Wall Street kicked off the holiday-shortened week on a positive note, with the Dow, S&P 500, and Nasdaq all posting gains during Monday’s session. A final-hour rally saw investors locking in trades ahead of Tuesday’s early market closure for Christmas Eve, injecting fresh momentum into a market eager to close out the year on a high note.

The Nasdaq led the charge, driven by robust gains in Big Tech and semiconductor stocks, while the S&P 500 followed closely behind, benefiting from its tech-heavy weighting. Meanwhile, the Dow lagged, weighed down by its lower exposure to technology. Nvidia’s impressive 3% climb boosted the Nasdaq and S&P 500 significantly but had a smaller impact on the Dow, where stocks like UnitedHealth Group, up 1.4%, carry more influence due to its price-weighted structure.

Consumer Confidence Takes a Hit Amid Economic Uncertainty

Consumer confidence took an unexpected hit in December, with the Conference Board’s index dropping to 104.7 from November’s 112.8, well below expectations of 113.8. This decline reflects growing concerns about the economic outlook for 2025. While the report initially pressured equities, the market rebounded later in the day as traders took advantage of the dip, encouraged by the start of the historically bullish “Santa Claus rally” period.

Gold Falls as Dollar Strengthens and Treasury Yields Rise

In commodities, gold prices edged lower in thin holiday trading, pressured by a stronger U.S. dollar and rising Treasury yields. Market participants remain cautious as uncertainties surrounding the Federal Reserve’s 2025 interest-rate policy weigh on sentiment. While gold typically acts as a safe haven, its short-term performance has been vulnerable to shifting macroeconomic signals.

SPY Outlook: Santa Claus Rally on the Horizon?

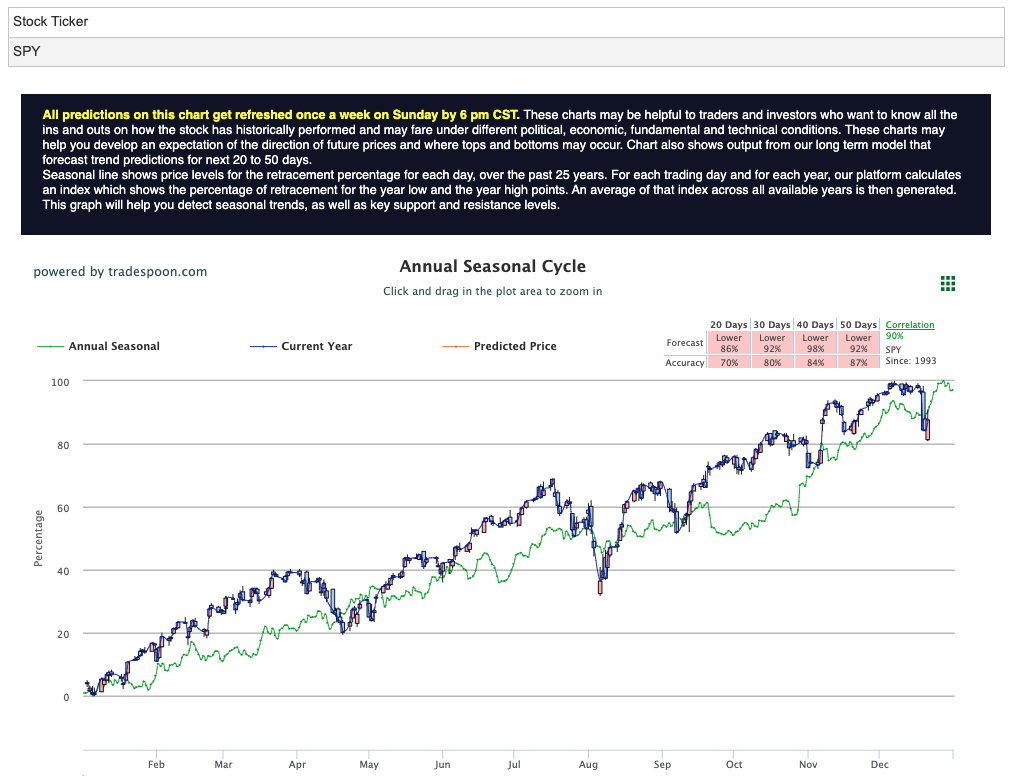

Despite short-term volatility, the SPY rally is showing resilience. Analysts project the potential for the SPY to climb between $620 and $640 over the coming months, with near-term support expected in the $560 to $580 range. However, risks tied to economic cooling, inflation concerns, and Federal Reserve policy remain front of mind for investors. For reference, the SPY Seasonal Chart is shown below:

As 2024 comes to a close, market sentiment is increasingly shaped by inflation data, earnings reports, and the Federal Reserve’s cautious tone regarding rate cuts. The Fed’s upward revision of inflation projections suggests that 2025 will present a mixed bag of challenges and opportunities. While the risk of a recession lingers, the likelihood of a “soft landing” scenario is gaining credibility.

