The stock market experienced a significant downturn on Thursday, with investors being on edge over concerns of an impending recession. All three major U.S. indices closed in the red after dropping throughout most of the day. Banks, in particular, were a significant drag on the market; SVB Financial’s massive loss caused other banking stocks such as JPMorgan Chase, Bank of America, and Wells Fargo to plummet.

Adding to investor’s concerns, jobless claims rose to 211,000, exceeding the expected 195,000 and last week’s results, indicating that the labor market may be loosening. However, economists predict that the February jobs report, set to be released on Friday, will show an increase of 225,000 jobs, down from January’s 517,000. A decrease would be welcome news for the market, as it would suggest an economy weak enough to support further decreases in inflation but still strong enough to avoid a severe recession.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

This comes in the context of a market that has struggled in recent trading days, with the indexes coming into Thursday in the red for the week. On Wednesday, Powell returned to Capitol Hill to testify before the House Financial Services Committee, where he stated that the central bank had not yet decided on the size of the March rate hike. The market’s next test will come on Friday with the release of the February jobs report, which could prompt the Fed to pause its rate hikes if it indicates a decline in demand and inflation.

Federal Reserve Chairman Jerome Powell’s recent testimony to Congress that more interest rate hikes are on the way has contributed to the market’s instability. Powell noted that economic data indicates the rate of inflation is declining slowly, and rates need to rise slightly from here and then stay high for a while.

Additionally, on Wednesday, the release of the latest Beige Book was seen. The report revealed that six of the twelve Federal Reserve districts reported little or no change in economic activity through February’s end, whereas the other six districts indicated growth at a modest pace had expanded. This resulted in only a slight rise in nationwide activity, according to the Fed report.

The latest report also showed that inflation pressures remained widespread, with energy and raw material prices on the rise, while many districts reported moderating price increases. However, there was relief in shipping and freight costs, and some firms are finding it hard to pass on cost increases to their customers. This could be a positive signal that inflation can moderate without causing a sharp rise in unemployment.

The labor market conditions remained healthy, with employment continuing to increase despite hiring freezes by some firms and scattered reports of layoffs. Meanwhile, consumer spending remained steady; however, some districts had concerns about rising credit card debt. On a positive note, travel and tourism were bright spots, while manufacturing—which had been a worry—was reported to have stabilized.

With these reports and headlines in mind, I have a specific sector and symbol that I am interested in, but let us review the latest market conditions via our A.I. data before we commit.

The VIX traded near $18 for most of the week before spiking to $22 on Thursday, and upcoming earnings reports from companies such as CRWD, ORCL, and DOCU, as well as Powell’s congressional hearing have strongly influenced the market. The SPY is currently trading at overhead resistance levels of $408 and then $418, with support at $402 and then $395. I expect the market to trade sideways for the next two to eight weeks. Additionally, I would recommend remaining market-neutral on the market at this time and encourage subscribers to hedge their positions. See the $SPY Seasonal Chart below:

Looking at the current market conditions, there is one sector that has suffered and could bounce back in the next few weeks. If tech is to boom, then there is one symbol I’ll be looking at to profit from.

Microsoft Corporation (MSFT) is an American multinational technology company that develops, licenses, and sells computer software, consumer electronics, and personal computers. In the tech sector, Microsoft is one of the largest and most valuable companies globally. Its products include the Windows operating system, the Office suite of productivity software, Xbox gaming consoles, and the Surface line of touchscreen personal computers.

There are several reasons why it may be a good idea to buy tech stocks now, including Microsoft. Firstly, technology companies have continued to show resilience and growth throughout and following the COVID-19 pandemic. As people have spent more time at home, they have increasingly used technology to stay connected, entertained, and productive. This has led to an increased demand for products and services offered by companies like Microsoft.

In addition, tech has seen a decent dip over the last month and offers a great price to enter. Year-to-date MSFT data shows the tech giant has sustained success; however, after an early spike in 2023, MSFT has lowered significantly over the last month. Let’s review our A.I. forecasts.

