U.S. stock markets opened the week with impressive momentum, as all three major indices traded in positive territory. The S&P 500 made a historic leap, closing above the 6000 mark for the first time, continuing last week’s rally and setting a new milestone. Small-cap stocks led the charge on Monday, while other sectors like financials, energy, and industrials saw gains, with some analysts attributing this to optimism surrounding policies that could favor these sectors. This week’s focus is now on the Consumer Price Index (CPI) and Producer Price Index (PPI) reports, expected to provide crucial insights into inflation.

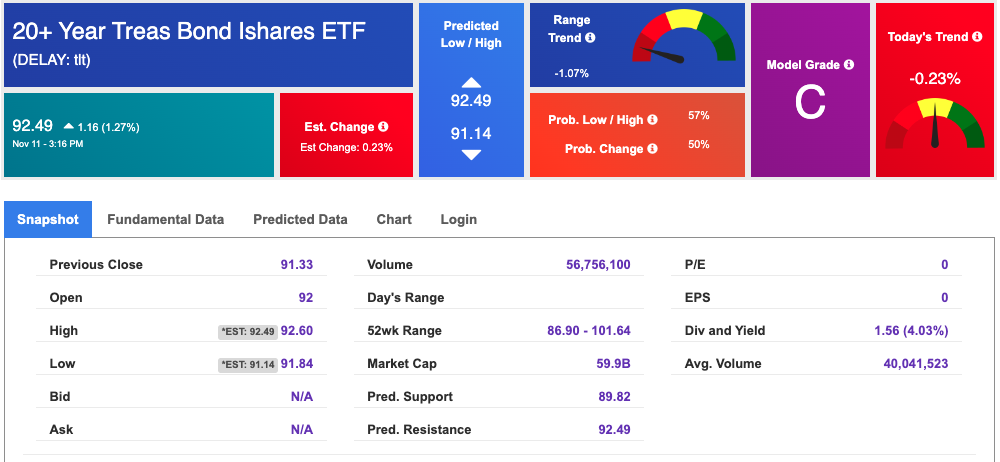

While small-cap stocks set the pace for Monday’s rally, sectors anticipated to benefit from Donald Trump’s policy stance—such as financials, energy, and industrials—also rose. Tesla, buoyed by Elon Musk’s public support for Trump, helped lift the consumer discretionary sector, which also saw gains. With Treasury markets closed for the Veterans Day holiday, bond traders turned to the iShares 20+ Year Treasury Bond ETF, which fell about 0.6%, hinting that yields could be rising if the bond market were open.

Early Monday, U.S. stock futures were pointed higher, building on last week’s momentum following Trump’s election victory. The Dow Jones Industrial Average futures were up by 201 points (0.5%), while S&P 500 futures climbed 0.4%, and Nasdaq 100 futures rose by 0.5%. Last Friday, all three indexes closed at record highs after a whirlwind week featuring Trump’s victory and a decision by the Federal Reserve to lower interest rates. The S&P 500 experienced its best week in over a year, fueled by optimism around corporate earnings under Trump’s administration.

Despite Monday’s overall market strength, some of the largest tech stocks—coined the “Magnificent Seven”—faltered. Tesla and Alphabet were the only gainers among the group, while Apple slipped 2.4% and Nvidia dropped 1.8%. Microsoft, Meta Platforms, and Amazon were down over 1% each. Chip stocks also struggled, with the iShares Semiconductor ETF dropping 3.6% as sector sentiment cooled.

Energy stocks managed to hold steady despite declining oil prices, reflecting Wall Street’s continued confidence in oil companies’ profitability under a Trump presidency. However, oil prices lost ground, with Brent crude dropping 1.4% to $72.86 per barrel and WTI crude sliding 1.6% to $69.26 per barrel. The U.S. dollar’s 0.4% rise against a basket of currencies contributed to oil’s decline, making it more expensive for foreign buyers. In addition, concerns over sluggish demand growth in China weighed on the outlook for global oil demand.

