In a week marked by significant market shifts and economic indicators, the financial landscape demands attention from astute investors seeking clarity amidst uncertainty. From Federal Reserve deliberations to bond market fluctuations, here’s a detailed breakdown tailored for those seeking a deeper understanding of the week’s events.

Federal Reserve Signals and Interest Rate Implications

As we track our investment portfolios through the ebbs and flows of the market, Federal Reserve Chairman Jerome Powell’s recent remarks regarding interest rates hold particular weight. Powell’s suggestion of potential rate cuts this year reverberates throughout financial circles, influencing decisions on savings, investments, and retirement plans. Simultaneously, the breach of a critical threshold in the 10-year Treasury yield prompts us to consider its potential impact on our fixed-income investments and long-term financial goals.

Economic Growth Insights and Financial Planning

Amidst these developments, the Federal Reserve Bank of Atlanta’s upward revision of first-quarter economic growth forecasts brings a glimmer of hope. With projections now pointing towards a robust GDP increase, exceeding initial estimates, we pause to reassess our retirement strategies and asset allocations. This newfound optimism prompts reflection on how we can align our financial plans with emerging economic trends and potential delays in interest rate adjustments.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Understanding Inflation Trends and Budgetary Considerations

Delving into the nuanced insights from the Personal Consumption Expenditures (PCE) data, we gain valuable perspective on inflationary pressures. While monthly core PCE index alignments offer some reassurance, the year-over-year rise signals sustained inflation trends. These insights guide our budgeting strategies and retirement income planning, shaping expectations around cost-of-living adjustments and purchasing power preservation.

In the midst of market volatility, we approach our investment decisions with a blend of optimism and caution. With a historically favorable period approaching and broader market participation evident, opportunities for strategic investments amidst pullbacks emerge. However, we remain mindful of potential resistance levels in market rallies, prompting a prudent approach to asset allocation and risk management to safeguard our financial future.

As we evaluate sector performance, we note the promise of value stocks amidst expectations of normalized yield curves and subdued inflation. Conversely, concerns arise over the underperformance of technology stocks, prompting a reassessment of sector exposure within our investment portfolios. Notable industry challenges, such as those faced by Tesla, remind us of the importance of diversification and prudent investment choices.

Geopolitical tensions, particularly in regions like the Middle East, underscore the interconnected nature of global financial markets. Fluctuations in oil prices and Treasury yields remind us of the need for diversified investment strategies and resilience in the face of geopolitical uncertainties. As we navigate these dynamics, we remain steadfast in our commitment to informed decision-making and long-term financial planning.

