This past week, the stock market navigated a series of significant events, ranging from shifts in economic data to Federal Reserve policy updates and geopolitical tensions. Despite the challenges, U.S. equities demonstrated strong resilience, with notable rebounds following early declines. Investors were faced with volatility, yet the markets remained buoyant heading into the final quarter of the year.

One of the pivotal developments was the release of the Job Openings and Labor Turnover Survey (JOLTS), which revealed a decline in job openings. This drop raised fresh concerns over the strength of the labor market, sparking discussions about potential implications for the Federal Reserve’s future interest rate decisions. On one hand, fewer job openings may suggest a cooling economy; on the other, it alleviates fears of wage-driven inflation, which had been a key concern for policymakers.

Further support for the labor market’s recovery came from the ADP National Employment Report, which showed private sector employers adding 143,000 jobs in September. This marked the first acceleration in job growth in six months and exceeded expectations, particularly with the manufacturing sector seeing its first job increase since April. While the services sector continued to drive the bulk of the hiring, the labor market’s overall strength is giving rise to cautious optimism about the economy’s direction.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Federal Reserve Chair Jerome Powell‘s remarks this week continued to influence market sentiment. Speaking at the National Association for Business Economics (NABE) conference, Powell suggested that the Fed might be more measured in its approach to future interest rate hikes. This more cautious tone temporarily spooked markets, which had hoped for a more aggressive rate-cut strategy.

However, as the week progressed, investors regained confidence. The tempered outlook from the Fed, combined with stronger-than-expected economic data, painted a picture of gradual recovery rather than an immediate downturn. Powell’s indication that the Fed is keen to avoid overly drastic moves provided reassurance that the central bank remains watchful but not reactive to short-term market fluctuations.

Several high-profile companies, including Tesla and Apple, reported their earnings this week, delivering mixed results. Tesla’s earnings showed strong vehicle deliveries, though they missed revenue estimates. Despite this, Tesla’s stock saw gains, driven by investor optimism about its long-term growth. On the other hand, Apple faced more significant challenges, with declining iPhone sales weighing on its stock performance. These contrasting reports from two tech giants underscored the sector’s mixed performance but reinforced its influence on broader market movements.

Ongoing tensions in the Middle East and Europe added another layer of complexity to the markets, particularly within the energy sector. Oil prices fluctuated throughout the week, with WTI Crude Oil surging more than 5% to almost $74 per barrel. This spike followed growing concerns that the U.S. might support a strike by Israel on Iran’s oil facilities, which would significantly reduce global oil supply. Stocks in the energy sector, including Diamondback Energy and Schlumberger, saw gains alongside this increase in oil prices.

However, geopolitical risks also introduced market volatility. Investors are increasingly concerned about how rising tensions may impact global energy supplies and broader economic stability. At the same time, ongoing discussions about renewable energy policies are keeping pressure on traditional energy stocks, adding to the uncertainty within the sector.

The technology sector outperformed this week, buoyed by optimism in software companies and a broader rally following the Fed’s comments. While tech companies like Tesla and Apple generated mixed earnings results, the sector as a whole enjoyed positive momentum, driven by a more optimistic market outlook and the belief that inflationary pressures may be easing.

In contrast, the energy sector experienced more volatility due to fluctuating oil prices. Investors remain cautious, given the geopolitical backdrop and the uncertainties around renewable energy policies that could affect traditional energy stocks. The combination of these factors left the sector under pressure, even as individual energy stocks posted gains.

Despite the overall resilience of the stock market, investor anxiety was evident in the rising VIX, often referred to as the market’s “fear gauge.” This index rose above 20, signaling heightened volatility as the market reacted to geopolitical tensions and Federal Reserve uncertainty. Stocks that are sensitive to energy prices, such as cruise lines, were among the hardest hit, as rising oil prices fueled concerns about higher fuel costs. Nonetheless, the Nasdaq Composite was the most resilient of the major indices, managing to close flat for the week, while the Dow and S&P 500 registered slight losses.

Investors are keeping a close eye on upcoming economic data, particularly Friday’s employment report for September. Along with key indicators like Services PMI, ISM Services, and factory orders, these data points are expected to provide further insight into the state of the U.S. economy and the labor market’s trajectory. If the employment data shows continued strength, it could provide a temporary boost to market sentiment, even amid lingering concerns about inflation and the Fed’s policy direction.

While the market’s resilience this week was encouraging, risks remain. Treasury yields continue to be volatile, with the 10-year yield trading between 3.6% and 4.4%, contributing to broader market uncertainty. Additionally, gold is breaking out to all-time highs, reflecting investor caution as they seek safe-haven assets amid potential geopolitical and economic risks.

Amid these mixed signals, some investors are adopting a market neutral stance, anticipating that the market will trade sideways in the short and medium term. With inflation appearing to remain within expectations and the earnings season performing better than initially feared, the long-term outlook remains intact. However, caution is warranted as potential risks of a recession, rising unemployment, and the vulnerability of small banks exposed to commercial and residential real estate come into focus.

