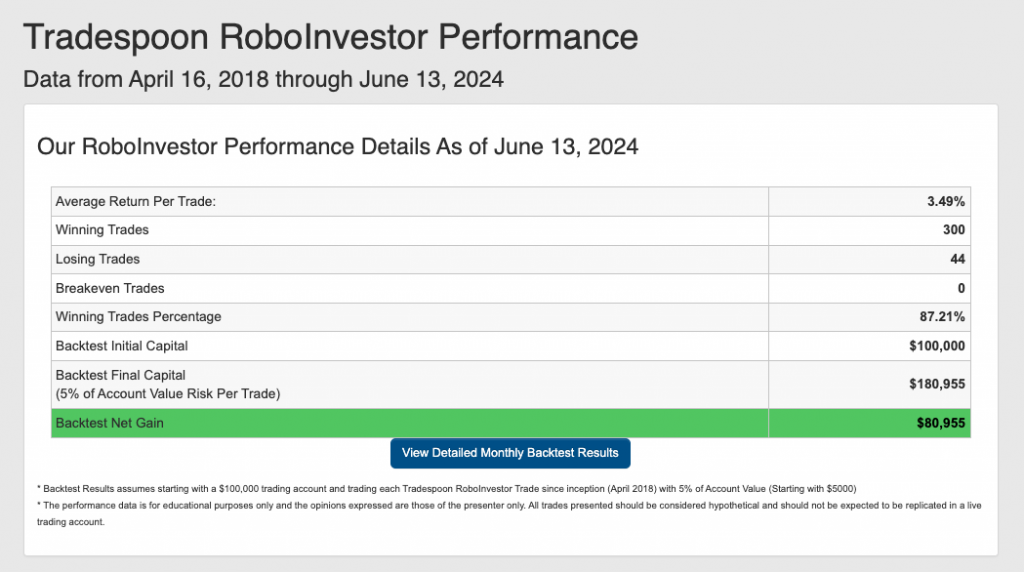

Harnessing the power of AI, our RoboInvestor stock and ETF advisory service leverages cutting-edge technology to pinpoint trades with a high probability of profitability. Our proprietary AI platform eliminates the noise and emotional factors that often influence investor decisions, providing our members with clear, data-driven insights and strategies for success.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.21% going back to April 2018.

As we reach the halfway point of 2024, investors find themselves grappling with a maze of market challenges that persist, from escalating inflationary pressures to the fluid landscape of Federal policies and geopolitical tensions, such as the ongoing conflict in Ukraine. In these uncertain times, the importance of having a reliable and knowledgeable investment partner cannot be overstated. That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!