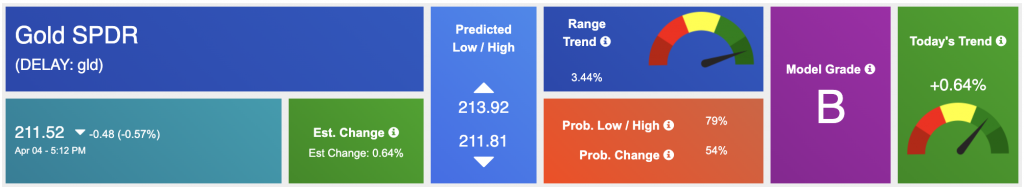

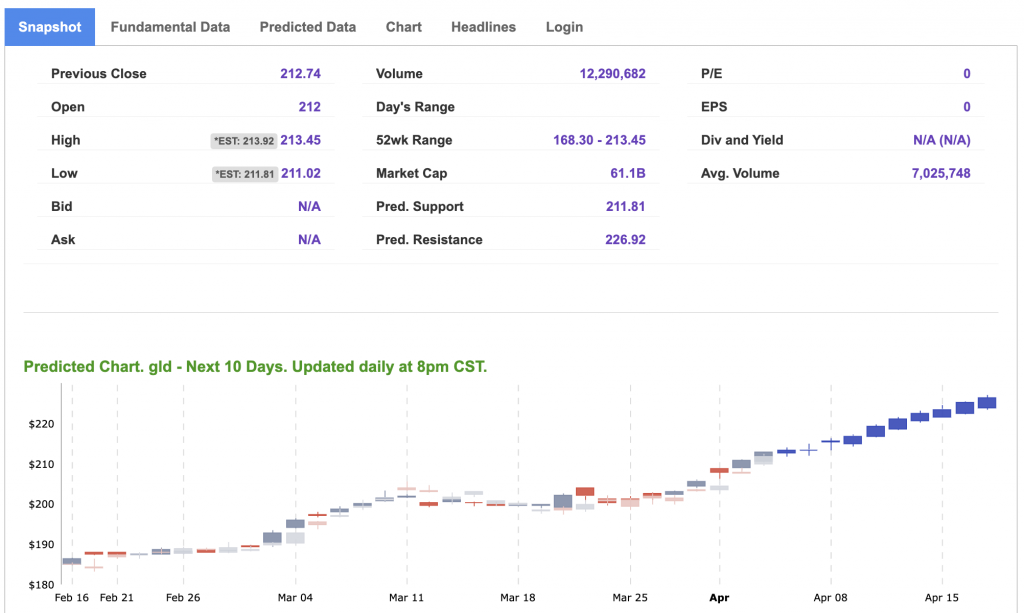

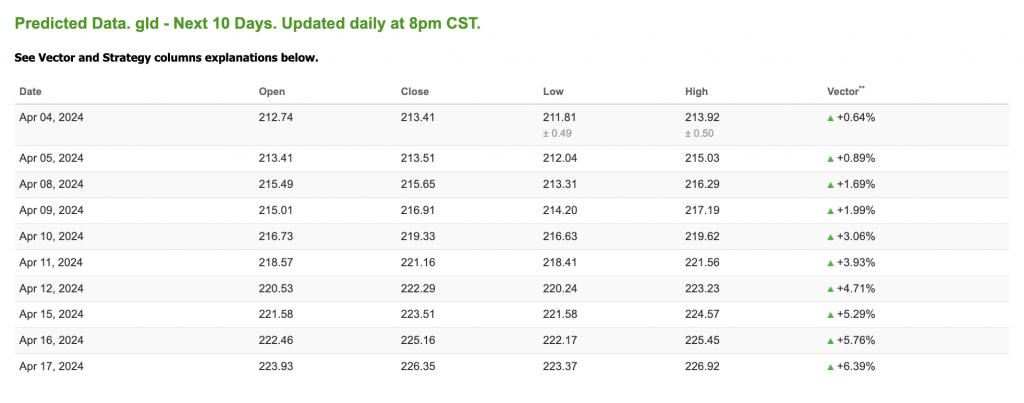

Seizing Opportunity: GLD as a Strategic Investment Choice

As we evaluate potential investment opportunities amidst the current market landscape, one asset class stands out for consideration: Gold, represented by the SPDR Gold Shares ETF (GLD). Let’s delve into why GLD could be a compelling buy for the upcoming week, especially given the prevailing market conditions highlighted in our analysis.

In times of economic uncertainty and fluctuating market sentiments, gold has historically served as a safe haven asset, offering a hedge against volatility and geopolitical tensions. With geopolitical concerns on the rise, evidenced by recent developments in regions like the Middle East, investing in GLD could provide a buffer against market turbulence and protect our portfolios from downside risks.

As we navigate through inflationary pressures highlighted by the sustained rise in the year-over-year core PCE index, the allure of gold as an inflation hedge becomes increasingly appealing. Unlike fiat currencies, which may depreciate in value over time due to inflationary pressures, gold has demonstrated its ability to preserve purchasing power over the long term. By allocating a portion of our portfolio to GLD, we position ourselves to mitigate the erosive effects of inflation and safeguard the real value of our investments.

Amidst sector-specific challenges and uncertainties surrounding technology stocks, diversifying our investment portfolio becomes imperative for managing risk and optimizing returns. Gold offers diversification benefits by exhibiting low correlation with traditional asset classes such as equities and bonds. By incorporating GLD into our investment strategy, we enhance portfolio resilience and reduce overall volatility, thereby fostering long-term wealth preservation.

Given the Federal Reserve’s cautious stance on interest rates and the potential for future rate cuts, gold may benefit from a conducive interest rate environment. As expectations of lower interest rates persist, the opportunity cost of holding non-yielding assets like gold diminishes, making it an attractive proposition for investors seeking alternative sources of returns. Against the backdrop of rising bond yields and uncertainties surrounding equity markets, GLD emerges as a strategic investment choice poised to capitalize on prevailing interest rate dynamics.

As we navigate through the intricacies of the financial markets, the case for considering GLD as a strategic investment choice for the upcoming week becomes compelling. With its potential to serve as a hedge against market uncertainty, inflationary pressures, and geopolitical risks, GLD offers diversification benefits and the prospect of capital appreciation in a dynamic investment landscape. By seizing the opportunity to incorporate GLD into our portfolios, we position ourselves for long-term wealth preservation and capital growth amidst evolving market conditions.

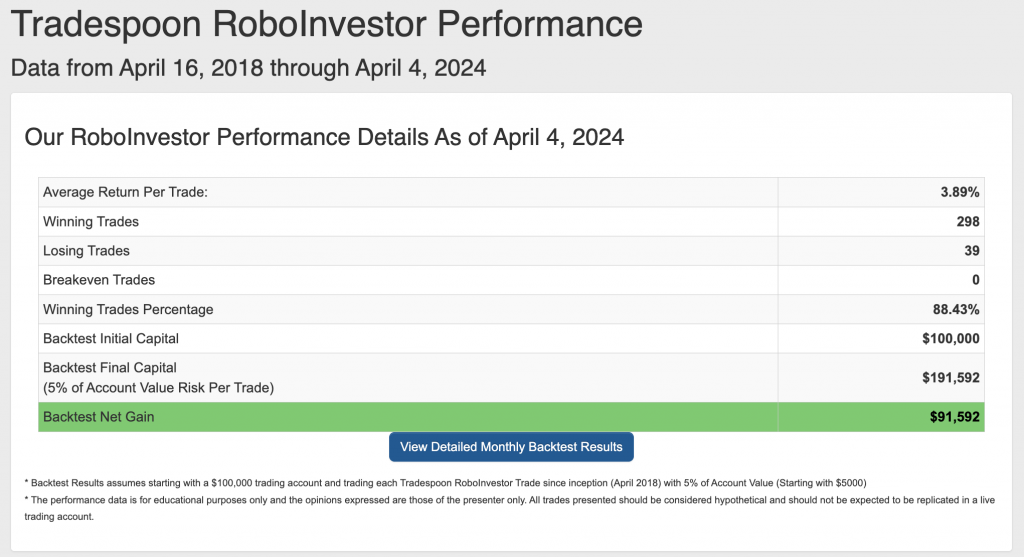

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.43% going back to April 2018.

As we navigate deeper into 2024, investors face a labyrinth of market challenges, from surging inflation to shifting Federal policies and geopolitical uncertainties like the ongoing conflict in Ukraine. In such turbulent times, having a trusted and informed investment partner becomes paramount. Enter RoboInvestor – your steadfast ally in the ever-evolving financial landscape. Offering a comprehensive array of resources and expert insights, RoboInvestor empowers you to navigate your portfolio with confidence and seize promising opportunities amidst the rapid pace of market dynamics.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!