Investor Takeaways: Preparing for 2025

With just days remaining in 2024, disciplined risk management and strategic positioning are more critical than ever. The market’s long-term trend remains upward, but near-term volatility is expected as macroeconomic uncertainties persist. Key drivers for 2025 will include inflation data, Federal Reserve policy decisions, and sector performance, with technology likely to remain in the spotlight.

As investors navigate this transitional period, the ability to capitalize on market pullbacks while maintaining a focus on long-term growth will be essential. The final trading sessions of the year will set the tone for January and beyond, making vigilance and adaptability crucial.

Holiday Trading Schedule

As a reminder, U.S. markets will close early on Tuesday, December 24, with the New York Stock Exchange and Nasdaq shutting down at 1 p.m. ET and the bond market closing at 2 p.m. ET. Markets will remain closed on Wednesday, December 25, in observance of Christmas. Normal trading hours will resume on Thursday, December 26.

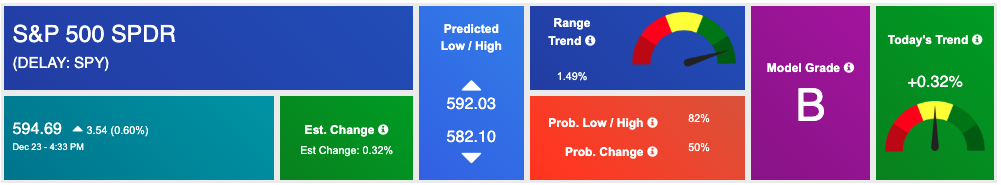

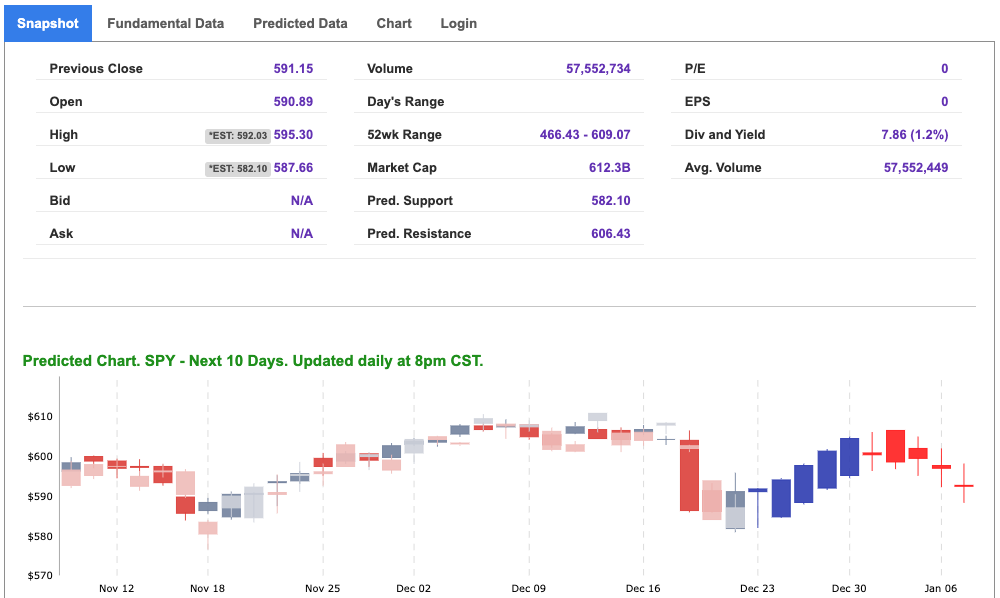

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

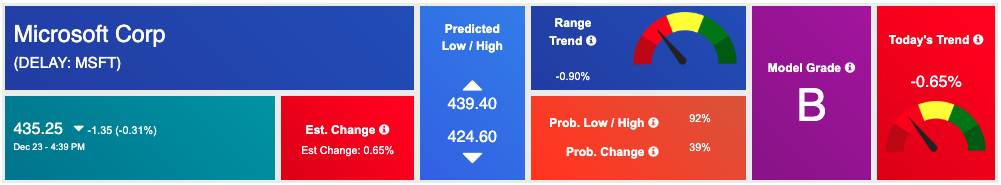

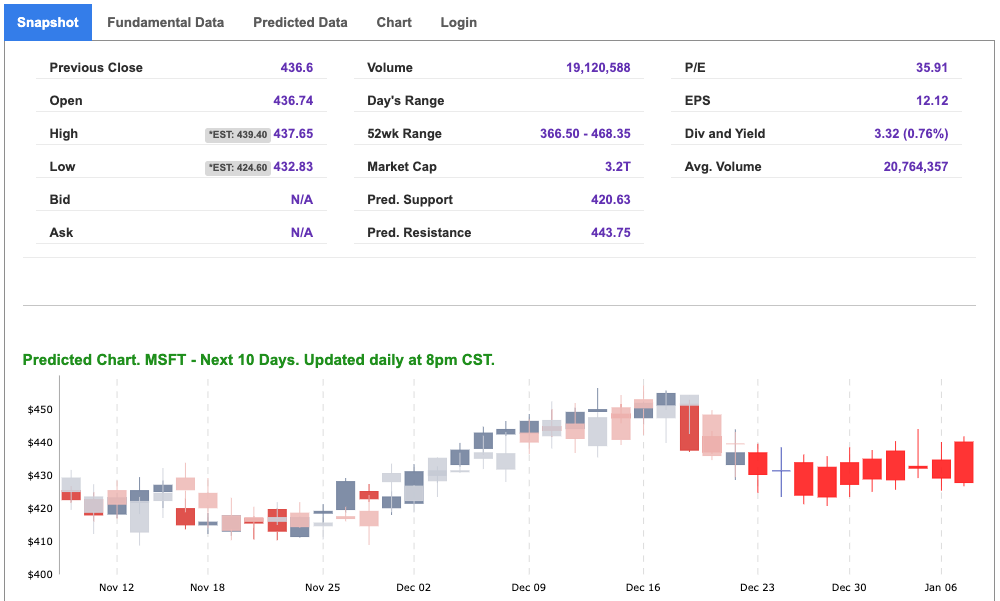

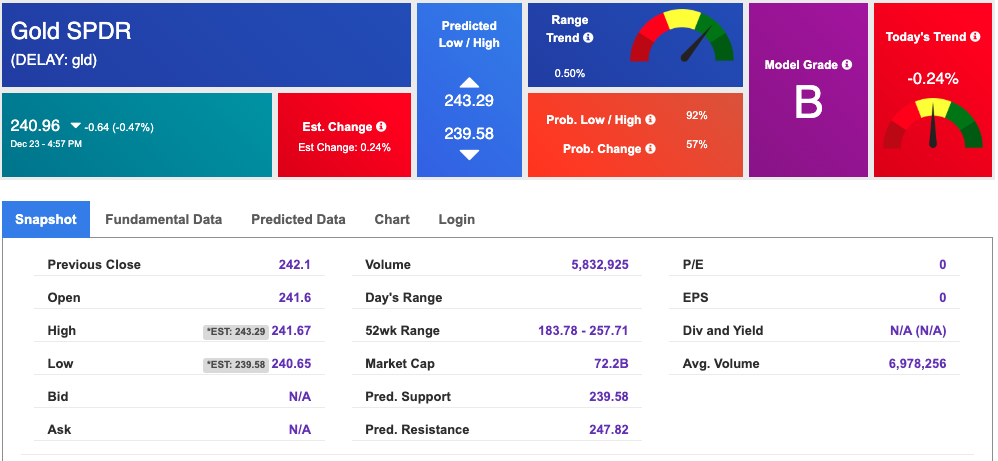

Our featured symbol for Tuesday is Microsoft Corp. – MSFT is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $435.25 with a vector of -0.65% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, MSFT. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

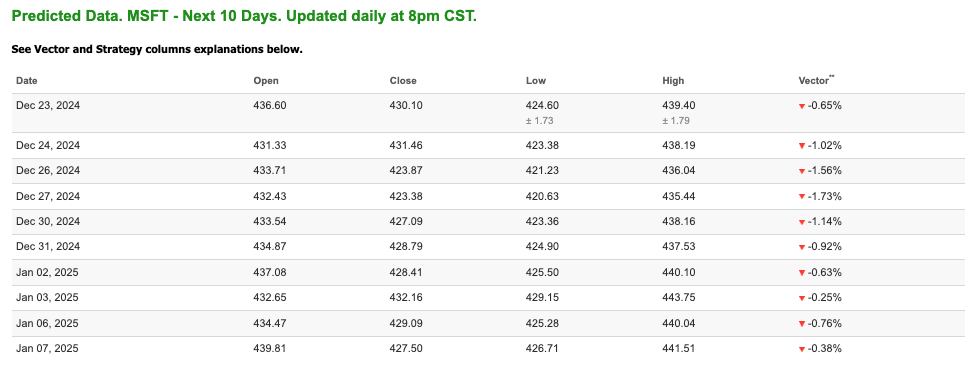

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $69.55 per barrel, down 0.13%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $73.06 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

