The Nasdaq Composite extended its winning streak to three consecutive days on Thursday as investors eagerly awaited the release of the Federal Reserve’s favored inflation measure, the Personal Consumption Expenditures (PCE) data, due on Friday. This optimism comes amidst a series of significant economic data releases that have shaped market sentiment throughout the week.

Economic Data and Market Reaction

In the latest economic developments, initial jobless claims fell last week, signaling a resilient labor market. The Bureau of Economic Analysis also revised its first-quarter GDP estimate upward to 1.4%. This positive news follows a mixed start to the week on Monday, where market sentiment was cautious after a volatile end to the previous week.

Despite the overall optimistic tone, the semiconductor sector experienced notable declines earlier in the week. Chipmakers, who have been major contributors to market gains, saw a rotation of investor interest into other sectors. Nvidia shares dropped by 6.7%, Super Micro Computer fell by 8.7%, Broadcom declined by 3.7%, and Microchip Technology decreased by 2.6%. By Thursday, the sector continued to struggle, with Micron Technology stocks pulling down the semiconductor index further.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Fed Rate Speculations and Treasury Yields

Investor sentiment has been buoyed by hopes that the Federal Reserve may cut interest rates later this year. The focus is on the upcoming core PCE index reading, which could influence the Fed’s monetary policy decisions. On Thursday, bond yields remained relatively stable, with the 10-year Treasury note yield at 4.251% and the two-year yield at 4.738%. However, later in the day, Treasury yields saw a slight pullback, with the 10-year yield decreasing to 4.287%.

Global Market Focus and Key Economic Indicators

This week has been pivotal for global markets, with a slew of critical economic reports and corporate developments capturing investor attention. Key data releases included consumer confidence on Tuesday, new home sales on Wednesday, and weekly jobless claims alongside the revised GDP figures on Thursday. The climax of the week will be the core PCE data on Friday, providing essential insights for investors navigating an environment marked by significant economic indicators and business shifts.

As the end of the quarter approaches, market volatility is expected to increase. The Russell 2000 rebalancing and the end of the first half of 2024 trading may contribute to heightened trading activity and fluctuations. The 10-year yield has been particularly volatile, trading within a range of 4.2% to 4.7%, and retesting the 4.3% mark this week as markets hover near all-time highs.

Sector Performance and Market Trends

Value stocks and interest-sensitive sectors are rebounding, while major indices like QQQ and SPY are reaching all-time highs. Oil futures have extended gains amid rising political risk perceptions and expectations of market tightness in the third quarter. SPDR Gold Shares have also seen an uptick following economic data releases that were not as inflationary as anticipated. Thursday’s economic reports included durable goods orders, GDP growth estimates, and weekly jobless claims, all contributing to market dynamics.

Job Market Insights

Jobless claims for the week ending June 22nd declined more than economists had expected, with initial claims at 233,000, down 6,000 from the previous week’s revised level. This marks the highest level of claims since 2021. The four-week moving average rose slightly to 236,000, while continuing claims increased to 1.84 million, surpassing expectations.

