As August bids farewell with a tough stance on the stock market, investors are still finding solace in a promising overall yearly performance. The month of August saw the major stock indexes closing on a somber note, as losses were posted across the board. The Dow Jones Industrial Average faced a particularly challenging Thursday, concluding what has been a trying August. Despite the setback in August, the larger perspective reveals a year that has shown positive progress for the markets.

Adding to the mix, Thursday witnessed the Federal Reserve’s key indicator of inflation, the core personal consumption expenditure (PCE) price index, ticking slightly higher on an annual basis in July. This uptick signals an ongoing battle to rein in inflation, suggesting that the struggle might prove to be more formidable than anticipated.

However, all attention is now laser-focused on the impending Friday jobs report, which is anticipated to reveal another dip in nonfarm payrolls, potentially adding more complexity to the financial landscape.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

In the technology sector, Salesforce, a leading cloud-based enterprise software provider, surprised analysts with its second-quarter earnings, surpassing estimates and even offering an optimistic outlook for both the third quarter and the fiscal year. This positive news propelled the company’s stock up by 3%. Looking at the fiscal second quarter that closed on July 31, Salesforce showcased its resilience with revenue reaching $8.6 billion, marking an impressive 11% increase from the previous year. This performance not only exceeded the company’s own projected range but also beat the Street consensus, which had predicted revenue to be around $8.53 billion.

As the markets find themselves in a consolidation phase, experts are predicting heightened volatility in the latter half of the year. This forecast comes in light of the increase in capital requirement for regional banks and a mixed bag of economic data. This data has hinted at a slowdown in inflationary pressures and a notable pullback in interest rates, which ultimately contributed to a market rebound. The global financial arena is further impacted by continued concerns over China’s economic weakness, compounded by defaults on payments by major lenders. Meanwhile, the DXY (U.S. Dollar Index) continues its rally, and longer-dated treasuries are experiencing a substantial upward surge, even revisiting the yield highs last witnessed in October. To counter these challenges, China has injected additional stimulus by implementing measures such as interest rate cuts on mortgages and tax reductions.

Despite the challenges, specific sectors are showing persistent weakness. This includes Europe, small-cap companies, technology, regional banks, and cyclicals. In fact, the technology sector and the $SPY (SPDR S&P 500 ETF Trust) have both broken their uptrend patterns and are now trading above their 50-day moving averages. Simultaneously, the $DXY has initiated a pullback.

However, the landscape isn’t without its casualties. Dollar General faced a 12% plummet after its second-quarter earnings failed to meet analysts’ expectations. The discount retailer also revised its fiscal-year guidance downward, making it the worst performer in the S&P 500 for Thursday.

On a more positive note, Chewy, the online retailer specializing in pet foods and accessories, surprised investors with a second-quarter profit that defied expectations. Despite having 20.4 million active customers, matching predictions, the number fell from the previous year. Chewy’s projection of third-quarter net sales, ranging between $2.74 billion and $2.76 billion, fell short of the $2.79 billion anticipation. This announcement led to a 12% drop in Chewy’s shares.

The recent release of Amazon.com’s Buy with Prime app for Shopify brought a considerable boost to the latter’s stocks, surging by 11%. The app empowers U.S.-based merchants on Shopify to seamlessly provide customers with the option to utilize their Prime benefits when making purchases.

Shifting gears to the cannabis sector, Tilray experienced an 11% surge, while Canopy Growth saw an even more impressive 26% jump. This came in response to the Drug Enforcement Administration’s announcement that it would review the classification of cannabis. The U.S. Department of Health and Human Services is urging the DEA to reconsider the current Schedule I classification and instead assign a Schedule III designation to cannabis.

In the midst of these market dynamics, Apple stands strong with its shares rising for the fifth consecutive trading day. This streak positions the tech giant for its most prolonged winning run since July, signifying its resilience amid the fluctuations.