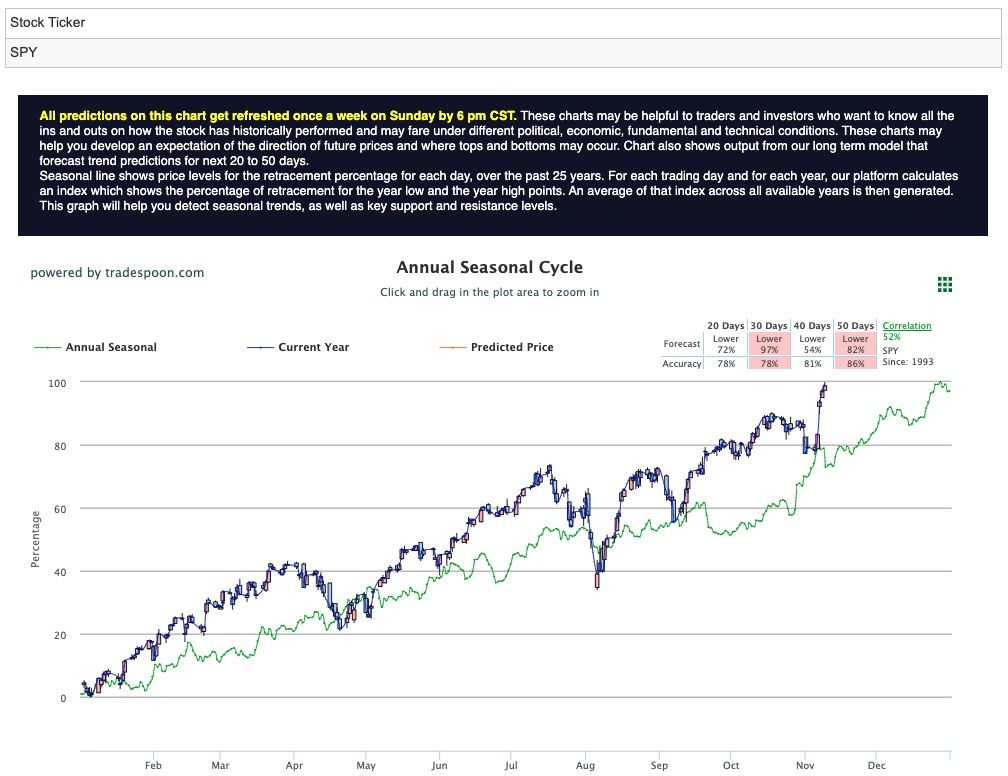

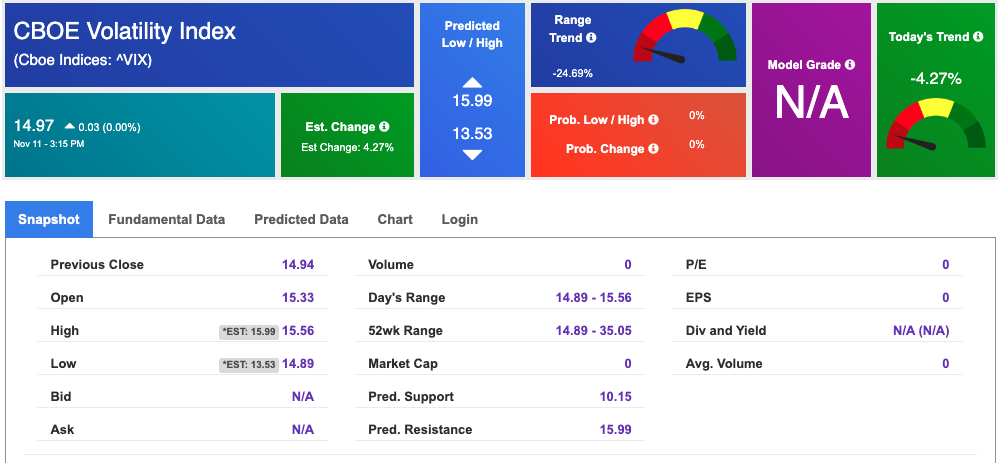

The previous week showcased significant market volatility, fueled by Trump’s election win, a Federal Reserve rate cut, and mixed economic data. Following the election, the CBOE Volatility Index (VIX) dropped as market sentiment leaned cautiously bullish, buoyed by stabilizing inflation and strong earnings from key corporations. Despite a cautious outlook, the S&P 500’s recent strength suggests potential gains toward the 6100 range, with support seen around the 5400–5500 zone. For reference, the SPY Seasonal Chart is shown below:

Amid signs of cooling economic activity, the Federal Open Market Committee (FOMC) announced a quarter-point rate cut, lowering the federal funds rate to a range of 4.5% to 4.75%. The Fed’s move signals a strategic recalibration aimed at tempering inflation while encouraging growth. Fed Chair Jerome Powell described the decision as a “recalibration,” leaving the door open to potential future rate hikes. Powell emphasized a balanced approach, highlighting the Fed’s goal to foster growth while managing inflation risks in a measured manner.

Additionally, Powell’s recent remarks underscore the Fed’s cautious approach to achieving a “soft landing,” avoiding sudden shifts in monetary policy. The S&P 500 has stayed above its 20-day Simple Moving Average (SMA) and is holding strong at all-time highs. Similarly, the Russell 2000, representing small-cap stocks, is approaching its peak despite rising bond yields. The VIX has stabilized around 15, a level indicative of reduced market anxiety, though analysts expect some volatility to persist amid ongoing political and economic developments.

Looking ahead, the market’s focus this week is on a range of economic indicators, including CPI, PPI, retail sales, industrial production, and business inventories. Several major Federal Reserve speeches are also scheduled, offering additional insights into the Fed’s policy outlook. Investors are watching closely as market expectations lean towards further rate cuts. Bloomberg data indicates potential rate reductions of up to 50 basis points this year, with as much as 125 basis points of cuts projected by 2025—a factor that could further support consumer spending and business investments.

On the corporate earnings front, big names like Home Depot, Cisco, Walt Disney, and Alibaba are due to report, adding another layer of market-moving potential to this week’s agenda.