Market Outlook

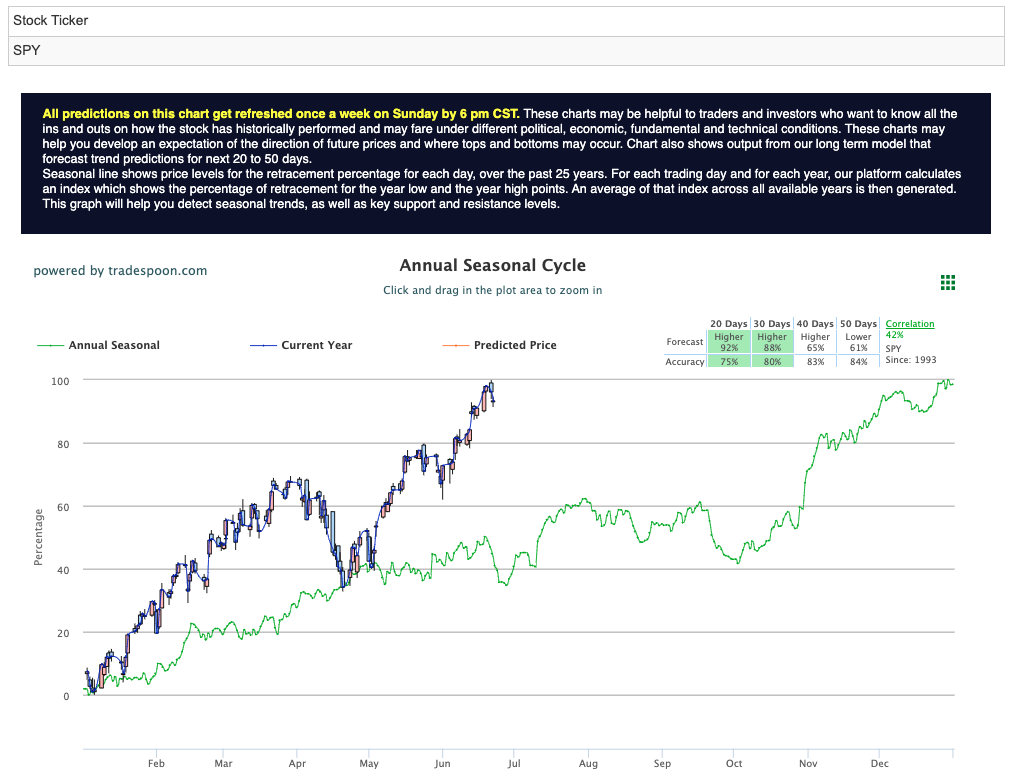

Despite the potential risks and approaching recessionary signals, including cooling economic activity and rising unemployment, the overall market sentiment remains bullish. Inflation is aligning with expectations, and the earnings season has been better than anticipated. However, concerns about the failure of small banks due to exposure to commercial and residential real estate linger. The SPY rally is expected to be capped at $550-$560 levels, with short-term support at $520-$530 in the coming months. Investors anticipate the market to continue posting higher highs and higher lows. For reference, the SPY Seasonal Chart is shown below:

As we approach the second half of 2024, market participants remain vigilant, balancing optimism with caution amidst a complex economic landscape. After reviewing the latest data, one symbol has caught my attention, and my AI models concur.

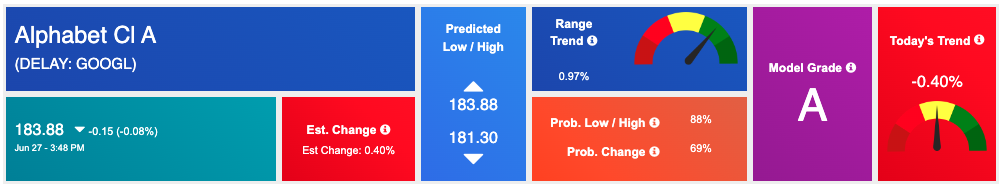

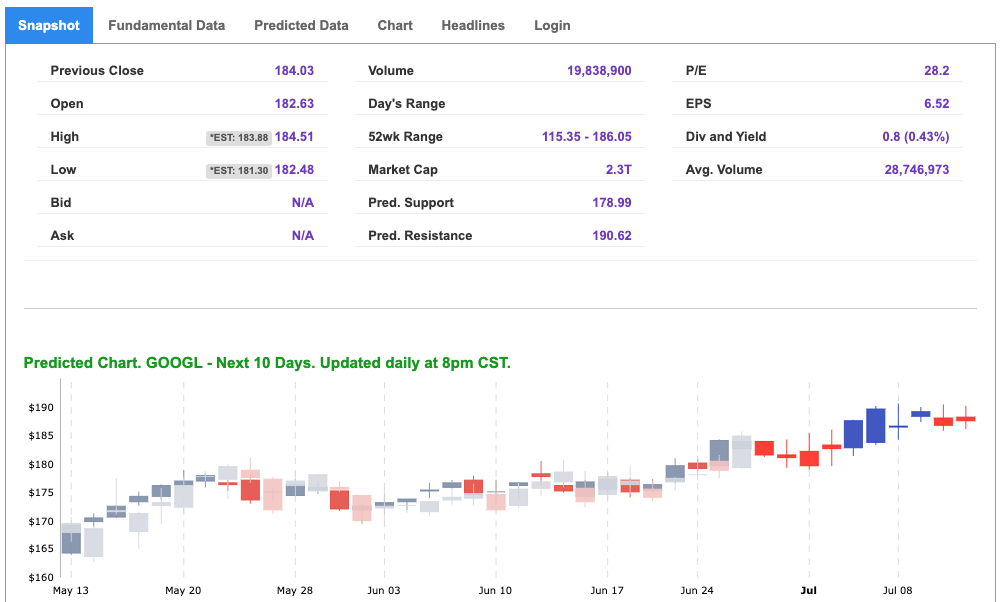

Alphabet Inc. (GOOGL), the parent company of Google, has demonstrated robust market performance over the past year, driven by strong revenue growth and a diversified business model. Despite tech stock volatility, Google has maintained an upward trajectory, bolstered by its dominance in online advertising, innovation in artificial intelligence, and expanding cloud services. Over the past quarter, GOOGL shares have gained significantly, reflecting investor confidence in the company’s sustained growth.

With inflation aligning with expectations and the potential for the Federal Reserve to cut interest rates later this year, the market sentiment toward growth stocks like GOOGL remains positive. The anticipation of a more dovish Fed policy creates a conducive environment for tech giants to thrive, making GOOGL an attractive investment.