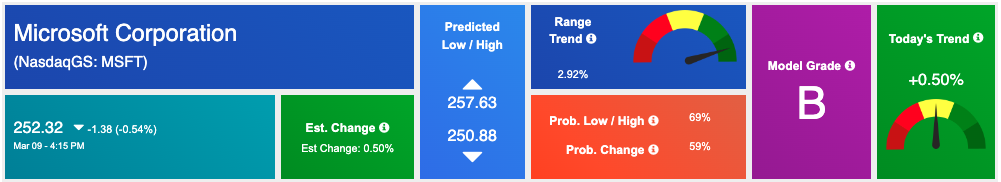

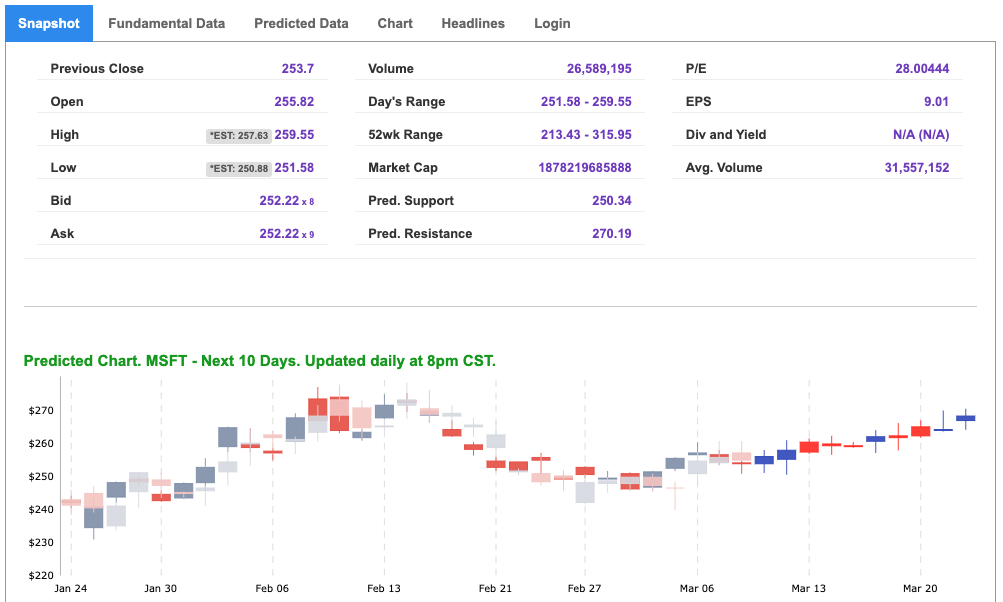

With a 52-week range of $213-$315, MSFT is trading in the lower third of its yearly range and has plenty of room for upside. The symbol is sporting a model grade of “B”, which puts it in the top 25% for accuracy within our data universe.

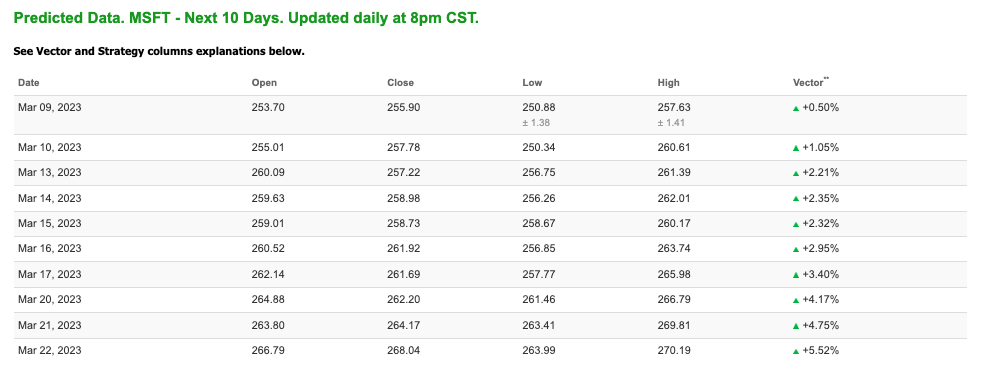

Our 10-day forecast from the Stock Forecast Toolbox shows a steady and impressive vector trend. One directional and growing incrementally, MSFT is offering a promising forecast. Let’s double-check with our long-term forecast tool, Seasonal Charts. See $MSFT Seasonal Chart:

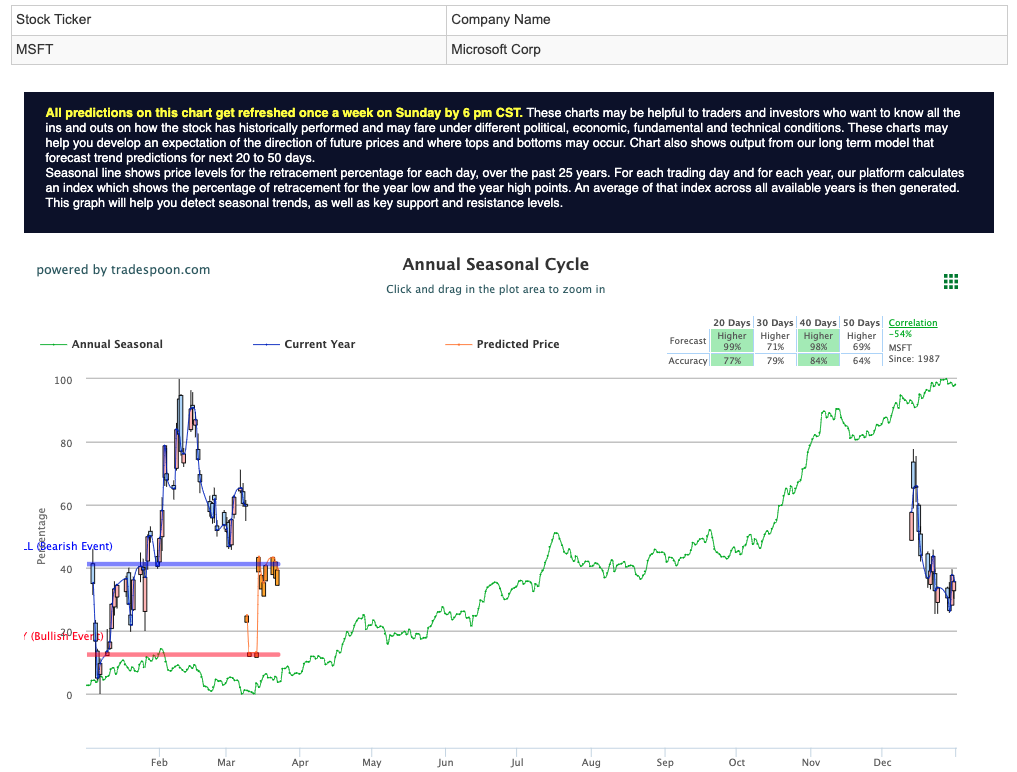

With all four-time ranges flashing higher for MSFT, I like what I am seeing for this symbol. Furthermore, two-time frames are flashing very impressive accuracy scores which leads me to believe, along with the 10-day forecast, MSFT has some good days ahead of it. I’ll be looking to get involved with tech and specifically MSFT in the coming weeks.

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

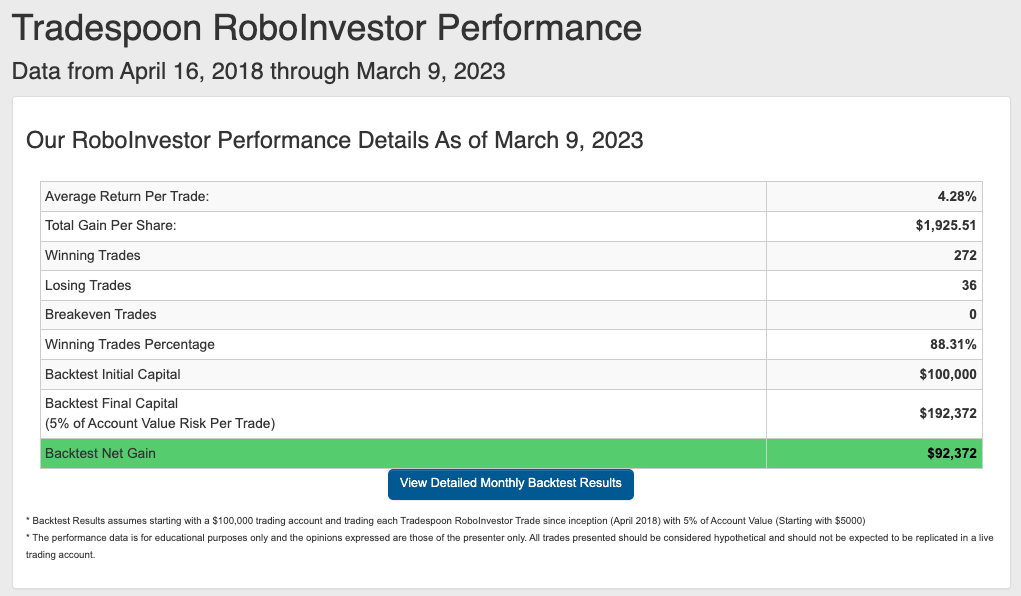

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.31% going back to April 2018.

In 2023, investors are facing a dynamic market affected by a combination of factors such as inflation, Federal policies, and geopolitical tensions, including the ongoing conflict in Ukraine. To successfully navigate this complex landscape, it is crucial to partner with a trustworthy and knowledgeable investment platform. RoboInvestor provides the necessary expertise and tools to help investors manage their portfolios with confidence and capitalize on opportunities in the fast-paced market.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!