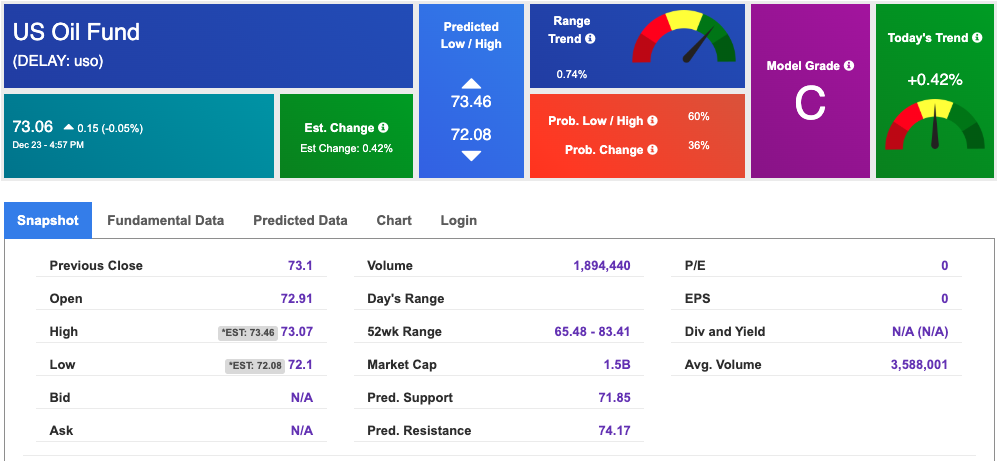

The price for the Gold Continuous Contract (GC00) is down 0.59% at $2629.40 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $240.96 at the time of publication. Vector signals show -0.47% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

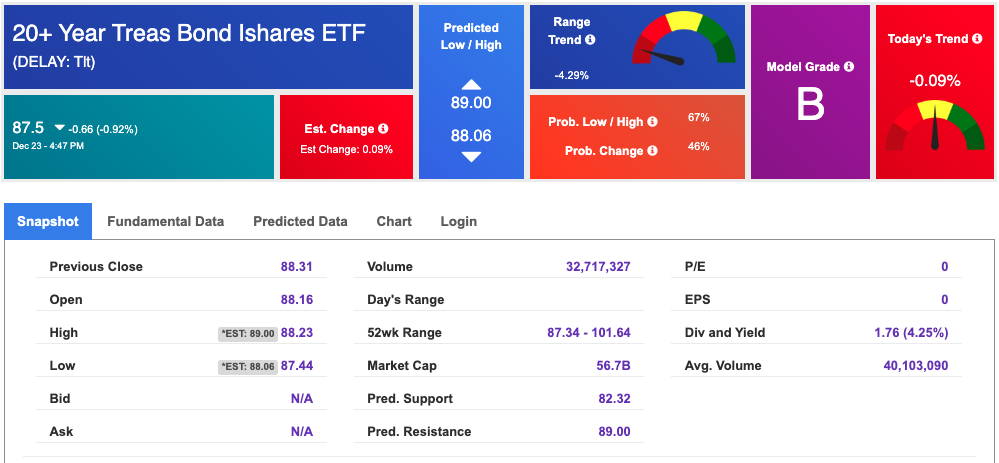

The yield on the 10-year Treasury note is flat at 4.593% at the time of publication.

The yield on the 30-year Treasury note is up at 4.776% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

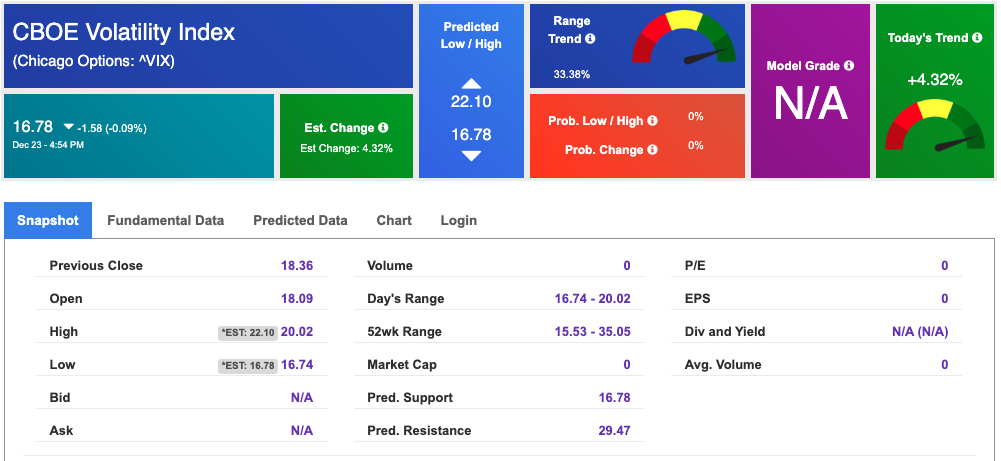

The CBOE Volatility Index (^VIX) is priced at $16.78 down 0.09% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!