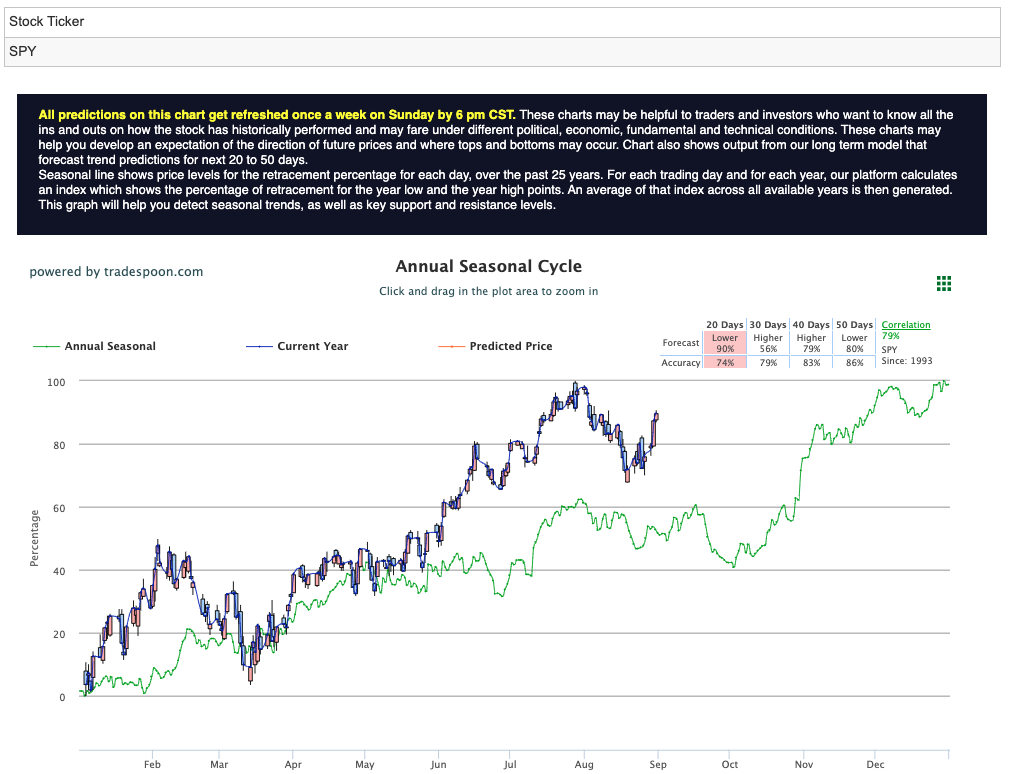

Taking a strategic standpoint, an increasing number of investors are embracing a market-neutral approach. This decision is backed by economic data indicating a low likelihood of recession, coupled with a notable pullback in the U.S. Dollar Index ($DXY). Despite this stance, caution remains, and experts anticipate the SPY rally to be capped within the $450-470 range. A short support level is identified between 400 and 430 for the coming months, highlighting the need for prudent risk management strategies in the face of an evolving financial landscape. For reference, the SPY Seasonal Chart is shown below:

Amid the diverse market landscape discussed above, the healthcare sector remains a focal point for investors seeking stability. While August’s market turbulence left its mark on various industries, healthcare has emerged as a resilient sector, providing investors with a dependable haven.

The fluctuating economy, coupled with concerns surrounding inflation and interest rates, has prompted investors to search for sectors that can weather the storm. Healthcare, known for its relatively stable demand regardless of market conditions, has garnered attention for its defensive characteristics. As consumers continue to prioritize their well-being and medical needs, healthcare companies tend to enjoy consistent revenue streams, making the sector a reliable choice in uncertain times. Alongside healthcare, tech has been a standout as well.