Google’s leadership in artificial intelligence and machine learning positions it well to capitalize on the AI-driven growth trend. Market optimism about AI’s potential to drive profits has already significantly contributed to recent tech stock rallies, with Google at the forefront of this innovation wave.

Moreover, Google’s diversified revenue streams—encompassing its search engine, YouTube platform, and cloud services—provide a buffer against sector-specific downturns, making GOOGL a safer bet in the tech sector. This resilience, coupled with economic data that shows strong operational fundamentals despite fluctuating jobless claims and GDP revisions, positions GOOGL as a solid investment choice.

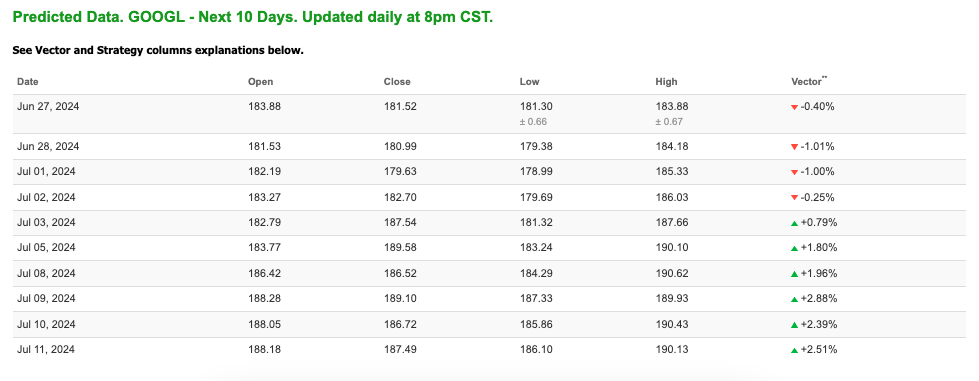

With insights from my Stock Forecast Toolbox, my AI models are producing a confident trend that GOOGL is positioned for robust growth in the upcoming week. Utilizing extensive market data and economic indicators, these models confirm that Alphabet Inc. stands to benefit from favorable market conditions and strong investor sentiment. The AI-driven forecast underscores a bullish outlook for GOOGL, aligning with this week’s positive market trends.

Investors seeking to leverage market optimism and technological innovation may find GOOGL a compelling addition to their portfolios, supported by its strong fundamentals and favorable market conditions.

Harnessing the power of AI, our RoboInvestor stock and ETF advisory service leverages cutting-edge technology to pinpoint trades with a high probability of profitability. Our proprietary AI platform eliminates the noise and emotional factors that often influence investor decisions, providing our members with clear, data-driven insights and strategies for success.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

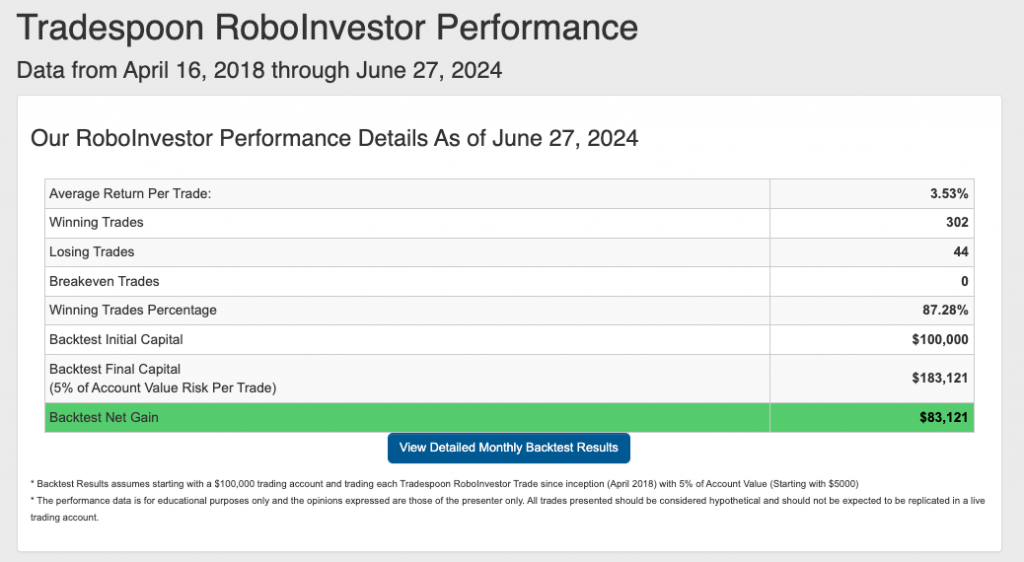

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.28% going back to April 2018.

As we reach the halfway point of 2024, investors find themselves grappling with a maze of market challenges that persist, from escalating inflationary pressures to the fluid landscape of Federal policies and geopolitical tensions, such as the ongoing conflict in Ukraine. In these uncertain times, the importance of having a reliable and knowledgeable investment partner cannot be overstated. That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!