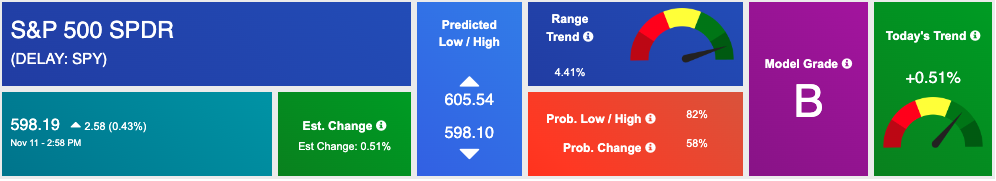

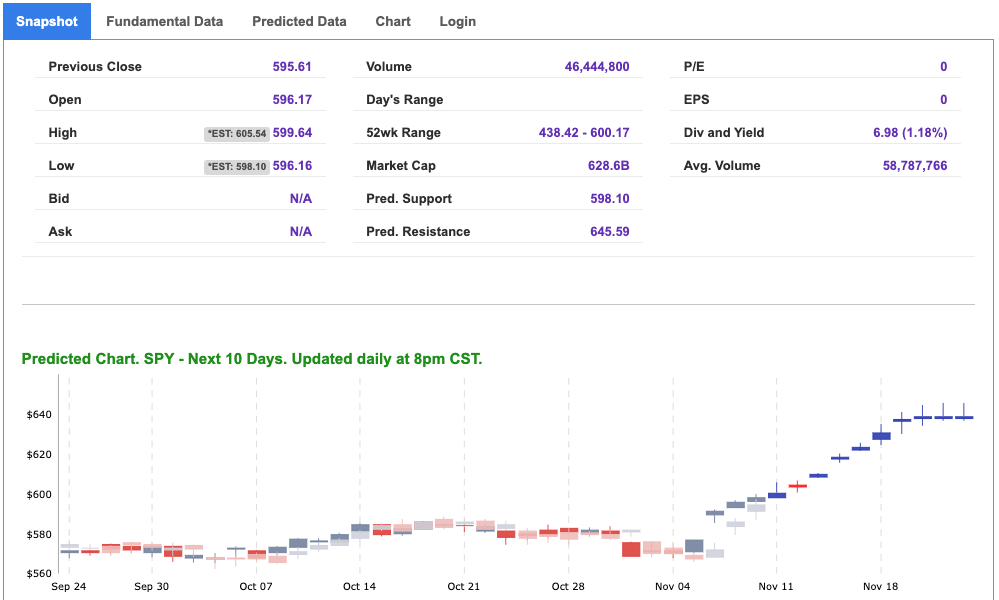

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

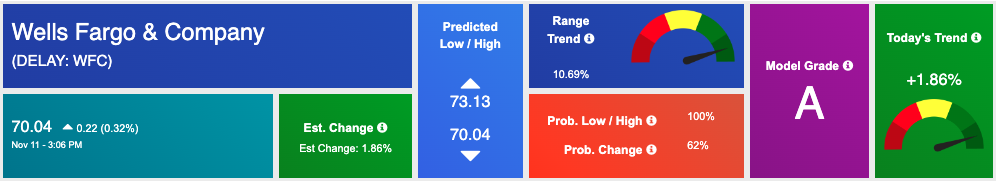

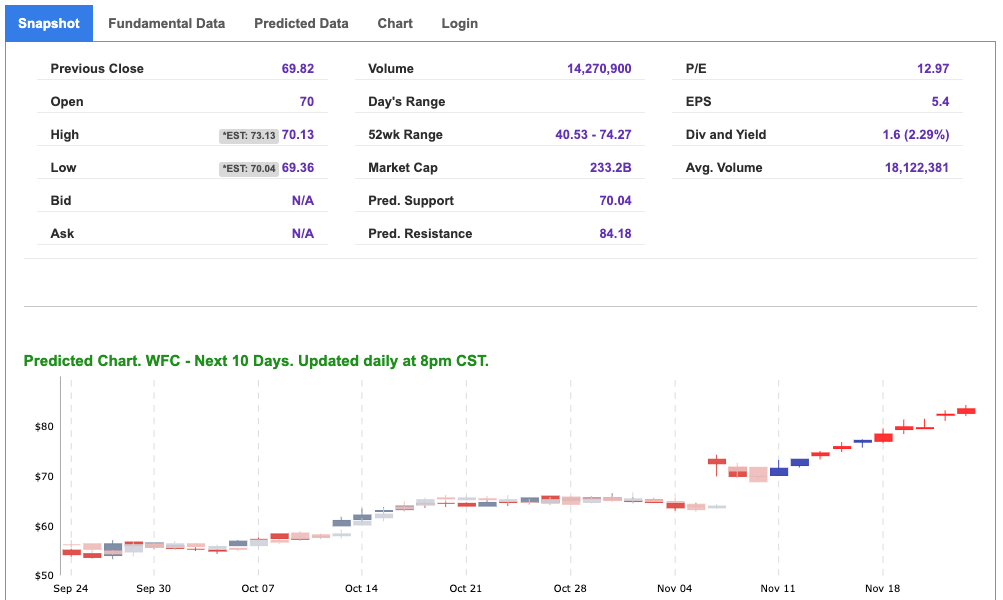

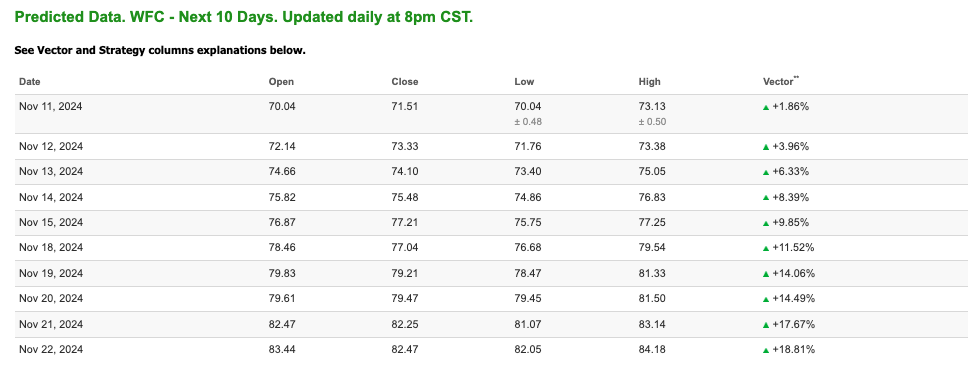

Our featured symbol for Tuesday is Wells Fargo & Co. – WFC is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $70.04 with a vector of +1.86% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does NOT have a position in the featured symbol, WFC. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