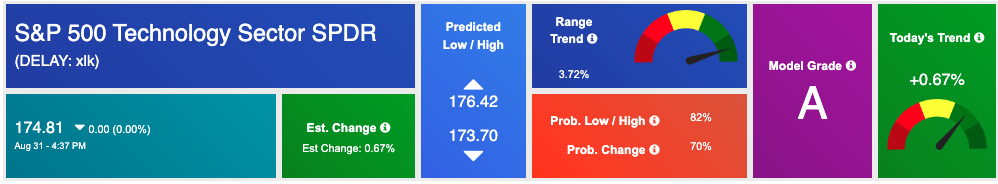

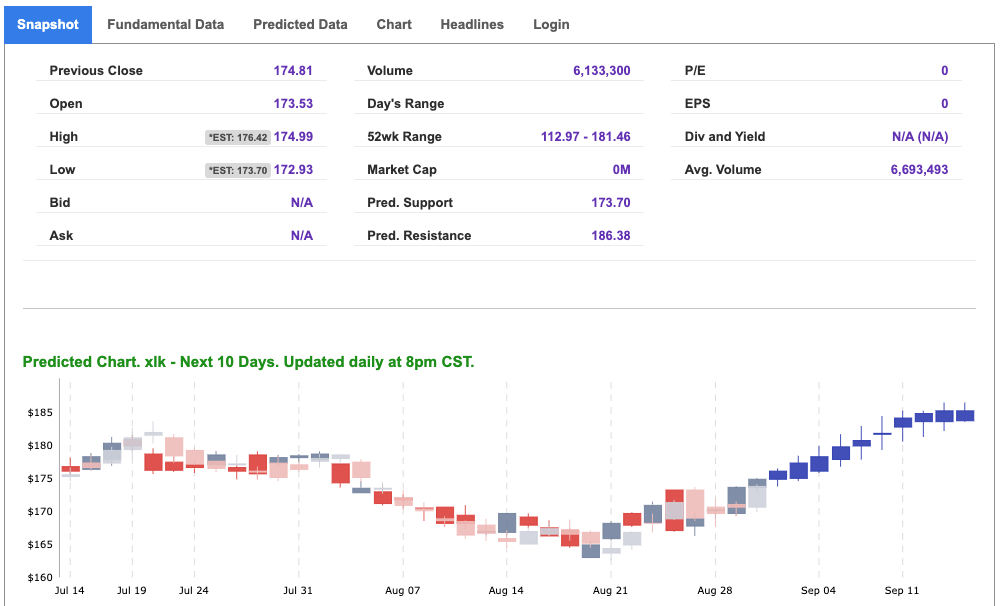

Among the numerous investment options available, the Technology Select Sector SPDR Fund ($XLK) stands out as a promising choice. This exchange-traded fund (ETF) focuses on the technology sector and includes companies at the forefront of innovation. With holdings that span across software, hardware, and other technology-related industries, $XLK offers exposure to the rapidly evolving tech landscape.

As investors assess their options amidst market fluctuations, there are compelling reasons to consider investing in $XLK and the broader technology sector.

In conclusion, the current market landscape, characterized by fluctuations and uncertainties, underscores the value of stability and resilience. Healthcare and the technology sector, exemplified by $XLK, offer investors the potential to navigate these challenges while positioning themselves for growth. By carefully evaluating the opportunities and risks, investors can make informed decisions that align with their financial goals and aspirations.

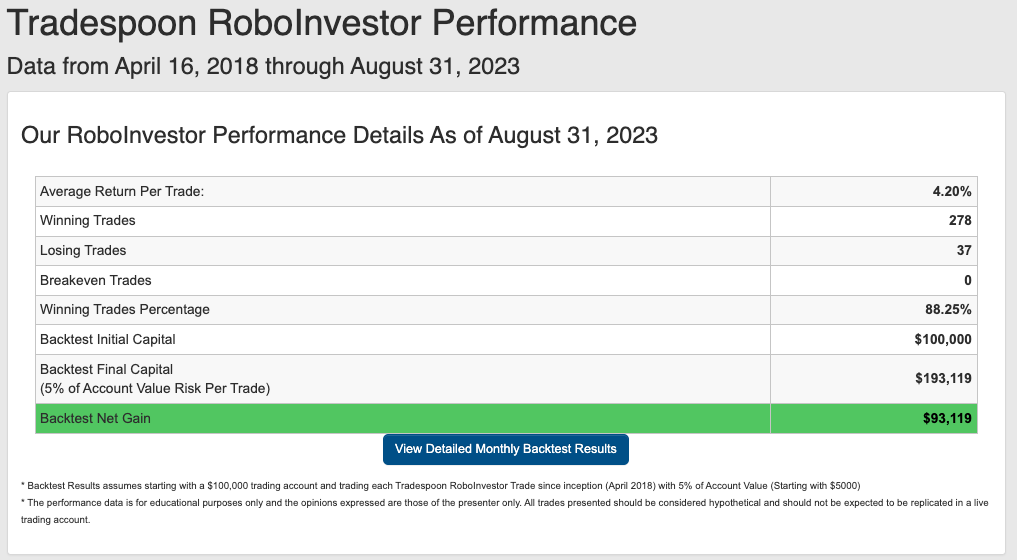

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.25% going back to April 2018.

As we continue onto the second half of 2023, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!