As we enter the final quarter of the year, the stock market continues to demonstrate its resilience, despite facing persistent economic, geopolitical, and policy-related challenges. While volatility remains a significant factor—driven by heightened geopolitical tensions and the Federal Reserve’s uncertain policy direction—the market’s strength still offers optimism for investors.

In the coming weeks, key economic reports will be critical in shaping market sentiment. As the U.S. economy grapples with cooling growth and rising inflationary pressures, decisions by the Federal Reserve, alongside evolving global geopolitical developments, will heavily influence the market’s trajectory.

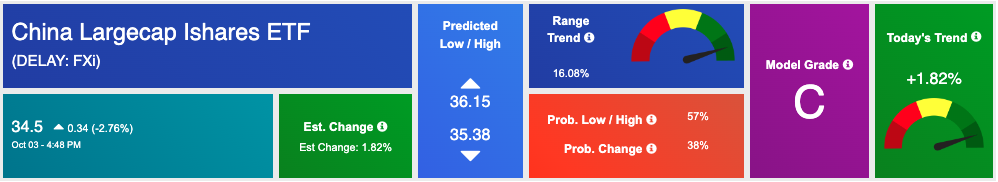

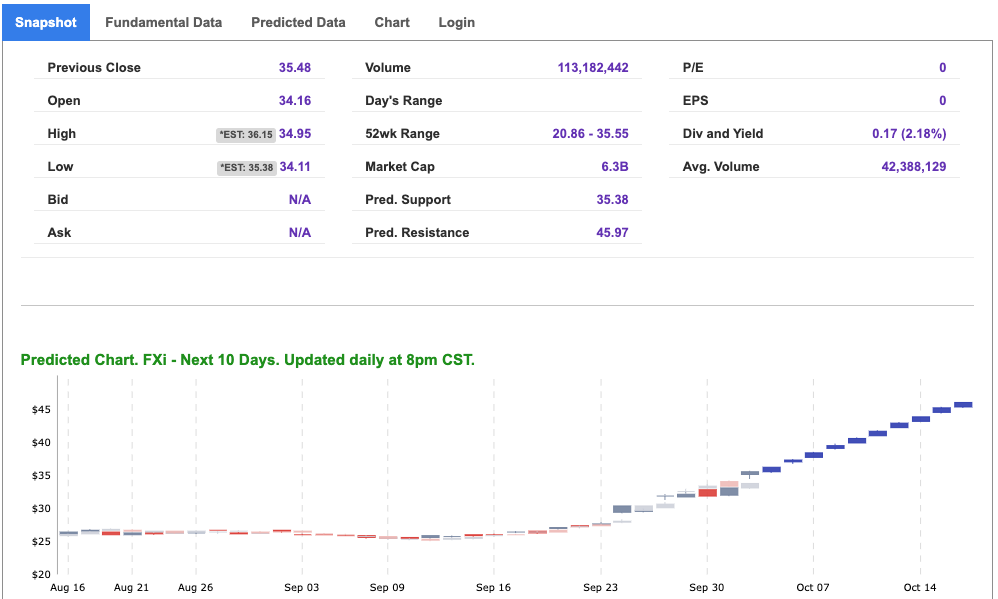

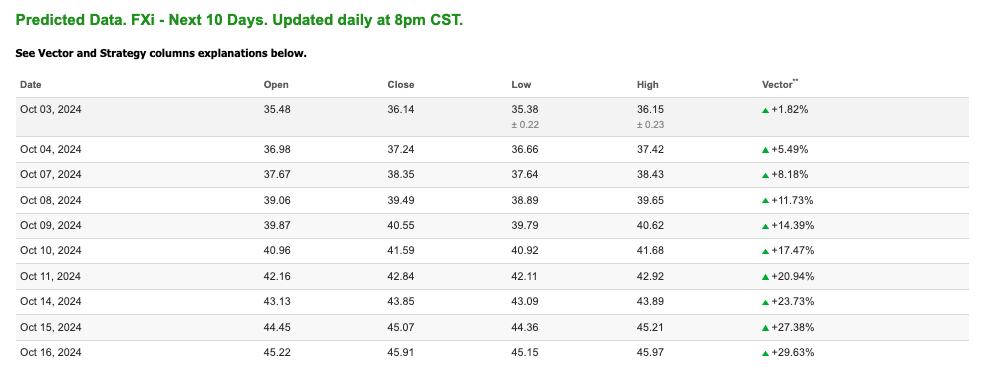

Against this backdrop, the iShares China Large-Cap ETF (FXI) presents a timely opportunity for investors. FXI, which tracks the performance of China’s largest companies across sectors like financials, technology, and energy, offers a strategic entry point for those seeking to benefit from a potential rebound in the Chinese market—despite the broader volatility that persists globally.

Recent data from China suggests that the world’s second-largest economy may be entering a period of recovery after months of stagnation due to a series of lockdowns and a faltering property market. Key indicators, such as improvements in industrial production and retail sales, point to a gradual rebound in domestic consumption and manufacturing output. This rebound is being bolstered by targeted stimulus measures from the Chinese government, which is keen to support its economy in the wake of global economic pressures.