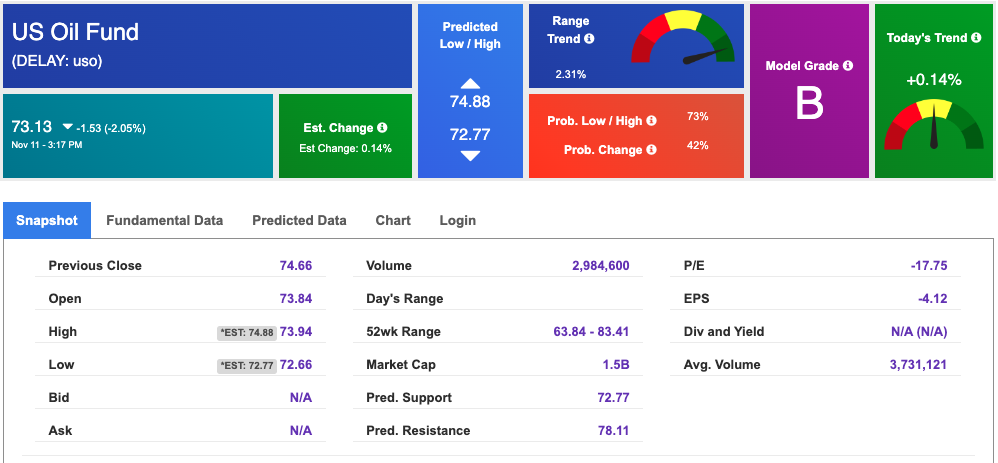

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $68.18 per barrel, down 3.13%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $73.13 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

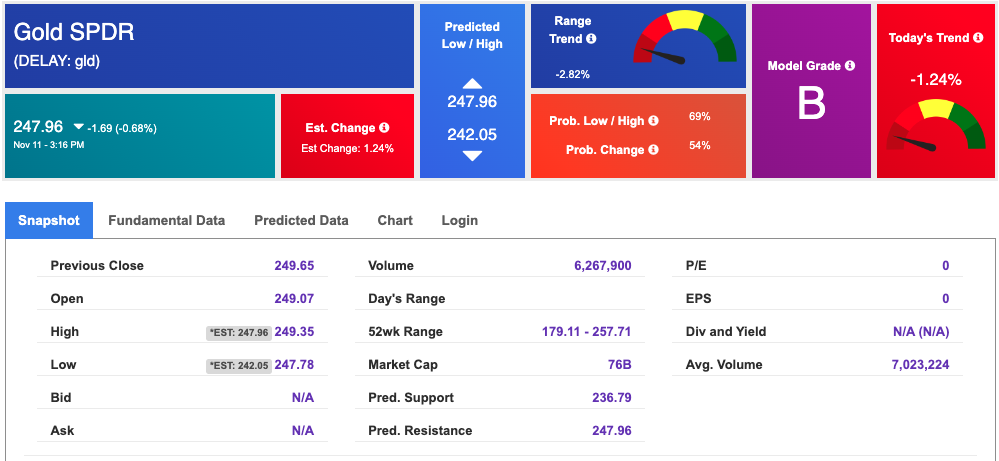

The price for the Gold Continuous Contract (GC00) is down 2.42% at $,629.40 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $247.96 at the time of publication. Vector signals show -1.24% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The yield on the 10-year Treasury note is flat at 4.310% at the time of publication.

The yield on the 30-year Treasury note is flat at 4.473% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The CBOE Volatility Index (^VIX) is priced at $14.97 up 0.03% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!