One of the strongest catalysts for FXI’s potential upside is the increased commitment from the Chinese government to stabilize and stimulate its financial markets. In August, Beijing implemented new measures aimed at reducing borrowing costs, cutting mortgage rates, and offering subsidies to spur consumer spending. These efforts are beginning to bear fruit, with several analysts predicting that growth in China’s GDP will exceed expectations for the remainder of the year.

Furthermore, China’s central bank has made it clear that it is prepared to implement additional monetary easing measures if needed, which could provide further tailwinds for FXI as investor confidence in the region strengthens.

The technology sector, which accounts for a substantial portion of FXI, has shown resilience in the face of recent headwinds. Tech stocks in China have benefited from signs that regulatory crackdowns are beginning to ease, with companies like Alibaba and Tencent regaining some of their lost ground. After a challenging year for Chinese tech giants due to heightened regulatory scrutiny, there is growing optimism that the worst is behind them, and the sector is poised for recovery.

The shift in sentiment is also driven by improved relations between China and the U.S. regarding trade and technology. Reports suggest a de-escalation in tech-related tensions, which could remove some of the geopolitical risk that has weighed heavily on Chinese tech stocks. With tech companies comprising a significant portion of FXI’s holdings, this sector’s revival is a strong reason to consider FXI a buy.

From a valuation standpoint, Chinese stocks are trading at a discount compared to their global peers, making FXI particularly attractive for value-conscious investors. With price-to-earnings ratios in China’s large-cap companies significantly lower than those in the U.S. and other developed markets, FXI provides a high-upside opportunity as investors look for assets that are priced below their potential future growth.

As global investors seek diversification amid rising risks in Western markets, the Chinese market—especially via FXI—represents an appealing option. The long-term growth potential of China’s domestic consumption, coupled with government support for key sectors, suggests that FXI could be well-positioned for gains in the coming weeks.

The broader market sentiment also plays in FXI’s favor. U.S. equity markets have experienced heightened volatility due to concerns over the Federal Reserve’s interest rate policies, ongoing geopolitical tensions, and inflation risks. In contrast, China’s proactive fiscal measures and the stabilization of its key industries present a more favorable risk-reward profile.

Additionally, the U.S. dollar’s recent weakness has bolstered emerging markets, with China standing to benefit as a major player. A weaker dollar often leads to stronger performance in international markets, as it makes their goods more competitive on the global stage. For FXI, this environment could result in increased foreign investment, further supporting a rally in Chinese equities.

With improving economic data, government support, and easing regulatory pressures in key sectors like technology, FXI offers a balanced yet high-upside investment for the upcoming week. China’s renewed focus on economic recovery and stabilization efforts makes it an attractive market, and FXI, with its diversified holdings across major Chinese industries, is well-positioned to capitalize on these positive developments. As market sentiment continues to favor international exposure and value opportunities, FXI stands out as a symbol worth watching closely.

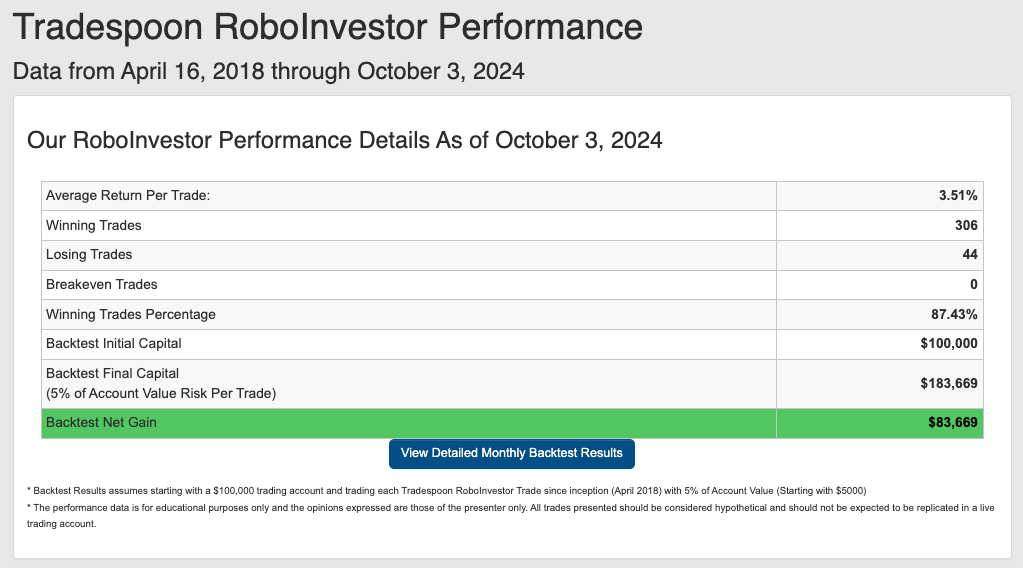

Enhance your investment decisions by leveraging the power of AI with our RoboInvestor stock and ETF advisory service. Utilizing advanced technology, this service identifies trades with a high probability of profitability. Our proprietary AI platform cuts through market noise and removes emotional biases, delivering clear, data-driven insights and strategies to help you succeed in today’s dynamic market environment.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.43% going back to April 2018.

As we advance further in Q4, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!